Market Definition

The market covers integrated semiconductor solutions that combine power switching components such as IGBTs and MOSFETs with built-in gate drivers and protection circuits. These modules are designed to efficiently manage and control electrical power across different voltage and current ranges.

This market includes a wide spectrum of solutions tailored to control and manage electrical energy efficiently across various voltage and current levels. The report presents a comprehensive analysis of the key market drivers, emerging trends, and the competitive landscape, which are expected to determine the market dynamics throughout the forecast period.

Intelligent Power Module Market Overview

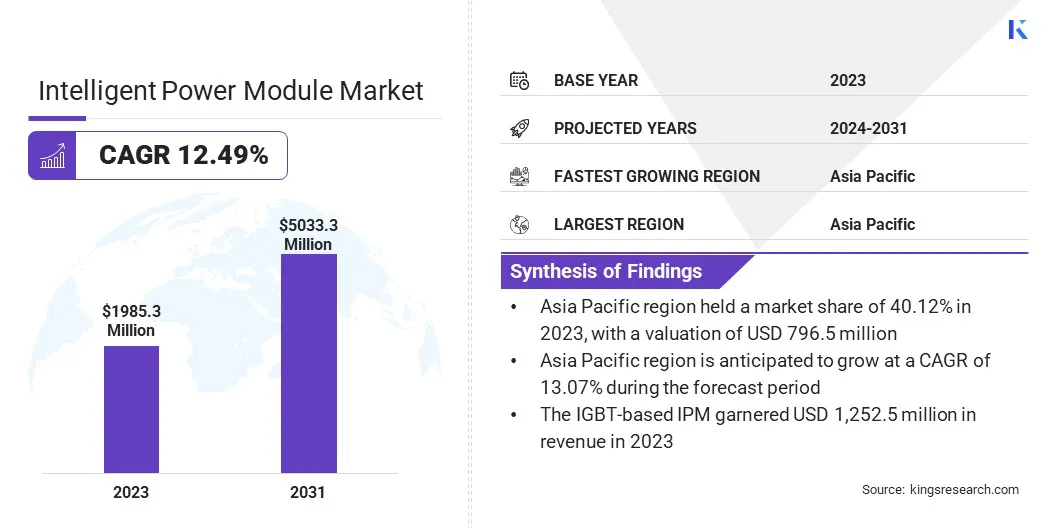

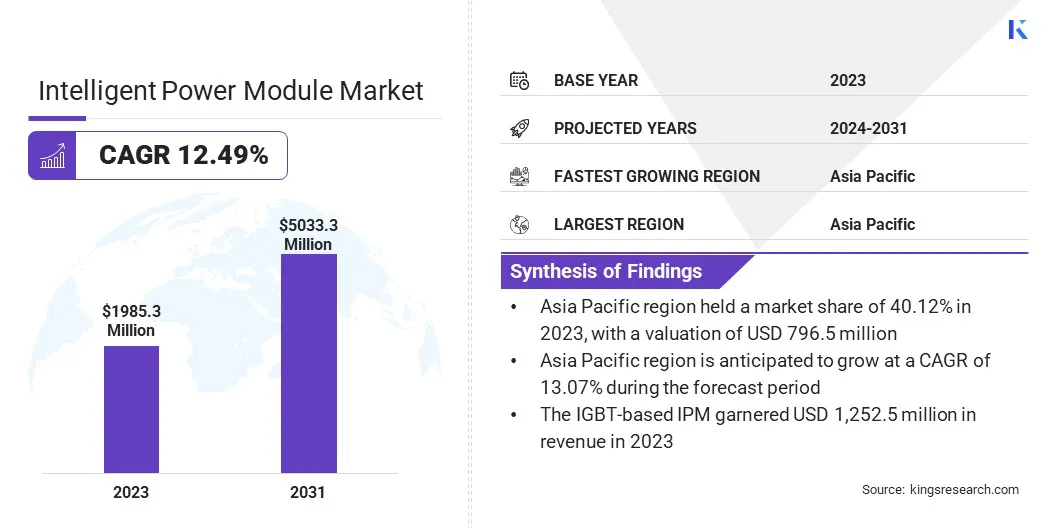

The global intelligent power module market size was valued at USD 1,985.3 million in 2023 and is projected to grow from USD 2,208.6 million in 2024 to USD 5,033.3 million by 2031, exhibiting a CAGR of 12.49% during the forecast period.

The growing adoption of electric vehicles (EVs) is driving the growth of the market. As the EV sector expands globally, the demand for compact, energy-efficient, and high-performance power electronics continues to rise, positioning intelligent power modules as a key component in electric drivetrain systems, onboard chargers, and inverters.

Major companies operating in the intelligent power module industry are Ideal Power, Inc, ROHM Co., Ltd., Vincotech GmbH, Sanken Electric Co., Ltd., Semiconductor Components Industries, LLC, Sensitron Semiconductor, Danfoss, Alpha and Omega Semiconductor, Mitsubishi Electric Corporation, Wolfspeed, Inc., Renesas Electronics Corporation, CISSOID, Infineon Technologies AG, STMicroelectronics, and Fuji Electric Co., Ltd.

Moreover, the integration of wide bandgap semiconductors, particularly silicon carbide (SiC) and gallium nitride (GaN), is significantly advancing intelligent power module technology.

These materials support higher switching frequencies, superior thermal conductivity, and lower energy losses, which result in more efficient and compact module designs. Their use enables the development of high-performance solutions that meet the demands of modern electric vehicles, industrial automation systems, and renewable energy infrastructure.

- In January 2023, Renesas Electronics Corporation launched a new automotive Intelligent Power Device (IPD), designed to enhance power distribution control in next-generation vehicle electrical/electronic (E/E) architectures. The RAJ2810024H12HPD, offered in a compact TO-252-7 package, reduces mounting area by approximately 40% compared to conventional alternatives. The device features advanced current detection capabilities, enabling highly accurate monitoring of abnormal currents, supporting the development of safer and more precise automotive power control systems.

Key Highlights

- The intelligent power module industry size was recorded at USD 1,985.3 million in 2023.

- The market is projected to grow at a CAGR of 12.49% from 2024 to 2031.

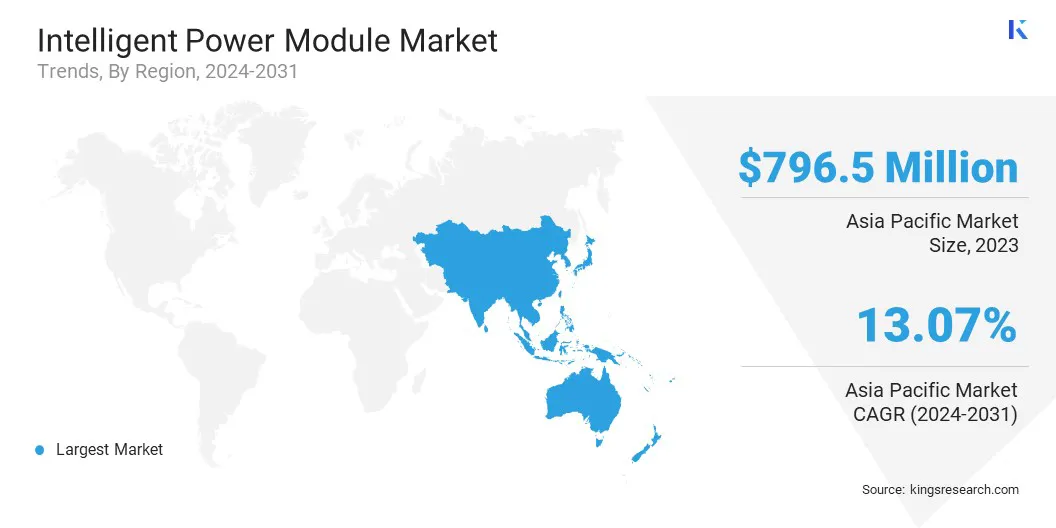

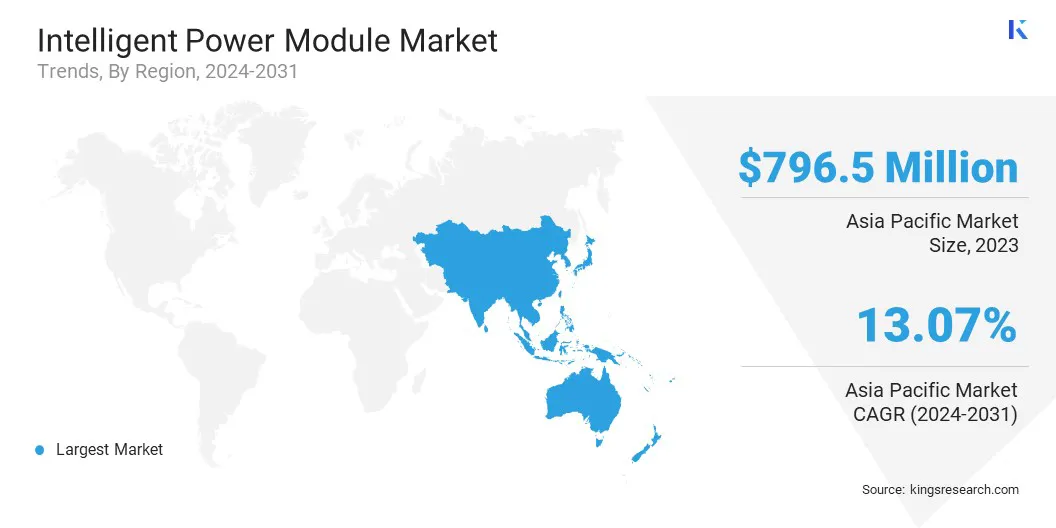

- Asia Pacific held a market share of 40.12% in 2023, with a valuation of USD 796.5 million.

- The IGBT-based IPM segment garnered USD 1,252.5 million in revenue in 2023.

- The low voltage segment is expected to reach USD 2,378.9 million by 2031.

- The industrial automation segment is expected to reach USD 1,271.9 million by 2031.

- North America is anticipated to grow at a CAGR of 12.42% during the forecast period.

Market Driver

Growth in Electric Vehicles and Industrial Automation

The market is driven by the growing adoption of electric vehicles (EVs) and the increasing implementation of industrial automation across key sectors. As EV production accelerates globally, there is a rising need for efficient and compact power management systems capable of handling high voltage and current requirements.

Intelligent power modules play a critical role in EV powertrains as they enable precise motor control, reduced energy loss, and improved thermal performance essential for vehicle efficiency and battery life. Simultaneously, the rise of Industry 4.0 and the shift toward smart manufacturing are fueling the demand for advanced power modules in automation equipment such as motor drives, robotic systems and conveyors.

These applications require highly integrated and reliable power solutions to support continuous operations and energy optimization. These factors are increasing the adoption of intelligent power modules, in turn, driving the growth of the market. The International Energy Agency (IEA) reported that global electric car registrations reached nearly 14 million units in 2023, driving the total number of electric vehicles on the road to 40 million.

Market Challenge

High Initial Cost and Complexity of Integration

A major challenge facing the intelligent power module market is the high initial cost and complexity of integration into existing systems, particularly for small and medium-sized enterprises (SMEs). Intelligent power modules combine power switching components with advanced control and protection circuitry, which increases their unit cost compared to discrete components.

Moreover, integrating these modules into legacy systems require significant redesign, specialized expertise, and additional investment in compatible components and software tools.

To address this key players are developing standardized module platforms and plug-and-play solutions that simplify integration and reduce engineering overhead. Additionally, as production scales and demand grows, economies of scale are expected to gradually bring down costs, making intelligent power modules more accessible to a broader range of end-users.

Market Trend

Integration of Wide Bandgap Semiconductors

The market is witnessing a significant trend toward the integration of wide bandgap semiconductors, particularly silicon carbide (SiC) and gallium nitride (GaN), which is reshaping the design and performance standards of power modules. These advanced materials offer superior properties compared to traditional silicon, such as higher thermal conductivity, faster switching speeds, and the ability to operate at higher voltages and temperatures.

As a result, intelligent power modules incorporating SiC and GaN enable more compact, energy-efficient, and reliable systems, making them especially attractive for demanding applications in electric vehicles, industrial drives, and renewable energy systems. This shift is not only enhancing overall system performance but also contributing to reduced energy losses and improved thermal management, which are critical for modern power electronics.

- In March 2025, onsemi launched its first-generation 1200V silicon carbide (SiC) MOSFET-based SPM 31 intelligent power modules. These EliteSiC IPMs offer industry-leading energy efficiency and power density in an ultra-compact footprint, outperforming traditional Field Stop 7 IGBT solutions and enabling a lower overall system cost.

Intelligent Power Module Market Report Snapshot

|

Segmentation

|

Details

|

|

By Power Device Type

|

IGBT-based IPM, MOSFET-based IPM

|

|

By Voltage Rating

|

Low Voltage, Medium Voltage, High Voltage

|

|

By Application

|

Industrial Automation, Consumer Electronics, Automotive (EV/HEV), Renewable Energy, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Power Device Type (IGBT-based IPM, MOSFET-based IPM): The IGBT-based IPM segment earned USD 1,252.5 million in 2023 due to its high efficiency and robust performance in high-voltage and high-current industrial applications.

- By Voltage Rating (Low Voltage, Medium Voltage, High Voltage): The low voltage held 56.48% of the market in 2023, due to its widespread use in compact consumer devices and low-power motor drives.

- By Application (Industrial Automation, Consumer Electronics, Automotive (EV/HEV), and Renewable Energy): The industrial automation segment is projected to reach USD 1,271.9 million by 2031, owing to the growing adoption of smart factory solutions and energy-efficient motor control systems.

Intelligent Power Module Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific intelligent power module market share stood around 40.12% in 2023 in the global market, with a valuation of USD 796.5 million. This dominance is primarily driven by the strong presence of consumer electronics manufacturing hubs, rapid industrialization, and growing adoption of electric vehicles across countries such as China, Japan, South Korea, and India.

Additionally, favorable government initiatives promoting energy-efficient technologies and the expansion of renewable energy infrastructure are further contributing to the region’s leadership in the market. Rising demand for high-performance motor control solutions and the availability of cost-effective production capabilities are also increasing the adoption of intelligent power modules in this region.

In November 2024, according to the India Brand Equity Foundation, electric vehicles accounted for over 50% of new three-wheeler registrations in India, approximately 5% of two-wheeler sales, and around 2% of new passenger car purchases.

North America is poised to grow at a significant growth at a CAGR of 12.42% over the forecast period, driven by increasing investments in industrial automation, rising demand for energy-efficient systems, and the growing penetration of electric and hybrid vehicles.

The region’s developed industrial ecosystem and ongoing advancements in technology are accelerating the adoption of intelligent power modules across manufacturing and automotive applications. These factors support the integration of efficient power management solutions, particularly in systems requiring high reliability and compact design.

Government incentives promoting clean energy adoption, along with strategic collaborations between industry players and research institutions, are further boosting market expansion in the region.

Regulatory Frameworks

- In the U.S., Intelligent Power Modules are subject to a regulatory framework that includes compliance with the Federal Communications Commission (FCC) rules. This ensures that IPMs do not emit excessive electromagnetic disturbances that could interfere with other electronic devices.

- In Europe, Intelligent Power Modules must adhere to a regulatory framework that includes the Restriction of Hazardous Substances (RoHS) Directive, which restricts the use of specific hazardous materials in electronic equipment to ensure environmental safety.

Competitive Landscape

The intelligent power module market is highly competitive, with key players adopting multiple strategies to enhance their technological edge and market presence. Key companies are heavily investing in R&D to develop high-efficiency, compact, and thermally optimized modules across varied voltage and power ranges.

To accelerate innovation and time-to-market, many players are forming strategic alliances with OEMs, system integrators, and research bodies. Expansion of global manufacturing and design capabilities is also a priority, helping firms meet localized demand and improve supply chain reliability.

Additionally, mergers, acquisitions, and joint ventures remain key strategies for gaining access to advanced technologies, entering new markets, and scaling production.

- In March 2023, Hitachi Energy secured a multi-year supply agreement with VREMT Geely Auto, one of the world’s largest electric vehicle manufacturers. Under this agreement, Hitachi Energy will provide its advanced RoadPak high-performance power semiconductor modules for Geely’s ZEEKR brand, an all-electric premium vehicle line.

List of Key Companies in Intelligent Power Module Market:

- Ideal Power, Inc

- ROHM Co., Ltd.

- Vincotech GmbH

- Sanken Electric Co., Ltd.

- Semiconductor Components Industries, LLC

- Sensitron Semiconductor

- Danfoss

- Alpha and Omega Semiconductor

- Mitsubishi Electric Corporation

- Wolfspeed, Inc.

- Renesas Electronics Corporation

- CISSOID

- Infineon Technologies AG

- STMicroelectronics

- Fuji Electric Co., Ltd.

Recent Developments (Product Launch)

- In June 2024, Texas Instruments launched the 650V three-phase GaN intelligent power module for 250W motor drive applications. The DRV7308 GaN IPM is engineered to overcome common design and performance limitations in home appliances and HVAC systems by delivering high inverter efficiency, enhanced acoustic performance at lower system costs.

.