Market Definition

The market refers to the industry that deals with the development, technology and production, of SiP technologies. SiP is a type of Integrated Circuit (IC) packaging that combines multiple electronic components, such as microprocessors, memory, sensors, and power management ICs, into a single, compact package or module.

This enables smaller, more efficient electronic devices. The report explores the key drivers of market development, offering detailed regional analysis and a comprehensive overview of the competitive landscape shaping future opportunities.

System in Package Market Overview

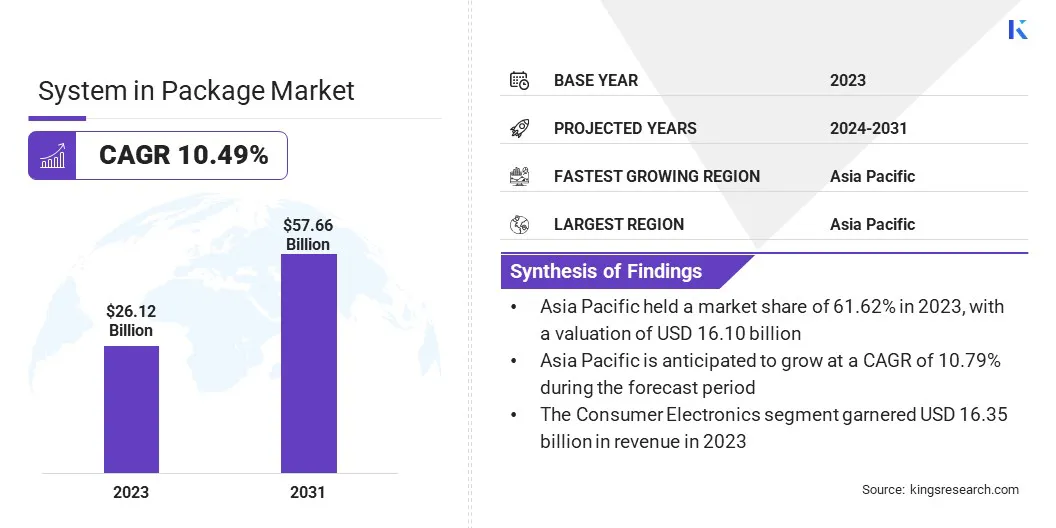

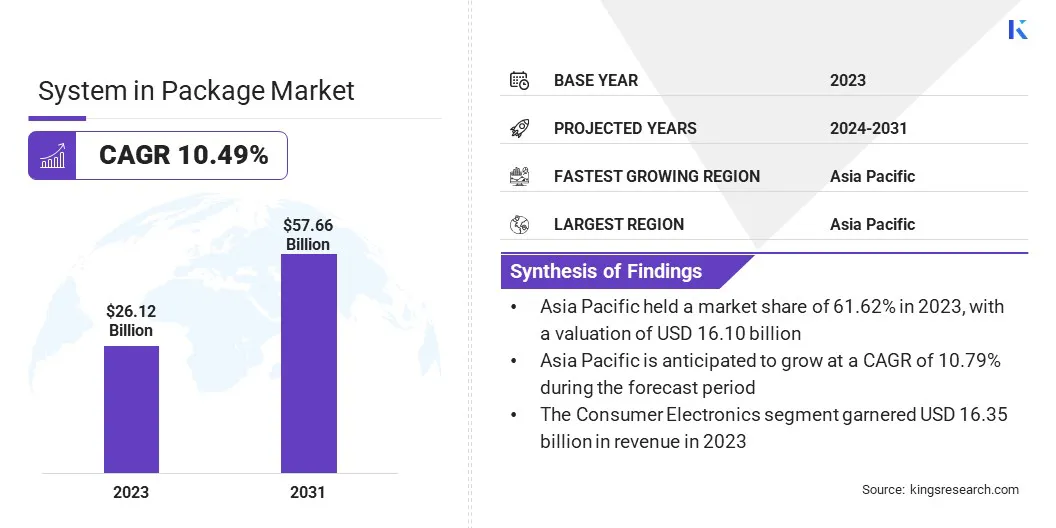

The global system in package market size was valued at USD 26.12 billion in 2023, which is estimated to be USD 28.68 billion in 2024 and reach USD 57.66 billion by 2031, growing at a CAGR of 10.49% from 2024 to 2031.

The increasing demand for smaller, lighter, and more powerful consumer electronics, such as smartphones, wearables, and IoT devices, is driving the adoption of SiP technology to optimize space and performance.

Major companies operating in the system in package ndustry are ASE, Amkor Technology, Powertech Technology Inc, UTAC, SAMSUNG ELECTRO-MECHANICS, ChipMOS TECHNOLOGIES INC., Jiangsu Changdian Technology Co., Ltd., Unisem, Intel Corporation, Qualcomm Technologies, Inc., Octavo Systems LLC, GS Nanotech, Semiconductor Components Industries, LLC, Micross, and Swissbit.

The market is rapidly expanding, driven by the demand for compact, high-performance electronic solutions across various industries. SiP technology enables the integration of multiple components, such as processors, memory, and passive elements, into a single package, significantly reducing size, power consumption, and design complexity.

This approach enhances system efficiency and accelerates time-to-market for new products. Electronic devices are becoming more sophisticated and space-constrained. SiP offers a scalable and cost-effective solution, making it increasingly vital to modern electronics design.

- In April 2024, Octavo Systems launched the OSD32MP2 family in Austin, TX, introducing powerful SIP modules that integrate the STM32MP25 processor. These SiPs drastically reduce design complexity, size, and cost, empowering engineers to accelerate innovation across industrial, IoT, and consumer electronics applications.

Key Highlights:

- The system in package industry size was valued at USD 26.12 billion in 2023.

- The market is projected to grow at a CAGR of 10.49% from 2024 to 2031.

- Asia Pacific held a market share of 61.62% in 2023, with a valuation of USD 16.10 billion.

- The 3D IC packaging technology segment garnered USD 11.71 billion in revenue in 2023.

- The Ball Grid Array (BGA) segment is expected to reach USD 31.65 billion by 2031.

- The wire bond and die attach segment held a market share of 48.95% in 2023.

- The automotive and transportation segment is anticipated to register a CAGR of 11.16% during the forecast period.

- The RF front-end segment is anticipated to hold a market share of 32.01% in 2031.

- The market in North America is anticipated to grow at a CAGR of 10.48% during the forecast period.

Market Driver

"Miniaturization of Devices"

The demand for smaller, lighter, and more powerful consumer electronics is driving the system in package market. Devices like smartphones, wearables, and IoT gadgets are becoming increasingly compact. Thus, manufacturers are turning to SiP technology to integrate multiple components into a single, space-efficient package.

SiP allows for the miniaturization of complex systems without compromising on performance, power efficiency, or reliability. This is pushing innovations in SiP design to meet the requirements of next-generation electronic devices while maintaining functionality and reducing device size.

- In Dec 2024, Broadcom unveiled its groundbreaking 3.5D XDSiP platform, combining 3D silicon stacking with 2.5D packaging. This innovation redefines custom AI XPU design by improving power efficiency, reducing latency, and enabling ultra-compact, high-performance computing systems for next-generation AI applications.

Market Challenge

"Cost of Development"

The high initial cost of SiP development is a significant challenge, as it requires substantial investments in research, design, testing, and specialized manufacturing processes. These costs can be a barrier, particularly for smaller companies.

However, advancements in design automation, standardization of SiP components, and the development of modular platforms help reduce expenses. Additionally, collaborations between industry players and improved economies of scale can help mitigate these costs, making SiP technology more accessible and cost-effective over time.

Market Trend

"Low Power and Energy Efficiency"

A prominent trend in the system in package market is the growing demand for low power and energy-efficient solutions. Minimizing power consumption has become essential for extending device lifetimes and reducing operational costs as battery-operated devices and IoT applications continue to proliferate.

SiP solutions, like Nordic Semiconductor’s nRF9151, offer significant reductions in power usage while maintaining high performance, making them ideal for long-term IoT deployments. This trend is particularly crucial for applications in remote monitoring, wearables, and other energy-sensitive devices.

- In Sept 2024, Nordic Semiconductor launched the nRF9151, the smallest and lowest power cellular IoT SiP solution. This pre-certified SiP supports LTE-M/NB-IoT and DECT NR+, offering a compact, energy-efficient design ideal for massive IoT markets like smart city applications, industrial automation, and asset tracking. The nRF9151 simplifies development, reduces power consumption, and provides robust global connectivity with increased supply chain resilience, positioning it as a breakthrough solution in the rapidly growing IoT market.

System in Package Market Report Snapshot

|

Segmentation

|

Details

|

|

By Packaging Technology

|

2D IC Packaging Technology, 2.5D IC Packaging Technology, 3D IC Packaging Technology

|

|

By Package Type

|

Ball Grid Array (BGA), Surface Mount Package, Pin Grid Array (PGA), Flat Package (FP), Small Outline Package

|

|

By Packaging Method

|

Wire Bond and Die Attach, Flip Chip, Fan-Out Wafer Level Packaging (FOWLP)

|

|

By Application

|

Consumer Electronics, Industrial, Automotive and Transportation, Aerospace and Defence, Healthcare, Emerging, Others

|

|

By Device

|

Power Management Integrated Circuit (PMIC), Microelectromechanical Systems (MEMS), RF Front-End, RF Power Amplifier, Baseband Processor, Application Processor, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Packaging Technology (2D IC Packaging Technology, 2.5D IC Packaging Technology, 3D IC Packaging Technology): The 2.5D IC packaging technology segment earned USD 10.52 billion in 2023, due to the increasing demand for advanced packaging in mobile devices, consumer electronics, and IoT products.

- By Package Type [Ball Grid Array (BGA), Surface Mount Package, Pin Grid Array (PGA), and Flat Package (FP) Small Outline Package]: The Ball Grid Array (BGA) segment held 54.27% share of the market in 2023, due to its reliability, cost-effectiveness, and widespread adoption in high-performance SiP applications.

- By Packaging Method [Wire Bond and Die Attach, Flip Chip, Fan-Out Wafer Level Packaging (FOWLP)]: The wire bond and die attach segment is projected to reach USD 27.75 billion by 2031, owing to their crucial role in improving electrical connectivity and reducing production costs in SiP designs.

- By Application (Consumer Electronics, Industrial, Automotive and Transportation, Aerospace and Defence, Healthcare, Emerging, Others): The automotive and transportation segment is anticipated to register a CAGR of 11.16% during the forecast period, due to the rising integration of SiP solutions for smart automotive electronics and electric vehicles (EVs).

- By Device [Power Management Integrated Circuit (PMIC), Microelectromechanical Systems (MEMS), RF Front-End, RF Power Amplifier, Baseband Processor, Application Processor, Others]: The RF front-end segment is anticipated to hold a market share of 32.01% in 2031, due to the growing demand for SiP solutions in wireless communication and 5G infrastructure.

System in Package Market Regional Analysis

Based on region, the market is classified into North America, Europe, Asia-Pacific, Middle East & Africa , and Latin America.

Asia Pacific system in package market share stood at around 61.62% in 2023, with a valuation of USD 16.10 billion. Asia Pacific dominates the market, due to the rapid growth of consumer electronics, automotive sectors, and IoT applications in the region.

The region's strong manufacturing base, coupled with advancements in semiconductor technologies and packaging solutions, supports the widespread adoption of SiP products.

Furthermore, increasing investments in R&D and the growing demand for compact, energy-efficient devices have positioned Asia Pacific as a key hub for SiP innovation, ensuring its continued market leadership.

- In May 2024, Wise-integration and Leadtrend Technology, a Taiwanese company introduced a GaN SiP designed for rapid consumer device charging. This collaboration targets a 65-watt USB PD adapter for high-speed charging of smartphones and laptops, optimizing system efficiency, reducing component count, and offering faster system development.

The system in package industry in North America is poised for significant growth over the forecast period at a CAGR of 10.48%. North America is emerging as a rapidly growing region in the market, driven by strong demand for advanced electronics, particularly in consumer devices, automotive, and IoT applications.

The region benefits from a robust technological ecosystem, continuous innovation, and significant investments in research and development. Additionally, North America's leading role in industries such as telecommunications and automotive, alongside increasing adoption of 5G technologies, contributes to the growing adoption of SiP solutions, boosting the market.

Regulatory Frameworks

- In India, the Bureau of Indian Standards (BIS) sets guidelines for the manufacturing and testing of electronic systems, including SiP products, to ensure quality and safety.

- In the U.S., the Food and Drug Administration (FDA) mandates approval for SiP products used in medical devices or healthcare applications. This regulatory framework ensures that electronic systems meet stringent safety, efficacy, and quality standards before being introduced to the market.

- In the European Union (EU), SiP products must have CE marking to confirm compliance with EU safety, health, and environmental standards. This certification ensures that SiP products meet the EU’s requirements for product safety, performance, and environmental impact.

Competitive Landscape:

Companies in the system in package industry are focusing on advancing miniaturization, enhancing performance, and improving power efficiency. They are integrating multiple components, such as processors, memory, and sensors, into compact, cost-effective solutions to meet the increasing demand for high-performance, space-saving technologies.

These innovations are particularly important for applications in IoT, automotive, telecommunications, and consumer electronics. Manufacturers are also investing in AI and ML capabilities, optimizing SiP products for edge computing and real-time data processing to support the evolving technological landscape.

- In October 2024, Lantronix announced the launch of five new SiP solutions powered by Qualcomm, aimed at enhancing AI/ML and video capabilities at the edge. These solutions support smart city applications, including robotics, industrial automation, and video surveillance, further solidifying Lantronix's leadership in the industrial and enterprise IoT markets. The integration of Qualcomm's chipsets enables cost-effective, high-performance edge computing, driving innovation in advanced AI-driven technologies for critical industrial sectors.

List of Key Companies in System in Package Market:

- ASE

- Amkor Technology

- Powertech Technology Inc

- UTAC

- SAMSUNG ELECTRO-MECHANICS

- ChipMOS TECHNOLOGIES INC.

- Jiangsu Changdian Technology Co., Ltd.

- Unisem

- Intel Corporation

- Qualcomm Technologies, Inc.

- Octavo Systems LLC

- GS Nanotech

- Semiconductor Components Industries, LLC

- Micross

- Swissbit

Recent Developments (Product Launch)

- In December 2024, Broadcom unveiled its groundbreaking 3.5D eXtreme Dimension System in Package (XDSiP) technology, enabling the development of next-gen AI accelerators (XPUs). This platform integrates over 6000 mm² of silicon and up to 12 high-bandwidth memory stacks, offering enhanced power efficiency, reduced latency, and improved interconnect density. With its innovative 3.5D stacking, it addresses the growing demands of AI computing, positioning Broadcom at the forefront of custom XPU solutions.

- In March 2023, Octavo Systems announced the development of its OSD62x family of SiP solutions, based on Texas Instruments' AM62x processors. These SiPs integrate high-speed memory, power management, and passive components into compact form factors. Designed for edge computing, IoT, and AI applications, the OSD62x family provides solutions that reduce system sizes by 60% and speed up market entry by up to nine months.