Lyme Disease Diagnostics Market Size

Lyme Disease Diagnostics Market Size

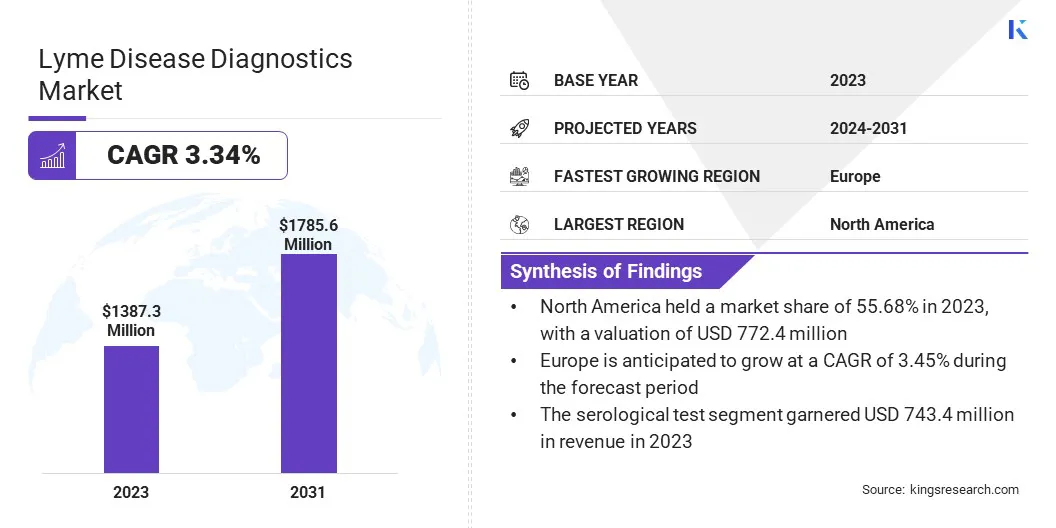

The global Lyme Disease Diagnostics Market size was valued at USD 1,387.3 million in 2023 and is projected to grow from USD 1,418.3 million in 2024 to USD 1,785.6 million by 2031, exhibiting a CAGR of 3.34% during the forecast period. The market is rapidly expanding due to technological advancements and rising incidence of Lyme disease driven by climate change. Innovations such as PCR and serological tests enhance diagnostic accuracy.

Government initiatives and preventive measures further boost market growth. In the scope of work, the report includes solutions offered by companies such LabCorp, Quest Diagnostics, Abbott, Bio-Rad Laboratories, Inc, DiaSorin S.p.A, F. Hoffmann-La Roche Ltd, Meridian Bioscience Inc., QuidelOrtho Corporation., Thermo Fisher Scientific Inc., QIAGEN, and others.

The market for Lyme disease diagnostics is rapidly evolving with technological advancements and increasing government initiatives worldwide. Innovations such as PCR assays and advanced serological tests are enhancing sensitivity and accuracy in detecting Borrelia burgdorferi, which is driving market growth.

Rising incidence of Lyme disease, exacerbated by climate change and expanding tick habitats, underscore the urgent need for effective diagnostic solutions. Government support through funding, research grants, further propels market expansion. With a focus on early detection and improved patient outcomes, the market is expected to witness continued growth, driven by innovations and efforts to raise public health awareness globally.

- For example, in 2022, the United States Fair Health Organization noted significant growth in Lyme disease cases over the past 15 years, highlighting its emergence as a growing national health concern.

Lyme disease diagnostics refer to the methods and technologies used to detect and confirm the presence of Lyme disease in individuals. These diagnostics aim to identify the bacterium Borrelia burgdorferi, which causes Lyme disease, through various testing methods.

Key diagnostic techniques include Polymerase Chain Reaction (PCR) assays, which detect bacterial DNA, and serological tests, which identify antibodies produced by the immune system in response to the infection. Accurate and timely diagnostics are crucial for effective treatment and management of Lyme disease, helping to prevent complications and improve patient outcomes.

Analyst’s Review

Recent technological advancements are driving the growth of the Lyme disease diagnostics market.

- For instance, in June 2022, Adaptive Biotechnologies Corporation introduced T-Detect Lyme, a groundbreaking diagnostic test that translates genetics of the adaptive immune system into clinical applications.

This test identifies T cells activated by Borrelia burgdorferi, the bacterium associated with Lyme disease, using the body's unique T-cell response to disease-associated antigens. By detecting this immune response, T-Detect Lyme aids in early diagnosis, offering a more precise and swift approach to managing Lyme disease, thus meeting the growing demand for advanced diagnostic solutions in the healthcare industry.

To capitalize on recent technological advancements and government support, key players in the market are looking to strategically invest in innovative diagnostic technologies. Collaborating with government entities through research funding and aligning with public health initiatives will further strengthen their market positioning. This approach meets the growing demand for advanced diagnostic tools and also supports broader healthcare objectives, driving market growth and improving diagnostic capabilities for Lyme disease worldwide.

Lyme Disease Diagnostics Market Growth Factors

The increasing global incidence of Lyme disease is currently a major factor driving the demand for improved diagnostic capabilities to ensure timely and accurate detection and treatment. Advanced diagnostic tools, such as PCR assays and serological tests, are enhancing sensitivity and specificity, reducing diagnostic uncertainties, and enabling earlier intervention.

This increased demand is propelling market growth as healthcare providers and diagnostic companies invest in research and development to explore new testing methods and technologies. Point-of-care testing (POCT) solutions are particularly gaining traction, further accelerating market expansion by facilitating rapid and decentralized diagnosis in diverse healthcare settings worldwide.

- According to CDC estimates, approximately 476,000 Americans are diagnosed and treated for Lyme disease each year.

A significant challenge in the Lyme disease diagnostics market is the variability in symptoms and its overlap with other diseases, which increases diagnostic complexity and leads to potential misdiagnosis. This is expected to hinder market growth by delaying accurate treatment and impacting patient outcomes.

However, key players are addressing this challenge through ongoing research and development aimed at enhancing diagnostic specificity. They are investing in advanced technologies, such as PCR assays and serological tests, which offer improved sensitivity and help differentiate Lyme disease from similar conditions. Additionally, educational initiatives and collaboration with healthcare providers aim to increase awareness and facilitate early detection, mitigating the impact of diagnostic challenges on the market growth.

Lyme Disease Diagnostics Market Trends

The innovations in diagnostic technologies are driving market growth by significantly expanding detection and diagnosis capabilities. PCR assays and advanced serological tests offer accuracy and reliability, meeting the increasing demand for precise diagnostic solutions.

This surge in effective diagnostics not only supports healthcare providers in delivering timely treatments but also fuels investment in research and development within the diagnostic sector. As more stakeholders recognize the value of these advancements in improving patient outcomes and public health management, the market for Lyme disease diagnostics continues to grow, with ongoing advancements propelling further technological upgrades and market expansion.

Government initiatives play a crucial role in driving the lyme disease diagnostics market. Governments worldwide are increasingly allocating resources to combat Lyme disease through funding research, supporting awareness campaigns, and upgrading public health infrastructure. These efforts aim to improve early detection and treatment, reducing the burden of Lyme disease on healthcare systems and society.

Concurrently, preventive measures such as robust surveillance programs and community education initiatives enhance public awareness and promote proactive strategies to mitigate tick exposure. Such favorable regulatory environment drives innovation in diagnostic technologies and expands the market for advanced solutions that can effectively meet the growing demand for accurate and timely diagnosis of Lyme disease.

Segmentation Analysis

The global market is segmented based on diagnostic type, sample, end-user, and geography.

By Diagnostic Type

Based on diagnostic type, the market is categorized into serological test, polymerase chain reaction, and others. The serological test led the Lyme disease diagnostics market in 2023, reaching a valuation of USD 743.4 million. These tests, their adoption among healthcare providers.

Technological advancements, such as improved enzyme-linked immunosorbent assays (ELISA) and Western blotting, enhance which detect antibodies produced in response to Borrelia burgdorferi infection, are crucial for diagnosing Lyme disease, particularly in later stages. High sensitivity and specificity of serological tests increase diagnostic accuracy, attracting investments and fostering market expansion.

Additionally, growing awareness about Lyme disease and supportive government initiatives facilitates early detection and frequent testing, further boosting the demand for serological tests. These factors are expected to collectively propel the growth of the market.

By Sample

Based on sample, the market is divided into blood, cerebrospinal fluid, and others. The blood segment captured the largest lyme disease diagnostics market share of 71.56% in 2023. The segment is witnessing expansion through its essential role in serological tests and PCR assays. These tests use blood samples to detect antibodies or bacterial DNA associated with Borrelia burgdorferi infection, ensuring accurate diagnosis across different stages of Lyme disease.

With high diagnostic accuracy, widespread adoption among healthcare providers, and ongoing technological advancements, including multiplex assays and automated systems, the segment meets increasing demand driven by raised disease awareness and regulatory support.

By End-User

Based on end-user, the market is categorized into hospitals, diagnostic laboratories, and others. The diagnostic laboratories segment is expected to garner the highest revenue of USD 980.5 million in 2031.

Equipped with advanced technologies like PCR assays and serological tests, these laboratories ensure high sensitivity and specificity in diagnosing Lyme disease. They serve as centralized hubs for comprehensive testing, supporting healthcare providers in making informed clinical decisions.

Collaboration between laboratories and healthcare professionals enhances diagnostic efficiency and the interpretation of results. Furthermore, ongoing research and adherence to regulatory standards may drive innovation within these laboratories, further improving diagnostic capabilities and driving growth of the market.

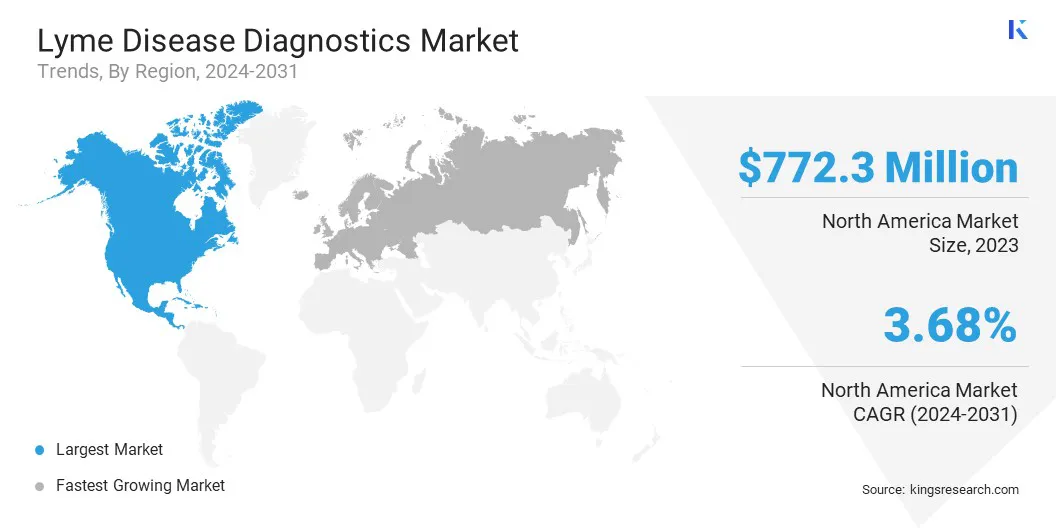

Lyme Disease Diagnostics Market Regional Analysis

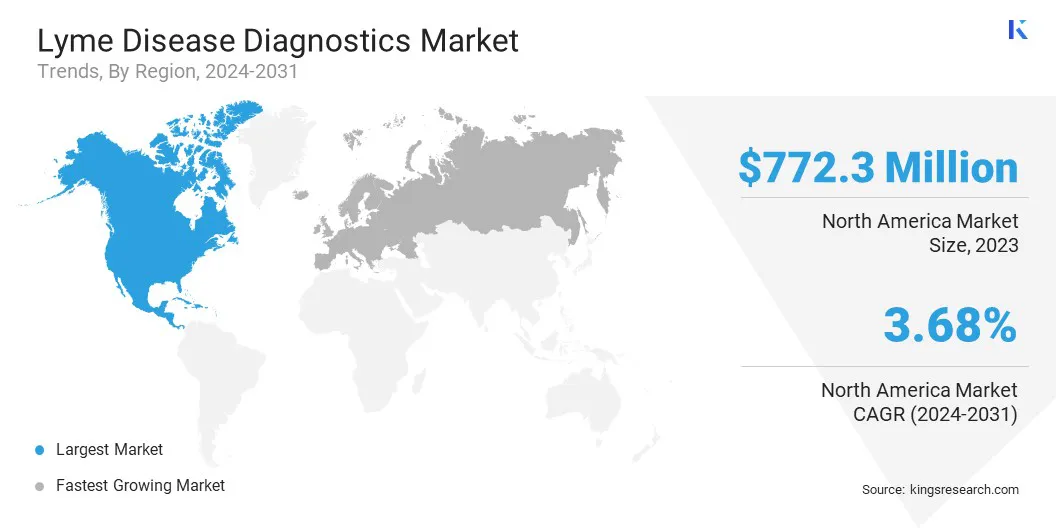

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America lyme disease diagnostics market share stood around 55.68% in 2023 in the global market, with a valuation of USD 772.4 million. The market growth in the region is driven by several factors, including the increasing prevalence of tick-borne diseases and proactive initiatives by both government and private institutes to diagnose Lyme disease effectively.

- According to CDC, in 2022, over 63,000 cases of Lyme disease were reported in the U.S.

Additionally, several prominent market players in North America are currently expanding their diagnostic portfolios to include advanced technologies aimed at detecting Lyme disease-causing pathogens.

- For instance, T2 Biosystems is introducing the T2Lyme Panel Diagnostic technology in 2022, enhancing diagnostic capabilities in the region. These technological advancements, including the identification and characterization of metabolic biomarkers and biosignatures, are pivotal in improving diagnostic accuracy and driving therapeutic advancements.

The rising healthcare expenditure and well-established healthcare infrastructure further support market growth.

Europe is anticipated to witness the significant growth at a CAGR of 3.45% over the forecast period. The region faces a high incidence of Lyme disease, particularly in forest-covered and rural areas where tick habitats are prevalent. Governments and healthcare facilities across Europe are actively investing in diagnostic research and public health initiatives to enhance early detection and management of Lyme disease.

This proactive approach is supported by robust healthcare infrastructure and regulatory frameworks in the region that promote the adoption of advanced diagnostic technologies.

Competitive Landscape

The global Lyme disease diagnostics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Lyme Disease Diagnostics Market

- LabCorp

- Quest Diagnostics

- Abbott

- Bio-Rad Laboratories, Inc

- DiaSorin S.p.A

- Hoffmann-La Roche Ltd

- Meridian Bioscience Inc.

- QuidelOrtho Corporation.

- Thermo Fisher Scientific Inc.

- QIAGEN

Key Industry Development

July 2022 (Approval): T2 Biosystems received approval from the United States Food and Drug Administration (USFDA) for its T2Lyme Panel. This panel has been designed to enhance the accuracy of early Lyme disease diagnosis, potentially improving patient care and outcomes. By directly identifying the bacteria responsible for Lyme disease from a patient's blood sample, the T2Lyme Panel aims to provide precise and timely diagnostic information. This advancement represents a significant step forward in Lyme disease diagnostics, offering healthcare providers a reliable tool to support early detection and effective management of the disease.

The global Lyme disease diagnostics market is segmented as:

By Diagnostic Type

- Serological Test

- Polymerase Chain Reaction

- Others

By Sample

- Blood

- Cerebrospinal Fluid

- Others

By End User

- Hospitals

- Diagnostic Laboratories

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America