Market Definition

The market involves technologies used for determining position, orientation, and velocity without external references. It is vital in aerospace, automotive, defense, and maritime sectors. The market includes hardware such as accelerometers and gyroscopes and software for navigation and guidance.

It supports accurate and continuous navigation in various environments. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Inertial Navigation System Market Overview

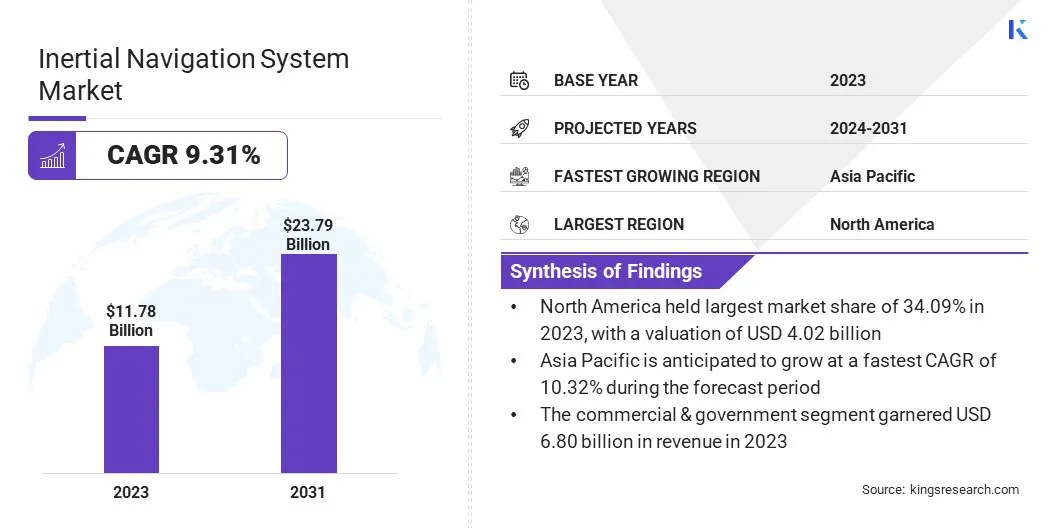

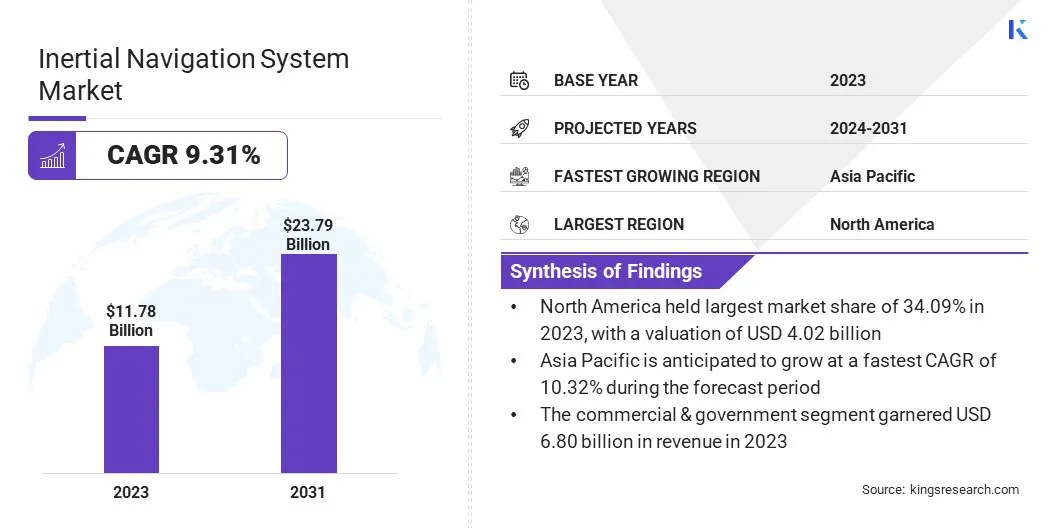

The global inertial navigation system market size was valued at USD 11.78 billion in 2023 and is projected to grow from USD 12.76 billion in 2024 to USD 23.79 billion by 2031, exhibiting a CAGR of 9.31% during the forecast period.

The market is growing due to increased defense spending, rising demand for real-time navigation in aviation and maritime sectors, and advancements in micro-electro-mechanical systems (MEMS) technology enabling compact, cost-effective, and high-performance solutions across multiple commercial and military applications.

Major companies operating in the inertial navigation system industry are Safran Electronics & Defense, Collins Aerospace, Northrop Grumman, Honeywell International Inc., Teledyne Marine Technologies Incorporated, Gladiator Technologies, Inc., Thales, VectorNav Technologies LLC, Hottinger Brüel & Kjær, Trimble Inc., L3Harris Technologies Inc., J.F. Lehman & Company, Parker Hannifin Corp, OXTS, and MEMSIC Semiconductor Co. Ltd.

The market is experiencing strong growth due to rising military and defense spending on advanced navigation and guidance technologies. With a growing emphasis on precision, situational awareness, and operational reliability in GPS-denied environments, defense agencies are upgrading vehicles, artillery, and missile systems.

These investments aim to enhance mission effectiveness, support strategic defense objectives, and ensure high-performance navigation capabilities across complex and rapidly evolving combat scenarios.

- In February 2025, Safran Electronics & Defense signed a long-term agreement with the Finnish Defence Forces to supply advanced Geonyx Inertial Navigation Systems for artillery platforms through 2031. Featuring Hemispherical Resonator Gyroscope (HRG) Crystal technology, Geonyx delivers precise navigation and targeting in Global Navigation Satellite System (GNSS) denied environments. Its compact, durable design enhances operational accuracy and mission readiness across diverse military applications.

Key Highlights:

- The inertial navigation system industry size was recorded at USD 11.78 billion in 2023.

- The market is projected to grow at a CAGR of 9.31% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 4.02 billion.

- The accelerometers segment garnered USD 4.77 billion in revenue in 2023.

- The airborne segment is expected to reach USD 8.59 billion by 2031.

- The ring laser gyro segment is anticipated to witness a CAGR of 9.85% during the forecast period.

- The commercial & government segment is estimated to capture a share of 56.93% by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 10.32% over the forecast period.

Market Driver

"Increasing Need for Real-Time Navigation"

The increasing need for real-time, resilient navigation particularly in defense and maritime sectors is fueling the expansion of the inertial navigation system market. These systems are crucial for maintaining accurate positioning and operational reliability in contested and GPS-denied environments.

As geopolitical tensions rise and mission-critical operations become more complex, there is a growing focus on solutions that deliver continuous performance, enhanced security, and quick integration into naval and other strategic platforms, reinforcing their role in modern navigation and defense infrastructure.

- In February 2025, Thales and CS GROUP partnered to deliver a cyber-secure maritime navigation system for naval surface ships. Combining Thales’ TopAxyz inertial navigation unit with CS GROUP’s real-time computer, the system offers exceptional performance and resilience in electronic warfare environments. Proven in sea trials, it benefits from over 20 million operational hours in civil aviation.

Market Challenge

"Calibration and Alignment Issues"

Calibration and alignment challenges significantlyu impact the inertial navigation system market, as sensor errors from accelerometers and gyroscopes can cause drift and misalignment, leading to inaccurate data over time. This is particularly critical in long-duration or high-precision operations.

To address this challenge, companies are using advanced real-time correction algorithms and integrating machine learning to improve sensor accuracy and reduce manual calibration needs.

Additionally, sensor fusion combining INS with GPS or other systems is being implemented to enhance overall reliability and accuracy, ensuring consistent performance across various environments and applications without relying solely on inertial measurements.

Market Trend

"Technology Advancements in Micro-Electro-Mechanical Systems"

The inertial navigation system market is influenced by advancements in micro-electro-mechanical systems technology (MEMS). These developments are enabling the production of smaller, lighter, and more cost-effective inertial sensors without compromising accuracy or reliability.

MEMS-based INS solutions are increasingly being adopted across commercial, aerospace, automotive, and defense sectors due to their scalability and integration flexibility. Enhanced manufacturing techniques and improved sensor performance are fostering broader applications, making MEMS a key technology for next-generation navigation systems in both consumer and industrial markets.

- In April 2025, Thales introduced a new MEMS-based Inertial Measurement Unit (IMU) within its TopAxyz product line, marking a significant advancement in navigation technology. This next-generation IMU is 20% smaller, 10% lighter, and more energy-efficient, while maintaining high precision and resilience. It supports a wide range of civil and military applications, delivering reliable performance in demanding operational environments.

Inertial Navigation System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Accelerometers , Gyroscopes, Others

|

|

By Platform

|

Airborne, Ground, Maritime, Space

|

|

By Technology

|

Mechanical Gyro, Ring Laser Gyro, Fiber Optics Gyro, Microelectromechanical System (MEMS), Others

|

|

By End User

|

Commercial & Government, Military & Defense

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Accelerometers, Gyroscopes, and Others): The accelerometers segment earned USD 4.77 billion in 2023 due to rising demand for precise motion sensing in aerospace, defense, automotive, and consumer electronic applications.

- By Platform (Airborne, Ground, Maritime, and Space): The airborne segment held a share of 36.22% in 2023, primarily fueled by increasing adoption of advanced inertial navigation systems in aircraft to enhance flight safety, positioning accuracy, and operational efficiency.

- By Technology (Mechanical Gyro, Ring Laser Gyro, Fiber Optics Gyro, and Microelectromechanical System (MEMS), and Others): The mechanical gyro segment is projected to reach USD 6.50 billion by 2031, propelled by its continued use in heavy-duty defense and aerospace applications requiring proven durability and reliability.

- By End User (Commercial & Government and Military & Defense): The commercial & government segment held a share of 56.93% in 2031, bolstered by increasing adoption of inertial navigation systems in aviation, transportation, and public infrastructure for enhanced safety and operational efficiency.

Inertial Navigation System Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America inertial navigation system market share stood at around 34.09% in 2023, valued at USD 4.02 billion. North America's aerospace and defense sector, particularly in the U.S., is creating a strong demand for advanced inertial navigation systems (INS).

The region's significant investment in military, aviation, and space technologies requires high-precision navigation solutions to ensure operational accuracy and reliability.

With ongoing defense contracts, military modernization efforts, and the expansion of space exploration, the need for sophisticated INS technologies continues to grow, positioning North America as a central hub for the innovation and deployment of these systems

- In September 2023, Honeywell and Civitanavi Systems introduced the HG2800 inertial measurement unit (IMU) for global commercial and defense industry. These tactical-grade IMUs are designed for high-performance applications such as pointing, stabilization, and short-duration navigation in aircraft. Offering low noise, high bandwidth, and minimal data latency, the HG2800 is ideal for surveillance, targeting, and acoustic-sensitive systems requiring silent operation.

The Asia Pacific inertial navigation system industry is estimated to grow at a robust CAGR of 10.32% over the forecast period The adoption of distance-based tolling systems across national highway networks is accelerating the demand for high-precision navigation technologies in the region.

As countries modernize transportation infrastructure and implement intelligent mobility solutions, inertial navigation systems are becoming integral to ensuring accurate vehicle tracking and seamless toll collection. This shift reflects a broader regional focus on efficiency, automation, and data-driven traffic management.

- In June 2024, Ministry of Road Transport & Highways reports that the Indian Highways Management Company Limited (IHMCL), under the National Highways Authority of India (NHAI), launched a GNSS-based Electronic Toll Collection (ETC) system aimed at enabling seamless, distance-based tolling.

Regulatory Framework

- In the U.S., the Federal Aviation Administration (FAA) regulates inertial navigation systems (INS) for aviation, focusing on accuracy, reliability, and flight crew training. While FAA regulations primarily address civil aviation, the US Department of Defense oversees military-specific INS requirements.

- In India, the Ministry of Defence oversees inertial navigation systems (INS), establishing standards, quality control, and procurement processes for defense applications. The Defence Research and Development Organisation (DRDO) contributes to the development and testing of INS technologies.

- In Japan, the Ministry of Economy, Trade and Industry (METI) regulates inertial navigation systems (INS) and related technologies, overseeing navigation and precision positioning standards crucial for the development and application of INS across various industries.

- In Europe, the European Union Aviation Safety Agency (EASA) regulates inertial navigation systems in the aviation sector, establishing standards and guidelines to ensure safety, compliance, and effective integration of these systems within aircraft operations.

Competitive Landscape

Key players in the inertial navigation system industry are implementing strategic initiatives such as mergers and acquisitions and product launch. By consolidating resources, expanding technological capabilities, and enhancing product portfolios, firms aim to strengthen their market position.

These strategies enable companies to meet the increasing demand for advanced, high-precision navigation solutions across various industries, thereby positioning themselves to capitalize on emerging opportunities and address the evolving needs of both commercial and defense sectors.

- In October 2024, Teledyne Marine launched the Intrepid Global Navigation Satellite System (GNSS)/Inertial Navigation System, integrated with the SeaBat T20-ASV processor. This compact system includes an IMU and dual GNSS antennas for precise positioning. It automates data streaming to third-party software, eliminating manual interfacing and ensuring seamless, accurate mapping with easy updates.

List of Key Companies in Inertial Navigation System Market:

- Safran Electronics & Defense

- Collins Aerospace

- Northrop Grumman

- Honeywell International Inc.

- Teledyne Marine Technologies Incorporated

- Gladiator Technologies, Inc.

- Thales

- VectorNav Technologies LLC

- Hottinger Brüel & Kjær

- Trimble Inc.

- L3Harris Technologies Inc.

- F. Lehman & Company

- Parker Hannifin Corp

- OXTS

- MEMSIC Semiconductor Co. Ltd.

Recent Developments (M&A/Product Launches/Agreements)

- In March 2024, Honeywell acquired Civitanavi Systems to enhance its autonomous operations portfolio in aerospace and expand its presence in Europe. Civitanavi's advanced inertial navigation and stabilization solutions are expected to support growth across Honeywell’s commercial and defense sectors.

- In October 2023, VectorNav Technologies introduced the VN-210-S and VN-310-S GNSS-aided inertial navigation systems (INS) to enhance its tactical series. The VN-210-S combines a tactical-grade IMU with a triple-frequency GNSS receiver, improving performance in GNSS-denied environments. The VN-310-S features dual GNSS receivers for accurate heading estimation and robust interference mitigation, ensuring reliable positioning in diverse applications.

- In June 2023, Wisk Aero, a leading U.S.-based advanced air mobility company, signed a contract with Safran Electronics & Defense to equip its Generation 6 autonomous, all-electric air taxi with SkyNaute inertial navigation systems, enhancing precision and reliability in autonomous flight operations for next-generation urban air mobility solutions.