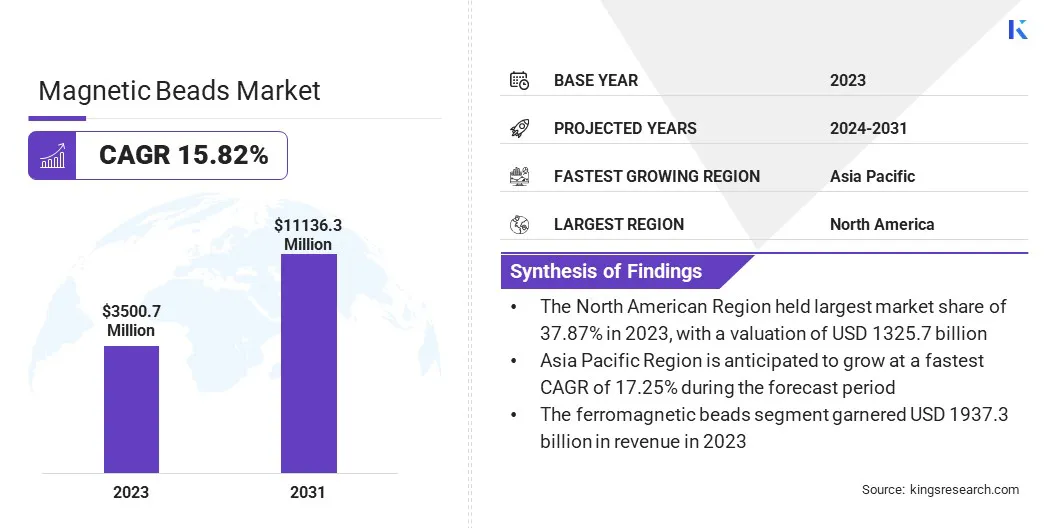

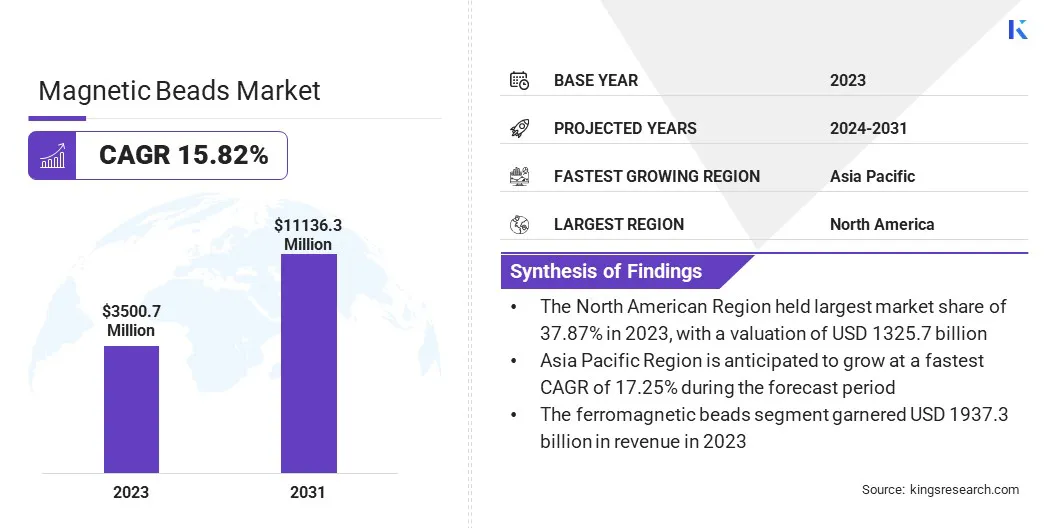

Magnetic Beads Market Size

The global magnetic beads market size was valued at USD 3500.7 million in 2023, which is estimated to be USD 3982.7 million in 2024 and reach USD 11136.3 million by 2031, growing at a CAGR of 15.82% from 2024 to 2031.

The rapid growth of the global market can be attributed to technological advancement and product development, increasing investments in research and development (R&D), prevalence of chronic diseases, and growing healthcare infrastructure.

In the scope of work, the report includes products offered by companies such as Kerafast, Hudson Robotics, Electron Microscopy Sciences, Macherey-Nagel, Idexx Laboratories, Bel-Art Products, Thermo Fisher Scientific, Merck KGaA, Cytiva, and Promega.

The expanding applications of magnetic bead technology across hospitals, diagnostic centers, in-vitro diagnostics (IVD), and other sectors have created the demand for novel bead materials and integration with nanotechnology. Research into alternative bead materials, such as biocompatible and biodegradable polymers, offers opportunities for developing more sustainable and versatile beads.

Biodegradable beads, in particular, provide a more environmentally responsible alternative to traditional materials, mitigating environmental impact and addressing the growing market demand for eco-friendly products.

- In February 2023, Thermo Fisher Scientific Inc. introduced Invitrogen DynaGreen Magnetic Beads, a microplastic-free, submicron magnetic bead platform designed to reduce the environmental impact of protein purification processes. These beads are a new addition to the company’s DynaGreen portfolio of sustainable solutions.

Magnetic beads, also referred to as magnetic particles or microspheres, are versatile tools employed in a wide range of scientific and industrial applications, due to their unique magnetic properties and capacity to bind target molecules. These microscopic spheres typically comprise a magnetic core, often consisting of iron oxide nanoparticles, embedded within a non-magnetic matrix such as a polymer or silica.

Analyst’s Review

The magnetic beads market is dominated by a few large companies with extensive product portfolios and numerous smaller specialized firms. Leading companies in this market are offering a comprehensive selection of magnetic beads with diverse size distributions, material compositions, and surface modifications to serve a broad range of applications.

They are further prioritizing R&D initiatives to drive innovation in bead technologies, optimize existing product performance, and penetrate new market segments.

Furthermore, companies are developing automated platforms and integrated solutions that combine magnetic beads with other technologies to offer more comprehensive and efficient workflows. These integrated systems commonly include instruments for detecting and quantifying target molecules captured by magnetic beads, such as fluorescence readers, microplate readers, or flow cytometers.

- In December 2024, Thermo Fisher Scientific Inc. launched Invitrogen MagniSort, a specialized magnetic bead-based cell separation technology platform designed for cell enrichment. The magnetic beads used in this platform are coated with antibodies specifically designed to bind proteins associated with the isolated target cells.

Magnetic Beads Market Growth Factors

Ongoing advancements in technology and product development are key drivers of growth in the magnetic beads market. Significant investments are being made by biotechnology companies to enhance the performance characteristics of magnetic bead technology. Advancements in manufacturing processes are yielding beads with increasingly uniform size and shape distributions.

This improved uniformity is crucial for achieving consistent binding, separation, and flow characteristics, leading to more reliable and reproducible results in assays and bioprocesses.

- In March 2024, Hemotune, a Swiss biotech firm, secured USD 15.3 million in a Series B2 funding round to accelerate the commercialization of its HemoSystem blood purification platform. This platform utilizes nanoengineered magnetic beads for efficient blood purification.

The market, while registering significant growth, faces several challenges, including high cost and business scalability issues. Manufacturing high-quality magnetic beads with consistent properties and surface functionalization is expensive, leading to low profit margins.

To address these challenges, manufacturers are investing heavily in the R&D of innovative manufacturing technologies for producing high-quality magnetic beads at reduced costs and on a larger scale.

Magnetic Beads Industry Trends

The rapid expansion of the magnetic beads industry is significantly influenced by their growing applications in molecular diagnostics and personalized medicine. Magnetic beads are playing a critical role in liquid biopsy, a non-invasive technique for detecting cancer biomarkers in blood and other bodily fluids.

This trend is driving the demand for highly sensitive and specific magnetic bead-based assays. Moreover, the growing emphasis on rapid and accurate diagnostics at the point of care is stimulating the development of portable and easy-to-use magnetic bead-based POCT platforms.

- For instance, in April 2024, New England Biolabs launched the Monarch Mag Viral RNA/DNA Extraction Kit, designed to enhance the recovery of viral nucleic acids for sensitive detection. This enhanced sensitivity is achieved through a combination of a magnetic bead-based method and a simplified extraction procedure.

Furthermore, magnetic bead manufacturers are increasingly integrating their products with microfluidic technologies. This integration is enabling the development of miniaturized and automated lab-on-a-chip systems for a diverse range of applications, including diagnostics, drug screening, and cell analysis.

Magnetic bead-based assays are also increasingly being incorporated into high-throughput screening (HTS) platforms for drug discovery and other large-scale applications.

Segmentation Analysis

The global market has been segmented based on type, application, end user, and geography.

By Type

Based on type, the market has been categorized into superparamagnetic beads and ferromagnetic beads. The ferromagnetic beads segment led the magnetic beads industry in 2023, reaching a valuation of USD 1937.3 million, driven by lower production costs, advancements in coating & surface modification, and increasing industrial applications.

While superparamagnetic beads are driving growth in the high-value biomedical and diagnostic sectors, ferromagnetic beads contribute to the overall expansion of the market by serving niche industrial applications that require strong magnetic retention.

For instance, in the mining industry, the separation of valuable magnetic minerals from non-magnetic rock requires a strong magnetic field, employing ferromagnetic beads or larger ferromagnetic separators. Increased investment in technologies has led to the development of novel ferromagnetic materials, coatings, and separation techniques, further fueling the market.

By Application

Based on application, the market can be segmented into bioresearch, in-vitro diagnosis, and others. The in-vitro diagnosis segment is growing rapidly and is projected to generate USD 6975.0 million revenue in 2031.

The increasing prevalence of infectious diseases and chronic conditions such as cancer and diabetes is driving the demand for accurate and rapid diagnostic tools. Magnetic separation provides a fast and efficient method for isolating target molecules, making it an essential technique in in-vitro diagnostics (IVD).

Magnetic beads are primarily utilized in IVD for applications such as sample preparation, immunoassays, and cell separation. They are also increasingly employed in molecular diagnostic tests for the extraction and purification of DNA and RNA from various biological samples, including blood, saliva, and tissue.

By End User

Based on end user, the market has been categorized into healthcare, diagnostics laboratories, pharmaceutical, biotechnology companies, academic and research institutions, and others. The healthcare and diagnostic laboratories segment held the largest market share of 46.67% in 2023, and is projected to generate USD 1810.6 million revenue in 2024.

Hospitals and diagnostic laboratories use magnetic beads technology for several processes, including pathogen detection, disease diagnosis, and genetic testing.

The high volume of daily testing in these settings necessitates efficient and high-throughput methodologies. Magnetic bead-based assays are well-suited for automation and can accommodate large sample volumes. Furthermore, their surface functionalization capabilities enable excellent specificity and sensitivity, ensuring reliable results and supporting efficient patient care.

Magnetic Beads Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. The North American magnetic beads market accounted for 37.87% share of the global market and was valued at USD 1325.7 million in 2023.

North America has a strong research infrastructure, including research institutions and universities at the forefront of life sciences research, genomics, proteomics, and drug discovery. These institutions are significant consumers of magnetic beads for a wide range of research applications.

The region also benefits from a strong venture capital and funding ecosystem that supports innovation and the development of technologies within the life sciences and biotechnology sectors, including magnetic bead technologies. Furthermore, companies in the region receive substantial R&D funding from government agencies such as the National Institutes of Health (NIH) in the U.S.

- Big Red Ventures, a U.S.-based venture capital firm, invested in Lo Biosciences in April 2024, supporting the development and commercialization of its at-home blood collection technology. This innovative device leverages magnetic bead technology for its core functionality.

The magnetic beads market in Asia Pacific is poised for significant growth over the forecasted period at a CAGR of 17.23%. This growth is attributable to increasing healthcare expenditures in diagnostic laboratories, hospitals, and research facilities by governments in key markets such as India, China, and Southeast Asian nations.

Furthermore, the region's emergence as a hub for medical tourism, attracting patients seeking cost-effective, high-quality medical treatments and diagnostics, is further fueling the demand for advanced diagnostic tools, including those utilizing magnetic bead technology.

Competitive Landscape

The global magnetic beads market report will provide valuable insights with a major emphasis on the consolidated nature of the market. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing numerous strategic initiatives, such as the expansion of services, investments in R&D, establishment of service delivery centers, and optimization of their service delivery processes, which are likely to create opportunities for market growth.

List of Key Companies in Magnetic Beads Market

Key Industry Developments

- December 2024 (Acquisition): Quanterix, a global digital health solutions provider, acquired Emission Inc., a company specializing in magnetic bead technology, to vertically integrate its bead technology capabilities. This acquisition aims to incorporate Emission’s proprietary bead technology into Quanterix’s product offerings.

- November 2024 (Expansion): Agarose Bead Technologies, a European manufacturer of agarose resins, expanded its Burgos facility by increasing production capacity to 100000 liters annually. Agarose is a common material used as a matrix in the production of magnetic beads.

The global magnetic beads market is segmented as:

By Type

- Superparamagnetic Beads

- Ferromagnetic Beads

By Application

- Bioresearch

- In-vitro Diagnostics

- Others

By End User

- Healthcare and Diagnostics Laboratories

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America