Lab Consumables Market Size

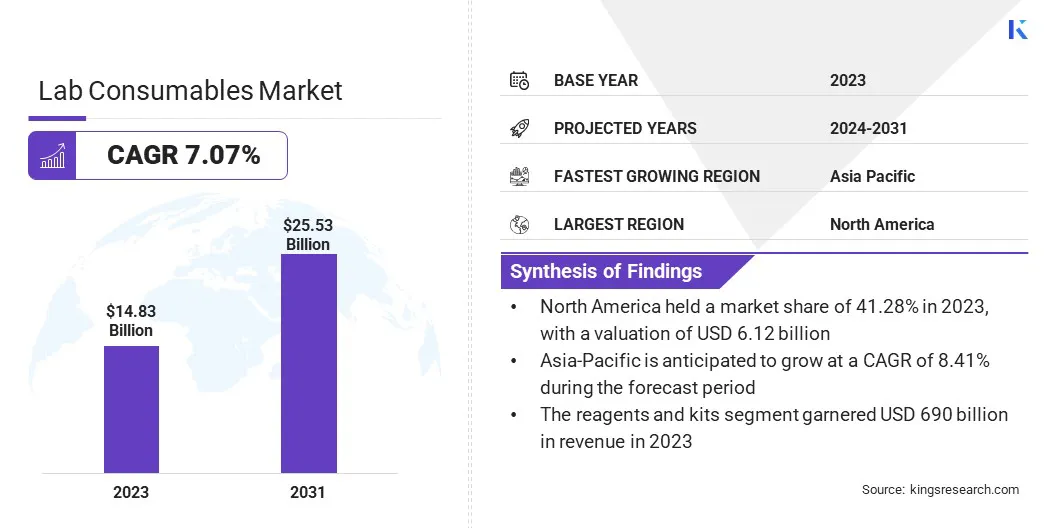

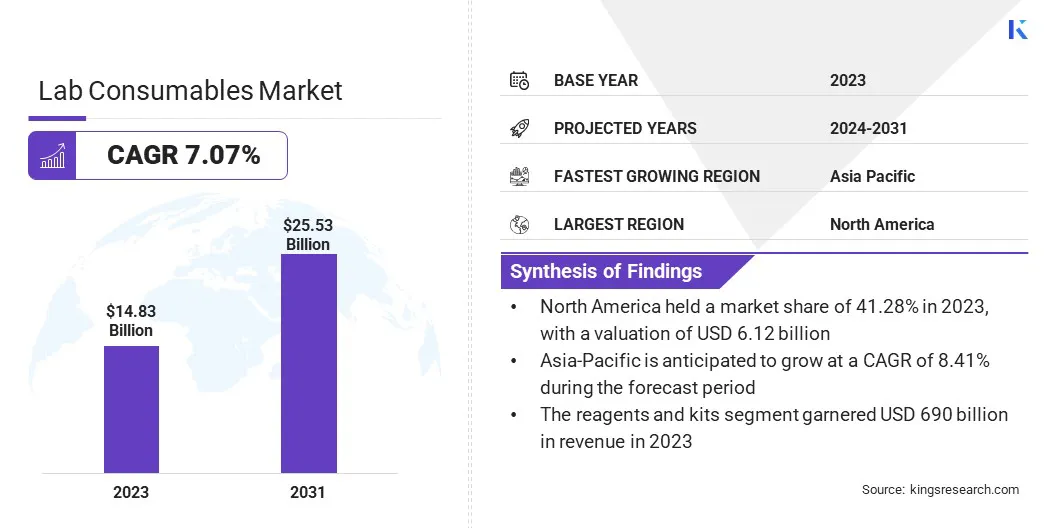

The global Lab Consumables Market size was valued at USD 14.83 billion in 2023 and is projected to grow from USD 15.83 billion in 2024 to USD 25.53 billion by 2031, exhibiting a CAGR of 7.07% during the forecast period. The market is experiencing robust growth due to rising demand from sectors such as biotechnology, diagnostics, and pharmaceuticals.

Increasing laboratory activities in clinical research, along with advancements in molecular biology and genomics, are further propelling market expansion. Additionally, the adoption of automation technologies in labs is highlighting the need for specialized consumables, further contributing to the market demand.

In the scope of work, the report includes solutions offered by companies such as Abbott, DH Life Sciences, LLC., Bio-Rad Laboratories, Inc., Agilent Technologies, Inc, Merck KGaA, Eppendorf SE, Corning Incorporated, QIAGEN, Bruker, Waters, and others.

Rising public health concerns, coupled with increasing government and private sector investments, are supporting the growth of the lab consumables market. Technological advancements have enabled lab equipment manufacturers to develop innovative products, thereby boosting the demand for both lab equipment and disposables.

- According to a 2022 report by the International Federation of Pharmaceutical Manufacturers and Associations, biopharmaceutical research and development spending was estimated at over USD 202 billion globally, surpassing industries such as aerospace, defense, chemicals, and software.

These substantial investments are expected to increase the demand for lab consumables and equipment, as laboratories worldwide expand their R&D capabilities and prioritize advancements in precision, automation, and sustainability.

Lab consumables are essential items used in laboratory settings that are typically single-use or have a limited lifespan, requiring regular replenishment. These products include pipettes, test tubes, petri dishes, gloves, reagents, and other materials that facilitate everyday laboratory tasks.

Unlike lab equipment, which is reusable, consumables are designed for short-term use and are crucial for maintaining sterile environments, accurate measurements, and proper experimentation.

Lab consumables are essential for research, diagnostics, clinical testing, and drug development. Their consistent demand across industries ensures the smooth operation of laboratories and supports the advancement of scientific research.

Analyst’s Review

Key players' investments in medical facilities and strategic collaborations are poised to bolster the expansion of the lab consumables market in the coming years. As leading companies expand their infrastructure and capabilities, they are driving innovation and improving access to advanced laboratory technologies.

- In June 2024, Merck, a leading science and technology company, announced a significant investment of USD 84.4 million in a new quality control building at its Darmstadt headquarters. This investment is aimed at enhancing the capabilities of its Life Science business, demonstrating Merck's commitment to improving quality assurance and efficiency in its operations.

These investments are increasing production capacity and enhancing the efficiency and quality of lab operations, leading to increased demand for consumables as laboratories adopt more sophisticated methodologies and expand their research activities.

Lab Consumables Market Growth Factors

The increasing investment in research and development within the biotechnology and pharmaceutical industries is fueling the progress of the market. As companies actively focus on drug discovery, genetic research, and clinical trials, the demand for essential consumables such as pipettes, reagents, petri dishes, and test tubes is rising.

These consumables play a crucial role in conducting experiments, analyzing results, and ensuring accurate data. The growing R&D pipelines, especially in areas such as biologics and personalized medicine, are leading to higher consumption of these materials. Furthermore, advancements genomics and molecular biology are fostering the increasing demand for consumables in laboratories , thereby propelling market growth.

The development of the lab consumables market is expected to be hindered by rising raw material costs, which can increase production expenses and lead to higher prices for consumers. Additionally, stringent regulatory requirements regarding product quality and safety may complicate the manufacturing processes, resulting in longer development timelines.

The growing competition in the market may compel companies to lower prices, thereby impacting profit margins. To address these challenges, key players are investing heavily in research and development to identify alternative, cost-effective materials and improve manufacturing efficiency.

They are further adopting eco-friendly practices to ensure sustainability, comply with regulations, and reduce costs. Furthermore, collaborations with suppliers enhance resource stability and streamline compliance with safety regulations, enabling companies to maintain a competitive edge in the market.

Lab Consumables Industry Trends

The growing demand for environmentally friendly products is augmenting the growth of the market by prompting companies to innovate and develop sustainable alternatives.

As laboratories face increasing pressure to reduce waste and adhere to stricter environmental regulations, the demand for biodegradable and recyclable products, such as eco-friendly pipettes and test tubes, is surging. This trend is attracting new customers, including research institutions and companies with sustainability goals, thereby creating a new market segment.

Additionally, as industries increasingly prioritize green practices and corporate responsibility, the adoption of sustainable consumables is expanding, contributing to sustained market growth.

The increasing use of automation technologies in laboratories is transforming the lab consumables market by growing demand for specialized, advanced products. Automated liquid handling systems, robotics, and high-throughput screening equipment require precise and reliable consumables, including specialized pipette tips, plates, and tubes compatible with these technologies.

To improve efficiency, accuracy, and scalability, laboratories are increasingly emphasizing automation in drug discovery, genomics, and clinical diagnostics. This shift is leading to a growing need for consumables tailored to automated workflows, thereby boosting market expansion.

Segmentation Analysis

The global market has been segmented based on type, application, and geography.

By Type

Based on type, the market has been categorized into reagents and kits, cell imaging consumables, and general lab supplies. The reagents and kits segment led the lab consumables market in 2023, reaching a valuation of USD 6.90 billion. The rising prevalence of chronic diseases and the growing focus on personalized medicine are highlighting the need for specialized reagents and kits in various fields, including molecular biology, clinical diagnostics, and biopharmaceuticals.

Innovations in reagent formulations and the development of user-friendly kits are enhancing their effectiveness and convenience, thereby aiding segmental growth. Additionally, the expansion of research activities in academic and commercial laboratories is increasing the consumption of these products.

As laboratories seek to improve accuracy and efficiency in their experiments, the reagents and kits segment is poised to witness continued expansion in the forthcoming years.

By Application

Based on application, the market has been categorized into pharmaceutical industry, biopharmaceuticals, and clinical diagnostics. The pharmaceutical industry segment captured the largest revenue share of 51.46% in 2023. The pharmaceutical industry is further categorized into pharmaceuticals, biotechnology, environmental testing, and material science.

The growth of the segment is fueled by rising investments in research and development, particularly in drug discovery and clinical trials. The increasing prevalence of diseases and rising demand for advanced therapies are compelling pharmaceutical companies to expand their laboratories and enhance their testing capabilities. This growth leads to higher consumption of lab consumables, including reagents, sample collection kits, and analytical tools.

Additionally, regulatory requirements for quality control and compliance prompt pharmaceutical firms to invest in high-quality lab consumables to ensure accuracy and reliability in their processes. With ongoing advancements in healthcare and technology, the pharmaceutical segment is projected to experience sustained growth in the near future.

Lab Consumables Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America lab consumables market accounted for the largest revenue share of 41.28% in 2023, with a valuation of USD 6.12 billion. This growth is largey attributed to increased investments in research, development, and biomanufacturing.

- In September 2022, the U.S. government announced an investment of over USD 2 billion to launch its biomanufacturing initiative, aimed at enhancing manufacturing capacity and supporting innovation in the life sciences sector.

This initiative is expected to boost demand for lab consumables as companies scale up operations to meet regulatory and production requirements. Additionally, the presence of major pharmaceutical and biotechnology firms in the region fosters a competitive landscape that drives continuous innovation in consumables. With the rising focus on personalized medicine and advanced therapies, the regional market is set to experience sustained growth in the foreseeable future.

Asia-Pacific market is anticipated to witness the fastest growth, registering a robust CAGR of 8.41% over the forecast period. This notable development is reinforced by expanding healthcare infrastructure and increasing investments in medical facilities.

- According to the National Bureau of Statistics of China, by the end of 2023, the country had 1.071 million medical and health facilities, comprising 39,000 hospitals and over 1 million grassroots institutions such as clinics and community health centers. This extensive network of healthcare facilities significantly increases the demand for lab consumables, including reagents and diagnostic kits.

Furthermore, the rising prevalence of chronic diseases and a growing focus on research and development in the life sciences sector further propel regional market expansion. Enhanced healthcare capabilities are expected to stimulate the growth of the Asia-Pacific market, improving patient outcomes.

Competitive Landscape

The global lab consumables market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Lab Consumables Market

- Abbott

- DH Life Sciences, LLC.

- Bio-Rad Laboratories, Inc.

- Agilent Technologies, Inc

- Merck KGaA,

- Eppendorf SE

- Corning Incorporated

- QIAGEN

- Bruker

- Waters

Key Industry Developments

- April 2024 (Product Launch): Eppendorf, a leading laboratory technology company, announced the expansion of its environmentally friendly laboratory consumables with the launch of the twin.tec Trace Plates. These new semi-skirted PCR plates are made from bio-circular polymers, meeting the increasing demand for sustainable lab products while maintaining high performance.

The global lab consumables market is segmented as:

By Type

- Reagents and Kits

- Cell Imaging Consumables

- General Lab Supplies

- Pipettes and Tips

- Containers and Vials

- Microplates

- Filtration Products

- Centrifuge Tubes and Accessories

- Cryogenic Storage

- Lab Gloves

- Lab Disposables

- Lab Labels and Markers

By Application

- Pharmaceutical Industry

- Pharmaceuticals

- Biotechnology

- Environmental Testing

- Material Science

- Biopharmaceuticals

- Clinical Diagnostics

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America