Market Definition

The market refers to the industry focused on manufacturing ceramic materials used in medical applications, such as implants, prosthetics, and surgical tools. These materials, like bioceramics, alumina, and zirconia, are valued for their biocompatibility, strength, and durability, offering solutions for bone replacements, dental implants, and diagnostic equipment, enhancing patient care and treatment outcomes.

Medical Ceramics Market Overview

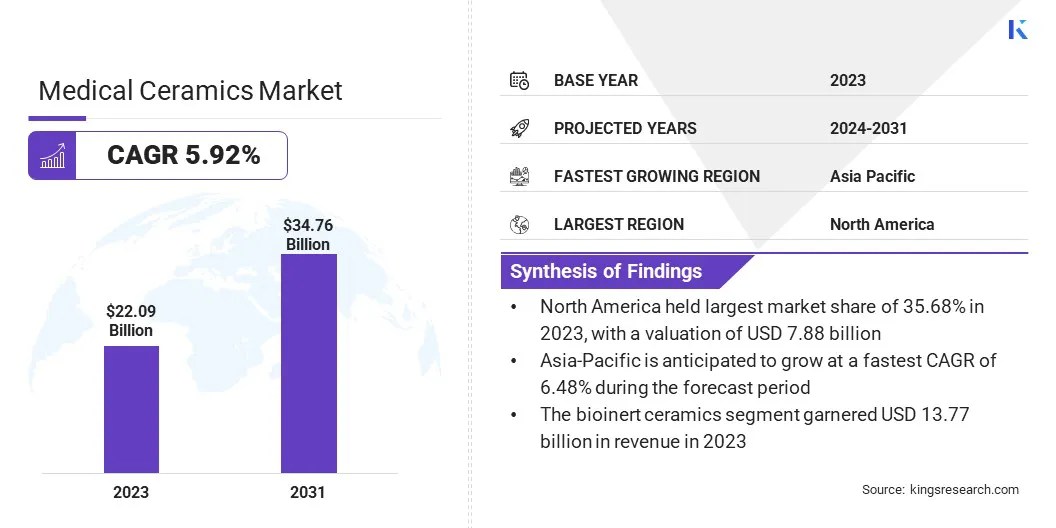

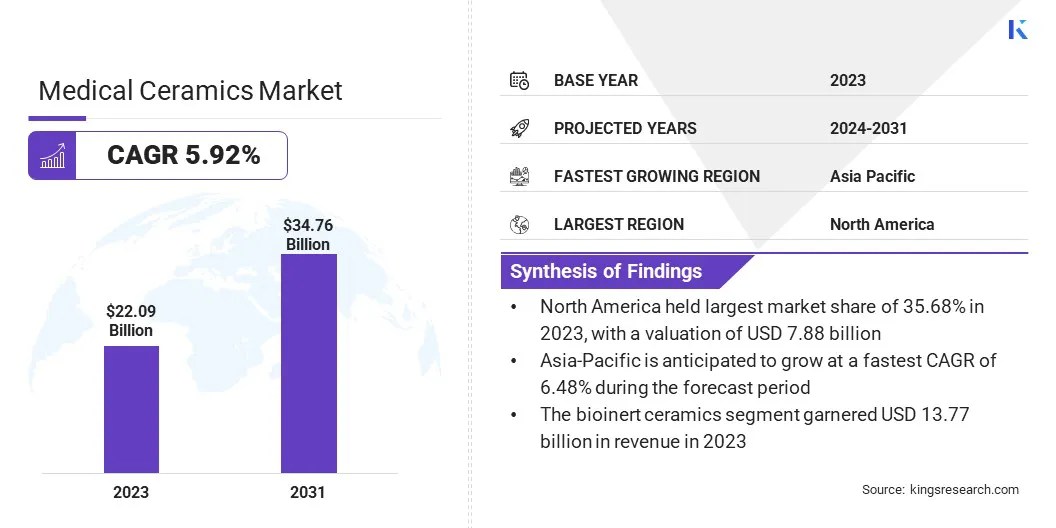

The global medical ceramics market size was valued at USD 22.09 billion in 2023, which is estimated to be USD 23.23 billion in 2024 and reach USD 34.76 billion by 2031, growing at a CAGR of 5.92% from 2024 to 2031.

Rising healthcare expenditure, particularly in emerging markets, is driving the demand for advanced medical technologies. Increased investments in healthcare infrastructure boost the adoption of high-performance materials like medical ceramics for implants and devices.

Major companies operating in the medical ceramics industry are CeramTec GmbH, KYOCERA Corporation, Morgan Advanced Materials, 3M, dsm-firmenich, Oceania International LLC, Bakony Ipari Kerámia Kft., CoorsTek Inc., Institut Straumann AG, Paul Rauschert GmbH & Co. KG., APC International, Ltd., Elan Technology, Dentsply Sirona, PI Ceramic GmbH, and NORITAKE CO., LIMITED.

The market includes a variety of specialized ceramic materials used in healthcare applications. These materials play a key role in the development of devices such as joint replacements, dental restorations, and diagnostic tools, offering exceptional durability, stability, and resistance to degradation.

Their unique characteristics make them essential for creating long-lasting, reliable solutions in the medical field, supporting improved patient outcomes and enhancing the performance of medical treatments and devices.

- In July 2024, a groundbreaking procedure took place when a 3D-printed ceramic subperiosteal jaw implant was successfully placed in a patient for the first time. Developed by Lithoz using high-strength zirconia and innovative 3D printing technology, this implant reduces healing time by 75% and eliminates the need for bone augmentation, offering a less invasive solution for patients with atrophic jaws.

Key Highlights:

- The medical ceramics industry size was valued at USD 22.09 billion in 2023.

- The market is projected to grow at a CAGR of 5.92% from 2024 to 2031.

- North America held a market share of 35.68% in 2023, with a valuation of USD 7.88 billion.

- The bioinert ceramics segment garnered USD 13.77 billion in revenue in 2023.

- The dental applications segment is expected to reach USD 13.77 billion by 2031.

- The hospitals and clinics segment is anticipated to register the fastest CAGR of 6.32% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.48% during the forecast period.

Market Driver

"Rising Demand for Advanced Medical Implants"

The rising demand for advanced medical implants is a significant growth driver of the medical ceramics market. The need for dental, orthopedic, and joint replacement implants continues to grow as populations age and chronic health conditions become more prevalent.

- According to the WHO, by 2030, 1 in 6 people will be aged 60 or older. By 2050, it will double to 2.1 billion, including 426 million people aged 80+ years.

Ceramics, with their superior strength, biocompatibility, and durability, are increasingly preferred for medical treatments. Their ability to mimic natural bone, resist wear, and support long-term functionality makes them ideal for implant materials, further driving their adoption in medical treatments globally.

- In October 2023, Orthofix announced the 510k clearance and launch of OsteoCove, an advanced bioactive synthetic graft made of biphasic ceramic granules. This product strengthens the market, offering superior bone formation for spine and orthopedic procedures, driving the demand for ceramic-based solutions in bone grafting applications.

Market Challenge

"Limited Awareness and Adoption"

Limited awareness and adoption of medical ceramics remain a significant challenge in the market. Despite their advantages, such as biocompatibility and durability, some medical professionals and institutions may not be fully aware of these benefits or may hesitate to adopt them due to unfamiliarity or perceived risks.

Increasing education and training programs for healthcare professionals, along with clear evidence of successful case studies and improved patient outcomes, can foster greater confidence and encourage broader acceptance & integration of medical ceramics in clinical settings.

Market Trend

"Advancements in 3D Printing"

A key trend in the medical ceramics market is the increasing use of 3D printing technologies to create custom, patient-specific ceramic implants and medical devices. This advancement allows for highly precise designs tailored to individual anatomical requirements, improving the fit and functionality of implants.

Additionally, 3D printing offers faster production times and reduced material waste compared to traditional manufacturing methods, making it a cost-effective and efficient solution for producing complex ceramic components, driving innovation and adoption in the healthcare sector.

- In July 2024, Desktop Metal announced the debut of advanced ceramic binder jet 3D printing technology, showcasing 3D-printed ceramic parts, including surgical tools. This breakthrough demonstrates how additive manufacturing is expanding the capabilities of medical ceramics, allowing for more complex, patient-specific solutions with enhanced precision and reduced production time.

Medical Ceramics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material Type

|

Bioinert Ceramics (Zirconia,Alumina), Bioactive Ceramics (Hydroxyapatite, Glass Ceramics), Bioresorbable Ceramics, Piezoceramics

|

|

By Application

|

Dental Applications (Implants, Crowns & Bridges, Braces, Inlays and Onlays, Bone Grafts & Substitutes), Orthopedic Applications (Joint Replacement, Knee Replacement, Fracture Fixation, Synthetic Bone Grafts), Cardiovascular Applications, Plastic Surgery Applications

|

|

By End User

|

Hospitals and Clinics, Specialty Centers, Other End Users

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Material Type (Bioinert Ceramics, Bioactive Ceramics, Bioresorbable Ceramics, Piezoceramics): The bioinert ceramics segment earned USD 13.77 billion in 2023, due to their high demand in orthopedic implants and prosthetics.

- By Application (Dental Applications, Orthopedic Applications, Cardiovascular Applications, Plastic Surgery Applications): The dental applications segment held 40.23% share of the market in 2023, due to increasing dental implant procedures and esthetic advancements.

- By End User (Hospitals and Clinics, Specialty Centers, Other End Users): The hospitals and clinics segment is projected to reach USD 17.86 billion by 2031, owing to the growing healthcare infrastructure and patient volume.

Medical Ceramics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a share of around 35.68% in 2023 in the global market, with a valuation of USD 7.88 billion. North America continues to dominate the medical ceramics market, due to advanced healthcare infrastructure, high patient demand, and a robust healthcare system.

The region benefits from strong research and development investments, particularly in the U.S., where innovations in medical technologies such as implants, prosthetics, and surgical instruments are highly prevalent. Additionally, increasing awareness of medical ceramics' benefits, coupled with rising aging populations and high healthcare spending, drives the region’s dominance in the market.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 6.48% over the forecast period. Asia Pacific is expected to register the fastest growth in the market, driven by improving healthcare systems, rising disposable incomes, and increasing healthcare accessibility.

Countries like China, India, and Japan are expanding their medical infrastructure to meet the demands of rapidly growing populations. The growing adoption of advanced technologies and increasing investments in healthcare, particularly in orthopedic and dental applications, is accelerating the demand for medical ceramics in this region, contributing to its fast-paced market growth.

- In August 2023, Smith+Nephew launched the OR3O Dual Mobility System in India, utilizing advanced OXINIUM DH ceramic material for improved hip arthroplasty. This innovation reduces wear and corrosion risks, positioning it as a breakthrough in the market.

Regulatory Frameworks

- In the U.S. the Food and Drug Administration (FDA) is responsible for protecting public health by ensuring the safety, efficacy, and security of human and veterinary drugs, biological products, and medical devices; and by ensuring the safety of the nation's food supply, cosmetics, and products that emit radiation.

- The ISO 13485, is an internationally agreed standard sets out the requirements for a quality management system specific to the medical devices industry.

- The letters ‘CE’ appear on many products traded on the extended Single Market in the European Economic Area (EEA). They signify that products sold in the EEA have been assessed to meet high safety, health, and environmental protection requirements.

Competitive Landscape

Grants in the medical ceramics industry are often awarded to companies for advancing technologies like improved biocompatibility, enhanced durability, and innovative manufacturing processes.

These funds support research and development of advanced materials, enabling breakthroughs in implants, prosthetics, and surgical tools. The grants help accelerate innovation, facilitate clinical trials, and foster partnerships for the commercialization of cutting-edge medical ceramic solutions.

- In June 2024, SiNAPTIC Technologies, a Colorado-based company, received an Early-Stage Capital and Retention Grant through the Colorado Office of Economic Development and International Trade’s (OEDIT) Advanced Industries Accelerator program. This grant will support SiNAPTIC’s development of advanced ceramic manufacturing technologies, including biocompatibility testing and FDA Master File submissions for medical applications, fostering innovation and creating local job opportunities.

List of Key Companies in Medical Ceramics Market:

- CeramTec GmbH

- KYOCERA Corporation

- Morgan Advanced Materials

- 3M

- dsm-firmenich

- Oceania International LLC

- Bakony Ipari Kerámia Kft.

- CoorsTek Inc.

- Institut Straumann AG

- Paul Rauschert GmbH & Co. KG.

- APC International, Ltd.

- Elan Technology

- Dentsply Sirona

- PI Ceramic GmbH

- NORITAKE CO., LIMITED

Recent Developments (Launch/Acquisition)

- In November 2024, Lithoz showcased its ceramic 3D-printed filtration technology, Separonics, at Formnext. This innovative ceramic solution, manufactured using Lithoz’s CeraFab S320, aims to revolutionize lithium extraction by reducing energy consumption, increasing output, and improving water recycling efficiency, highlighting advancements in the market.

- In December 2024, GBC Advanced Materials acquired XJet's Carmel 1400 Ceramic AM solution to scale up production for medical ceramics. This acquisition will enhance GBC's ability to produce high-quality, geometrically complex ceramic parts efficiently, improving production capabilities in the medical industry.