Market Definition

The market focuses on technologies and formulations designed to administer drugs directly into the body through injections. It covers a variety of delivery methods, including intravenous, intramuscular, and subcutaneous routes.

The market involves the development of sterile, stable formulations, such as solutions, suspensions, and emulsions, ensuring precise dosing and rapid absorption. Injectable drugs are widely used chronic diseases treatment, vaccines, and biologics, offering targeted and controlled therapeutic effects.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Injectable Drug Delivery Market Overview

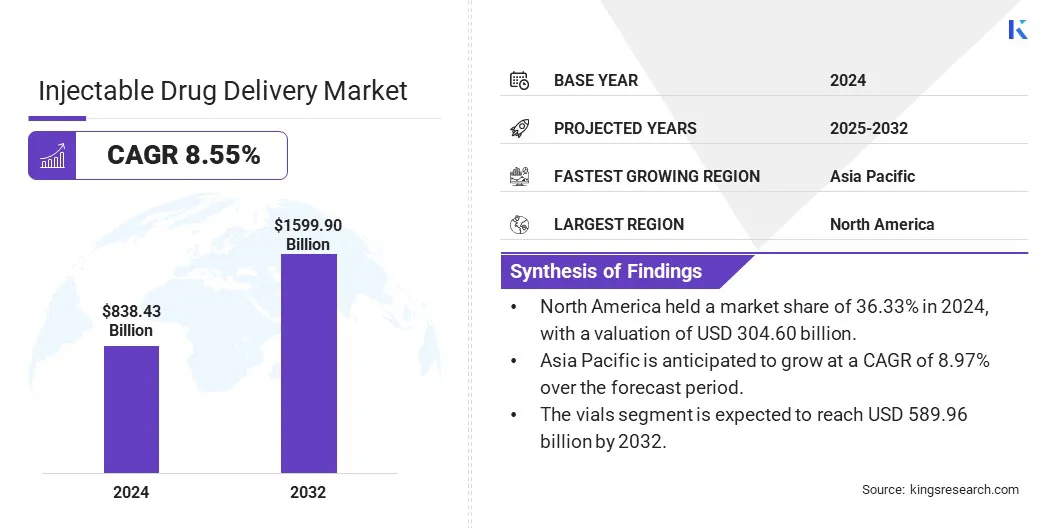

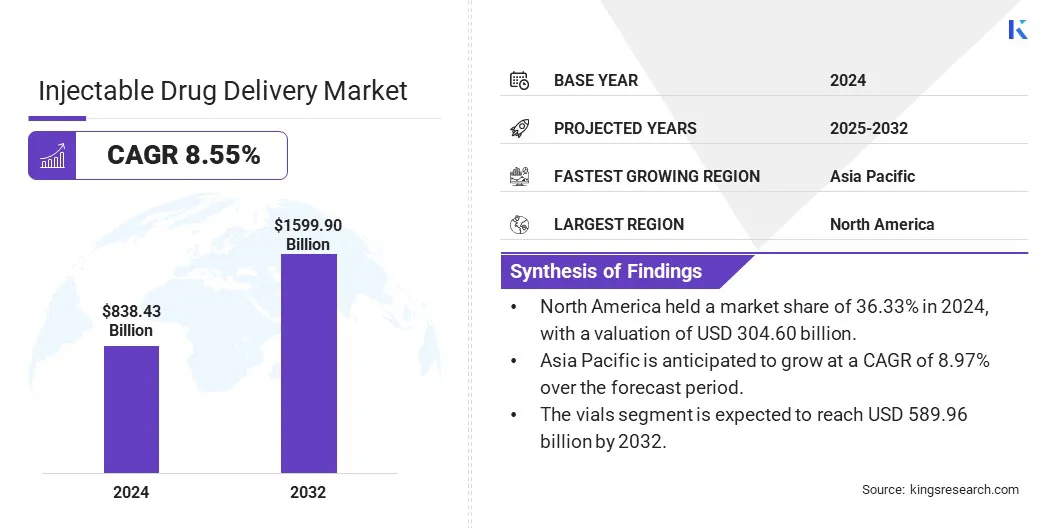

The global injectable drug delivery market size was valued at USD 838.43 billion in 2024 and is projected to grow from USD 900.81 billion in 2025 to USD 1,599.90 billion by 2032, exhibiting a CAGR of 8.55% during the forecast period.

The growth of the market is driven by advancements in biologic drugs requiring precise and efficient delivery systems. Additionally, improved delivery technologies, such as self-injection devices and long-acting formulations, are enhancing patient compliance and treatment outcomes. These developments are boosting sustained expansion across various therapeutic areas.

Key Market Highlights:

- The injectable drug delivery industry size was valued at USD 838.43 billion in 2024.

- The market is projected to grow at a CAGR of 8.55% from 2025 to 2032.

- North America held a market share of 36.33% in 2024, with a valuation of USD 304.60 billion.

- The formulations segment garnered USD 485.28 billion in revenue in 2024.

- The vials segment is expected to reach USD 589.96 billion by 2032.

- The autoimmune diseases segment secured the largest revenue share of 35.48% in 2024.

- The home care settings market is estimated to grow at a robust CAGR of 10.81% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 8.97% over the forecast period.

Major companies operating in the injectable drug delivery market are Becton, Dickinson and Company, West Pharmaceutical Services, Inc., Ypsomed Holding AG, Owen Mumford Ltd., Gerresheimer AG, Pfizer Inc., Novartis AG, Sanofi S.A., Fresenius Kabi AG, CordenPharma International, Amgen Inc., Janssen Pharmaceuticals, Inc., Mylan N.V., Teva Pharmaceutical Industries Ltd., and AbbVie Inc.

The growing prevalence of chronic conditions such as diabetes, cancer, and autoimmune disorders is fueling demand for injectable therapies. These diseases require precise and controlled dosing, effectively delivered through injectable methods. Market growth is propelled by the increasing adoption of biologics and specialized treatments that rely on injections to ensure effectiveness and patient adherence.

- In March 2025, the FDA expanded approval of Amvuttra (vutrisiran) to treat transthyretin-mediated cardiomyopathy (ATTR-CM), a rare and fatal heart condition. This injectable therapy, previously approved for nerve-related complications of ATTR, now addresses both cardiac and neurological symptoms, offering comprehensive treatment for patients.

Advancements in Biologic Drugs

Biologic drugs, including monoclonal antibodies and vaccines, require injectable delivery due to their complex molecular structures. Continuous innovation in biologics expands treatment options, increasing the need for reliable delivery systems. These advancements contribute substantially to the growth of the market by enabling treatments that are ineffective if administered orally.

- In March 2025, the U.S. Food and Drug Administration (FDA) approved Qfitlia (fitusiran), a subcutaneous injection for routine prevention of bleeding episodes in patients aged 12 and older with hemophilia A or B, with or without factor inhibitors. This approval marks a significant advancement in hemophilia treatment, offering a more convenient and effective management option.

Regulatory Requirements and Rising Safety Concerns

A significant challenge hindering the expansion of the injectable drug delivery market is navigating strict regulatory requirements and ensuring patient safety. These regulations can delay product approvals and increase development costs.

To address this challenge, key players are investing in advanced testing methods and quality control measures. They are also collaborating closelywith regulatory bodies to streamline approval processes.

Additionally, firms focus on developing user-friendly, safe delivery devices that minimize risks such as infections or dosing errors. These efforts enable companies to meet safety standards and accelerate the introduction of innovative products.

Improved Delivery Technologies

Developments in injection devices such as auto-injectors, prefilled syringes, and needle-free systems enhance safety, usability, and patient convenience. These innovations promote wider acceptance and adherence to injectable therapies. The market is influenced by ongoing improvements that reduce pain and anxiety, thereby broadening the patient base.

- In March 2025, ARS Pharmaceuticals received FDA approval for neffy 1 mg, the first needle-free epinephrine nasal spray designed for children aged 4 and above, weighing 15 to 30 kg. This device offers a needle-free alternative to traditional epinephrine auto-injectors, enhancing patient compliance and ease of use in emergencies.

Injectable Drug Delivery Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Devices (Syringes, Needles, Pen Injectors, Autoinjectors, Others), Formulations (Solutions, Suspensions, Emulsions, Others)

|

|

By Formulation Packaging

|

Ampules, Vials, Cartridges, Bottles

|

|

By Therapeutic Application

|

Autoimmune Diseases, Diabetes, Cancer, Hormonal Disorders, Others

|

|

By End User

|

Hospitals and Clinics, Home Care Settings, Ambulatory Surgical Centers (ASCs), Diagnostic Centers, Research and Academic Institutions

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Devices and Formulations): The formulations segment earned USD 485.28 billion in 2024 due to the increasing demand for advanced biologic drugs and tailored drug delivery systems that enhance treatment efficacy and patient compliance.

- By Formulation Packaging (Ampules, Vials, Cartridges, and Bottles): The vials segment held a share of 38.44% in 2024, fueled by its versatility, cost-effectiveness, and widespread use for storing and transporting a wide range of liquid and lyophilized drugs.

- By Therapeutic Application (Autoimmune Diseases, Diabetes, Cancer, Hormonal Disorders, and Others): The autoimmune diseases segment is projected to reach USD 550.28 billion by 2032, propelled by the rising prevalence of autoimmune disorders and the increasing use of biologic therapies that require injectable administration for effective treatment.

- By End User (Hospitals and Clinics, Home Care Settings, Ambulatory Surgical Centers (ASCs), Diagnostic Centers, and Research and Academic Institutions): The home care settings segment is estimated to grow at a significant CAGR of 10.81% through the forecast period, largely attributed to the growing demand for convenient, self-administered treatments that reduce hospital visits and lower healthcare costs.

Injectable Drug Delivery Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America injectable drug delivery market share stood at around 36.33% in 2024, valued at USD 304.60 billion. North America has a well-established biopharmaceutical sector, leading in the development of injectable biologics and specialty drugs. The region’s advanced research facilities and collaborations between industry and academia accelerate innovation.

Moreover, the rising shift toward home healthcare and self-administration of injectable drugs boosts demand for user-friendly devices. This trend propels the growth of the regional market by enabling remote treatment and reducing reliance on healthcare facilities.

- In December 2024, the U.S. FDA approved Opdivo Qvantig, a subcutaneous injectable formulation of Bristol Myers Squibb’s cancer immunotherapy, Opdivo. This new version, co-developed with Halozyme Therapeutics, enables significantly shorter administration times compared to intravenous infusions and may support at-home treatment for various solid tumors.

The Asia Pacific injectable drug delivery industry is estimated to grow at a CAGR of 8.97% over the forecast period. This growth is primarily fueled by the development of hospitals, specialty clinics, and diagnostic centers, particularly in urban areas. This expansion enhances access to injectable therapies for chronic and infectious diseases,boosting regional market expansion.

Furthermore, the region has emerged as a major hub for pharmaceutical manufacturing, including sterile injectables and devices. Increased local manufacturing reduces costs and shortens supply chains, encouraging greater product launches and propelling regional market growth.

- In January 2025, Akums Drugs and Pharmaceuticals initiated the development of a new facility in India dedicated to lyophilized and sterile dosage manufacturing. This facility aims to enhance the production of injectables and biologics, supporting the growing demand for advanced therapies in the region.

Regulatory Frameworks

- The market in the U.S. is regulated by the Food and Drug Administration (FDA). Products must comply with Current Good Manufacturing Practices (cGMP) under 21 CFR Parts 210 and 211. Injectable biologics require a Biologics License Application (BLA), and manufacturers often submit a Drug Master File (DMF). The Biologics Control Act further governs the safety and approval of biological injectable products.

- The European Medicines Agency (EMA) regulates injectable drug delivery systems across the European Union. Companies must adhere to EU Good Manufacturing Practice (GMP) guidelines as outlined in EudraLex Volume 4. Directive 2001/83/EC governs the production and approval of medicinal products. All injectable products are subject to central or decentralized marketing authorization processes, ensuring high safety and quality standards for patient use.

- The market in China is regulated by the National Medical Products Administration (NMPA). The Drug Administration Law (DAL) and associated Drug Registration Regulations guide market approvals. Manufacturers must comply with GMP standards, covering sterile production environments, process validation, and product stability. China has strengthened regulatory enforcement to ensure injectable products meet both domestic and international quality expectations.

- The Pharmaceuticals and Medical Devices Agency (PMDA), under the Ministry of Health, Labour and Welfare (MHLW), regulates injectable drugs in Japan. The Pharmaceutical and Medical Device Act (PMD Act) outlines the approval framework, requiring GMP compliance for all manufacturing. Products are classified under prescription, OTC, or quasi-drugs. Injectable biologics undergo extensive pre-approval evaluation for safety, quality, and efficacy through the PMDA review process.

Competitive Landscape

Major players in the injectable drug delivery industry are focusing on launching advanced injectable solutions to meet evolving therapeutic needs. These launches are tailored to address the challenges linked to next-generation biologics, such as viscosity, compatibility, and delivery efficiency.

By introducing innovations in syringe design and formulation, companies aim to improve treatment outcomes and patient comfort. Such strategic product developments are contributing market growth by strengthening product portfolios and expanding options for pharmaceutical partners.

- In September 2024, BD announced the commercial release of the BD Neopak XtraFlow Glass Prefillable Syringe. This new syringe platform is tailored to enhance drug compatibility and injection performance for next-generation biologics.

Key Companies in Injectable Drug Delivery Market:

- Becton, Dickinson and Company

- West Pharmaceutical Services, Inc.

- Ypsomed Holding AG

- Owen Mumford Ltd.

- Gerresheimer AG

- Pfizer Inc.

- Novartis AG

- Sanofi S.A.

- Fresenius Kabi AG

- CordenPharma International

- Amgen Inc.

- Janssen Pharmaceuticals, Inc.

- Mylan N.V.

- Teva Pharmaceutical Industries Ltd.

- AbbVie Inc.

Recent Developments (Partnerships/Product Launch)

- In February 2025, Fresenius Kabi introduced Calcitonin Salmon Injection, USP Synthetic, a calcium regulator for treating symptomatic Paget’s disease of the bone and hypercalcemia. This addition expands the company's portfolio of injectable therapies.

- In January 2025, Becton, Dickinson and Company (BD) unveiled its latest innovations in drug delivery at Pharmapack 2025. The company highlighted advancements in prefillable syringes and autoinjector platforms designed to enhance patient experience and meet the evolving needs of biologic therapies.

- In January 2025, Gerresheimer showcased its Gx Cap, a digitally connected tablet container closure that monitors medication intake, at Pharmapack 2025. This innovation aims to support adherence in clinical trials and enhance patient compliance.

- In October 2024, Ypsomed Holding AG entered into a strategic collaboration with BD to develop advanced self-injection systems for high-viscosity biologic drugs. This partnership aims to develop innovative solutions that facilitate patient-friendly solutions for complex biologic therapies.