Market Definition

The medical foam market involves the research, development, manufacturing, and distribution of specialized foam materials tailored for various healthcare applications.

These foams, including polyurethane (PU), polyethylene (PE), and polystyrene (PS), are engineered to meet stringent medical standards, ensuring biocompatibility, durability, and functionality in diverse medical environments. They play a critical role in advanced wound care, surgical cushioning, orthopedic supports, medical packaging, prosthetics, and bedding for patient comfort.

Medical Foam Market Overview

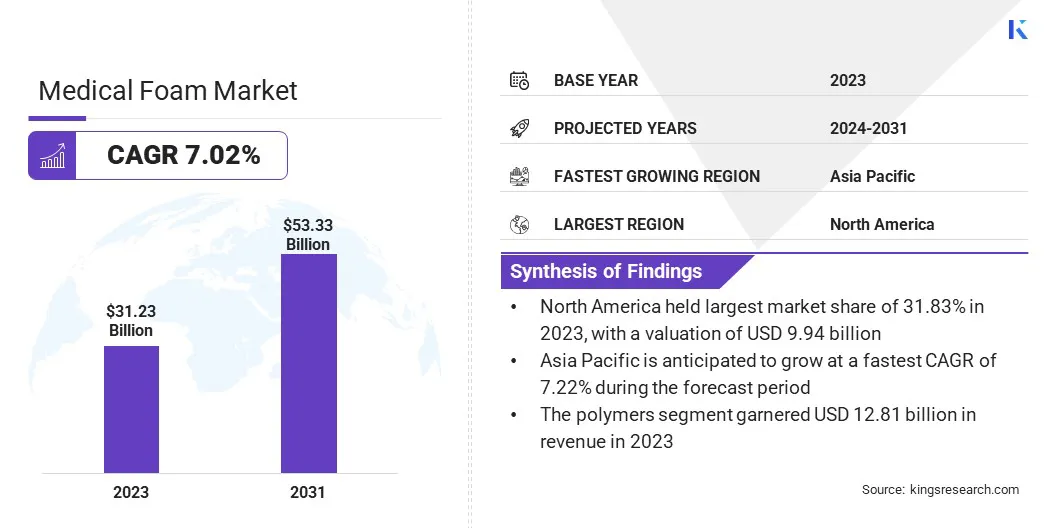

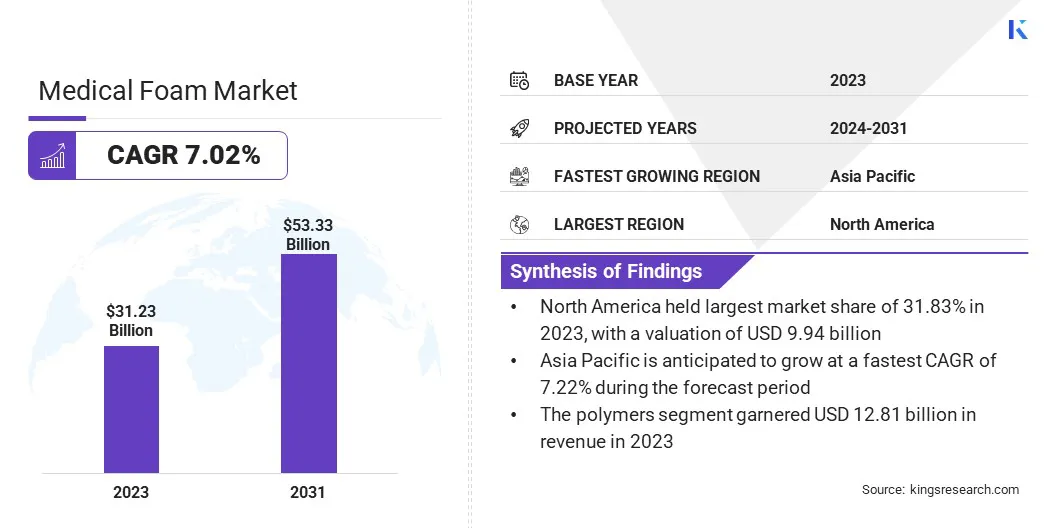

According to Kings Research, the global medical foam market size was valued at USD 31.23 billion in 2023 and is projected to grow from USD 33.17 billion in 2024 to USD 53.33 billion by 2031, exhibiting a CAGR of 7.02% during the forecast period.

This growth is driven by growing healthcare expenditure, increasing demand for advanced wound care solutions, and the expanding use of medical foam in prosthetics, medical packaging, and cushioning materials for patient care.

Key Market Highlights:

- The medical foam industry size was valued at USD 31.23 billion in 2023.

- The market is projected to grow at a CAGR of 7.02% from 2024 to 2031.

- North America held a market share of 31.83% in 2023, with a valuation of USD 9.94 billion.

- The flexible segment garnered USD 11.81 billion in revenue in 2023.

- The polymers segment is expected to reach USD 21.28 billion by 2031.

- The polyurethane (PU) segment is expected to reach USD 12.87 billion by 2031.

- The bedding & cushioning segment is expected to reach USD 16.85 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.22% during the forecast period.

Major companies operating in the medical foam market are Mölnlycke Health Care AB., UFP Technologies, Inc., Rogers Corporation, FXI, WITPFoam, Freudenberg Group, Huntsman International LLC, Armacell, American Foam Corporation, UFP Technologies, Inc., SEKISUI CHEMICAL CO., LTD., 3M, INOAC CORPORATION, Recticel NV, and American Excelsior Company.

The market is also benefiting from technological advancements in foam production, including the development of antimicrobial and biodegradable foams to meet stringent regulatory requirements. Additionally, the aging global population and the increasing prevalence of chronic diseases are fueling the need for high-quality, durable, and biocompatible medical foams.

Rising Demand for Advanced Wound Care and Infection Control

The increasing prevalence of chronic wounds, surgical procedures, and hospital-acquired infections (HAIs) is a key driver of the medical foam market. Growing aging population and the rising incidence of diabetes and pressure ulcers are generating significant demand for high-performance wound care products.

Medical foams, particularly PU and silicone-based foams, are widely used in wound dressings due to their superior moisture management, cushioning, and antimicrobial properties.

Additionally, the heightened focus on infection control in healthcare facilities, especially post pandemic, has led to the increased adoption of antimicrobial and bio-based foams for surgical support and hospital bedding.

High Production Costs and Raw Material Price Volatility

One of the significant challenges in the medical foam market is the high production cost associated with manufacturing high-quality, medical-grade foams. The production process requires advanced formulations, precision engineering, and strict adherence to regulatory standards, all of which contribute to elevated costs.

Additionally, the need for antimicrobial treatments, hypoallergenic properties, and biocompatibility increases production expenses. Manufacturers can focus on supply chain diversification to reduce dependency on a single supplier or region for raw materials.

Investing in sustainable and alternative raw materials, such as bio-based foams or more readily available options, can help mitigate the impact of price fluctuations. Additionally, adopting advanced manufacturing techniques, such as automation and waste-reduction processes, can enhance efficiency, improve production scalability, and lower costs over time.

Growth of Sustainable and Biodegradable Medical Foams

Sustainability is becoming a dominant trend in the medical foam market, driven by growing environmental awareness, increasing regulatory pressure, and the healthcare industry’s commitment to adopting eco-friendly materials.

Traditional petroleum-based foams, though widely used, contribute to long-term plastic waste and environmental degradation. In response, there is a clear shift toward biodegradable and bio-based foams that offer comparable performance while minimizing their environmental impact.

Manufacturers are increasingly focusing on developing bio-based PU foams sourced from renewable materials such as soybean oil, castor oil, and other plant-based feedstocks. These sustainable alternatives maintain the critical properties required for medical applications, including cushioning, durability, and antimicrobial efficacy, while also offering a lower environmental footprint compared to conventional foams.

Medical Foam Market Report Snapshot

|

Segmentation

|

Details

|

|

By Form

|

Flexible, Rigid, Spray

|

|

By Material

|

Polymers, Latex, Metals

|

|

By Product

|

Polyurethane (PU), Polystyrene (PS), Polyolefin, Polyvinyl Chloride (PVC), Others

|

|

By Application

|

Bedding & Cushioning, Packaging, Devices & Components, Prosthetics & Wound Care, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Form (Flexible, Rigid, Spray): The flexible segment earned USD 11.81 billion in 2023, due to the rising demand for versatile, adaptable foam materials in healthcare applications, particularly for wound care, patient cushioning, and medical device padding.

- By Material (Polymers, Latex, Metals): The polymers segment held 41.03% share of the market in 2023, due to the versatility, durability, and biocompatibility of polymer-based foams, such as PU and PE, which are widely used in wound care, prosthetics, and medical device components.

- By Product (Polyurethane (PU), Polystyrene (PS), Polyolefin, Polyvinyl Chloride (PVC), and Others): The polyurethane (PU) segment is projected to reach USD 12.87 billion by 2031, owing to its extensive use in high-demand applications like wound care, surgical supports, and medical cushioning.

- By Application (Bedding & Cushioning, Packaging, Devices & Components, Prosthetics & Wound Care, and Others): The bedding & cushioning segment is projected to reach USD 16.85 billion by 2031, owing to the increasing need for comfortable, supportive medical mattresses and patient care solutions. This growth is linked to the rising elderly population, increasing number of long-term care patients, and growing demand for products that improve comfort during extended periods of bed rest.

Medical Foam Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a medical foam market share of around 31.83% in 2023, with a valuation of USD 9.94 billion. This dominance can be attributed to the robust healthcare infrastructure, high levels of medical spending, and the growing demand for advanced healthcare solutions in the region.

The U.S., in particular, plays a central role in driving the adoption of innovative medical foam products, especially in wound care, surgical supports, and patient cushioning. Additionally, the increasing aging population and rising prevalence of chronic conditions are boosting the demand for medical foam applications in North America.

- In May 2023, Probo Medical, a global leader in medical imaging equipment, parts, and services, acquired the MRI coil repair operations of Creative Foam, Inc., a Michigan-based solutions provider. This acquisition enhances Probo’s in-house MRI coil repair capabilities, while a long-term partnership ensures that Creative Foam continues to provide re-foaming services for MRI coils to its customers.

The medical foam Industry in Asia Pacific is poised to grow at a CAGR of 7.22% over the forecast period, driven by the rapid expansion of healthcare infrastructure in emerging economies such as China, India, and Southeast Asia.

The rising healthcare investments, combined with the growing demand for medical foams in applications such as wound care, medical device packaging, and prosthetics, are key growth drivers of the market in the region.

Additionally, the country's strategic emphasis on strengthening its pharmaceutical sector is driving the demand for premium medical foams in packaging and device manufacturing. Additionally, the rising incidence of chronic diseases within its large population is accelerating the need for advanced medical solutions utilizing medical foam, thereby fostering market expansion.

Competitive Landscape:

The global medical foam market is characterized by several participants, including established corporations and emerging organizations. Key industry participants include major manufacturers of PU, PE, and silicone-based foams, as well as companies specializing in bio-based and biodegradable alternatives.

These companies compete in terms of product innovation, material quality, regulatory compliance, and manufacturing capabilities. Industry leaders leverage their extensive distribution networks, strong brand reputations, and deep financial resources to maintain market dominance, while emerging players focus on niche segments such as sustainable medical foams, advanced wound care solutions, and customized foam products for specific medical applications.

Companies are increasingly investing in Research and Development (R&D) to develop materials that meet evolving healthcare demands for sustainability, safety, and patient comfort to stay ahead in the market.

- In June 2023, Lion Corporation launched FERZEA PREMIUM HP Boost Foam, a specialized medical foam product aimed at improving skin hydration and addressing dry skin concerns. This move aligns with the growing trend of medical foams targeting specific therapeutic needs, especially in dermatology. Such innovations reflect the increasing demand for advanced skincare and medical foam solutions.

Key Companies in Medical Foam Market:

- Mölnlycke Health Care AB.

- UFP Technologies, Inc.

- Rogers Corporation

- FXI

- WITPFoam

- Freudenberg Group

- Huntsman International LLC

- Armacell

- American Foam Corporation

- UFP Technologies, Inc.

- SEKISUI CHEMICAL CO., LTD.

- 3M

- INOAC CORPORATION

- Recticel NV

- American Excelsior Company

Recent Developments (New Product Launch)

- In October 2024, Avery Dennison Medical launched the upgraded SilFoam Lite, emphasizing a key shift in the medical foam market. This product combines sustainability with MDR compliance, meeting stringent regulatory standards while catering to the growing demand for eco-friendly and high-performance materials in the healthcare sector.

- In January 2023, ConvaTec launched ConvaFoam, a next-generation wound care foam that enhances patient comfort and accelerates healing. This product reflects the growing emphasis on advanced solutions that improve clinical outcomes. The launch aligns with the rising demand for innovative, sustainable, and high-performance foams in healthcare applications.