Ion Exchange Membrane Market Size

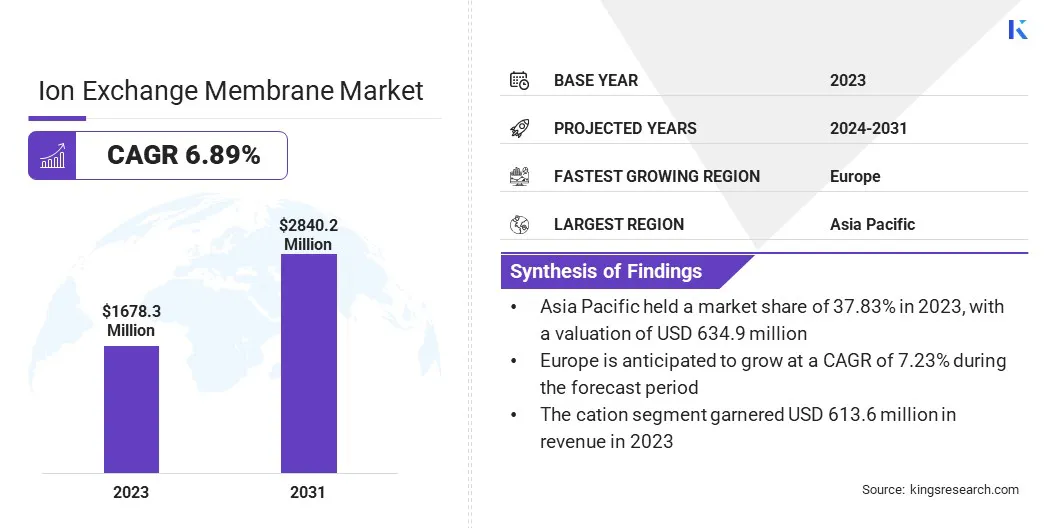

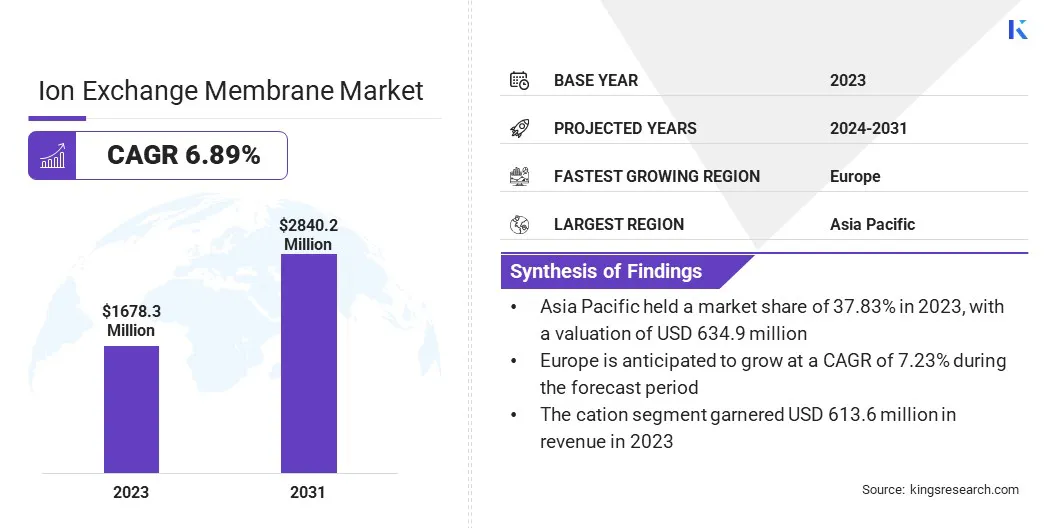

The global Ion Exchange Membrane Market size was valued at USD 1,678.3 million in 2023 and is projected to grow from USD 1,781.7 million in 2024 to USD 2,840.2 million by 2031, exhibiting a CAGR of 6.89% during the forecast period. The focus on sustainability and technological innovation is significantly propelling the growth of the market.

Advances in high-performance membranes and resins are enhancing system efficiency and durability, driving increased adoption across emerging sectors. As industries seek more sustainable and effective solutions, the integration of cutting-edge materials and optimized processes is expanding the market’s reach and boosting demand for advanced ion exchange technologies.

In the scope of work, the report includes solutions offered by companies such as 3M, AGC Chemicals Americas, Dioxide Materials, DuPont, IEI, FUJIFILM Manufacturing Europe B.V., SUEZ, LANXESS, Merck KGaA, Sartorius AG, and others.

The ion exchange membrane market is experiencing robust growth, driven by factors, including increasing demand for clean water, stringent environmental regulations, and advancements in resin technology. Key industries, such as water treatment, pharmaceuticals, and food and beverage, are leveraging ion exchange systems for increasing the efficiency of contaminant removal and water purification processes.

Innovations such as specialized software tools and improved resin capacities are enhancing system performance and expanding applications. The market is also witnessing a rise in customized solutions tailored to specific industry needs, further propelling its expansion.

- In January 2023, LANXESS and Total Energies partnered to supply biocyclic styrene, derived from tall oil, for producing sustainable ion exchange membranes. These membranes, used in chemical process treatment, food purification, and wastewater treatment, are certified under the ISCC PLUS standard's mass balance method. This certification aligns with LANXESS’s commitment to sustainability and is integral for maintaining the same certification standards in their ion exchange membrane products.

An ion exchange membrane is a specialized membrane used in ion exchange processes to selectively permit certain ions to pass while blocking others. These membranes are designed to separate ionic species based on their charge and size, allowing for the selective removal or separation of specific ions from a solution.

They are typically used in various applications, such as water treatment, chemical processing, and energy production, where they facilitate desalination, electrodialysis, and fuel cells. Ion exchange membranes can be anionic (allowing negatively charged ions to pass) or cationic (allowing positively charged ions to pass), and are crucial for enhancing the efficiency and specificity of ion exchange systems.

Analyst’s Review

The market is propelling toward growth due to the rising emphasis on sustainable and renewable energy technologies, which drives demand for advanced water treatment solutions.

With the growing emphasis on clean energy initiatives by industries and government authorities, there is an increasing demand for efficient ion exchange systems to enhance processes, such as proton exchange membrane (PEM) electrolysis for green hydrogen production.

- In April 2024, LANXESS introduced specialized ion exchange resin grades within its Lewatit UltraPure range designed for water treatment in PEM electrolysis. This technology converts electricity from renewable sources into hydrogen to offer a sustainable method for hydrogen production. The advanced resins facilitate the electrolysis process by ensuring high-purity water, thus enhancing the efficiency and stability of hydrogen production and better adapting to fluctuations in wind and solar energy.

Key players may leverage advancements in specialized ion exchange resins to enhance the efficiency of critical processes like PEM electrolysis. By integrating these innovations, companies could improve their offerings in sustainable technologies, attract new business opportunities, and meet the rising demand for clean energy solutions. This strategic focus may help drive market growth and establish a competitive edge in the evolving landscape of renewable energy, potentially boosting market expansion in the coming years.

Ion Exchange Membrane Market Growth Factors

The rising global demand for clean and safe drinking water, fueled by rapid urbanization, industrialization, and population growth, is significantly propelling the growth of the ion exchange membrane market.

As water resources face increasing pressure of contaminants, the need for advanced water purification technologies is becoming critical. Ion exchange resins, essential in removing contaminants, such as heavy metals, hardness, and other impurities, are becoming indispensable in both municipal and industrial water treatment processes. This rising dependence on ion exchange solutions to ensure high water quality is driving market growth, presenting substantial opportunities for stakeholders and businesses in this segment.

However, the high initial capital expenditure, maintenance costs, and the complexities in managing and disposing of hazardous waste byproducts, are deterring potential adopters and impeding market growth.

To address these challenges, leading market players are investing in R&D to develop more cost-effective and efficient membrane technologies. They are also focusing on sustainable waste management practices to mitigate environmental concerns. In addition, they are using strategic partnerships and collaborations to leverage technological advancements and reduce operational costs. These factors are expected to drive product adoption across various industries and foster market expansion over the forecast period.

Ion Exchange Membrane Market Trends

The integration of specialized software tools tailored to specific industries is emerging as a significant trend in the ion exchange membrane market.

- For instance, in March 2023, LANXESS added a new feature to its LewaPlus design software, which allows users in precise dimensioning of ion exchange systems according to stringent industry requirements, facilitating the implementation of highly specific process configurations.

The software supports the use of Lewatit types that have been specially developed for food applications, enabling more effective and customized ion exchange solutions. Therefore, the growing trend of industry-specific software tools is driving innovation and efficiency in the market, while meeting the unique needs of various sectors.

Ongoing research and development efforts are significantly enhancing the efficiency and selectivity of ion exchange resins, driving market growth and innovation. Scientists and engineers are focused on creating resins with higher ion exchange capacities, which allow effective contaminant removal in water treatment processes.

In addition, advancements are leading to the development of resins with faster kinetics, enabling quicker and more efficient ion exchange reactions. Another key area of progress is improved resistance to fouling, which reduces the frequency of maintenance and prolongs the lifespan of the resins.

These innovations are enhancing the performance and reliability of ion exchange systems while making them more cost-effective and sustainable. As a result, their applications are expanding across various industries, increasing their demand in the market.

Segmentation Analysis

The global market has been segmented based on charge, material insights, application, and geography.

By Charge

Based on charge, the market has been categorized into cation, anion, amphoteric ion exchange, bipolar ion exchange membranes, and others. The cation segment led the ion exchange membrane market in 2023, reaching a valuation of USD 613.6 million.

The rising demand for clean water due to population growth and industrialization is expected to drive the adoption of these resins to effectively remove hardness, making them essential for water treatment systems. Technological advancements in resin performance and production capacity further enhance their appeal, driving broader adoption.

In addition, stringent environmental regulations and increasing use of cation exchange membranes in various industries, such as pharmaceuticals and food processing, are expanding their market reach. This combination of high utility, innovation, and regulatory compliance is fueling significant growth in the cation exchange resins segment.

By Material Insights

Based on material insights, the market has been categorized into hydrocarbon membranes, perfluorocarbon membranes, inorganic membranes, composite membranes, and others. The inorganic membrane segment captured the largest ion exchange membrane market share of 38.34% in 2023.

These membranes, made from materials like ceramics and metals, offer superior thermal, chemical, and mechanical stability, making them ideal for harsh environments and high-temperature processes. Their efficiency in separation tasks, such as gas separation and desalination, coupled with the demand for sustainable and energy-efficient solutions, is boosting their adoption rate.

Technological advancements further enhance their performance and versatility, increasing their appeal across industries like petrochemicals, power generation, and wastewater treatment. This combination of durability, efficiency, and innovation is fueling significant market expansion.

By Application

Based on application, the market has been categorized into electrodialysis, electrolysis, storage batteries, water treatment, and others. The water treatment segment is expected to account for the highest revenue of USD 864.4 million by 2031.

Ion exchange membranes are increasingly playing a vital role in the water treatment sector, offering high energy efficiency, low maintenance costs, and environmental benefits. As global concerns over clean drinking water and sanitation intensify, the demand for these membranes is expected to rise. They are crucial for removing impurities from contaminated water, while also meeting the regulatory requirements.

Furthermore, the Safe Drinking Water Act (SDWA) mandates that the Environmental Protection Agency (EPA) establish and enforce national drinking water standards, creating a favorable environment for advanced ion exchange membrane technologies. These regulatory frameworks drive the growth of the segment by necessitating effective solutions to meet stringent water quality standards.

Ion Exchange Membrane Market Regional Analysis

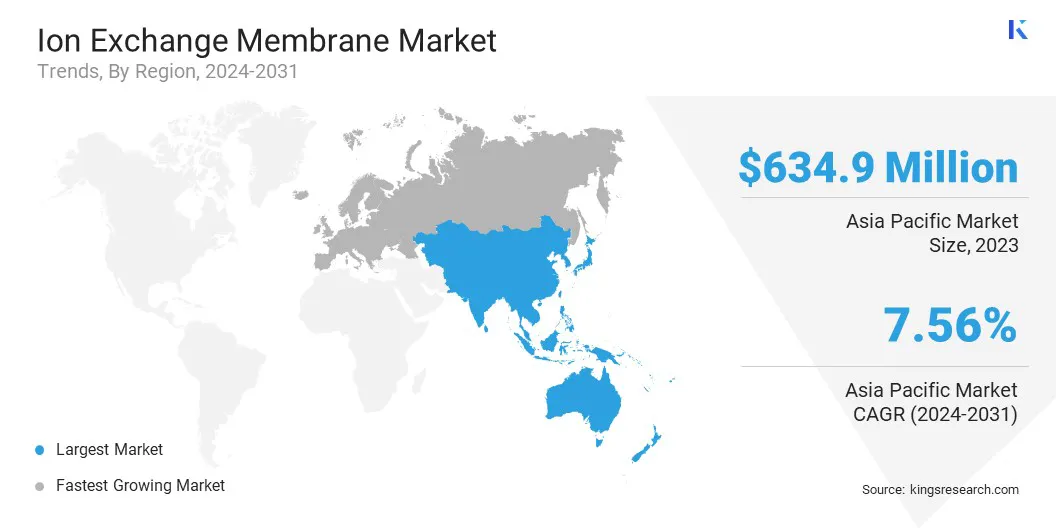

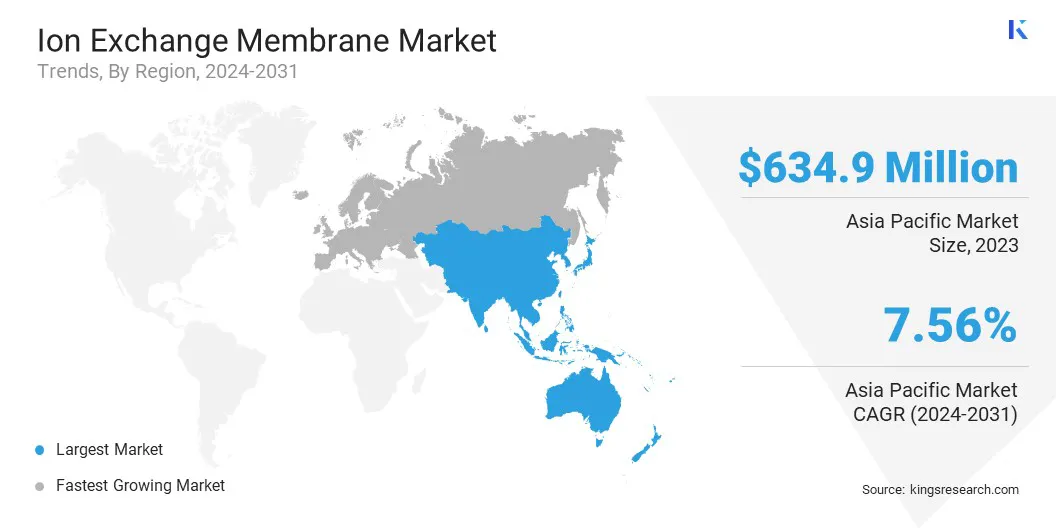

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific ion exchange membrane market share stood around 37.83% in 2023 in the global market, with a valuation of USD 634.9 million. The Asia-Pacific region is experiencing significant growth in the market, propelled by rapid urbanization, population growth, and industrial expansion.

The increasing demand for clean water, coupled with stringent water quality regulations and sustainability initiatives in countries like China and India, is fueling investments in advanced water treatment technologies.

- In February 2023, SUEZ, along with its partners, secured the engineering, procurement, and construction contract for Wanhua Chemical Group’s Penglai seawater reverse osmosis desalination plant.

This project was designed to preserve local freshwater resources and protect the ecological environment, supporting Wanhua and its industrial partners in their ecological transition.

It marked the largest desalination project won by SUEZ since February 2022 and the first for an industrial customer. With only 2.5% of the Earth's 1.45 billion cubic kilometers being freshwater, SUEZ is concentrating on advancing desalination technology to address water shortages in coastal regions. This project underscores the region's focus on preserving freshwater resources and supporting ecological transitions, which is expected to drive market growth in the region.

Europe is anticipated to witness significant growth at a CAGR of 7.23% over the forecast period. The need to upgrade and modernize aging water infrastructure across many European countries is creating substantial demand for advanced water treatment technologies. Strict regulatory standards, such as the EU's Water Framework Directive, enforce high water quality requirements, further accelerating the adoption of ion exchange membranes.

In addition, the focus on water reuse and recycling, along with the impacts of climate change, is increasing the demand for resilient and efficient water treatment solutions. Technological innovations and investments spurred by the European Green Deal are advancing water treatment technologies, enhancing their effectiveness.

- In February 2023, LANXESS began supplying its Lewatit ion exchange resins and Bayoxide iron oxide adsorbers in France through the distribution solutions provider, Caldic. This move was part of LANXESS's strategy to standardize its distribution structure across Western Europe. The company had previously collaborated with Caldic in the Benelux countries for several years.

This highlights the ongoing expansion and strategic alignment of water treatment solutions in the European market, driven by infrastructure needs, regulatory pressures, and a commitment to sustainability.

Competitive Landscape

The global ion exchange membrane market report provides valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in the Ion Exchange Membrane Market

Key Industry Development

September 2023 (Product Launch): DuPont announced the launch of its first product dedicated to green hydrogen production named the DuPont AmberLite P2X110 Ion Exchange Resin. This new ion exchange resin is specifically designed for the unique chemistry of electrolyzer loops to support hydrogen production from water.

The global ion exchange membrane market is segmented as:

By Charge

- Cation

- Anion

- Amphoteric Ion Exchange

- Bipolar Ion Exchange Membranes

- Others

By Material Insights

- Hydrocarbon Membrane

- Perfluorocarbon Membrane

- Inorganic Membrane

- Composite Membrane

- Others

By Application

- Electrodialysis

- Electrolysis

- Storage Batteries

- Water Treatment

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America