Market Definition

The life science analytics industry refers to the use of data analytics, Artificial Intelligence (AI), and advanced technologies to analyze and interpret complex biological, clinical, and healthcare data.

It enables pharmaceutical, biotech, and healthcare companies to improve drug discovery, clinical trials, patient care, and operational efficiency by leveraging data-driven insights for informed decision-making and better outcomes.

Life Science Analytics Market Overview

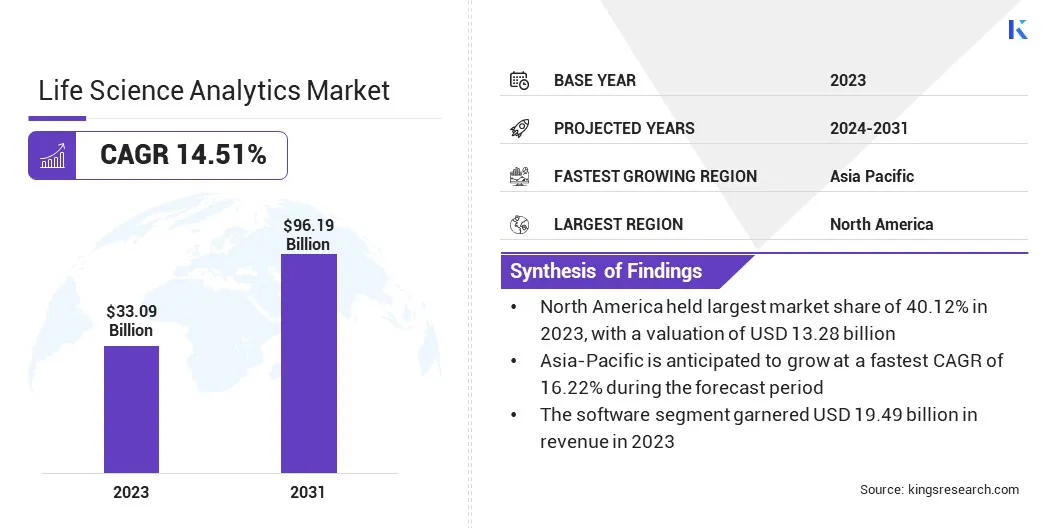

The global life science analytics market size was valued at USD 33.09 billion in 2023, which is estimated to be valued at USD 37.25 billion in 2024 and reach USD 96.19 billion by 2031, growing at a CAGR of 14.51% from 2024 to 2031.

The growing adoption of data-driven decision-making is fueling the market, with AI, big data, and predictive analytics optimizing drug discovery, patient care, and operational efficiency. These technologies enhance precision, reduce costs, and accelerate research and healthcare advancements.

Major companies operating in the global life science analytics market are Oracle, SAS Institute Inc., Accenture, Veeva Systems Inc., IBM, Analytics8, IQVIA, Cognizant, TAKE Solutions Limited, Wipro, MaxisIT, SAP SE, Cotiviti, Inc, Optum, Inc., and Infosys Limited.

The market is expanding as pharmaceutical, biotechnology, and healthcare organizations increasingly rely on advanced analytics to improve decision-making and operational efficiency. The market is characterized by rapid technological advancements, data integration across various platforms, and growing adoption of real-time analytics solutions.

Companies are leveraging analytics to enhance drug development, clinical research, and patient management. With a strong focus on innovation and data-driven insights, the market continues to evolve, fostering improved healthcare outcomes and business performance.

- In October 2024, Oracle launched Oracle Analytics Intelligence for Life Sciences, an AI-powered platform that unifies disparate data sets to accelerate insight generation. Built on Oracle Cloud Infrastructure, it enhances research, patient care, and market analysis by integrating real-world data, improving decision-making, and optimizing therapeutic strategies.

Key Highlights:

- The life science analytics industry size was valued at USD 33.09 billion in 2023.

- The market is projected to grow at a CAGR of 14.51% from 2024 to 2031.

- North America held a market share of 40.12% in 2023, with a valuation of USD 13.28 billion.

- The research and development technology segment garnered USD 11.88 billion in revenue in 2023.

- The pharmaceutical & biotech companies segment is expected to reach USD 41.08 billion by 2031.

- The software segment is anticipated to hold a market share of 54.10% in 2031.

- The predictive segment is anticipated to register a CAGR of 18.01% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 16.22% during the forecast period.

Market Driver

"Rising Adoption of Data-driven Decision Making"

The rising adoption of data-driven decision-making is a key growth driver for the life science analytics market, as organizations increasingly leverage AI, big data, and predictive analytics to enhance efficiency and innovation.

- In January 2025, Innovaccer acquired Humbi AI, integrating its actuarial intelligence into the Healthcare Intelligence Cloud. This enhances risk management, value-based contracting, and drug commercialization for providers, payers, and life sciences firms, reinforcing Innovaccer’s commitment to AI-driven healthcare transformation and data-driven decision-making.

These technologies enable pharmaceutical and biotech firms to accelerate drug discovery, optimize clinical trials, and improve patient care by analyzing vast datasets in real time. Additionally, predictive analytics helps in identifying disease patterns, optimizing resource allocation, and reducing costs, ultimately leading to improved healthcare outcome and streamlined operations.

- In March 2024, Microsoft advanced AI in healthcare with new solutions in Microsoft Cloud for Healthcare, enhancing data integration, clinical decision-making, and patient care. These innovations empower organizations with secure, AI-driven insights to improve operational efficiency, personalized treatment, and healthcare outcomes.

Market Challenge

"Slow Adoption of Advanced Analytics"

The slow adoption of advanced analytics in the life science analytics industry is hindered by resistance to change, lack of awareness, and organizational inertia. Many organizations are hesitant to integrate new technologies, due to concerns over costs, complexity, and disruption.

To overcome this challenge, companies should focus on educating stakeholders about the long-term benefits, providing training programs, and demonstrating the tangible impact of analytics on clinical outcomes and operational efficiency. Additionally, implementing scalable, user-friendly solutions can ease the transition and foster quicker adoption.

Market Trend

"Cloud-based Analytics Solutions"

Cloud-based analytics solutions have emerged as a significant trend in the life science analytics market, as organizations increasingly migrate to cloud platforms. This shift allows life science companies to scale their analytics capabilities, enabling faster and more efficient data processing.

It also fosters improved collaboration across teams, as data can be accessed in real time from anywhere. Additionally, cloud platforms help reduce infrastructure costs by eliminating the need for on-premise servers, making advanced analytics more accessible and cost-effective for a wider range of organizations.

- In December 2024, Cognizant and Salesforce partnered to enhance customer experience in life sciences. By utilizing Salesforce's AI-driven Life Science Cloud, they aim to improve patient outcomes, drive operational efficiency, and create personalized, connected experiences for healthcare providers and patients.

Life Science Analytics Market Report Snapshot

| Segmentation |

Details |

| By Application |

Research and Development, Sales and Marketing Supports, Regulatory Compliance, Supply chain Analytics, Pharmacovigilance |

| By End User |

Pharmaceutical & Biotech Companies, Medical Devices Companies, Research Centers, Outsourced Life Science Organizations |

| By Component |

Software, Services |

| By Type |

Reporting, Description, Predictive, Prescriptive |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific |

| Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Application (Research and Development, Sales and Marketing Supports, Regulatory Compliance, Supply chain Analytics, Pharmacovigilance): The research and development segment earned USD 11.88 billion in 2023, due to the increased demand for advanced analytics in drug discovery and clinical trials.

- By End User (Pharmaceutical & Biotech Companies, Medical Devices Companies, Research Centers, Outsourced Life Science Organizations): The pharmaceutical & biotech companies segment held 48.98% share of the market in 2023, due to their significant investment in analytics to streamline drug development and optimize operations.

- By Component (Software, Services): The software segment is projected to reach USD 52.04 billion by 2031, owing to the rising need for cloud-based platforms and AI-driven solutions for real-time data processing and insights generation.

- By Type (Reporting, Description, Predictive, Prescriptive): The predictive segment is anticipated to register a CAGR of 18.01% during the forecast period, due to the growing demand for forecasting patient outcomes, disease progression, and operational efficiencies using advanced predictive models.

Life Science Analytics Market Regional Analysis

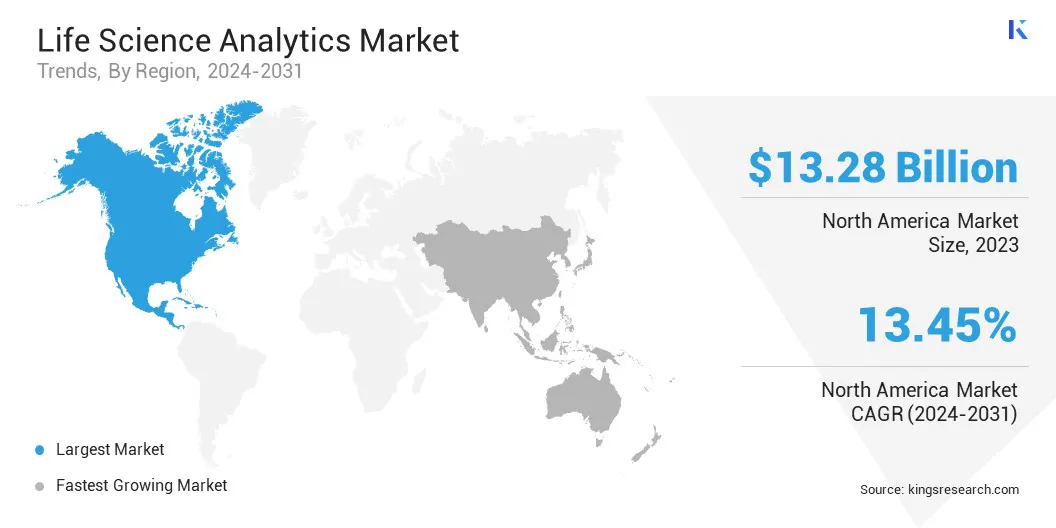

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for around 40.12% share of the life science analytics market in 2023, with a valuation of USD 13.28 billion. North America dominates the market, driven by robust healthcare infrastructure, technological advancements, and significant investments in research and development.

The presence of key market players, coupled with the increasing adoption of AI, big data, and cloud technologies, further accelerates market growth in the region.

Additionally, regulatory support, strong healthcare networks, and a high focus on personalized medicine and drug development contribute to North America's leadership, making it a hub for innovation and analytics solutions in the life sciences industry.

- In March 2024, Google Cloud advanced healthcare AI tools like Vertex AI Search and Healthcare Data Engine, streamlining data search, improving clinical workflows, and supporting personalized care. These innovations enhance efficiency, patient outcomes, and transform healthcare globally.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 16.22% over the forecast period. Asia Pacific is the fastest-growing region in the life science analytics industry, fueled by expanding healthcare access, rising focus on improving patient outcomes, and increasing investments in biotechnology and pharmaceuticals.

Countries like China and India are accelerating the adoption of digital healthcare solutions, driven by improving technological infrastructure and government support for healthcare innovation.

The region's diverse population and evolving healthcare needs create opportunities for personalized medicine, while a burgeoning middle class is pushing the demand for enhanced healthcare services and analytics capabilities.

- In July 2024, Indegene, an Indian company, announced a strategic collaboration with Microsoft to drive generative AI adoption in life sciences, aiming to enhance innovation, data analytics, and content creation. This partnership focuses on scaling AI solutions across clinical, commercial, and regulatory functions.

Region’s Regulatory Framework Also Plays a Significant Role in Shaping the Market

- In the U.S., the Food and Drug Administration (FDA) is responsible for protecting the public health by assuring the safety, efficacy, and security of human and veterinary drugs, biological products, medical devices, food supply, cosmetics, and products that emit radiation. The FDA also provides accurate, science-based health information to the public.

- The U.S. Department of Health and Human Services (HHS) aims to enhance the health and well-being of all Americans, by providing for effective health services and by fostering sound, sustained advances in the sciences underlying medicine, public health, and social services.

- In the EU, manufacturers can place a CE (Conformité Européenne) mark on a medical device once it has passed a conformity assessment. The conformity assessment usually involves an audit of the manufacturer's quality system and, depending on the type of device, a review of technical documentation from the manufacturer on the safety and performance of the device.

Competitive Landscape:

The life science analytics industry is characterized by a large number of participants, including both established corporations and rising organizations. In the market, companies are expanding their operations through strategic partnerships, acquisitions, and investments in advanced technologies.

These expansions aim to enhance data management, AI capabilities, and global reach, enabling companies to offer innovative solutions, improve patient outcomes, and meet evolving industry demands.

- In March 2024, Axtria opened its largest office in India, a 76,000 square feet centre in Hyderabad, supporting its mission to drive innovation in life sciences. The expansion will enhance its AI-driven services, foster talent, and strengthen its presence in the region.

List of Key Companies in Life Science Analytics Market:

- Oracle

- SAS Institute Inc.

- Accenture

- Veeva Systems Inc.

- IBM

- Analytics8

- IQVIA

- Cognizant

- TAKE Solutions Limited

- Wipro

- MaxisIT

- SAP SE

- Cotiviti, Inc

- Optum, Inc.

- Infosys Limited

Recent Developments (Acquisition/Launch/Partnership)

- In June 2024, EPAM Systems acquired Odysseus Data Services, a leading health data analytics company. This acquisition enhances EPAM’s capabilities in advanced data analytics, AI, and real-world evidence, enabling better outcomes across the life sciences value chain, including drug treatment, safety, and clinical studies.

- In August 2024, Trinity Life Sciences launched new Customer Engagement solutions, combining deep commercial insights with technology. Led by Nancy Phelan, these solutions offer adaptive segmentation, HCP insights, and multi-channel orchestration, helping life sciences organizations enhance engagement and drive better patient outcomes.

- In November 2023, Accenture and Salesforce announced investments to enhance Salesforce Life Sciences Cloud, integrating generative AI and data-driven innovations. This collaboration aims to transform healthcare professional and patient experiences by improving productivity and developing advanced solutions for life sciences companies.

- In June 2024, PQE Group launched its Regulated Artificial Intelligence & Data Analytics division to drive efficiency and innovation in Life Sciences. The division ensures regulatory compliance while leveraging AI for decision optimization, risk reduction, and accelerating innovation, in collaboration with GenAIz to enhance service capacity and solutions.

- In January 2025, Clarivate launched DRG Fusion, a platform designed to simplify commercial analytics in life sciences. Fusion integrates real-world data to provide biopharma and medtech organizations with insights on patient acquisition, segmentation, market access, and sales targeting, enhancing decision-making and boosting product value.

- In November 2023, Wipro partnered with Amazon Web Services (AWS) to introduce the "Lab of the Future" for the life sciences industry. This cloud-based platform integrates generative AI and advanced analytics to streamline lab processes, enhance collaboration, and reduce costs, accelerating drug development and improving efficiency.