Market Definition

The market encompasses the development, manufacture, and application of isostatic pressing technologies. These technologies are used to improve the structural integrity and density of materials through the application of uniform pressure in all directions. The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

Isostatic Pressing Market Overview

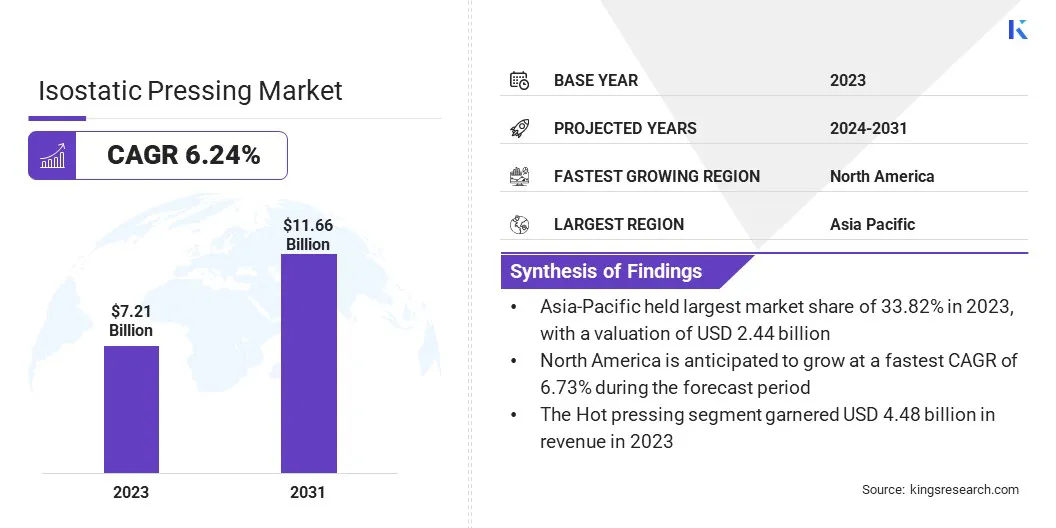

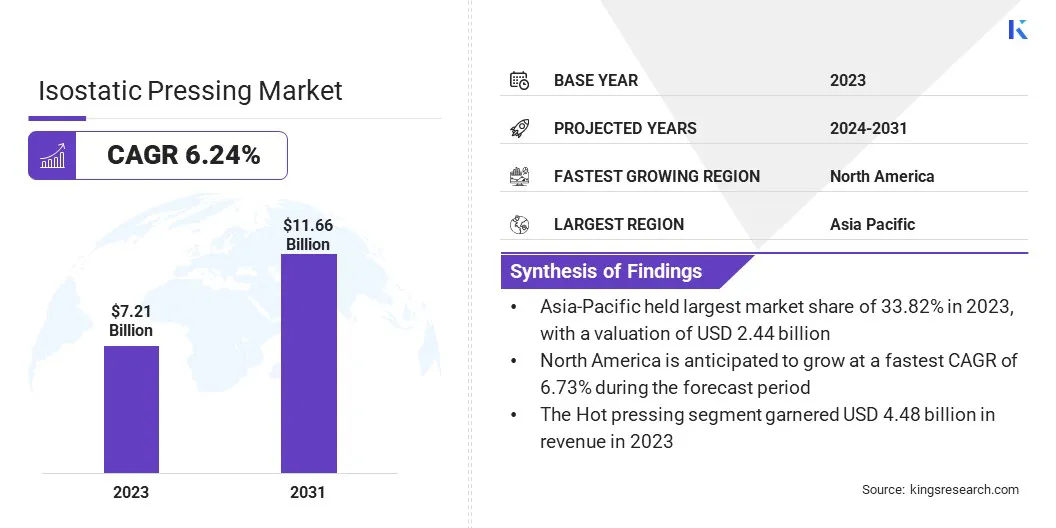

The global isostatic pressing market size was valued at USD 7.21 billion in 2023 and is projected to grow from USD 7.63 billion in 2024 to USD 11.66 billion by 2031, exhibiting a CAGR of 6.24% during the forecast period.

This growth is attributed to the rising demand for high-performance and defect-free components across key end-use industries such as aerospace, automotive, healthcare, and energy.

Major companies operating in the isostatic pressing industry are EPSI, Bodycote, DORST Technologies GmbH, FREY & Co. GmbH, KOBE STEEL, LTD., Pressure Technology, Inc., HIPERBARIC, Nikkiso Co., Ltd, Höganäs AB, Quintus Technologies AB., Kennametal Inc, AIP - American Isostatic Presses Inc, Shanxi Golden Kaiyuan Co., Ltd., FCT Systeme GmbH, and TWI Ltd.

The increasing adoption of additive manufacturing and the need for complex, high-integrity parts have significantly contributed to market expansion. Furthermore, technological advancements in hot and cold isostatic pressing techniques, coupled with the growing emphasis on material efficiency and sustainability, are boosting growth.

- In October 2023, HIPERBARIC introduced the Hiperbaric 20 HIP, a compact and versatile Hot Isostatic Press (HIP) designed for small production and R&D applications. Capable of achieving up to 2,000 bar pressure and 2,000°C temperature, it eliminates defects in 3D-printed metallic materials, enhancing ductility and fatigue resistance. The press is ideal for industries such as aerospace and medical, with a cooling system that increases productivity and reduces costs.

Key Highlights

- The isostatic pressing industry size was valued at USD 7.21 billion in 2023.

- The market is projected to grow at a CAGR of 6.24% from 2024 to 2031.

- Asia-Pacific held a market share of 33.82% in 2023, with a valuation of USD 2.44 billion.

- The systems segment garnered USD 3.92 billion in revenue in 2023.

- The hot pressing segment is expected to reach USD 7.22 billion by 2031.

- The small segment is anticipated to witness the fastest CAGR of 6.35% over the forecast period.

- The dry segment garnered USD 4.17 billion in revenue in 2023.

- The manufacturing segment is estimated to generate a value of USD 2.86 billion by 2031.

- North America is anticipated to grow at a CAGR of 6.73% over the forecast period.

Market Driver

"Advancements in Powder Metallurgy and Ceramic Technologies"

Advancements in powder metallurgy and ceramic technologies are propelling the growth of the isostatic pressing market by enabling the production of high-density, low-porosity components with enhanced mechanical and thermal properties.

Innovations in powder formulations and processing techniques have expanded applications in sectors such as aerospace, electronics, and medical devices. Isostatic pressing, particularly hot isostatic pressing (HIP) and cold isostatic pressing (CIP), allows for the consolidation of complex shapes with high density and minimal porosity.

The development of advanced ceramics, such as zirconia, alumina, and silicon carbide, has expanded the range of applications in aerospace, defense, medical, and energy sectors.

- In August 2023, TWI announced significant investments in powder metallurgy hot isostatic pressing (PM HIP) capabilities, including the acquisition of a state-of-the-art outgassing system with a residual gas analyser (RGA). By year-end, it also installed a larger, heated outgassing unit to improve vacuum levels and moisture removal, essential for producing high-value near net shape parts.

Market Challenge

"Complexity in Process Control and Material Handling"

Complexity in process control and material handling remains a key challenge to the progress of the isostatic pressing market, particularly in high-precision applications. The process demands strict control of parameters such as pressure, temperature, and powder uniformityto prevent defects such as porosity, cracking, or density variations.

Variations in powder characteristics such as particle size, moisture content, and flowability can significantly affect compaction quality and end-product performance. Moreover, handling ultra-fine powders requires controlled environments and specialized equipment to prevent contamination, ensure safety, and maintain product integrity.

These technical demands increase production complexity and require highly skilled personnel, advanced instrumentation, and ongoing process optimization. Manufacturers are addressing these challenges by investing in automation, real-time monitoring systems, and training programs to improve consistency and reduce operator dependency.

Additionally, advancements in simulation and process modeling are improving material flow and pressure distribution, enhancing process reliability and product quality.

Market Trend

"Expanding Applications of HIP (Hot Isostatic Pressing)"

Technological advancements are significantly expanding the applications of Hot Isostatic Pressing (HIP) by improving material properties, manufacturing efficiency, and design capabilities.

Innovations in HIP systems have led to enhanced control over pressure and temperature, enabling the production of stronger, more durable components with minimal internal porosity. The development of advanced materials, including high-performance alloys and ceramics, is broadening HIP's use in aerospace, medical, and energy sectors.

Additionally, improvements in process automation and monitoring systems are increasing production efficiency and reducing cycle times, making HIP more cost-effective for high-volume manufacturing.

These advancements are boosting the adoption of HIP as a preferred solution for creating complex, high-quality parts that meet the stringent demands of industries requiring exceptional material integrity.

- In November 2024, Quintus Technologies introduced the QIH 200 URC Hot Isostatic Press in Västerås, Sweden, enhancing productivity by integrating multiple heat treatment processes into a single cycle. This advanced system improves material densification, particularly for additive manufacturing components in industries such as aerospace, medicine, and energy.

Isostatic Pressing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Systems, Services

|

|

By Type

|

Hot Pressing, Cold Pressing

|

|

By Capacity

|

Small, Medium, Large

|

|

By Process

|

Dry, Wet

|

|

By End Use

|

Manufacturing, Medical, Electricals & Electronics, Automotive, Aerospace & Defense, Energy & Power, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Systems and Services): The systems segment earned USD 3.92 billion in 2023 due to the increasing demand for advanced isostatic pressing technologies in high-performance manufacturing applications.

- By Type (Hot Pressing and Cold Pressing): The hot pressing segment held a share of 62.09% in 2023, attributed to its ability to produce high-density, defect-free components for critical applications.

- By Capacity (Small, Medium, and Large): The medium segment is projected to reach USD 4.35 billion by 2031, fueled by growing demand for versatile isostatic pressing solutions in various industries

- By Process (Dry and Wet): The wet segment is anticipated to grow at a CAGR of 6.28% over the forecast period, aided by its ability to enhance material properties and improve density in complex components.

- By End Use (Manufacturing, Medical, Electricals & Electronics, Automotive, Aerospace & Defense, Energy & Power, and Others): The manufacturing segment is projected to reach USD 2.86 billion by 2031, bolstered by increasing demand for high-performance components across various industries.

Isostatic Pressing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific isostatic pressing market share stood at around 33.82% in 2023, with a valuation of USD 2.44 billion. This dominance is attributed to the region’s strong industrial base, high demand for advanced manufacturing technologies, and the presence of leading players in sectors such as automotive, aerospace, and electronics.

Furthermore, increasing investments in R&D, along with government support for sustainable manufacturing practices, is fostering expansion. The region’s focus on innovation and its growing emphasis on the adoption of high-performance materials further solidify Asia Pacific’s position as a key market for isostatic pressing.

North America isostatic pressing industry is likely to register a CAGR of 6.73% over the forecast period. This growth is propelled by the rising demand for high-performance materials in industries such as aerospace, automotive, and healthcare, where isostatic pressing is critical for ensuring superior material properties and component reliability.

The region’s strong focus on technological advancements, particularly in additive manufacturing and complex material processing, has further fueled the adoption of isostatic pressing. Moreover, the increasing need for precision and quality in critical components is boosting the demand for advanced isostatic pressing techniques.

Investments in R&D and process optimization are further fostering the development of more efficient and cost-effective isostatic pressing systems, aiding regional market progress.

- In October 2023, Bodycote acquired Lake City HT and Stack Metallurgical Group for USD 145 million to expand its Hot Isostatic Pressing (HIP) operations in the U.S. The acquired businesses generated approximately USD 45 million in revenue in 2023, with a 29% growth in H1. Additionally, Bodycote opened new HIP facility in Greater Los Angeles in 2024 to support the growing demand in the Space and Civil Aviation sectors.

Regulatory Frameworks

- In the European Union (EU), isostatic pressing equipment is regulated under the Pressure Equipment Directive (2014/68/EU), which establishes essential safety requirements for the design and manufacture of pressure equipment operating above 0.5 bar. It ensures product safety, supports free movement within the internal market, and mandates conformity assessments for equipment.

- In Japan, isostatic pressing equipment is administered under the High Pressure Gas Safety Act, which is regulated by the High Pressure Gas Safety Institute of Japan (KHK). It governs the design, construction, and inspection of high-pressure gas facilities and equipment to ensure operational safety and prevent accidents related to high-pressure systems.

- In the United States, isostatic pressing systems are monitored under the ASME Boiler and Pressure Vessel Code (BPVC), published by the American Society of Mechanical Engineers. This comprehensive code establishes safety rules for the design, fabrication, and inspection of boilers and pressure vessels to ensure structural integrity and prevent failure under high-pressure conditions.

Competitive Landscape

The isostatic pressing industry is characterized by a moderately consolidated competitive landscape, comprising both established multinational corporations and specialized regional players. Companies are focusing on technological innovation, strategic partnerships, and expansions to strengthen their market position.

Leading players are increasingly investing in R&D to enhance the capabilities of isostatic pressing technologies, particularly in sectors such as aerospace, automotive, and healthcare. Additionally, mergers and acquisitions are allowing market leaders to expand their product portfolios and geographical reach.

The growing demand for high-quality, high-performance materials has prompted players to provide customized solutions that meet the specific needs of various industries, intensifying competition.

- In May 2023, Wallwork Group announced a USD 12.4 million investment to establish a Hot Isostatic Pressing (HIP) centre in Bury, North Manchester. The new 2,500 m² facility will house advanced Quintus HIP systems operating at up to 207 MPa and 1250°C, with the first unit expected to be operational by September 2023. This initiative is a part of a USD 24.80 million, five-year investment plan aimed at strengthening the UK's HIP capacity and supporting advanced manufacturing growth.

List of Key Companies in Isostatic Pressing Market:

- EPSI

- Bodycote

- DORST Technologies GmbH

- FREY & Co. GmbH

- KOBE STEEL, LTD.

- Pressure Technology, Inc.

- HIPERBARIC

- Nikkiso Co., Ltd

- Höganäs AB

- Quintus Technologies AB.

- Kennametal Inc

- AIP - American Isostatic Presses Inc

- Shanxi Golden Kaiyuan Co., Ltd.

- FCT Systeme GmbH

- TWI Ltd.

Recent Developments (M&A)

- In March 2024, Kittyhawk, Inc., backed by Trive Capital, acquired Stack HIP, LLC from Stack Metallurgical Group. This acquisition expanded Kittyhawk's Hot Isostatic Pressing (HIP) capabilities, enabling the processing of complex metal parts up to 63 inches in diameter, among the largest capacities in North America, serving sectors such as aerospace, defense, and medical.