Market Definition

The market refers to a rapidly evolving segment of the aerospace industry, which is focused on providing air transportation solutions to urban and suburban areas. It focuses on the design and deployment of electric vertical takeoff and landing (eVTOL) aircraft, backed by advanced flight control, autonomous navigation, and air traffic management.

UAM involves formulating efficient aerial mobility frameworks, tailored to densely populated environments. Its scope extends across passenger commuting, cargo transport, emergency medical services, and disaster response. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Urban Air Mobility Market Overview

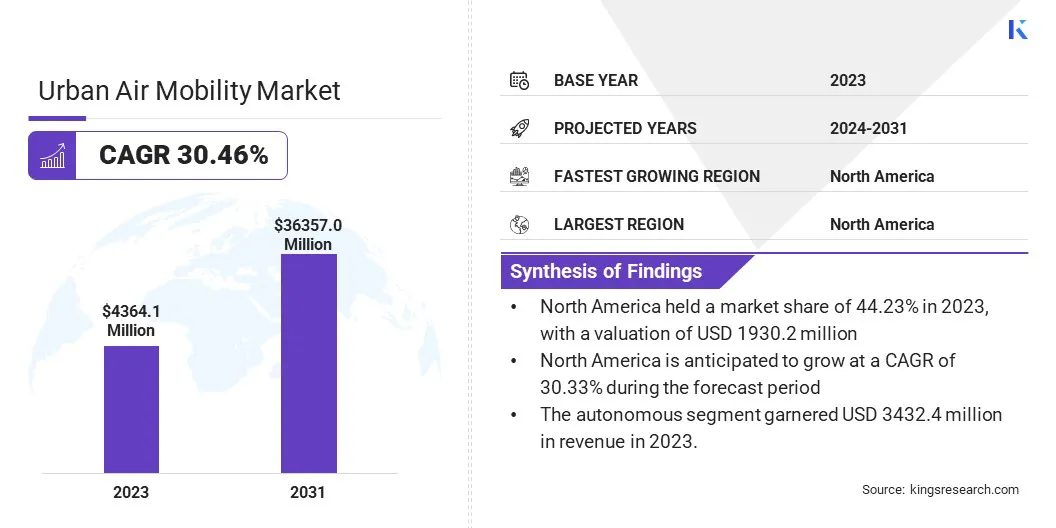

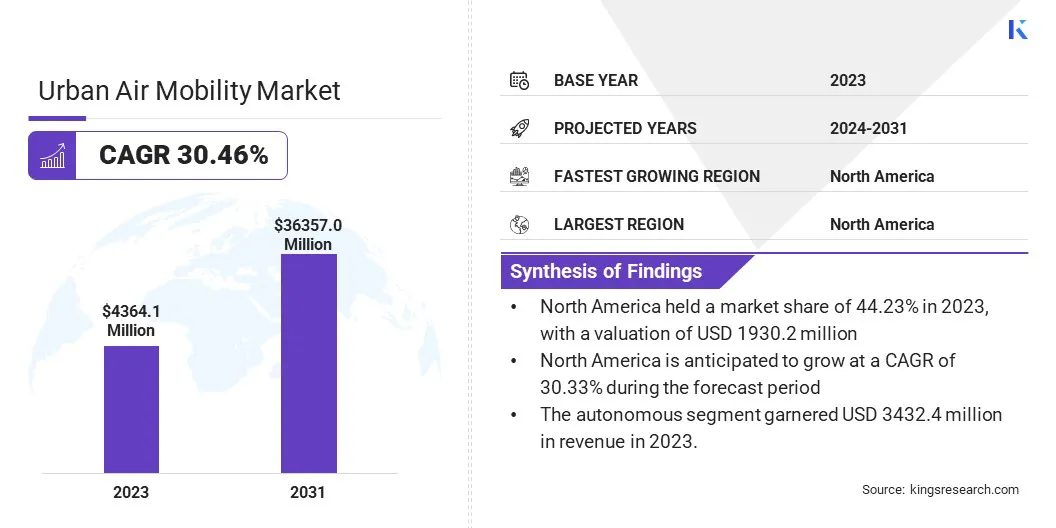

The global urban air mobility market size was valued at USD 4,364.1 million in 2023 and is projected to grow from USD 5,651.6 million in 2024 to USD 36,357.0 million by 2031, exhibiting a robust CAGR of 30.46% during the forecast period.

The is witnessing strong growth, supported by increasing use of the eVTOL aircraft in emergency and medical response, enabling access to critical areas during crises. Additionally, the integration of advanced air traffic management systems is enhancing operational efficiency, safety, and scalability of UAM services in urban environments.

Major companies operating in the urban air mobility industry are Textron Inc., Airbus, Ehang, Lilium Aviation GmbH, Carter Aviation, Volocopter GmbH., Uber Technologies Inc., Aurora Flight Sciences, Eve Holding, Inc., Archer Aviation Inc., Safran Group, Airogroup B.V., Vertical Aerospace, Joby Aviation and Embraer SA.

The growing pressure on urban infrastructure and the need to cut down travel time in congested cities is accelerating the growth of the market. Traditional road-based systems are unable to meet increasing mobility demands, which is leading authorities and private operators to explore aerial solutions, such as air taxis.

UAM offers a faster and more direct mode of transport across urban corridors, especially during peak hours. This shift creates a strong interest in scalable air mobility platforms for passenger movement.

- In March 2025, Joby Aviation, Inc. partnered with Virgin Atlantic, a leading UK-based long-haul airline, to introduce its groundbreaking air taxi service across the UK. This collaboration focuses on delivering efficient, zero-emission, and short-range travel solutions to enhance regional connectivity. As part of the agreement, Virgin Atlantic customers can book seats on Joby’s aircraft directly through the airline’s app or website.

Key Highlights:

- The urban air mobility industry size was valued at USD 4,364.1 million in 2023.

- The market is projected to grow at a CAGR of 30.46% from 2024 to 2031.

- North America held a market share of 44.23% in 2023, with a valuation of USD 1,930.2 million.

- The air taxis segment garnered USD 2,321.9 million in revenue in 2023.

- The autonomous segment is expected to reach USD 28,867.5 million by 2031.

- The intracity segment secured the largest revenue share of 68.12% in 2023.

- The fixed wing hybrid is poised for a robust CAGR of 30.90% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 30.25% during the forecast period.

Market Driver

"Adoption of UAM in Emergency and Medical Response"

The integration of air mobility solutions in emergency and medical response systems is significantly contributing to the expansion of the urban air mobility market. The eVTOL aircraft is being adopted for critical applications such as organ transport, rapid disaster relief, aerial surveillance, and emergency medical supply delivery.

Their ability to bypass ground congestion and operate in confined urban spaces allows faster and more direct access to hospitals and incident sites. This operational efficiency is driving interest from public health authorities and private medical providers.

As cities are prioritizing faster response capabilities, the demand for UAM solutions in lifesaving missions is accelerating, which helps strengthen their commercial viability and support broader market growth.

- In September 2023, Jump Aero introduced its electric vertical takeoff and landing (eVTOL) emergency response aircraft, which received a commercial order from Falck Ambulance Services. The company also revealed that the development of the first full-scale prototype is being partially funded by the United States Air Force. Designed for rapid deployment in rural emergencies, the aircraft is capable of reaching a speed limit of up to 250 knots, enabling medical personnels to quickly reach the scene with critical lifesaving equipment.

Market Challenge

"Infrastructure Limitations and Airspace Integration"

A significant barrier to the growth of the urban air mobility market is the lack of dedicated infrastructure, such as vertiports and charging stations, along with complexities in integrating eVTOL aircraft into existing controlled airspaces. These limitations hinder their large-scale deployment in densely populated areas.

To address this, companies are actively collaborating with municipal authorities, aviation regulators, and infrastructure developers to design modular vertiport networks and implement standardized takeoff and landing zones.

Additionally, several players are investing in digital airspace management technologies and partnering with navigation service providers to ensure safe and real-time coordination between traditional and advanced aerial vehicles.

Market Trend

"Integration of Advanced Air Traffic Management Systems"

The deployment of next-generation air traffic management (ATM) systems tailored for low-altitude urban operations is facilitating the safe integration of UAM aircraft into shared airspaces. These systems enable real-time tracking, deconfliction, and coordination of multiple autonomous or piloted vehicles within dense urban environments.

- In December 2024, Eve Air Mobility signed a letter of intent (LOI) with Helicopters Inc., a prominent U.S.-based operator specializing in vertical lift and helicopter services. The LOI was issued for the acquisition of up to 50 electric vertical takeoff and landing (eVTOL) aircraft. The agreement also includes provisions for service support and the integration of Eve’s urban air traffic management (UATM) software, Vector. The eVTOL aircraft are designed to deliver low operational costs, simplified mechanical systems, optimized structural efficiency, and lower noise emissions, contributing to a more sustainable and quieter urban air environment.

Additionally, innovations in unmanned traffic management (UTM) frameworks are key to ensuring scalable and safe operations, which are being actively tested in collaboration with national aviation authorities.

Urban Air Mobility Market Report Snapshot

|

Segmentation

|

Details

|

|

By Platform

|

Air Taxis, Air Shuttles & Air Metro, Personal Air Vehicles, Cargo Air Vehicles, Air Ambulance & Medical Emergency Vehicles, Last-Mile Delivery Vehicles

|

|

By Platform Operations

|

Piloted, Autonomous

|

|

By Range

|

Intercity, Intracity

|

|

By Platform Architecture

|

Rotary Wing, Fixed Wing Hybrid

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Platform (Air Taxis, Air Shuttles & Air Metro, Personal Air Vehicles, Cargo Air Vehicles, Air Ambulance & Medical Emergency Vehicles and Last-Mile Delivery Vehicles): The air taxis segment earned USD 2,321.9 million in 2023 due to its efficient and on-demand transportation solutions in congested urban areas.

- By Platform Operations (Piloted, Autonomous): The autonomous segment held 78.65% of the market in 2023, due to its ability to enhance operational efficiency, reduce human errors, and lower operational costs.

- By Range (Intercity, Intracity): The intracity segment is projected to reach USD 24,446.5 million by 2031, owing to its ability to efficiently address the growing demand for short-range and rapid transportation solutions.

- By Platform Architecture (Rotary Wing, Fixed Wing Hybrid): The fixed wing hybrid segment is poised for growth at a CAGR of 30.90% throughout the forecast period, due to its ability to offer efficient and long-range travels with lower operating costs, making it ideal for urban transportation.

Urban Air Mobility Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America urban air mobility market share stood at around 44.23% in 2023 in the global market, with a valuation of USD 1,930.2 million. Initiatives like NASA’s Advanced Air Mobility (AAM) program and FAA’s regulatory support, are advancing the market in North America.

These efforts are accelerating certification processes, airspace integration, and pilot programs, creating a favorable environment for commercial-scale operations.

In June 2024, NASA researchers unveiled a custom-built virtual reality flight simulator designed to study how passengers perceive air taxi rides. This tool gathers data on the comfort of the ride for developing next-generation aircraft tailored to passenger needs.

The simulations conducted in the Ride Quality Lab aim to evaluate the tolerability of various motion profiles, providing valuable insights for the advanced air mobility community. By improving ride experience and addressing motion sensitivity, the findings are expected to support greater public acceptance and adoption of air taxi services in the future.

The presence of a mature aerospace and tech ecosystem, particularly in Silicon Valley and the Pacific Northwest, is further fueling the market's growth. These innovation hubs are accelerating the development and testing of eVTOL aircraft, contributing to a steady pipeline of certified platforms ready for deployment.

The Asia Pacific urban air mobility industry is poised for significant growth at a robust CAGR of 30.25% over the forecast period. The region’s smart city initiatives, backed by government investments in intelligent infrastructure, are creating a favorable environment for integrating air taxis into future urban mobility ecosystems.

These projects often include digital air traffic systems and vertiport prototypes, which help in laying the groundwork for commercial operations.

- In February 2025, Vjaitra Air Mobility unveiled two variants of a five-seater vertical takeoff and landing (VTOL) aircraft, with one model offering an estimated range of up to 370 miles. Designed to accommodate one pilot and four passengers, the air taxi platform features a modular layout, allowing it to be adapted for multiple applications. These include troop deployment, commercial passenger transit, logistics, emergencies, and delivery services.

Furthermore, collaborations between aerospace startups and major telecommunications and mapping technology providers are enhancing route planning, real-time monitoring, and networked airspace control, which are vital for safe and scalable UAM deployment across the Asia Pacific.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) oversees UAM operations under existing frameworks such as 14 CFR Part 135 and Part 298. In July 2023, the FAA introduced the Advanced Air Mobility (AAM) Implementation Plan, to facilitate early-stage AAM operations by 2028 through the Innovate28 initiative. This plan focuses on utilizing existing infrastructure with modifications, including parking stations and charging ports.

- The European Union Aviation Safety Agency (EASA) is developing a comprehensive regulatory framework for UAM, which focuses on safety standards, aircraft certification, and societal acceptance. EASA also conducts studies to understand public perception and is working toward integrating UAM into the European airspace.

Competitive Landscape

Market players are increasingly prioritizing technological advancement and their research and development efforts to enhance the performance, safety, and reliability of eVTOL aircraft. These strategies are enabling manufacturers to refine propulsion systems, improve passenger comfort, and meet evolving regulatory standards.

By investing in full-scale prototypes and integrating advanced materials and systems, companies are accelerating certification processes and strengthening the commercial viability of urban air mobility solutions.

Continuous innovations are also playing a vital role in shaping a competitive market environment, directly contributing to the steady growth and maturity of the urban air mobility industry.

- In May 2024, Textron Inc. achieved a key milestone in the development of its Nexus electric vertical take-off and landing (eVTOL) aircraft by successfully joining the two main fuselage sections of its full-scale technology demonstrator. This marked the integration of the central structure intended to house passenger seating. Made for accommodating one pilot and four passengers, the Nexus is a zero-emission aircraft powered by a distributed electric propulsion system.

List of Key Companies in Urban Air Mobility Market:

- Textron Inc.

- Airbus

- Ehang

- Lilium Aviation GmbH

- Carter Aviation

- Volocopter GmbH.

- Uber Technologies Inc.

- Aurora Flight Sciences

- Eve Holding, Inc.

- Archer Aviation Inc.

- Safran Group

- Airogroup B.V.

- Vertical Aerospace

- Joby Aviation

- Embraer SA

Recent Developments (Joint Venture/Product Launch)

- In March 2025, EHang and its joint venture, Hefei HeYi Aviation Co., Ltd., received certification from the Civil Aviation Administration of China (CAAC) to operate civil, human-carrying pilotless aerial vehicle services. This enables the launch of ticketed commercial flights for public, offering low-altitude tourism, urban sightseeing, and other aerial services at designated locations in Guangzhou and Hefei. This has marked a significant step toward the commercialization of autonomous urban air mobility in China.

- In February 2025, EHang advanced urban air mobility in Europe with the successful flight of its EH216-S pilotless eVTOL in Benidorm, Spain. This was the first urban flight of an autonomous eVTOL aircraft in Europe. The demonstration took place under the European Union’s U-ELCOME (U-Space European Common Deployment) project. Coordinated by Eurocontrol, the initiative involves 51 partners from Spain, France, and Italy, working collaboratively to accelerate the deployment of U-space services across the region.

- In October 2024, Eve Air Mobility launched its aftermarket services portfolio, “Eve TechCare,” during the MRO Europe event. This solution is tailored to improve the efficiency and safety of Urban Air Mobility (UAM) operations. Designed specifically for electric vertical take-off and landing (eVTOL) aircraft, Eve TechCare delivers a complete suite of services, combining technical support, advanced operational tools, and expert maintenance resources to optimize aircraft performance throughout their lifecycle.