Marine Scrubber Market Size

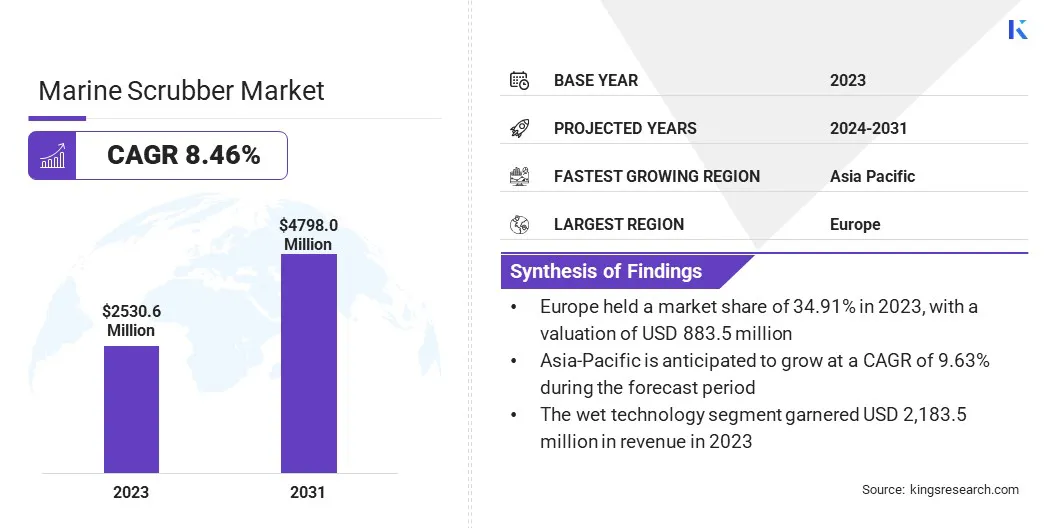

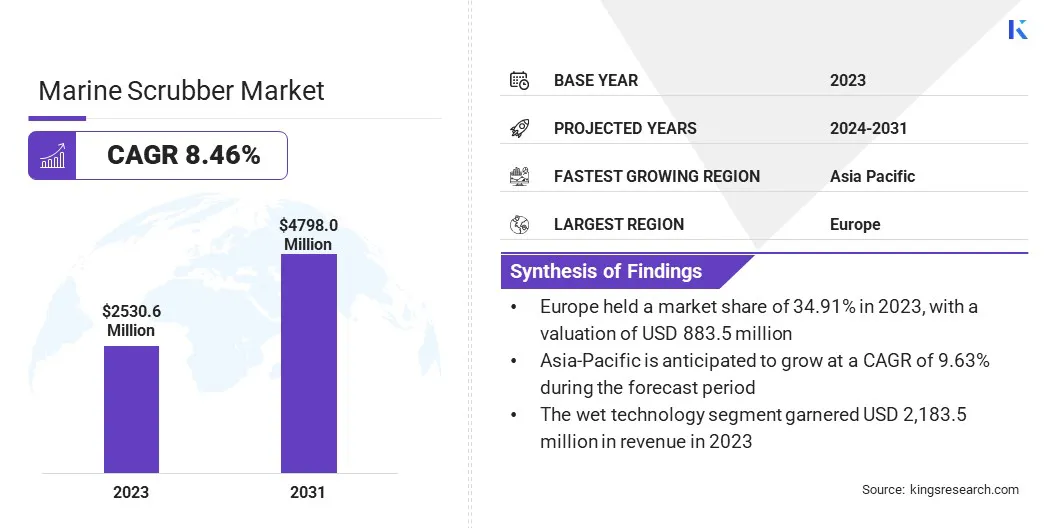

The global Marine Scrubber Market size was valued at USD 2,530.6 million in 2023 and is projected to grow from USD 2,716.8 million in 2024 to USD 4,798.0 million by 2031, exhibiting a CAGR of 8.46% during the forecast period. The expansion of global trade is a major driver for the market.

With the growth of international marine freight transport, driven by increasing demand for goods and commodities, the number of vessels operating worldwide continues to rise. This surge in maritime activity necessitates compliance with stringent environmental regulations to reduce sulfur emissions.

Consequently, the demand for marine scrubbers has increased with shipping companies seeking cost-effective solutions to meet these regulatory requirements. The growing volume of goods transported by sea, combined with the need for sustainable shipping practices, significantly boosts the market for marine scrubbers.

In the scope of work, the report includes products offered by companies such as Alfa Laval, Fuji Electric Co., Ltd., Mitsubishi Heavy Industries, Ltd, VDLAEC Maritime B.V., ANDRITZ, KwangSung Corporation Ltd., Wartsila Corporation, Yara International ASA, DuPont De Nemours, Inc., Damen Shipyards Group N.V, and others.

Moreover, stringent environmental regulations are a crucial factor driving the growth of the marine scrubber market. These regulations are part of a broader global effort to mitigate the environmental impact of maritime shipping, which has traditionally relied on heavy fuel oil (HFO) with high sulfur content. As a result, ship owners and operators are increasingly adopting marine scrubbers to ensure compliance with these global environmental standards.

- The International Maritime Organization (IMO) has introduced comprehensive rules under MARPOL Annex VI, particularly focusing on the reduction of sulfur oxide (SOx) emissions from ships. The IMO 2020 regulation mandates that vessels either use fuel with a sulfur content of 0.5% or lower or implement alternative solutions like marine scrubbers to clean their exhaust emissions.

Additionally, the rapid expansion of online shopping and the development of a robust e-commerce industry are boosting the growth of the market. The surge in online retail has significantly increased the demand for global shipping, as goods need to be transported across continents to meet consumer demand. This rise in maritime trade has led to a higher number of cargo ships and container vessels being deployed, increasing demand for marine scrubbers, contributing to the market's expansion.

Marine Scrubber is an exhaust gas cleaning system installed on ships to remove pollutants, particularly sulfur oxides (SOx), from the exhaust gases produced by the vessel's engine. Marine scrubbers work by spraying a mixture of water and other chemicals into the exhaust stream, which neutralizes and removes harmful emissions before they are released into the atmosphere. This makes the ships more compliant with environmental regulations by allowing them to continue using high-sulfur fuel oil (HFO) while reducing the environmental impact of their emissions.

Analyst’s Review

The increasing emphasis on corporate social responsibility (CSR) and sustainability among shipping companies is boosting the marine scrubber market. By implementing marine scrubbers, companies showcase their commitment to environmental stewardship and adhere to regulatory standards.

This focus on sustainability not only enhances their brand reputation but also meets the expectations of stakeholders, including customers and investors, who are increasingly concerned about environmental impact of their businesses. As more companies are aligning with CSR objectives and focusing on reducing their environmental footprint, the demand for marine scrubbers is expected to rise, fueling the market growth over the forecast period.

The shipping industry's continuous dedication to meeting stringent environmental regulations and improving emission control capabilities is impacting the market. According to our analysis, as shipping companies strive to adhere to increasingly strict standards for sulfur emissions and reduce their environmental impact, the demand for marine scrubbers is expected to grow.

- According to the International Council on Clean Transportation, the installation of 644 additional scrubbers between 2020 and 2023 highlights a robust adoption trend. This growth is expected to continue, with the scrubber fleet projected to reach at least 5,061 units by 2025.

Marine Scrubber Market Growth Factors

The significant growth in global import and export activity is a major driving factor for the marine scrubber market. A substantial portion of international trade involves the transportation of key commodities like crude oil, natural gas, coal, iron ore, grains, and manufactured goods, which are primarily moved via large cargo vessels.

Major trading countries, such as China, the U.S., Germany, Japan, and South Korea, are heavily involved in this global trade network. As these countries continue to drive global demand for raw materials and finished products, the number of vessels required to transport these goods increases.

High volumes of commodities transported by sea, combined with the involvement of major trading economies, amplify the demand for marine scrubbers, making this a significant factor contributing to the market's growth.

- According to UNCTAD, Maritime trade is projected to grow by 2.4% in 2023 and continue expanding at a rate of over 2% annually between 2024 and 2028.

Moreover, as major oil-producing countries like the U.S., Saudi Arabia, and Russia ramp up production to meet global energy demands, there is a corresponding rise in the number of oil tankers transporting crude oil across international waters. The surge in crude oil trade, driven by both supply and demand dynamics, directly boosts the demand for marine scrubbers, impacting the market's growth.

- According to the U.S Energy Information Administration in 2024, the United States exported approximately 10.15 million barrels per day (b/d) of petroleum to 173 countries and imported about 8.51 million b/d from 86 countries. This made the U.S. a net petroleum exporter for the third consecutive year, with net exports totaling around 1.19 million b/d.

However, the initial expense of installing marine scrubbers is substantial, which can be a major challenge for shipowners, especially for older vessels or smaller fleets. The costs associated with maintaining and operating scrubbers also add to the overall financial burden hindering market expansion.

Despite these upfront expenses, scrubbers offer significant long-term benefits. The ability to continue using heavy fuel oil (HFO) while complying with emission regulations can result in considerable cost savings over time. For large vessels operating on HFO, these savings can outweigh the initial investment, making scrubbers a financially viable option in the long run.

This potential for long-term economic gain drives adoption among shipowners with larger fleets and newer vessels, who can more easily absorb the initial costs and benefit from the reduced fuel expenses over time.

Marine Scrubber Market Trends

The rapid growth of e-commerce and online trade is driving the demand for marine scrubbers.A rise in the global online shopping trend is fueling the need for maritime shipping to transport goods across continents. This trend is fueling shipping activity and consequently the need for marine vessels that are environmentally compliant.

To meet this need and manage emissions effectively, shipowners are increasingly adopting marine scrubbers. Therefore, the expansion of e-commerce, which fuels global trade, directly contributes to the growing demand for marine scrubbers.

The expansion of the global shipping industry is influencing the growth of the market. As global trade continues to rise, driven by increased demand for goods and commodities, the number of ships in operation is also growing. This surge in maritime activity necessitates better compliance with environmental regulations aimed at reducing emissions.

As a result, the demand for marine scrubbers, which enable vessels to meet these stringent standards while maintaining operational efficiency, is expected to increase significantly. The overall growth of the shipping industry, therefore, plays a crucial role in driving the expansion of the market.

- According to a report by the Institute of the Americas, as of June 2023, the global merchant fleet is registered across more than 150 nations, with over 50,000 merchant ships engaged in international trade.

Segmentation Analysis

The global market has been segmented on the basis of technology, installation, application, and geography.

By Technology

Based on technology, the market has been segmented into wet technology and dry technology. The wet technology segment led the marine scrubber market, reaching a valuation of USD 2,183.5 million in 2023. The wet technology segment dominated the market primarily due to its effectiveness in removing sulfur oxide (SOx) and its broader compliance capabilities.

Wet scrubbers, which use a liquid solution to capture and neutralize sulfur compounds from exhaust gases, offer superior performance in reducing SOx emissions compared to dry systems. Their adaptability to varying operational conditions and their ability to handle high sulfur fuel levels make them particularly attractive to ship owners.

Additionally, wet scrubbers can be configured in open-loop, closed-loop, or hybrid systems, providing flexibility to meet different regulatory requirements. This versatility, coupled with their proven efficiency,is expected to drive the market share of wet technology in marine scrubbers.

By Installation

Based on installation, the marine scrubber market has been classified into new build and retrofit. The retrofit segment secured the largest revenue share of 60.70 in 2023. Retrofitting existing vessels with scrubbers allows shipowners to comply with new environmental regulations without investing in new ships, making it a cost-effective solution. Many older vessels, which would otherwise require costly upgrades or replacement, can be adapted to meet stringent emission standards by installing scrubbers.

Additionally, retrofitting enables immediate compliance with regulations like the IMO 2020 sulfur cap, providing a practical means to manage operational costs and compliance. The ability to extend the lifespan of existing ships while ensuring regulatory compliance drives the market share of the retrofit installation segment.

By Application

Based on application, the market has been divided into bulk carriers, container ships, oil tankers, chemical tankers, cruises, and others. The container ships segment is expected to register significant growth at a robust CAGR of 9.90% over the forecast period due to their crucial role in global trade and the high volume of emissions generated by them.

Container ships handling large quantities of goods across international routes are heavily regulated to meet stringent environmental standards. The implementation of marine scrubbers on these ships helps manage sulfur oxide (SOx) emissions effectively, ensuring compliance with regulations such as the IMO 2020 sulfur cap.

Additionally, the substantial fuel consumption of container ships makes scrubbers a cost-effective solution for reducing emissions while continuing to use high-sulfur fuel oil (HFO). This combination of regulatory pressure and operational efficiency drives the rapid growth of the scrubber market within the container ship segment.

Marine Scrubber Market Regional Analysis

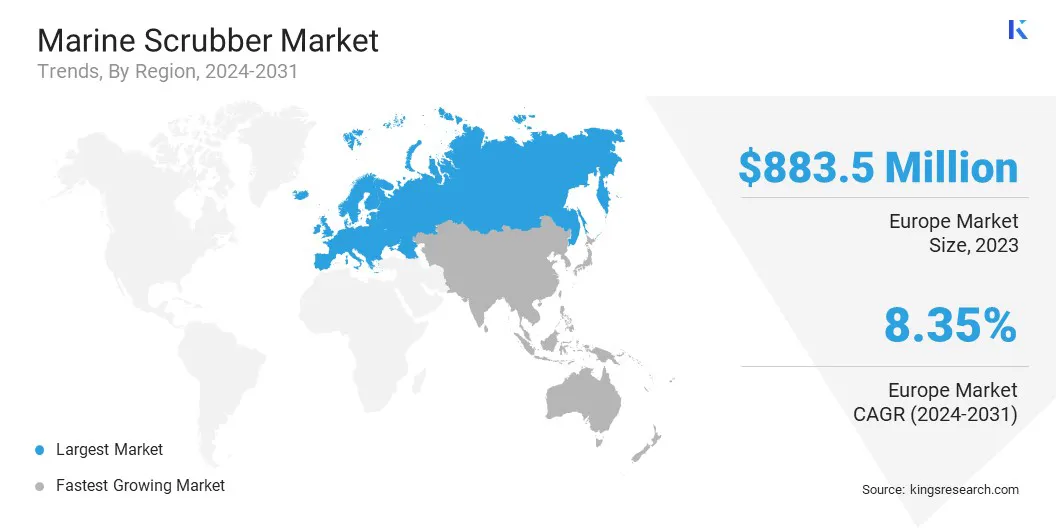

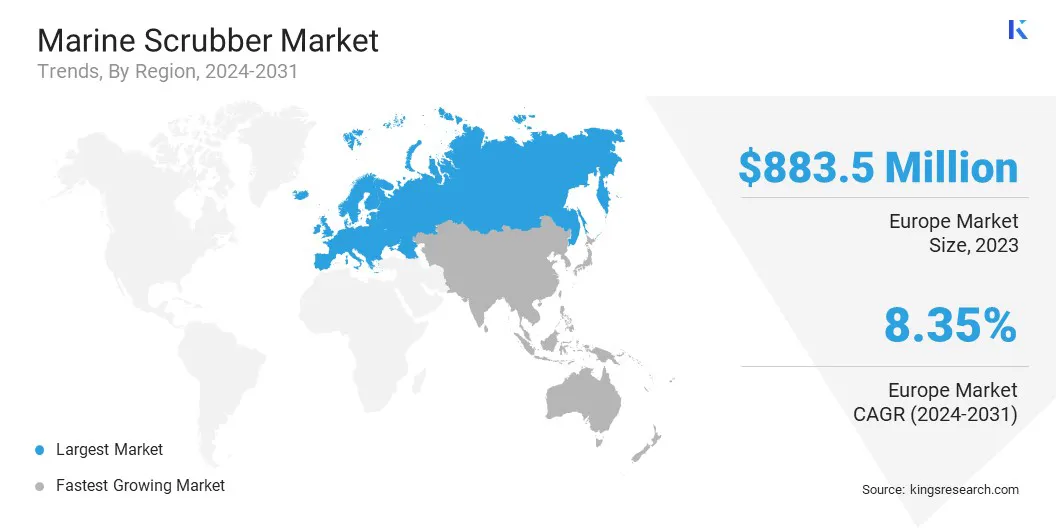

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Europe marine scrubber market share stood around 34.91% in 2023 in the global market, with a valuation of USD 883.5 million. This share can be attributed to the regulations enforced by the European Union (EU) and other regional authorities.

The EU's ambitious climate targets and the implementation of the Sulfur Emission Control Area (SECA) regulations mandate that ships operating in European waters must operate under strict sulfur emission limits. These regulations compel shipowners to adopt marine scrubbers as a means of complying with these standards while continuing to use high-sulfur fuels.

Additionally, the increasing maritime traffic in European ports due to high levels of trade and shipping activity further fuels the demand for marine scrubbers. Ports such as Rotterdam, Hamburg, and Antwerp are major hubs in global trade, and the volume of shipping activity in these ports necessitates effective emission control solutions. The adoption of marine scrubbers helps manage emissions from a large number of vessels operating in these busy maritime zones.

Asia Pacific is poised for significant growth at a robust CAGR of 9.63% over the forecast period owing to the rapid expansion of maritime trade in the region. Asia Pacific is a major hub for global shipping, with key ports in China, Japan, South Korea, and Singapore handling a significant portion of international cargo.

The surge in trade volume increases the demand for efficient emission control systems, as ships in this high-traffic region have to comply with both international and local environmental regulations.

- According to UNCTAD, at the beginning of 2023, 18 of the 35 major ship-owning companies were based in Asia. Hong Kong holds a 2.4% share of the global fleet, with a total of 2,537 vessels registered under its flag. Additionally, the Container Port Performance Index (CPPI), compiled by the World Bank and S&P Global Market Intelligence, reveals that 18 of the world’s top 25 ports are located in Asia, including 11 in Eastern Asia and four in Western Asia.

Moreover, the increasing investment in Asian port infrastructure and modernization significantly drives the region's growth. Many Asia Pacific countries are upgrading their ports to accommodate larger vessels and enhance operational efficiency.

This investment often includes the integration of advanced environmental technologies, including marine scrubbers, to manage emissions from the growing number of ships using these ports. The modernization of port facilities drives the adoption of scrubbers as part of a broader commitment to sustainable port operations.

Competitive Landscape

The global marine scrubber market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Marine Scrubber Market

- Alfa Laval

- Fuji Electric Co., Ltd.

- Mitsubishi Heavy Industries, Ltd

- VDLAEC Maritime B.V.

- ANDRITZ

- KwangSung Corporation Ltd.

- Wartsila Corporation

- Yara International ASA

- DuPont De Nemours, Inc.,

- Damen Shipyards Group N.V

Key Industry Developments

- March 2022 (Collaboration): VDL AEC Maritime partnered with Dutch shipping company, Seatrade Groningen BV, to enhance its supply chain. As part of this collaboration, VDL AEC Maritime provided two retrofit scrubber systems to Seatrade. This order marked VDL AEC Maritime’s first expansion of its portfolio within its home country and to a Dutch shipowner.

- November 2022 (Business Expansion): Wartsila received its inaugural order for carbon capture and storage-ready scrubber systems, known as CCS-Ready scrubbers. Four 8,200 TEU container vessels, at an undisclosed shipyard in Asia, were equipped with Wartsila’s CCS-Ready 35MW scrubbers in an open-loop configuration. Wartsila also announced to conduct additional design and engineering work to ensure that these vessels are prepared for future retrofits with a complete CCS system, integrating these considerations into the newbuilding construction phase.

The global marine scrubber market has been segmented:

By Technology

- Wet Technology

- Dry Technology

By Installation

By Application

- Bulk Carriers

- Container Ships

- Oil Tankers

- Chemical Tankers

- Cruises

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America