Market Definition

The market focuses on the seamless integration of medical devices and healthcare IT systems. It includes hardware, software, and networking technologies that support real-time data transmission, remote monitoring, and automated data entry.

Key components include wireless connectivity, interface devices, and integration platforms that enhance clinical workflow efficiency and patient care. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping industry growth.

Medical Device Connectivity Market Overview

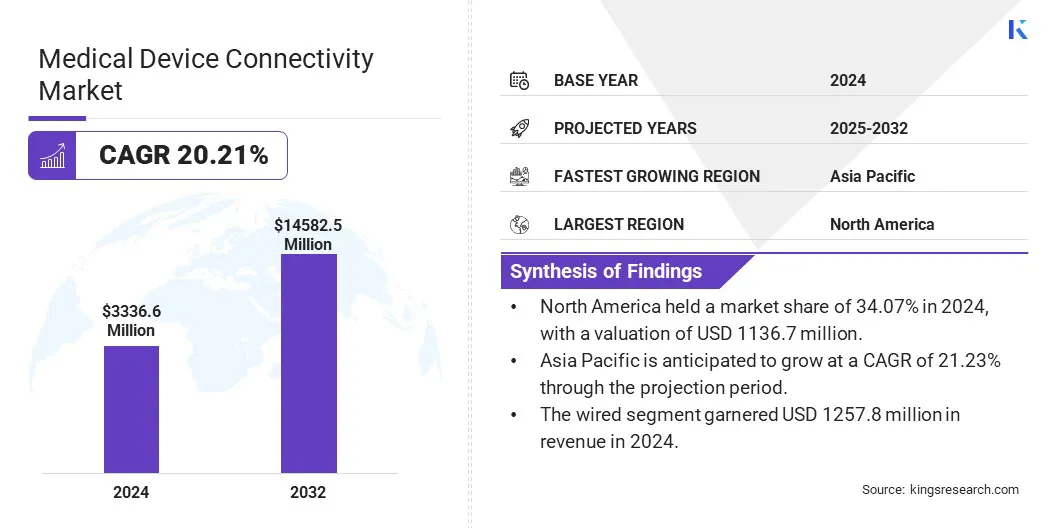

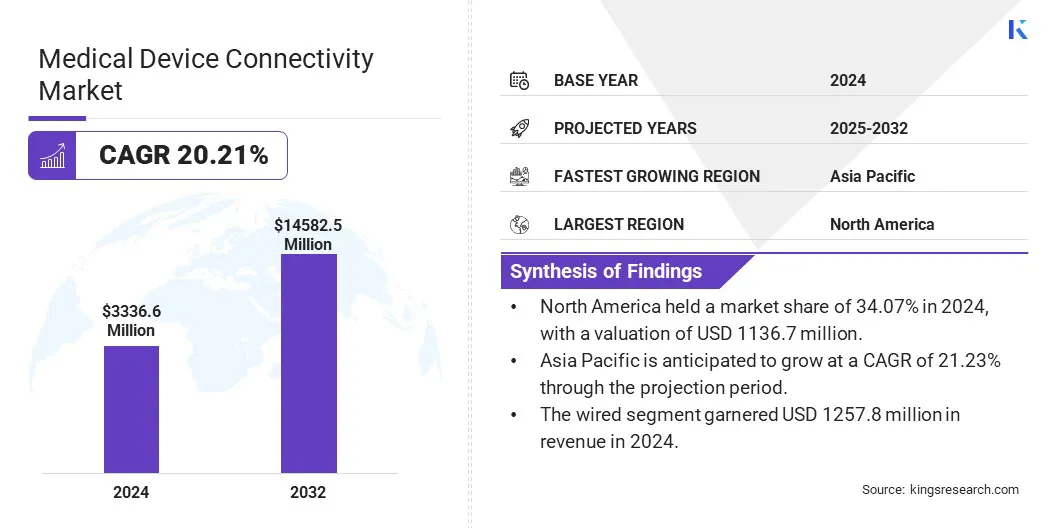

The global medical device connectivity market size was valued at USD 3336.6 million in 2024 and is projected to grow from USD 4005.2 million in 2025 to USD 14582.5 million by 2032, exhibiting a CAGR of 20.21% during the forecast period.

Integration of wearable biosensors and continuous patient monitoring systems is streamlining care delivery in both hospital and home settings. Advancements in secure, hospital-wide private 5G networks are addressing connectivity gaps, facilitating seamless device communication.

Major companies operating in the medical device connectivity industry are Medtronic, Abbott, GE HealthCare, Koninklijke Philips N.V., Stryker, Baxter, Cisco Systems, Inc., Infosys Limited, LANTRONIX, INC, Masimo, Digi International Inc., iHealth Labs Inc., Siemens Healthineers AG, Johnson & Johnson Private Limited, and MediCollector.

Additionally, the rising adoption of AI-assisted clinical workflows and smart care environments is fueling real-time data utilization and decision-making. Healthcare providers are increasingly adopting unified data infrastructures that integrate and analyze clinical and device data, enabling faster and more accurate decisions.

- In February 2025, Philips partnered with Mass General Brigham to develop a unified data infrastructure that enables real-time integration and analysis of data from medical devices and clinical systems. This collaboration aims to improve patient care by creating an AI-powered ecosystem that delivers actionable insights to clinicians. The initiative leverages Philips’ device information platforms and analytics tools to streamline medical data, generate smart alerts, and support timely clinical decision-making, thereby enhancing patient safety and operational efficiency.

Key Highlights:

- The medical device connectivity industry size was recorded at USD 3336.6 million in 2024.

- The market is projected to grow at a CAGR of 20.21% from 2025 to 2032.

- North America held a market share of 34.07% in 2024, with a valuation of USD 1136.7 million.

- The wired segment garnered USD 1257.8 million in revenue in 2024.

- The vital signs & patient monitors segment is expected to reach USD 3542.3 million by 2032.

- The ambulatory surgical centers segment is anticipated to witness the fastest CAGR of 20.52% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 21.23% through the projection period.

Market Driver

Advancements in Remote Patient Monitoring

Advancements in remote patient monitoring are propelling the growth of the medical device connectivity market by allowing continuous tracking of patient’s health outside of clinical settings. Wearable devices securely transmit data to healthcare providers, supporting quicker responses to changes in patient conditions.

This reduces the need for frequent hospital visits and improves the management of chronic diseases, making healthcare more efficient and accessible for patients and providers.

- In August 2024, Masimo received FDA 510(k) clearance for its W1 medical watch connectivity to the Masimo SafetyNet telemonitoring system. The integration enables secure Bluetooth transmission of continuous wrist-based oxygen saturation and pulse rate measurements to caregivers via the Masimo Secure Health Data Cloud.

Market Challenge

Complexity in Legacy System Integration

Complexity in integrating legacy systems presents a major challenge to the development of the medical device connectivity market. Many healthcare facilities rely on outdated infrastructure that lacks compatibility with modern connected devices. Integrating these legacy systems with new technologies requires custom interfaces, significant IT resources, and time-consuming upgrades.

This creates interoperability issues, delays in data sharing, and increases the risk of errors. The lack of standardized communication protocols further complicates integration, making it difficult for healthcare providers to fully leverage the benefits of connected medical devices and real-time data exchange.

To mitigate these issues, companies are developing interoperability-focused solutions and adopting standardized communication protocols such as HL7 and FHIR. They are designing middleware and integration platforms to bridge legacy and new systems without requiring full infrastructure replacement. Additionally, companies are offering cloud-based data management and connectivity services to streamline implementation.

Market Trend

Integration of IoT in Medical Connectivity

The growing adoption of IoT technology is a major trend in the medical device connectivity market. IoT enables seamless communcation between medical devices, allowing continuous patient data collection and transmission. This connectivity supports real-time monitoring and faster decision-making by healthcare providers.

IoT integration is improving remote patient care, enhancing emergency response capabilities, and enabling more efficient healthcare operations, accelerating the shift toward more connected and data-driven medical environments.

- In October 2024, LifeSigns, in collaboration with floLIVE and Hetrogenous, launched the 5G IoT Connected Ambulance Solution LifeConnect. The solution transforms traditional ambulances into mobile critical care units by enabling real-time patient monitoring and continuous vital data streaming via advanced 5GIoT technology.

Medical Device Connectivity Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Wireless, Wired, Hybrid

|

|

By Application

|

Vital Signs & Patient Monitors, Anesthesia Machines, Ventilators, Infusion Pumps, Imaging Centers, Respiratory Devices, Others

|

|

By End User Industry

|

Hospitals & Clinics, Maternity & Fertility Care Centers, Tertiary Care Centers, Home care settings, Ambulatory Surgical Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (Wireless, Wired, and Hybrid): The wireless segment earned USD 1054.6 million in 2024 due to increasing demand for remote monitoring and seamless data transmission in healthcare settings.

- By Application (Vital Signs & Patient Monitors, Anesthesia Machines, Ventilators, Infusion Pumps, Imaging Centers, and Respiratory Devices): The vital signs & patient monitors segment held a share of 24.21% in 2024, propelled by rising emphasis on continuous patient monitoring and early detection of critical conditions.

- By End User Industry (Hospitals & Clinics, Maternity & Fertility Care Centers, Tertiary Care Centers, and Home care settings, Ambulatory Surgical Centers, and Others): The hospitals & clinics segment is projected to reach USD 4366.0 million by 2032, owing to widespread adoption of integrated medical device systems for efficient and coordinated care delivery.

Medical Device Connectivity Market Regional Analysis

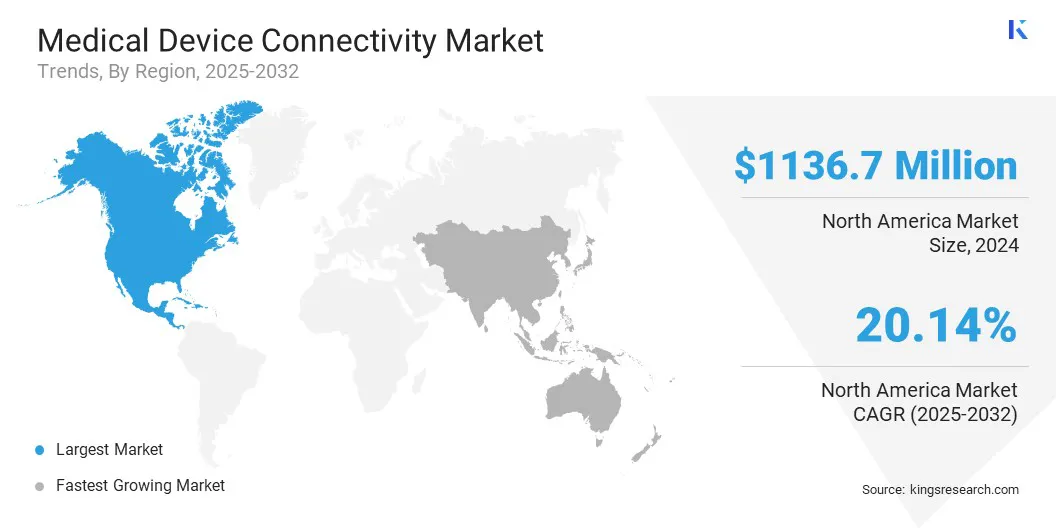

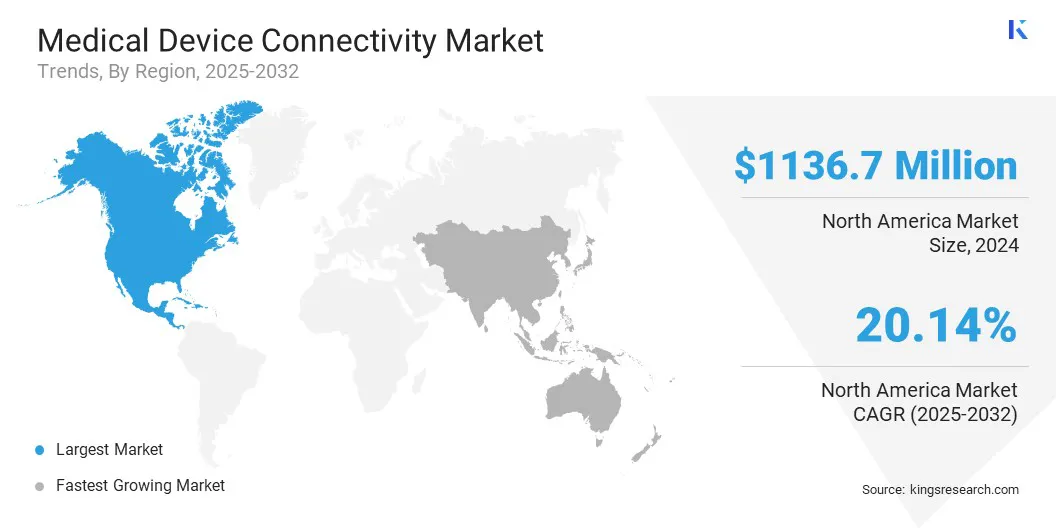

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America medical device connectivity market accounted for share of around 34.07% in 2024, valued at 1136.7 USD million. This dominance is reinforced by strategic acquisitions and advanced healthcare IT capabilities that have expanded connected medical device offerings.

The integration of AI-assisted virtual workflows, smart technology, and ambient intelligence solutions is enabling the development of enterprise-wide ecosystems that support dynamic clinical workflows. These advancements enhance caregiver efficiency, and improve patient experience. Additionally, the region is experiencing rapid adoption of innovative connected healthcare solutions, supporting to regional market expansion.

- In September 2024, Stryker acquired care.ai, a company specializing in AI-assisted virtual care workflows, smart room technology, and ambient intelligence. This acquisition strengthens Stryker’s healthcare IT portfolio and connected medical devices. Integrating care.ai’s solutions with Stryker’s Vocera platform and devices aims to establish an enterprise-wide ecosystem for dynamic clinical workflows and smarter care environments, enhancing caregiver efficiency and patient experience.

The Asia-Pacific medical device connectivity industry is set to grow at a robust CAGR of 21.23% over the forecast period. This growth is fueled by favorable government initiatives aimed at strengthening the region's medical device sector through enhanced local manufacturing capabilities.

Additionally, there is a strong emphasis on skill development and promoting industry wide innovation to meet the rising demand for advanced healthcare technologies. These initiatives are fostering a supportive ecosystem for medical device connectivity, facilitating adoption across hospitals, clinics, and other healthcare facilities.

- In November 2024, the Indian Union Minister for Chemicals and Fertilizers launched the "Scheme for Strengthening the Medical Device Industry" in India. With a total outlay of USD 59.24 million, the scheme focuses on manufacturing key components, skill development, clinical study support, common infrastructure development, and industry promotion.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates medical devices, including their connectivity features. The FDA ensures these devices are safe and effective for their intended use through regulatory pathways, including premarket approval (PMA), 510(k) clearance, and de novo classification.

- In China, the National Medical Products Administration (NMPA) oversees the registration and approval of medical devices.

- In India, the Central Drugs Standard Control Organisation (CDSCO) regulates the licensing, import, manufacture, and distribution of medical devices, including connectivity features, and conducts post-market surveillance of medical devices to ensure safety.

- In the UK, the Medicines and Healthcare Products Regulatory Agency (MHRA) monitorsmedical devices, ensuring their safety, effectivetiness, and quality, including those with connectivity functions.

Competitive Landscape

Market participants in the medical device connectivity industry are focusing on strategic acquisitions and technology integration. They are acquiring cloud-based platforms and compliance-focused solutions to enhance connectivity offerings.

Key players are expanding their offerings to cater to the rising demand for interoperable healthcare systems. Additionally, they are prioritizing cybersecurity and standardization to support secure and reliable real-time data exchange across diverse medical devices.

- In November 2024, Lauxera Capital Partners acquired Galen Data, a leading provider of secure, cloud-based connectivity solutions for medical devices. The acquisition is intended to strengthen Lauxera’s position in the medical device software ecosystem by integrating Galen Data’s connectivity expertise with Matrix Requirements.

List of Key Companies in Medical Device Connectivity Market:

- Medtronic

- Abbott

- GE HealthCare

- Koninklijke Philips N.V.

- Stryker

- Baxter

- Cisco Systems, Inc.

- Infosys Limited

- LANTRONIX, INC

- Masimo

- Digi International Inc.

- iHealth Labs Inc.

- Siemens Healthineers AG

- Johnson & Johnson Private Limited

- MediCollector

Recent Developments (M&A/Partnerships)

- In April 2025, GE HealthCare joined OR.NET e.V., an organization dedicated to advancing device integration and interoperability in medical technology. The collaboration supports the development and adoption of the Service-oriented Device Connectivity (SDC) protocol, based on ISO/IEEE 11073 standards. This protocol enables secure, bi-directional communication between medical devices from different manufacturers, fostering integrated clinical environments and improving data accuracy and coordination in patient care.

- In April 2024, Philips partnered with smartQare to integrate the viQtor wearable biosensor with Philips’ patient monitoring platforms. The collaboration aims to enable continuous patient monitoring both in hospitals and at home by ensuring seamless data flow and interoperability between devices and systems. This initiative helps healthcare providers by reducing clinical workload, improving care coordination, and enhancing patient safety through simplified, real-time access to vital data across care settings