Market Definition

The market refers to the industry involved in producing containers and packaging solutions for liquids, including beverages, dairy products, chemicals, and personal care items. It includes materials like glass, plastic, metal, and paperboard, with a focus on convenience and sustainability.

The report presents a comprehensive analysis of the key market drivers, emerging trends, and the competitive landscape, which are expected to determine the growth dynamics throughout the forecast period.

Liquid Packaging Market Overview

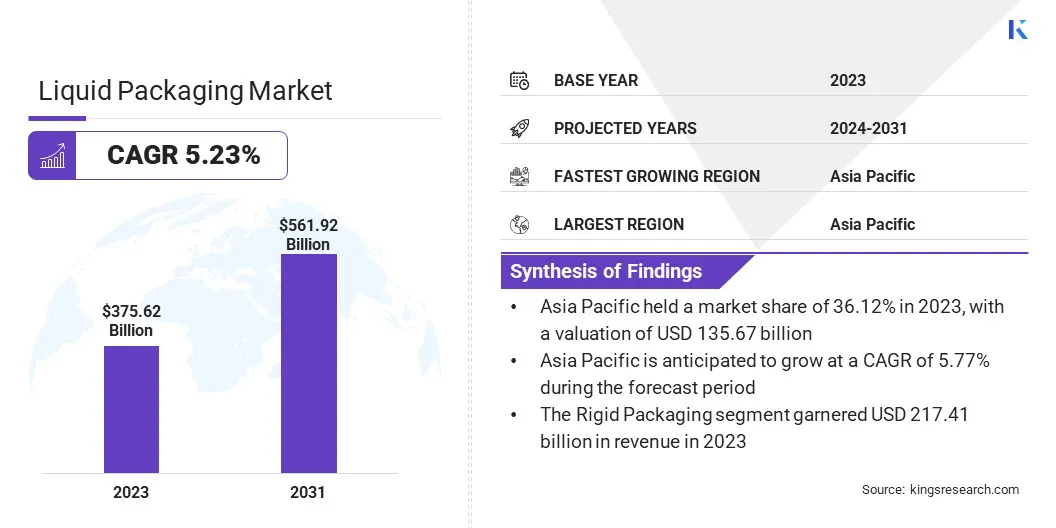

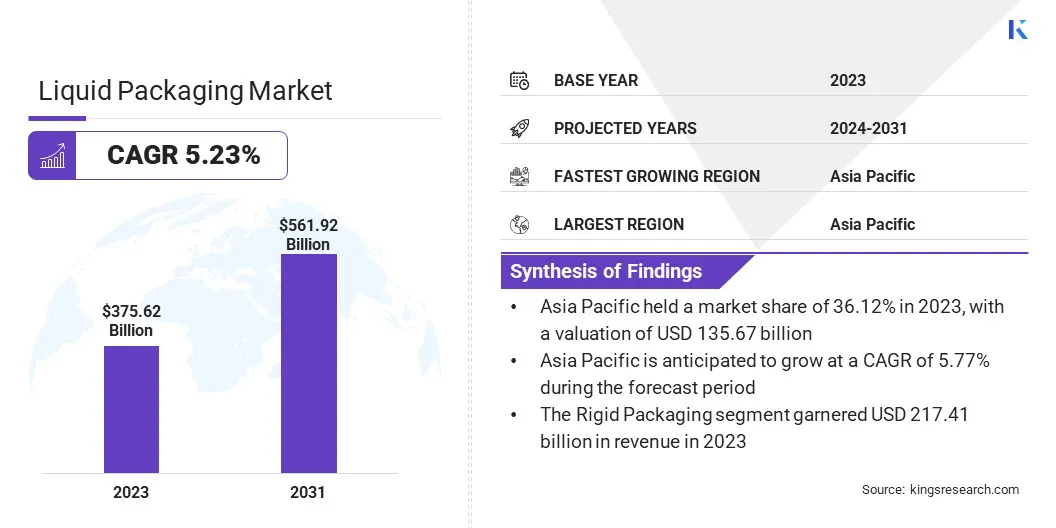

The global liquid packaging market size was valued at USD 375.62 billion in 2023, which is estimated to be USD 393.21 billion in 2024 and reach USD 561.92 billion by 2031, growing at a CAGR of 5.23% from 2024 to 2031.

The increasing demand for convenient, portable, and ready-to-consume beverages is driving the market. Consumers favor packaging that is easy to carry, store, and consume on the go, fueling innovation.

Major companies operating in the liquid packaging industry are Billerud AB, Comar, Pactiv Evergreen Inc., International Paper, Klabin S.A, Liquibox, Mondi, NIPPON PAPER INDUSTRIES CO., LTD., Smurfit Kappa, Tetra Laval Group, Dow , Amcor plc, Gerresheimer AG, SIG, and UFlex Limited.

The growing demand for plant-based, organic, and functional beverages is significantly influencing the market. Consumers are increasingly shifting toward healthier, environmentally conscious choices, boosting the need for specialized packaging that preserves the integrity of these products.

This trend drives innovation in packaging materials and designs, such as eco-friendly, recyclable, and biodegradable options. Packaging manufacturers must adapt to these evolving demands, offering solutions that ensure product freshness, sustainability, and convenience while meeting the unique requirements of plant-based and functional beverages.

- In October 2024, Unilever boosted investment in packaging R&D to reduce virgin plastic use. The company focuses on developing recyclable and compostable materials through its"Future Flexibles" program, addressing challenges in packaging liquid products while supporting sustainability and innovation in the market.

Key Highlights:

- The liquid packaging industry size was valued at USD 375.62 billion in 2023.

- The market is projected to grow at a CAGR of 5.23% from 2024 to 2031.

- Asia-Pacific held a market share of 36.12% in 2023, with a valuation of USD 135.67 billion.

- The rigid packaging segment garnered USD 217.41 billion in revenue in 2023.

- The plastics segment is expected to reach USD 255.10 billion by 2031.

- The food & beverage segment is anticipated to register the fastest CAGR of 5.84% during the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 5.04% during the forecast period.

Market Driver

Convenience and Portability

The demand for convenient, portable, and ready-to-consume beverages continues to grow as consumers lead increasingly fast-paced lifestyles. This shift is propelling the market, with packaging solutions for on-the-go consumption becoming essential.

Easy-to-carry formats like bottles, pouches, and resealable cartons are in high demand. Manufacturers are responding with lightweight, compact, and functional packaging that ensures product freshness while meeting convenience needs. This is pushing innovation in materials, designs, and packaging formats to enhance consumer experience and streamline portability.

- In October 2024, AeroFlexx delivered its first commercial batch of innovative AeroFlexx Paks. This lightweight, flexible packaging solution combines the best features of rigid and flexible packaging, addressing the growing demand for sustainable, portable, and consumer-friendly liquid packaging.

Market Challenge

Environmental Impact of Non-recyclable Packaging

The environmental impact of non-recyclable packaging, particularly plastic waste, continues to challenge the liquid packaging market. Despite advances in sustainable solutions, a large portion of packaging still ends up in landfills, contributing to pollution.

According to the UN Environment Programme, less than 10% of the seven billion tonnes of plastic waste generated globally has been recycled. Additionally, the global production of primary plastic is projected to reach 1,100 million tonnes by 2050. The industry is focusing on developing recyclable, compostable, and biodegradable materials, alongside investing in circular packaging models.

Solutions like using post-consumer recycled content, enhancing packaging designs for recyclability, and adopting alternative materials like plant-based plastics are key to reducing waste and ensuring sustainability in liquid packaging.

Market Trend

Minimalistic and Eco-friendly Designs

The trend of minimalistic and eco-friendly designs in liquid packaging is growing as consumers increasingly prioritize sustainability. Packaging that is simple, functional, and made from recyclable or biodegradable materials resonates with environmentally conscious buyers.

Clear sustainability messaging, such as labels highlighting eco-friendly materials or recycling instructions, has become crucial in influencing purchasing decisions. Brands are adapting by reducing excess packaging, choosing renewable resources, and focusing on transparency to align with the rising demand for greener, more responsible options.

- In January 2025, AeroFlexx partnered with Chemipack to drive sustainable packaging innovation across Europe. AeroFlexx aims to meet the growing demand for eco-friendly liquid packaging by deploying its proprietary filling machine at Chemipack’s facility, enhancing global sustainability efforts.

Liquid Packaging Market Report Snapshot

|

Segmentation

|

Details

|

|

By Packaging Type

|

Flexible Packaging (Pouches, Sachets, Bags-in-boxes, Films), Rigid Packaging (Bottles, Paperboard, Drums, Cans, Containers)

|

|

By Material

|

Plastics, Paperboard, Glass, Metal

|

|

By End User

|

Food & Beverage, Pharmaceutical, Personal Care, Household Care, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Packaging Type (Flexible Packaging, Rigid Packaging): The rigid packaging segment earned USD 217.41 billion in 2023, due to its durability, cost-effectiveness, and widespread use in liquid packaging applications.

- By Material (Plastics, Paperboard, Glass, Metal): The plastics segment held 43.95% share of the market in 2023, due to its versatility, lightweight properties, and affordability in packaging liquid products across various industries.

- By End User (Food & Beverage, Pharmaceutical, Personal Care, Household Care, Industrial): The food & beverage segment is projected to reach USD 215.71 billion by 2031, owing to the increasing consumer demand for packaged drinks and convenience products.

Liquid Packaging Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for a market share of around 36.12% in 2023, with a valuation of USD 135.67 billion. The region dominates the global liquid packaging market, due to its rapid industrialization, large population, and growing demand for packaged food & beverages.

Countries in this region are increasingly adopting sustainable packaging solutions to meet both consumer needs and regulatory requirements. Companies are focusing on eco-friendly innovations such as incorporating recycled materials as governments enforce stricter environmental policies. This shift toward sustainability further strengthens the position of Asia Pacific as a leader in the global market.

- In February 2025, Tetra Pak introduced packaging with 5% certified recycled polymers in India, becoming the first in the food & beverage packaging industry to do so. This innovation aligns with India’s Plastic Waste Management Rules, enhancing sustainability efforts.

The market in Europe is poised for significant growth at a robust CAGR of 5.04% over the forecast period. Europe is emerging as a fast-growing region in the liquid packaging industry, driven by a strong focus on sustainability and innovative packaging solutions.

Companies are adopting circular packaging solutions, such as using recycled materials and reducing plastic waste, due to the increasing consumer demand for eco-friendly products and the implementation of stringent environmental regulations.

This focus on sustainable practices positions Europe as a key player in the global market, accelerating the shift toward greener alternatives and reinforcing the region’s growth trajectory.

- In January 2024, Tetra Pak and Valio launched Northern Europe’s first tethered cap containing 30% certified recycled polymers. This innovative cap, designed to reduce plastic litter, aligns with Valio's sustainability goals, marking a significant step toward circular packaging solutions.

Regulatory Frameworks

- In the U.S., the Consumer Product Safety Commission (CPSC) sets safety standards for consumer products, including packaging, to protect the public from risks of injury, particularly those that may harm children.

- In the EU, the Packaging and Packaging Waste Regulation 2025/40 (PPWR) regulates packaging design, waste management, and recycling, including specific measures for liquid packaging to promote sustainability and waste prevention.

- In India, the Bureau of Indian Standards (BIS) establishes packaging guidelines, including IS 17753 for liquid food packaging, IS 8460 for wrapping tissue paper, and IS 14534 for plastic recycling, promoting safety, sustainability, and quality.

Competitive Landscape:

Companies in the liquid packaging industry are focusing on developing more sustainable and efficient packaging solutions. They are increasingly incorporating recyclable materials, reducing plastic usage, and optimizing designs for easier disposal and recycling.

Innovations such as all-polyethylene pouches, tethered caps, and plant-based materials are being explored to improve environmental impact while maintaining performance and safety standards.

- In February 2024, Amcor partnered with Stonyfield Organic and Cheer Pack North America to launch the first all-PE spouted pouch. This innovation uses recyclable AmPrima Plus film and a Vizi cap, offering a sustainable packaging solution for YoBaby yogurt.

List of Key Companies in Liquid Packaging Market:

- Billerud AB

- Comar

- Pactiv Evergreen Inc.

- International Paper

- Klabin S.A

- Liquibox

- Mondi

- NIPPON PAPER INDUSTRIES CO., LTD.

- Smurfit Kappa

- Tetra Laval Group

- Dow

- Amcor plc

- Gerresheimer AG

- SIG

- UFlex Limited

Recent Developments (M&A/Partnerships)

- In November 2024, Amcor and Kolon Industries announced a partnership to develop sustainable polyester materials for packaging. Focusing on chemically recycled PET and polyethylene furanoate, the collaboration aims to reduce carbon footprints and increase the use of recycled content in packaging solutions.

- In September 2024, Novvia Group acquired Liquid Bottles, a Florida-based supplier of plastic and glass containers. This acquisition expands Novvia’s product range, strengthens its presence in the Southeastern U.S. market, and enhances its e-commerce platform for better customer service.

- In June 2024, AeroFlexx announced a partnership with Chemipack to deliver eco-friendly liquid packaging solutions in Europe. This collaboration aims to meet the growing demand for sustainable packaging, leveraging Chemipack’s efficient filling operations and AeroFlexx’s innovative packaging technology.