Insecticides Market Size

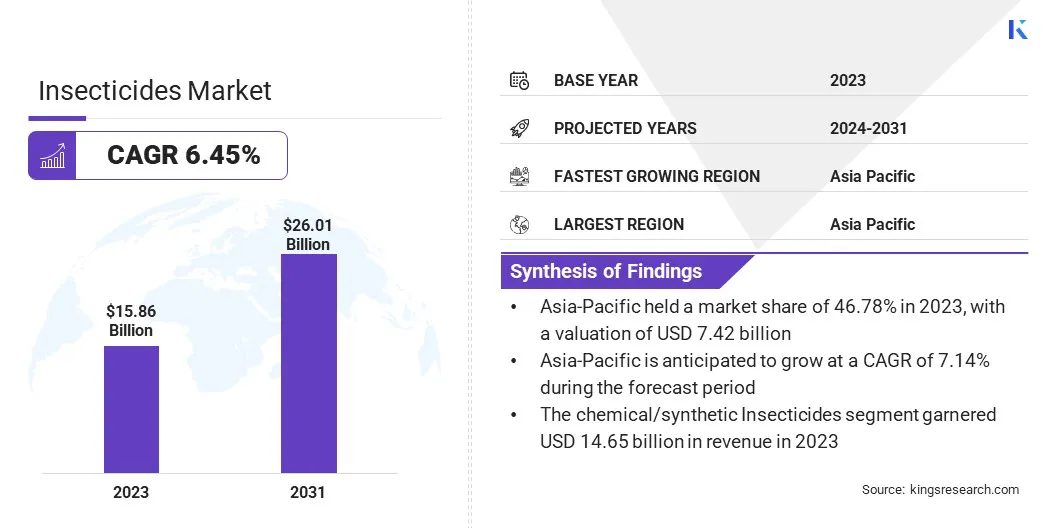

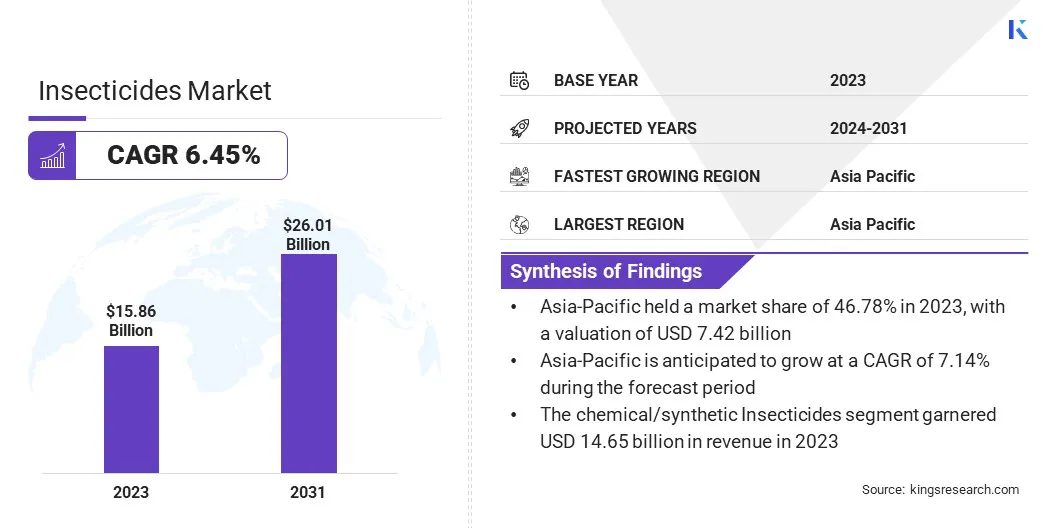

The global insecticides market size was valued at USD 15.86 billion in 2023 and is projected to grow from USD 16.79 billion in 2024 to USD 26.01 billion by 2031, exhibiting a CAGR of 6.45% during the forecast period. Increased demand for food, due to the growing global population, and the scarcity of arable land boosts the use of insecticides. Additionally, insecticides maximize the crop yield. These factors fuel the market.

In the scope of work, the report includes products offered by companies such as BASF, Syngenta Group Company, Nufarm, FMC Corporation, Drexel Chemical Company, UPL, Kenvos Group, Nissan Chemical Corporation, Corteva, Dhanuka Agritech Ltd, and others.

The insecticides market plays a crucial role in the global agricultural industry, addressing the increasing demand for effective pest control in farming, horticulture, and landscaping. This market encompasses a wide range of chemical and biological products designed to eliminate or manage insects that can harm crops by competing for resources or spreading diseases.

Factors such as the need for higher crop yields, innovations in insecticide formulations, and the growth of agricultural practices globally influence the market. Leading companies invest in research and development (R&D) to create more efficient and environmentally friendly insecticides, with the market also being governed by stringent regulations to ensure safety and reduce environmental impact.

- The Central Insecticides Board and Registration Committee (CIBRC) in India regulates the registration and approval of pesticides. It ensures that pesticides meet safety and efficacy standards before they can be marketed, aiming to protect human health, the environment, and agricultural productivity.

The market involves the development and supply of products used to control, repel, or eliminate insect pests that affect crops, livestock, and human health. These products are vital in protecting agricultural yields, improving crop quality, and preventing pest-borne diseases that can harm both food security and the economy.

Issues like pest resistance and environmental concerns affect agriculture. The market is driven by the increasing demand for effective, sustainable pest management solutions. The market is segmented into several categories, including type, mode of application, nature, and form.

This segmentation allows for tailored solutions to different crops, environmental conditions, and pest problems, ensuring that insecticides can meet the varied needs of farmers and agricultural businesses while minimizing environmental impact.

Analyst’s Review

The market is evolving, driven by the need for more sustainable and effective pest management solutions. As agricultural practices advance, the demand for insecticides that protect crops from a variety of pests remains strong, but the focus on reducing the environmental impact of these products keeps growing.

Companies are increasingly investing in research to develop insecticides that are both efficient and environmentally friendly. While chemical insecticides remain dominant, there is a notable shift toward bio-based and natural alternatives, as farmers and consumers seek safer options.

This transition reflects the market's commitment to balancing high agricultural productivity with environmental sustainability, ensuring that the insecticides market adapts to future agricultural challenges and the growing demand for eco-conscious solutions.

- Crymax, a biological insecticide from Certis Biologicals, utilizes a genetically engineered strain of Bacillus thuringiensis (Bt), combining toxins from both Bt kurstaki and Bt aizawai. It effectively targets newly hatched lepidopterous larvae and is a low-risk option for humans and non-target species. As a bio-based insecticide, Crymax offers natural microbial protection with minimal environmental impact, making it a suitable choice for sustainable pest management in agriculture.

What are the major factors affecting this market?

The market is growing due to several factors, with the increasing demand for food production being a primary driver. As the global population rises, there is a greater need for enhanced agricultural productivity to ensure food security.

Additionally, the adoption of integrated pest management (IPM) practices is driving growth in the market. IPM is based on the idea that the most effective way to manage pests is to use a combination of methods, rather than relying on a single approach.

This integrated strategy is gaining popularity, as it reduces the over-reliance on chemical insecticides while promoting sustainable and efficient pest control solutions. The demand for eco-friendly, efficient insecticides that align with IPM is boosting market expansion.

- The Financing Agrochemical Reduction and Management (FARM) program was officially launched in Nairobi, Kenya, in March 2024. Led by the Food and Agriculture Organization (FAO), this five-year initiative spans over countries: Ecuador, India, Kenya, Laos, the Philippines, Uruguay, and Vietnam. The program aims to drive investment that reduces the use of harmful agrochemicals in agriculture. It focuses on enhancing regulatory frameworks, building capacity, and working with banks and policymakers to adjust policies and financial resources, ultimately helping farmers transition to sustainable farming practices.

Environmental contamination is a significant challenge in the insecticides market, as certain insecticides can contaminate soil and groundwater, negatively affecting wildlife and human health. Some insecticides are persistent, remaining in the environment for long periods and accumulating in the soil.

To address this, the market is focusing on developing biodegradable, eco-friendly insecticides that break down more quickly, reducing environmental impact. Additionally, stricter regulations and better monitoring practices are being implemented to ensure safer usage, minimize risks, and protect ecosystems from the harmful effects of chemical insecticides.

What are the major trends in this market?

The development of bio-based and eco-friendly insecticides is gaining momentum as the agricultural industry seeks sustainable alternatives to chemical insecticides. These products, derived from natural sources such as plants, bacteria, or fungi, are designed to target specific pests while minimizing harm to non-target species, humans, and the environment.

Bio-based insecticides are becoming increasingly popular, due to their reduced environmental footprint, biodegradable properties, and growing consumer preference for organic farming practices. This trend is helping reduce reliance on synthetic chemicals, supporting long-term agricultural sustainability.

The emphasis on research and development (R&D) in the insecticides market is growing as companies strive to create more effective, efficient, and environmentally safe solutions. R&D efforts are focused on improving the efficacy of existing insecticides, developing new bio-based products, and finding alternatives to harmful chemicals.

Advances in genetic engineering, biotechnology, and formulation technologies are enabling the creation of insecticides that target specific pests more effectively, while reducing environmental impact. As agricultural practices evolve, increased investment in R&D is essential for developing innovative pest control solutions.

- In September 2024, Best Agrolife Ltd. announced a groundbreaking patent combining Plant Growth Regulators (PGR) with insecticides like Clothianidin, Dinotefuran, or Acetamiprid and Mepiquat. This innovation enhances the company's position and strengthens its competitive edge, supporting sustainable agriculture and farmer prosperity through advanced, high-performance products.

Segmentation Analysis

The global market is segmented based on type, mode application, nature, form, and geography.

How big is the Organophosphates segment in the market?

Based on type, the market has been segmented into Organophosphates, Pyrethroids, Neonicotinoids, Carbamates, Insect Growth Regulators (IGRs), and others. The Organophosphates segment led the insecticides market in 2023, reaching the valuation of USD 6.24 billion.

Organophosphate insecticides have driven market expansion because of their high efficacy in pest control, especially in agriculture. These chemicals offer fast-acting solutions, effectively protecting crops from a variety of damaging insects. Their relatively low cost and widespread availability have made them attractive to farmers globally.

As demand for increased food production and pest management solutions grows, the use of organophosphates remains prevalent in pest control, although concerns about health and environmental risks have also prompted research into safer alternatives.

How big is the foliar spray segment in the market?

Based on mode application, the market has been segmented into foliar spray, soil treatment, seed treatment, and others. The foliar spray segment led the market in 2023, reaching the valuation of USD 8.65 billion. Insecticides applied through foliar spray are highly efficient in controlling pests.

This method ensures that the insecticide directly reaches the target area on plant leaves, where pests typically reside. The spray covers large surfaces quickly, offering fast results and effective pest management. Foliar application also reduces the impact on surrounding areas, minimizing soil contamination. Foliar spraying has become a widely used technique in agriculture, due to its effectiveness, contributing to improved crop yields and protection against pest damage.

What is the market share of the chemical insecticides segment?

Based on nature, the market is bifurcated into chemical/synthetic insecticides and bio insecticides. The chemical/synthetic insecticides segment secured the largest revenue share of 92.34% in 2023 Chemical and synthetic insecticides are widely used, as they are highly effective in controlling pests, offering fast results and broad-spectrum protection.

They help increase agricultural productivity by preventing crop damage and the spread of diseases. These insecticides are easy to apply, cost-effective, and provide long-lasting effects. Additionally, they can be tailored to target specific pests, ensuring minimal impact on non-target species. Their convenience and efficiency make them a popular choice for farmers and pest control professionals globally.

What is the market scenario in Asia-Pacific and Europe region?

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific iaccounted for 46.78% share of the insecticides market in 2023, with a valuation of USD 7.42 billion. Asia Pacific is the largest market for insecticides, due to its vast agricultural landscape. The region's diverse climate conditions leads to frequent pest outbreaks, driving the demand for effective pest control solutions.

Additionally, rapid urbanization, population growth, and increasing food demand contribute to the need for higher agricultural productivity, further increasing the usage of insecticides. Rising disposable incomes and awareness about pest-borne diseases also fuel the market's growth. Moreover, the availability of affordable, locally manufactured insecticides and the shift toward modern farming techniques make the region a dominant force in the market.

The insecticides market in Europe is poised for significant growth over the forecast period at a CAGR of 6.40%. Europe is the fastest-growing region in the market, due to increasing concerns about crop protection and food security. The region is witnessing a shift toward sustainable agriculture, with more emphasis on eco-friendly insecticides.

Stringent regulations on chemical pesticide use are encouraging the development of innovative, safer alternatives. Additionally, growing awareness about pest-related diseases, along with the rising demand for high-quality crops, boosts the adoption of insecticides. The increasing focus on organic farming and precision agriculture technologies further accelerates market growth in Europe.

Competitive Landscape

The global insecticides market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Insecticides Market

- BASF

- Syngenta Group Company

- Nufarm

- FMC Corporation

- Drexel Chemical Company

- UPL

- Kenvos Group

- Nissan Chemical Corporation

- Corteva

- Dhanuka Agritech Ltd

Key Industry Developments

- January 2023 (Partnership): Bayer and Oerth Bio partnered to develop the next generation of sustainable crop protection products using Oerth Bio's innovative protein degradation technology. This collaboration aims to create solutions that align with Bayer’s sustainability objectives, reducing the environmental impact of agriculture. The new products will feature lower application rates, promoting efficient use of resources, and possess favorable safety profiles. This initiative supports Bayer’s commitment to more sustainable farming practices while addressing the growing global demand for effective and environmentally friendly crop protection.

- September 2022 (Launch): FMC India launched several innovative solutions to support Indian farmers, including Talstar Plus insecticide for pest control, Petra Biosolution to improve soil health, and Cazbo crop nutrition to enhance nutrient uptake and fruit quality. These products result from FMC’s extensive research and commitment to sustainability. FMC India also promotes agricultural training, partners on sustainable farming programs, and supports rural communities through various initiatives.

The global insecticides market is segmented as:

By Type

- Organophosphates

- Pyrethroids

- Neonicotinoids

- Carbamates

- Insect Growth Regulators (IGRs)

- Others

By Mode Application

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Others

By Nature

- Chemical/Synthetic Insecticides

- Bio Insecticides

By Form

- Liquid/Emulsifiable Concentrate

- Powder

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America