Market Definition

The market encompasses the production, distribution, and sale of machinery used for cutting, shaping, drilling, grinding, and finishing metal and other materials. It includes computer numerical control (CNC) machines, lathes, milling machines, grinders, and other precision tools used in industries such as automotive, aerospace, construction, and manufacturing.

The market covers aftermarket services such as maintenance, retrofitting, and tool replacement, driving industrial automation and efficiency improvements worldwide. The report outlines major factors driving the market, along with regional analysis and regulatory frameworks that are set to influence the growth trajectory over the forecast period.

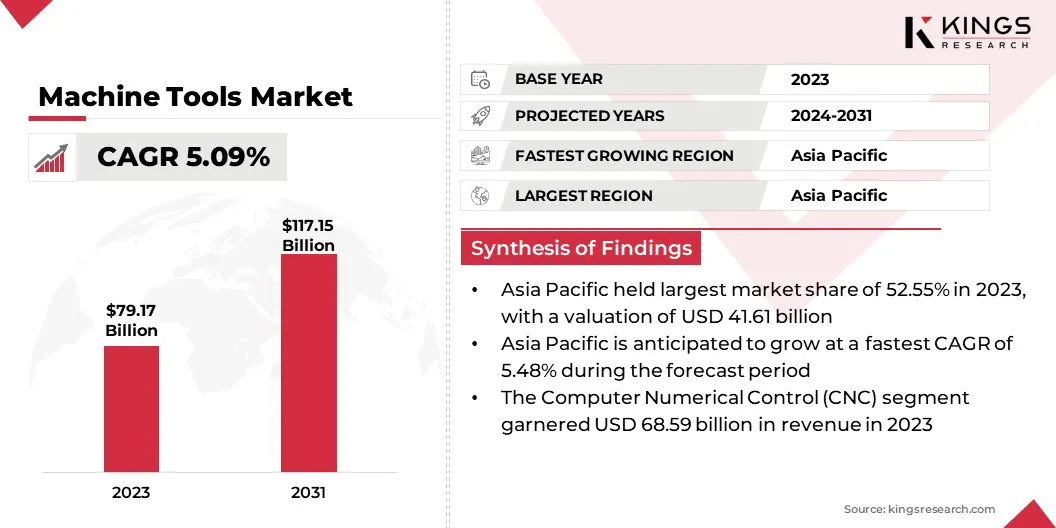

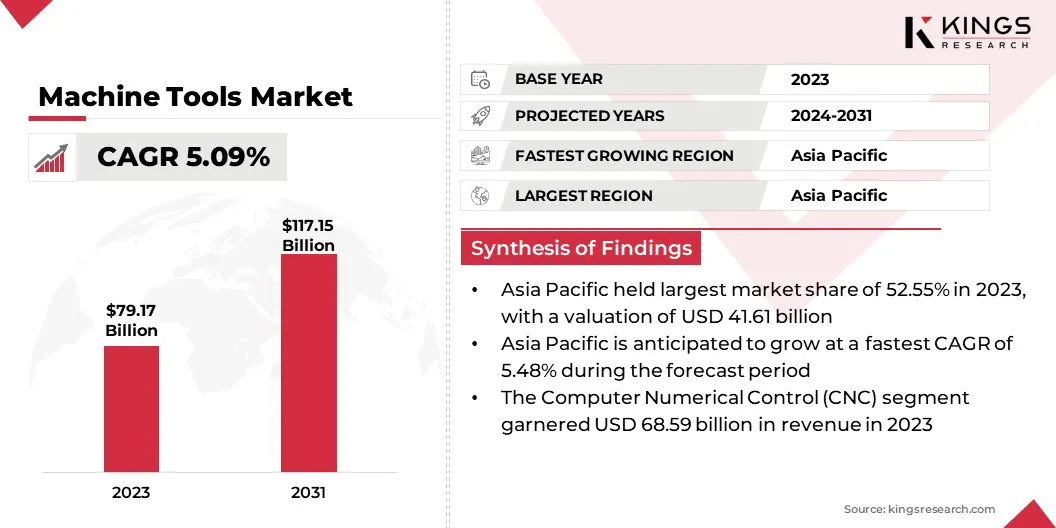

The global machine tools market size was valued at USD 79.17 billion in 2023 and is projected to grow from USD 82.75 billion in 2024 to USD 117.15 billion by 2031, exhibiting a CAGR of 5.09% during the forecast period. This market is witnessing steady growth, driven by rising industrial automation, advancements in CNC technology, and rising demand for precision manufacturing across various industries.

The automotive and aerospace sectors are contributing significantly to market expansion, as it demands high-precision tools for complex component production. Moreover, the growth of the construction and heavy machinery sectors boosts the demand for robust, high-performance machining solutions.

Major companies operating in the machine tools industry are DMG MORI, AMADA CO., LTD., TRUMPF, MAZAK CORPORATION, Okuma Corporation, Makino Inc., MAG IAS GmbH, GROB-WERKE GmbH & Co. KG, Haas Automation, Inc, Hardinge Inc., DN SOLUTIONS, Gleason Corporation, JTEKT Corporation, CHIRON Group SE, and EMAG Systems GmbH.

Innovations in automation and digital manufacturing are revolutionizing the market, enabling higher precision, faster production, and enhanced customization. The adoption of smart machining solutions, boosted by real-time data analytics and adaptive control systems, is optimizing efficiency across industries.

Additionally, the demand for lightweight and high-performance materials in sectors such as aerospace and automotive is fostering the development of advanced machining techniques.

- In October 2024, Nidec Machine Tool Corporation launched a 66,000m² machine tool production factory in Pinghu, China, to meet growing demand in the automotive, robotics, and industrial machinery sectors. The facility will manufacture hobbing machines, gear machine tools, and machining centers, with an initial output of 4 million units, aiming for 8 million by 2030.

Key Highlights

- The machine tools industry size was valued at USD 79.17 billion in 2023.

- The market is projected to grow at a CAGR of 5.09% from 2024 to 2031.

- Asia Pacific held a share of 52.55% in 2023, valued at USD 41.61 billion.

- The metal cutting segment garnered USD 58.24 billion in revenue in 2023.

- The computer numerical control (CNC) segment is expected to reach USD 102.667 billion by 2031.

- The automotive segment is projected to generate a revenue of USD 46.71 billion by 2031.

- North America is anticipated to grow at a CAGR of 5.33% over the forecast period.

Market Driver

Precision Manufacturing and AI-Driven Automation

The market is witnessing significant growth, primarily fueled by the rising demand for precision manufacturing across sectors such as aerospace, automotive, defense, and medical devices.

These industries require components with extremely tight tolerances, intricate geometries, and consistent quality, boosting the adoption of high-precision CNC machines and multi-axis machining centers. These advanced tools enhance accuracy, reduce error margins, and minimize material wastage, critical for performance-driven applications.

The growing implementation of automation and artificial intelligence (AI) is transforming conventional machining processes. Smart machine tools integrated with sensors, real-time monitoring, and AI-powered analytics are enabling predictive maintenance, adaptive control, and autonomous decision-making.

This enhances operational efficiency and reduces downtime while also mitigating labor shortages by decreasing dependence on manual intervention. Automation and AI are becoming pivotal in boosting productivity and streamlining manufacturing workflows in the evolving machine tools landscape.

- In November 2024, Hexagon’s Manufacturing Intelligence division unveiled ProPlanAI, an AI-powered CAM programming tool, at the Microsoft Ignite Conference. Integrated with Hexagon’s ESPRIT EDGE software and Microsoft’s Azure platform, ProPlanAI reduces machine tool programming time by up to 75% by leveraging company-specific data to automate process planning. The tool enhances productivity, preserves institutional knowledge, and supports the transition to autonomous manufacturing through its learning capabilities and AI-powered guidance features.

Market Challenge

High Capital Investment

A major challenge hampering the expansion of the machine tools market is the substantial capital investment required to acquire, implement, and maintain advanced manufacturing equipment. As the industry shift toward precision engineering, automation, and digital integration, the cost of high-performance CNC machines, multi-axis machining centers, and digitally enabled systems has risen considerably.

These expenses include infrastructure upgrades, specialized software, skilled workforce training, and ongoing maintenance. For small and medium-sized enterprises, these high upfront costs often limit their ability to adopt next-generation technologies, thereby constraining growth and competitiveness.

This challenge is further intensified by ongoing technological advancement, which raises concerns over equipment obsolescence and return on investment (ROI). In an environment marked by fluctuating demand and economic uncertainty, many businesses are cautious about committing large amounts of capital without guaranteed long-term value.

To mitigate this barrier, companies are increasingly turning to alternative financing models such as leasing arrangements, subscription-based equipment-as-a-service (EaaS), and government-supported incentive programs. These approaches help reduce the financial burden of modernization while enabling access to advanced technologies.

Market Trend

Digital Twin Adoption and Flexible Manufacturing

The market is witnessing considerable growth, primarily propelled by the adoption of digital twin technology and the increasing emphasis on customization and flexible manufacturing. Digital twin technology enables the creation of real-time virtual replicas of machines and processes using sensor data.

This allows manufacturers to simulate operations, monitor equipment health, and optimize system performance without the need for physical trials. The resulting improvements in setup efficiency, process accuracy, and design optimization significantly accelerate time-to-market and support more informed decision-making.

Moreover, the growing demand for adaptable and customizable manufacturing solutions is fueling the need for adaptable, customizable manufacturing solutions. In response, manufacturers are deploying modular machinery, quick-change tooling, and integrated software solutions to enable rapid reconfiguration and operational flexibility.

These advancements are enhancing production agility, reducing operational costs, and enabling companies to remain competitive in volatile, demand-driven markets.

- In October 2024, Nidec Machine Tool Corporation unveiled a digital twin platform for large machine tools at JIMTOF2024. The platform simulates machining processes in a virtual space to improve programming accuracy, enhance productivity, and reduce manpower requirements. Demonstrated using the MVR-Hx double-column five-face machining center, the solution aims to address labor shortages and operational inefficiencies in the metal-processing industry.

|

Segmentation

|

Details

|

|

By Type

|

Metal Cutting (Machining Centers, Turning Machines, Grinding Machines, Milling Machines, Eroding machines, Others), Metal Forming (Bending Machines, Presses, Punching Machines, Others)

|

|

By Technology

|

Computer Numerical Control (CNC), Conventional

|

|

By End Use

|

Automotive, Mechanical Engineering, Metal Working, Aerospace, Electrical Industry, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Metal Cutting and Metal Forming): The metal cutting segment earned USD 58.24 billion in 2023 due to its widespread adoption in precision manufacturing and high demand across industries such as automotive and aerospace.

- By Technology (Computer Numerical Control (CNC) and Conventional): The computer numerical control (CNC) segment held a share 86.63% in 2023, attributed to increasing automation, improved efficiency, and higher precision in metalworking processes.

- By End Use (Automotive, Mechanical Engineering, Metal Working, Aerospace, Electrical Industry, and Others): The automotive segment is projected to reach USD 46.71 billion by 2031, fueled by the rising need for lightweight and high-performance vehicle components.

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific machine tools market accounted for a substantial share of 52.55% in 2023, valued at USD 41.61 billion. This dominance is reinforced by the strong manufacturing base in countries such as China, Japan, South Korea, and India, which are key global hubs for aerospace, automotive, and electronics production.

China, the largest producer and consumer of machine tools, benefits from substantial government investments in industrial automation under initiatives such as "Made in China 2025." Japan and South Korea contribute through advancements in technology and robotics-integrated machining solutions. Additionally, India's rapid industrialization and infrastructure expansion continue to boost demand for machine tools, supporting regional market expansion.

- In October 2024, Nidec Corporation announced plans to establish a technical center at the Nidec Machine Tool Corporation site in Ritto, Japan. The facility will showcase the Nidec Group’s complete range of machine tools and offer integrated manufacturing solutions incorporating turning, cutting, grinding, and metallic lamination forming technologies.

North America machine tools industry is expected to register the fastest CAGR of 5.33% over the forecast period. This growth is fueled by the rising need for advanced machining solutions in aerospace, defense, and automotive sectors, particularly in the U.S. and Canada.

The Biden administration's push for domestic manufacturing and reshoring initiatives has led to increased investments in high-precision and automated machine tools. The U.S. aerospace sector, propelled by major aircraft manufacturers, relies heavily on next-generation machining technologies.

Additionally, the rapid expansion of electric vehicle (EV) production in North America, fueled by new gigafactories, is boosting demand for specialized machining tools. Government incentives, such as tax credits for automation and manufacturing modernization, further support regional industry expansion.

Canada’s focus on high-value manufacturing and Mexico’s emergence as a strategic hub for U.S. manufacturers are contributing to the domestic market growth.

Regulatory Frameworks

- In the United States, machine tools are regulated under the Export Administration Regulations by the Bureau of Industry and Security (BIS) for export controls, while the Occupational Safety and Health Administration (OSHA) enforces workplace safety standards. The American National Standards Institute (ANSI) and the National Institute of Standards and Technology (NIST) provide industry safety and performance guidelines.

- In the European Union, machine tools must comply with the Machinery Directive for safety requirements, the CE marking for market entry, and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations under the European Chemicals Agency (ECHA) for hazardous substances used in manufacturing.

- In China, machine tools are subject to the Export Control Law, regulated by the Ministry of Commerce, while the State Administration for Market Regulation (SAMR) enforces safety and quality standards.

- In Japan, the Ministry of Economy, Trade and Industry (METI) oversees export controls under the Foreign Exchange and Foreign Trade Act (FEFTA), and the Japan Industrial Standards (JIS) regulate performance and safety standards.

- In India, machine tools are governed by the Directorate General of Foreign Trade (DGFT) for trade regulations, while the Bureau of Indian Standards (BIS) sets safety and quality benchmarks, and the Ministry of Heavy Industries (MHI) monitors domestic manufacturing policies.

Competitive Landscape

Companies operating in the machine tools market are heavily investing in R&D to introduce advanced CNC machines with improved precision, automation, and energy efficiency.

They are integrating artificial intelligence (AI) and the Internet of Things (IoT) into their products to enhance real-time monitoring, predictive maintenance, and operational efficiency. To expand their global footprint, manufacturers are engaging in mergers, acquisitions, and joint ventures, allowing them to diversify their product portfolios and enter new regional markets.

Additionally, several companies are establishing smart manufacturing facilities and leveraging digital twin technology to optimize production processes. Customization and after-sales services, including maintenance and retrofitting, have become critical strategies for customer retention. The rising emphasis on automation and connectivity is reshaping the competitive landscape of industrial machining solutions.

- In September 2024, Phillips Machine Tools and EOS extended their strategic partnership into the Middle East and Africa (MEA) region to provide local technical services, Additive Minds consulting, and advanced manufacturing solutions. Building on their successes in India and the USA, the collaboration aims to support the MEA manufacturing industry with industrial 3D printing technologies and services across sectors such as aerospace, defense, medical, automotive, and space.

List of Key Companies in Machine Tools Market:

- DMG MORI

- AMADA CO., LTD.

- TRUMPF

- MAZAK CORPORATION

- Okuma Corporation

- Makino Inc.

- MAG IAS GmbH

- GROB-WERKE GmbH & Co. KG

- Haas Automation, Inc

- Hardinge Inc.

- DN SOLUTIONS

- Gleason Corporation

- JTEKT Corporation

- CHIRON Group SE

- EMAG Systems GmbH

Recent Developments (Product Launches)

- In January 2025, Siemens launched MACHINUM at IMTEX 2025 in Bengaluru, a digitalization portfolio aimed at enhancing efficiency and sustainability. As part of the Siemens Xcelerator platform, MACHINUM supports faster digital transformation by integrating software, IoT-enabled hardware, and digital twin capabilities. The solution can reduce setup time by up to 20% and energy consumption by up to 18%, addressing the rising demand for precision and energy-efficient manufacturing in India’s growing machine tool sector.

- In November 2024, JTEKT Corporation advanced its Model-Based Development (MBD) approach to improve bearing design efficiency and reliability. The update features a new design core system that reduces evaluation time by 75% and a high-speed test machine using magnetic bearings.

- In August 2024, FANUC America introduced the Series 500i-A CNC, a new control system featuring integrated 5-axis technology to enhance modern machining performance. Offering 2.7 times higher CPU processing power annd a new iHMI2 interface, the system is designed to simplify operation, boost productivity, and enable digital twin integration for advanced machining applications.