Market Definition

The market includes the supply and use of tiny electronic parts like resistors, capacitors, and inductors that are built together on a single chip. These are used in industries, such as electronics, cars, healthcare, and telecom, to make devices smaller and work better by improving how circuits handle signals and power.

The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Integrated Passive Devices Market Overview

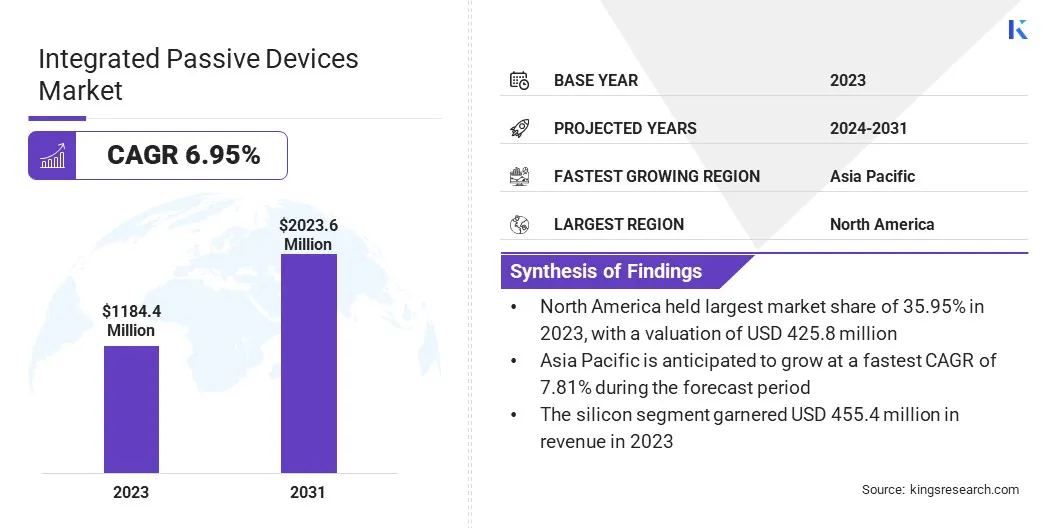

The global integrated passive devices market size was valued at USD 1,184.4 million in 2023 and is projected to grow from USD 1,264.3 million in 2024 to USD 2,023.6 million by 2031, exhibiting a CAGR of 6.95% during the forecast period.

The market is experiencing steady growth due to the rising demand for compact and high-performance electronic systems across various industries. The increasing adoption of smartphones, wearable devices, and advanced driver-assistance systems (ADAS) in vehicles is driving the need for miniaturized and efficient components.

Major companies operating in the integrated passive devices industry are Murata Manufacturing Co., Ltd., STMicroelectronics, Semiconductor Components Industries, LLC, Texas Instruments Incorporated, NXP Semiconductors, Johanson Technology, Analog Devices, Inc., TDK Electronics AG, Bourns, Inc., CTS Corporation, 3DiS Technologies, MACOM Technology Solutions Inc., X-FAB Silicon Foundries SE, and KYOCERA CORPORATION.

IPDs help reduce board space and improve electrical performance, making them ideal for modern electronics. Additionally, advancements in semiconductor packaging and integration techniques are further supporting market expansion.

Key Highlights

- The integrated passive devices industry size was valued at USD 1,184.4 million in 2023.

- The market is projected to grow at a CAGR of 6.95% from 2024 to 2031.

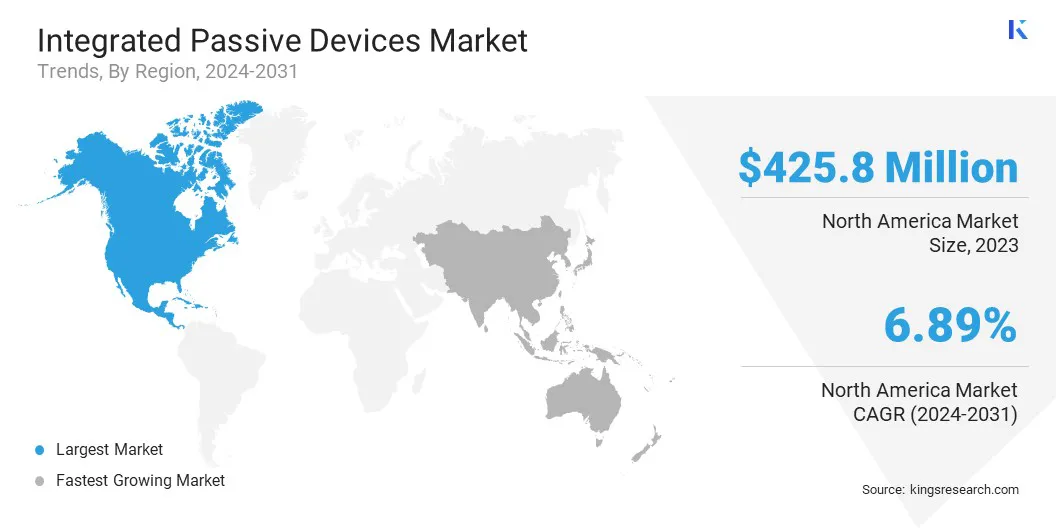

- North America held a market share of 35.95% in 2023, with a valuation of USD 425.8 million.

- The silicon segment garnered USD 455.4 million in revenue in 2023.

- The electromagnetic interference (EMI)/electrostatic discharge (ESD) segment is expected to reach USD 731.1 million by 2031.

- The consumer electronics segment is expected to reach USD 553.2 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.81% during the forecast period.

Market Driver

"Miniaturization and the Demand for Smaller Integrated Passive Devices"

The integrated passive devices market is experiencing significant growth due to the increasing demand for miniaturization in electronic devices. As industries such as telecommunications, automotive, and consumer electronics strive to develop smaller, more efficient products, the need for compact, high-performance components is increasing.

IPDs are essential in this process, as they combine passive components like resistors, capacitors, and inductors into a single integrated package, saving space and improving performance.

As electronic systems evolve to support high-frequency and high-speed operations, the demand for advanced IPDs continues to grow, making them essential for next-generation applications.

- In September 2023, X-FAB Silicon Foundries SE launched its XIPD fabrication platform, based on the XR013 130nm RF SOI process, to integrate inductors, capacitors, and resistors directly into device designs. The platform supports miniaturization and cost reduction in high-frequency applications including 5G, 6G, radar, and satellite communications.

Market Challenge

"High Production Costs"

A major challenge in the integrated passive devices market is the high production cost of advanced IPDs. The manufacturing process for IPDs involves intricate steps such as precise integration of multiple passive components on a single substrate, which requires specialized equipment and high-quality materials.

These factors contribute to significantly higher production costs compared to traditional discrete components. To mitigate this challenge, companies are investing in automation technologies and advanced manufacturing techniques like 3D printing and semiconductor packaging innovations.

These solutions help reduce labor-intensive steps, enhance production efficiency, and ultimately lower the cost of producing advanced IPDs, making them more accessible to a broader range of industries.

Market Trend

"Optimizing Space and Performance for Advanced Packaging Technologies"

The integration of integrated passive devices with advanced packaging technologies is emerging as a key trend in the integrated passive devices market. This integration is driven by the need to maximize space efficiency, improve thermal management, and enhance the overall performance of modern electronic devices.

Advanced packaging solutions, such as System-in-Package (SiP) and 3D packaging, enable a more efficient arrangement of components, ensuring better signal integrity, reduced power consumption, and a smaller device footprint.

Additionally, the expansion of Fan-Out Wafer Level Packaging (FOWLP) capabilities plays a crucial role by optimizing space utilization, supporting higher density IPDs while maintaining performance and reliability. FOWLP further contributes to improved thermal management, helping to prevent overheating in compact, high-performance devices.

- In October 2024, SkyWater Technology and Deca Technologies entered a partnership under a five-year contract awarded by the U.S. Department of Defense. The collaboration aims to expand domestic fan-out wafer-level packaging (FOWLP) capabilities, integrate active and passive devices, and support efforts to reshore the semiconductor supply chain.

Integrated Passive Devices Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Silicon, Glass, Others

|

|

By Application

|

Electromagnetic Interference (EMI)/Electrostatic Discharge (ESD), RF systems, Signal conditioning, Others

|

|

By End Use

|

Consumer Electronics, Automotive, Telecommunications, Healthcare & Lifesciences, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Silicon, Glass, Others): The silicon segment earned USD 455.4 million in 2023 due to its cost-effectiveness, reliability, and widespread use in high-performance applications.

- By Application (Electromagnetic Interference (EMI)/Electrostatic Discharge (ESD), RF systems, Signal conditioning, Others): The electromagnetic interference (EMI)/electrostatic discharge (ESD) segment held 36.22% of the market in 2023, due to its critical role in protecting sensitive electronic components in various devices.

- By End Use (Consumer Electronics, Automotive, Telecommunications, Healthcare & Lifesciences, and Others): The consumer electronics segment is projected to reach USD 553.2 million by 2031, owing to the growing demand for compact, high-performance devices such as smartphones, wearables, and smart home systems.

Integrated Passive Devices Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America integrated passive devices market share stood at around 35.95% in 2023 in the global market, with a valuation of USD 425.8 million, driven by the region's strong presence in advanced consumer electronics, automotive, and telecommunications industries.

The demand for high-performance, miniaturized components in sectors like smartphones, automotive ADAS, and 5G infrastructure is a key factor contributing to North America's dominance.

Additionally, the presence of leading semiconductor manufacturers, significant R&D investments, and strong technological innovation, are increasing the adoption of integrated passive devices in this region.

- In March 2025, Saras Micro Devices joined two U.S. Department of Commerce CHIPS National Advanced Packaging Manufacturing Program (NAPMP) projects. The company will contribute its STILE technology to the SHIELD USA and SMART Packaging initiatives, focused on advancing power delivery for high-performance computing and artificial intelligence applications.

The integrated passive devices industry in Asia Pacific is expected to register the fastest growth in the market, with a projected CAGR of 7.81% over the forecast period.

This growth is driven by the region's well-established electronics manufacturing ecosystem, with countries like China, Japan, and South Korea leading in the production of high-demand consumer electronics such as smartphones, tablets, and wearables. The growing automotive industry, particularly with the rise of electric vehicles and ADAS, is also boosting demand for integrated passive devices.

Additionally, growing investment in semiconductor manufacturing and packaging innovation is driving IPD adoption across Asia Pacific. Key applications include smartphones, IoT devices, automotive electronics, and high-frequency communication systems.

Regulatory Frameworks

- In the U.S., the primary regulatory body for semiconductors is the U.S. Department of Commerce, particularly the Bureau of Industry and Security (BIS). BIS administrates export controls, including those related to semiconductors, to prevent the diversion of technology to countries of concern.

- In Europe, the key regulatory authority for the semiconductor industry is the European Commission. The Commission plays a crucial role in implementing the Chips Act, a legislative package aimed at boosting semiconductor production within the EU.

Competitive Landscape

The integrated passive devices industry is characterized by key players focusing on various strategies to strengthen their market position. Companies are increasingly investing in research and development to create innovative and high-performance IPDs that meet the evolving needs of industries such as consumer electronics, automotive, and telecommunications.

Partnerships and collaborations with semiconductor manufacturers and technology providers are primary strategies adopted by market players to leverage advanced packaging and integration technologies. Moreover, they are focusing on expanding their production capabilities in regions with high demand, particularly in Asia Pacific, to cater to the growing market.

- In April 2024, Keysight Technologies, Inc., Synopsys, Inc., and Ansys collaborated on a new integrated radio frequency (RF) design migration workflow. The initiative focuses on efficiently migrating passive RF components to TSMC’s N6RF+ process node, enhancing power, performance, and area for wireless integrated circuits.

List of Key Companies in Integrated Passive Devices Market:

- Murata Manufacturing Co., Ltd.

- STMicroelectronics

- Semiconductor Components Industries, LLC

- Texas Instruments Incorporated

- NXP Semiconductors

- Johanson Technology

- Analog Devices, Inc.

- TDK Electronics AG

- Bourns, Inc.

- CTS Corporation

- 3DiS Technologies

- MACOM Technology Solutions Inc.

- X-FAB Silicon Foundries SE

- KYOCERA CORPORATION

Recent Developments (Collaboration/Product Launch)

- In March 2025, Nubis Communications and Samtec collaborated on a new co-packaged platform. The partnership focuses on enabling a 6.4T common connector for both optics and copper in high-bandwidth AI interconnects, leveraging Nubis’ 200G per lane Silicon Photonics IC and Samtec’s Si-Fly HD interconnects.

- In April 2023, Cadence Design Systems, Inc. introduced the EMX Designer, a passive device synthesis and optimization technology that delivers more than 10X faster synthesis times. The solution integrates with the Cadence Virtuoso ADE Product Suite, enabling rapid, DRC-clean passive device creation for improved productivity in IC design.