Market Definition

Intravenous (IV) hydration therapy is a medical treatment that administers fluids, electrolytes, vitamins, and medications directly into a vein through an IV line. The market involves the production, distribution, and administration of IV fluids and related services rehydration and nutrients, medications supply.

The report outlines the primary factors of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Intravenous (IV) Hydration Therapy Market Overview

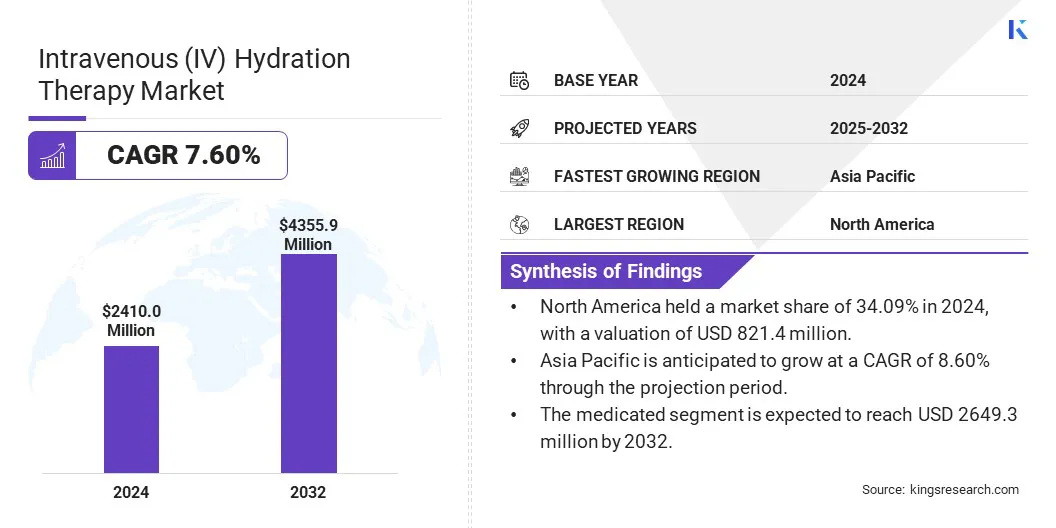

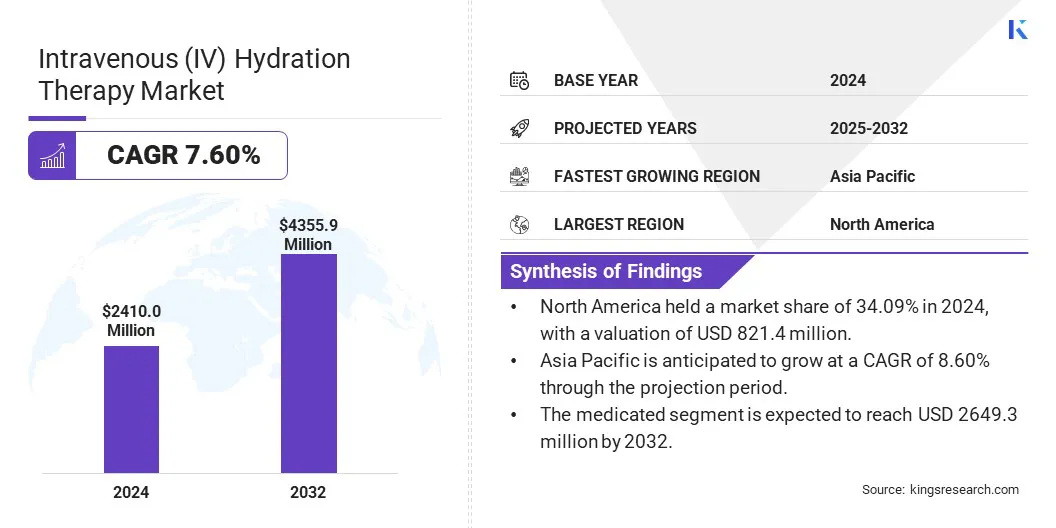

Global intravenous (IV) hydration therapy market size was valued at USD 2410.0 million in 2024, which is estimated to be USD 2585.0 million in 2025 and reach USD 4355.9 million by 2032, growing at a CAGR of 7.60% from 2025 to 2032.

Advancements in portable IV technology are fueling this growth by enabling hydration therapy in remote, military, and pre-hospital settings. These innovations enhance emergency care, increase treatment accessibility, and enhance outcomes in time-sensitive, resource-limited environments.

Major companies operating in the intravenous (IV) hydration therapy industry are CORE IV HYDRATION, Cryojuvenate Ltd, B. Braun Medical Inc., Otsuka Pharmaceutical Factory, Inc. , NexGen Orthopedics. , JW Life Science, Amanta Healthcare, Baxter, Drip Hydration, REVIV, The Wellness Co., BD, Fresenius Kabi AG, NuHealing IV Hydration & Wellness, and ICU Medical, Inc..

The market is experiencing steady growth due to rising demand for rapid and effective fluid replacement therapies across clinical and wellness settings. Increasing prevalence of chronic diseases, greater awareness of preventive healthcare, and advancements in IV delivery technologies are driving market expansion.

Additionally, the market benefits from growing adoption in outpatient care and home healthcare services, supported by innovations that enhance safety, efficiency, and accessibility of IV therapy for both medical and non-medical applications.

- In November 2024, ICU Medical and Otsuka Pharmaceutical Factory formed a joint venture to strengthen IV solutions manufacturing and innovation in North America, creating one of the largest global production networks. The partnership aims to enhance supply chain resilience and accelerate product development.

Key Highlights:

- The intravenous (IV) hydration therapy market size was recorded at USD 2410.0 million in 2024.

- The market is projected to grow at a CAGR of 7.60% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 821.4 million.

- The immune boosters segment garnered USD 676.7 million in revenue in 2024.

- The medicated segment is expected to reach USD 2649.3 million by 2032.

- The wellness centers & spas segment is anticipated to witness the fastest CAGR of 7.90% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 8.60% through the projection period.

Market Driver

Advancements in Portable IV Technology

The market is witnessing strong growth due to technological advancements in portable IV systems. These developments enable the delivery of critical fluids and electrolytes in diverse settings, including remote locations, emergency transport, and field operations.

Enhanced portability and ease of use allow healthcare providers to administer timely care outside traditional medical facilities, improving patient outcomes and reducing complications. As the demand for decentralized and responsive medical solutions rises, portable IV technologies are becoming essential tools in both civilian and defense healthcare systems.

- In June 2024, Danish MedTech company MEQU received FDA 510(k) clearance for its portable M Warmer System, designed to heat blood and IV fluids in emergency and combat situations. The system helps prevent hypothermia, thereby enhancing care quality in both U.S. military and civilian healthcare sectors.

Market Challenge

Shortage of Skilled Healthcare Professionals

A significant challenge limiting the expansion of the intravenous (IV) hydration therapy market is the shortage of skilled healthcare professionals trained in IV administration, particulalrly in remote or underserved regions. This gap can lead to improper treatment, increased risk of complications, and limited access to timely care.

To address this, manufacturers are investing in comprehensive training programs and expanding telemedicine support. Additionally, developing user-friendly automated IV devices can reduce reliance on specialized expertise and improve treatment safety and accessibility.

Market Trend

Shift toward Personalized Healthcare Solutions

The market is experiencing a rising trend of consumers seeking personalized and preventative healthcare solutions. Patients increasingly seek treatments tailored to their specific health needs, emphasizing wellness and disease prevention.

This shift prompts providers to offer customized IV therapies that deliver targeted nutrients and hydration, supporting natural, proactive health management.Consequently, the market expands by catering to individual preferences and enhancing patient engagement through personalized care.

- In January 2024, Prime IV Hydration and Wellness announced plans to expand in Beaverton, Oregon. The rapidly growing franchise aims to provide innovative, personalized IV therapy services focused on preventative care, addressing increasing consumer demand for natural health solutions.

Intravenous (IV) Hydration Therapy Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service

|

Immune Boosters, Energy Boosters, Skin Care, Migraine, Others

|

|

By Component

|

Medicated, Non-Medicated

|

|

By End Use

|

Hospitals & Clinics, Wellness Centers & Spas, Home Healthcare, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service (Immune Boosters, Energy Boosters, Skin Care, Migraine, and Others): The immune boosters segment earned USD 7 million in 2024, propelled by increasing demand for enhanced immunity and rising awareness of preventive health benefits.

- By Component (Medicated and Non-Medicated): The medicated segment held a share of 62.00% in 2024, supported by the growing use of therapeutic fluids targeting specific medical conditions and faster patient recovery.

- By End Use (Hospitals & Clinics, Wellness Centers & Spas, Home Healthcare, and Others): The hospitals & clinics segment is projected to reach USD 1434.2 million by 2032, fueled by expanding healthcare infrastructure and increased adoption of IV treatments in clinical settings.

Intravenous (IV) Hydration Therapy Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America intravenous (IV) hydration therapy market share stood at around 34.09% in 2024, valued at USD 821.4 million. This dominance is reinforced by well-established healthcare infrastructure, high adoption of advanced medical technologies, and increasing preference for home-based healthcare services.

Strong government support, favorable reimbursement policies, and growing awareness of the benefits of IV therapy further fuel regional market growth. Additionally, the region’s focus on personalized and preventive healthcare, along with rising investments in healthcare innovations, strenghtheing its leading position.

- In March 2025, the bipartisan Preserving Patient Access to Home Infusion Act was introduced to expand Medicare benefits for home infusion therapy, enabling patients with serious conditions such as infections, heart failure, and cancer to receive IV medications safely at home. Companion legislation is also planned for introduction in the U.S. Senate to support this initiative.

The Asia Pacific intravenous (IV) hydration therapy industry is estimated to grow at a CAGR of 8.60% over the forecast period. This growth is stimulated by rising healthcare awareness, expanding medical infrastructure, and increasing disposable incomes.

Growing demand for advanced medical treatments, coupled with a large population base and rising prevalence of chronic illnesses, fuels regional market growth.

Additionally, improving access to healthcare services and increasing investments in wellness centers and home healthcare contribute significantly to this expansion. The region’s expanding middle-class population and focus on preventative healthcare further accelerate the adoption of IV hydration therapies.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates the safety, efficacy, and security of medical devices, including intravenous hydration products. The FDA oversees approval processes, quality standards, and compliance to protect patients and maintain market safety.

- In the EU, IV devices require CE marking to demonstrate conformity with essential safety and performance requirements, allowing legal market access across member countries.

- In India, intravenous hydration devices are regulated under the Medical Devices Rules, 2017 by Central Drugs Standard Control Organization (CDSCO). Manufacturers must obtain licenses and comply with quality standards, performance evaluations, and post-market surveillance to ensure safety and effectiveness in healthcare settings.

Competitive Landscape

Companies in the intravenous (IV) hydration therapy market are focusing on innovation, expanding product portfolios, and enhancing the quality and efficacy of treatments to meet growing consumer demand. Many are investing in research and development to introduce advanced formulations with improved absorption and reduced side effects.

Collaborations with healthcare providers and clinics are broadening market reach. Additionally, firms are prioritizing regulatory compliance and patient safety while exploring new applications such as wellness and longevity, aiming to capitalize on the rising popularity of personalized and convenient intravenous treatments.

- In July 2024, ChromaDex launched pharmaceutical-grade intravenous and injectable Niagen, distributed by Wells Pharma to leading U.S. wellness clinics. Niagen IV provides faster, better-tolerated NAD+ therapy, promoting cellular health through prescription-only use nationwide.

List of Key Companies in Intravenous (IV) Hydration Therapy Market:

- CORE IV HYDRATION

- Cryojuvenate Ltd

- Braun Medical Inc.

- Otsuka Pharmaceutical Factory, Inc.

- NexGen Orthopedics.

- JW Life Science

- Amanta Healthcare

- Baxter

- Drip Hydration

- REVIV

- The Wellness Co.

- BD

- Fresenius Kabi AG

- NuHealing IV Hydration & Wellness

- ICU Medical, Inc.

Recent Developments (Collaboration)

- In October 2024, B. Braun collaborated with the U.S. government to secure critical IV fluid supplies following hurricane-related disruptions. The company increased production across multiple U.S. facilities and protected inventory to maintain a continuous supply. B. Braun urged healthcare providers to conserve fluids during the shortage, underscoring its commitment to patient care.