Market Definition

The market involves the production, distribution, and use of magnetic wire, which is a type of wire coated with an insulating material and commonly used in electrical and electronic applications.

Magnetic wire is typically made from copper or aluminum and is used for creating coils, inductors, transformers, motors, and other electrical components where a magnetic field is essential. This wire plays a crucial role in the functioning of electric motors, power transformers, relays, and other devices that require efficient energy transfer and magnetic properties.

The market encompasses various segments, including wire material type, application areas such as automotive, consumer electronics, energy, and industrial machinery, and distribution channels.

Magnetic wire Market Overview

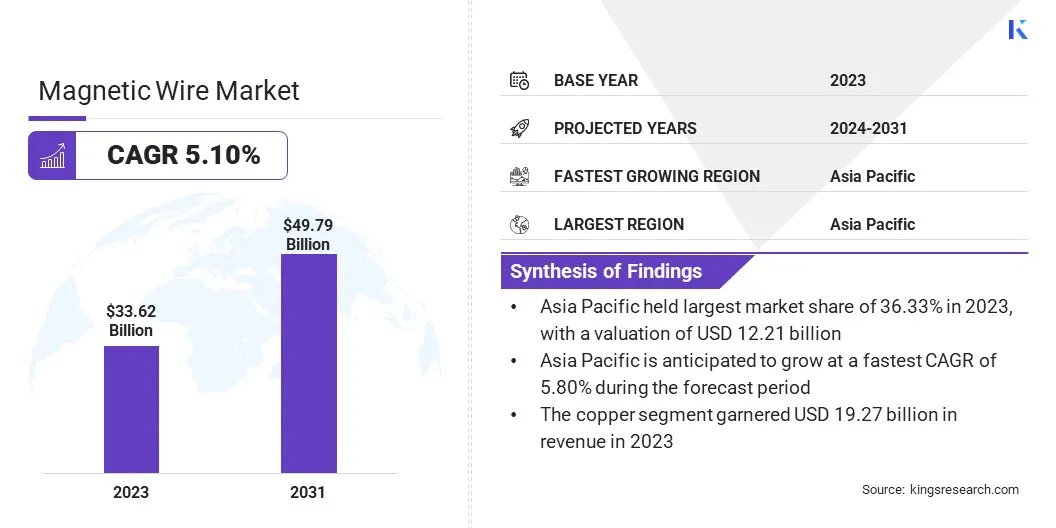

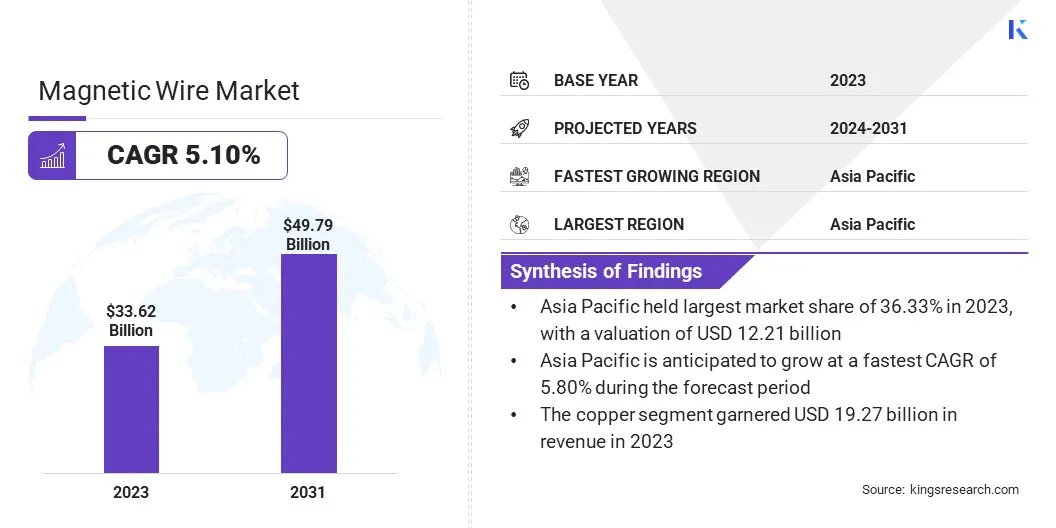

The global magnetic wire market size was valued at USD 33.62 billion in 2023 and is projected to grow from USD 35.16 billion in 2024 to USD 49.79 billion by 2031, exhibiting a CAGR of 5.10% during the forecast period.

This market is registering significant growth, driven by the increasing demand for electrical & electronic devices that require efficient energy transfer and magnetic properties. Key growth factors include the rising adoption of Electric Vehicles (EVs), which rely heavily on motors and transformers that utilize magnetic wire for energy conversion and transmission.

Additionally, the growing focus on renewable energy sources, such as wind and solar power, is boosting the demand for transformers and inductors, further propelling the market. The ongoing advancements in automation and the expansion of industrial applications also contribute to the demand for magnetic wires, as industries increasingly rely on motors, actuators, and other electrical components.

Major companies operating in the magnetic wire industry are Sumitomo Electric Industries, Ltd., Proterial, Ltd., Belden Inc., LS Cable & System Ltd., Ningbo Jintian Copper (Group) Co., MWS Wire Industries, Inc., Elektrisola Group, Superior Essex Inc., Sam Dong Co, Ltd., Stimple & Ward Company, Trafo Sterling, Wenzhou JOGO Imp&Exp Co., Alconex, BNTECHGO, and LEONI.

Moreover, the rising popularity of consumer electronics, such as smartphones, computers, and home appliances, has led to a surge in the need for magnetic wires in the manufacturing of various electrical components. With technological innovations and infrastructure development continuing to rise globally, the market is poised for continued expansion.

- In September 2024, Rea announced the expansion of its MagneFlex production at its Lafayette, Indiana, plant to meet increasing market demand. Following recent investments, Rea will add additional production lines at the Lafayette plant by the end of 2025 to support market growth.

Key Highlights

- The magnetic wire industry size was valued at USD 33.62 billion in 2023.

- The market is projected to grow at a CAGR of 5.10% from 2024 to 2031.

- Asia Pacific held a market share of 36.33% in 2023, with a valuation of USD 12.21 billion.

- The copper segment garnered USD 19.27 billion in revenue in 2023.

- The motors segment is expected to reach USD 23.54 billion by 2031.

- The electrical and electronics segment is expected to reach USD 16.74 billion by 2031.

- The market in North America is anticipated to grow at a CAGR of 4.65% during the forecast period.

Market Driver

"EV Growth and Renewable Energy Expansion"

The magnetic wire market is registering substantial growth, driven by the rising adoption of EVs and the expansion of renewable energy infrastructure. The vital role of magnetic wires in electric motors, battery management systems, and charging stations is boosting their demand and surging global EV sales.

Magnetic wires enable efficient current transmission in motor windings, contributing to enhanced vehicle performance, energy efficiency, and improved power density in compact motor designs. With automakers investing heavily in EV development and governments promoting electric mobility, the demand for magnetic wires in this sector is poised for sustained growth.

- In 2023, global electric car sales neared 14 million, representing a 35% increase from 2022, according to a report published by the International Energy Agency (IEA). Nearly 95% of these sales were concentrated in China, Europe, and the U.S. This surge reflects growing consumer demand, expanding charging infrastructure, and supportive policies such as the Clean Vehicle Tax Credit in the U.S. China recorded over 8.1 million EV sales, while Europe and the U.S. contributed nearly 3.2 million and 1.4 million, respectively.

Simultaneously, the growing focus on renewable energy is accelerating the demand for magnetic wires. Renewable energy systems such as wind turbines, solar inverters, and grid infrastructure require durable and efficient winding wires for transformers, generators, and energy storage solutions.

Magnetic wires ensure reduced power losses, improved thermal resistance, and enhanced energy efficiency, making them indispensable in renewable energy installations. As investments in sustainable energy projects expand globally, magnetic wires are playing a pivotal role in ensuring reliable energy transmission and supporting the transition to greener power solutions.

Market Challenge

"Thermal Stability Challenges"

The magnetic wire market faces the challenge of ensuring thermal stability, particularly in applications that demand prolonged exposure to high temperatures. Magnetic wires are widely used in electric motors, transformers, generators, and other power-intensive equipment where heat buildup is common.

Over time, excessive temperatures can deteriorate the insulation materials that protect the wire’s conductive core. This degradation may lead to reduced electrical efficiency, increased energy loss, and equipment failure.

Industries such as automotive (especially EVs), renewable energy, and consumer electronics are particularly affected, as these sectors increasingly demand components that can operate reliably under elevated thermal conditions.

Thus, manufacturers are integrating advanced insulation materials like polyimide, known for its exceptional thermal resistance and durability. Additionally, thermoset-based coatings are gaining traction due to their ability to withstand extreme temperatures without compromising mechanical strength. Beyond insulation improvements, advancements in wire design are also playing a crucial role.

Market Trend

"Technological Advancements and Digital Integration"

The magnetic wire market is evolving with advancements in insulation materials that enhance durability, thermal resistance, and electrical performance. Modern insulation technologies and specialized enamel coatings are increasingly integrated to improve resistance to high temperatures, chemicals, and mechanical stress.

These innovations are particularly effective in demanding applications like electric motors, transformers, and automotive systems, where performance reliability is critical. Enhanced insulation materials contribute to longer product lifespans and improved efficiency in high-voltage and high-frequency environments.

The market is also registering a shift toward automation, digitalization, and improved supply chain visibility. Manufacturers are adopting automated production systems to enhance precision, minimize defects, and reduce manual intervention.

Digital tools such as predictive maintenance software, IoT-enabled sensors, and real-time monitoring platforms are being employed to optimize production lines, ensure consistent quality, and improve productivity. Additionally, improved supply chain visibility through advanced tracking systems and data analytics helps streamline inventory management, track shipments, and respond swiftly to disruptions.

These advancements are driving operational efficiency, reducing costs, and strengthening the market’s capacity to meet rising demand across various industries.

- In July 2024, Rea Magnet Wire adopted the Descartes Transportation Manager solution and Descartes MacroPoint freight visibility solution to automate its transportation processes. By replacing manual practices with this cloud-based system, Rea improved efficiency, reduced transportation costs, and enhanced shipment security. The implementation will allow automating load tendering, streamlining carrier selection, and improving visibility into inbound shipments.

Magnetic wire Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material Type

|

Copper, Aluminum

|

|

By Application

|

Motors, Home Appliance, Transformer, Others

|

|

By End-use Industry

|

Electrical and Electronics, Industrial, Transportation, Aerospace, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material Type (Copper, Aluminum): The copper segment earned USD 19.27 billion in 2023, due to its superior conductivity and widespread use in high-performance applications like transformers and electric motors.

- By Application (Motors, Home Appliance, Transformer, and Others): The motors segment held 45.33% share of the market in 2023, due to the growing demand for EVs and industrial automation requiring efficient motor systems.

- By End-use Industry (Electrical and Electronics, Industrial, Transportation, Aerospace, Others): The electrical and electronics segment is projected to reach USD 16.74 billion by 2031, owing to the increasing demand for electronic devices and components that rely on magnetic wires for efficient energy transfer.

Magnetic wire Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 36.33% share of the magnetic wire market in 2023, with a valuation of USD 12.21 billion. This expansion is driven by rapid industrialization, robust manufacturing sectors, and the increasing demand for electrical and electronic products.

The region's dominance is largely attributed to key countries like China, Japan, and India, where significant growth in industries such as automotive, electronics, and renewable energy is fueling the demand for magnetic wires. China, as a global manufacturing hub, is a major contributor, with its expanding EV production and large-scale use of transformers, motors, and home appliances.

Additionally, the rise of renewable energy projects, particularly in wind and solar energy, has boosted the demand for transformers and inductors, driving the consumption of magnetic wires. The growth of consumer electronics, coupled with the growing automotive and industrial sectors, has further supported the demand.

Moreover, favorable government policies and initiatives promoting clean energy and electric mobility have significantly contributed to the market growth in this region.

The market in North America is expected to register the fastest growth, with a projected CAGR of 4.65% over the forecast period. This growth is driven by advancements in industrial automation, automotive manufacturing, and the push for sustainable energy solutions.

The region has registered a surge in the development of advanced manufacturing technologies and the growing adoption of Industry 4.0 principles, leading to an increased demand for motors and inductors in various industrial applications.

Moreover, this region’s strong focus on clean energy, particularly in wind power and energy storage systems, is a major driver of demand for magnetic wires in transformers and other electrical components. Additionally, the expansion of smart grid technologies and the integration of advanced electrical systems in both residential and industrial sectors have further contributed to the market growth.

The region's high standards for product quality also drive the demand for precision-engineered magnetic wire in various applications, ranging from home appliances to industrial automation.

- In March 2023, Elektrisola acquired Rea Magnet Wire's North American magnetic wire assets, including five manufacturing plants located in Indiana, Connecticut, Virginia, and Mexico, along with Rea’s leased corporate offices in Fort Wayne, Indiana. This acquisition strengthens Elektrisola’s position in the North American market by combining both companies' operational expertise and technological capabilities.

Regulatory Frameworks

- In the U.S., the National Electrical Manufacturers Association (NEMA) sets industry standards for magnetic wires. This framework outlines technical specifications, including insulation types, thermal classes, and performance criteria to ensure product reliability and electrical safety.

- In Europe, magnetic wire products are regulated under the European Committee for Electrotechnical Standardization (CENELEC). These guidelines specify requirements for enamelled round copper and aluminium winding wires, ensuring compliance with electrical and thermal performance benchmarks.

- In China, the China Compulsory Certification (CCC) system mandates quality and safety standards for electrical products, including magnetic wire. Compliance with CCC certification ensures products meet safety, efficiency, and environmental requirements for domestic use and import.

- In Japan, the Japanese Industrial Standards (JIS), outlines specifications for insulated copper and aluminium wires used in electrical equipment. These standards ensure that magnetic wire products meet durability, insulation, and temperature resistance criteria.

- In India, the Bureau of Indian Standards (BIS) enforces safety and quality regulations for magnetic wires which outlines technical requirements for winding wires used in electrical applications.

Competitive Landscape

The global magnetic wire industry is characterized by the presence of several key players and a growing number of regional manufacturers. The market is characterized by ongoing innovations and technological advancements, with companies focusing on improving product quality, production efficiency, and cost-effectiveness.

Leading manufacturers are increasingly investing in research and development to enhance the performance of magnetic wires, including innovations aimed at improving conductivity, temperature resistance, and durability for specialized applications.

Companies are exploring new materials, such as high-conductivity copper and aluminum, to meet the demands of industries like automotive, telecommunications, and renewable energy. The growing adoption of automation and smart technologies has prompted companies to develop magnetic wire solutions for industrial machinery, robotics, and IoT devices.

Additionally, the trend of strategic partnerships and collaborations among market players is growing, allowing companies to leverage each other’s strengths in technology and market reach.

- In August 2024, Superior Essex announced the rebranding of its magnet wire business following the acquisition of Essex Furukawa Magnet Wire. The company will now operate under the name Essex Solutions, encompassing all Essex Furukawa Magnet Wire locations globally, including Essex Energy in Italy. Additionally, Lacroix + Kress, IVA Insulations, and Hi-Wire will join Essex Solutions while retaining their individual brand identities.

List of Key Companies in Magnetic wire Market:

- Sumitomo Electric Industries, Ltd.

- Proterial, Ltd.

- Belden Inc.

- LS Cable & System Ltd.

- Ningbo Jintian Copper (Group) Co.

- MWS Wire Industries, Inc.

- Elektrisola Group

- Superior Essex Inc.

- Sam Dong Co, Ltd.

- Stimple & Ward Company

- Trafo Sterling

- Wenzhou JOGO Imp&Exp Co.

- Alconex

- BNTECHGO

- LEONI

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In December 2024, Sumitomo Electric Industries, Ltd. began mass production of ultra-thin, insulation-coated powder magnetic cores with insulation and dielectric strength. This innovation enables 14% more copper wire turns on stators, enhancing axial flux motor performance and improving heat dissipation while reducing the need for traditional insulation materials, reducing capital investment in the manufacturing process.