Market Definition

The market focuses on measurement technologies, systems, and services used in industrial settings to ensure precision, quality, and compliance in manufacturing and production processes.

The report outlines primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Industrial Metrology Market Overview

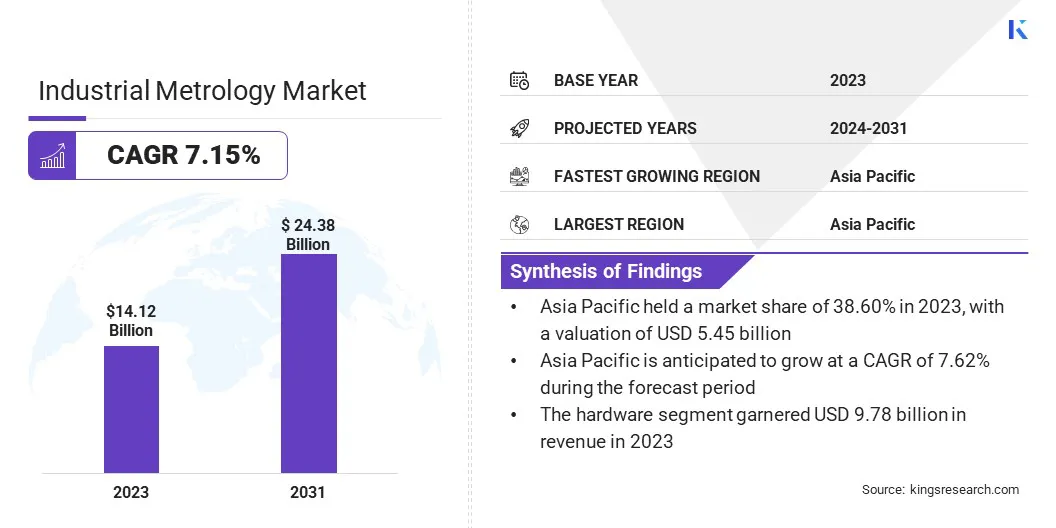

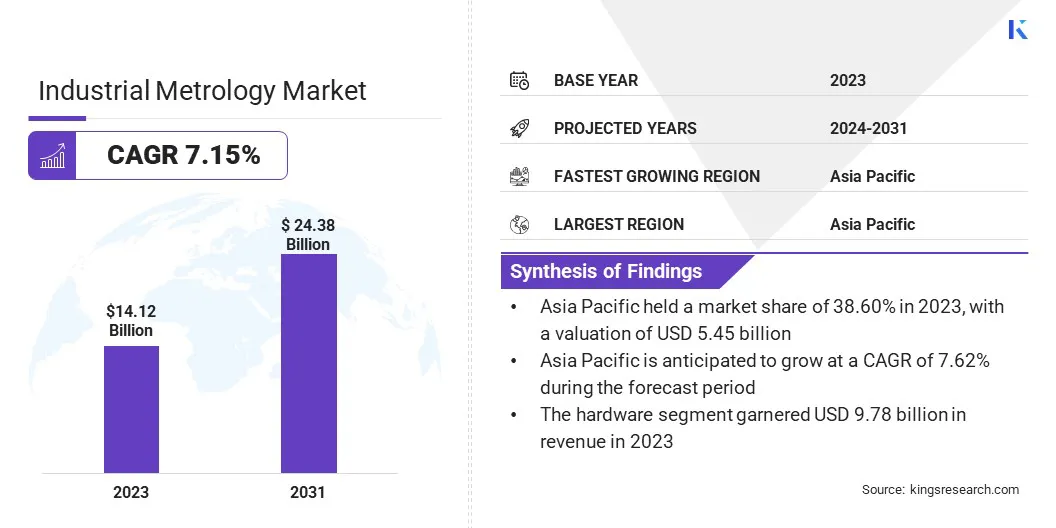

Global industrial metrology market size was valued at USD 14.12 billion in 2023, which is estimated to be valued at USD 15.03 billion in 2024 and reach USD 24.38 billion by 2031, growing at a CAGR of 7.15% from 2024 to 2031.

Rising demand for precision measurement is driving growth across sectors such as aerospace, automotive, and construction, where accurate layout and inspection are critical for ensuring safety, efficiency, and compliance in modern production workflows.

Major companies operating in the industrial metrology industry are Hexagon AB, KLA Corporation, FARO, Creaform, Baker Hughes Company, ZEISS Group, Mitutoyo Corporation, AccuScan, Nordson Corporation, Nikon Corporation, Renishaw plc., ATT Metrology Solutions, LK Metrology, Sandvik, Precitec GmbH & Co. KG, and others.

The market is experiencing steady growth, fueled by increasing demand for precision measurement and quality assurance in advanced manufacturing sectors such as aerospace, automotive, and electronics.

As industries adopt automation and digital transformation, metrology solutions such as 3D measurement, inspection, and reverse engineering is essential for ensuring product accuracy and compliance.

The market is expanding notably among small and mid-sized manufacturers (SMEs) seeking modular, user-friendly software to boost productivity, streamline processes, and remain competitive globally.

- In March 2025, Sandvik signed an agreement to acquire Verisurf Software, a US-based 3D metrology provider. The move strengthens Sandvik’s industrial metrology capabilities and digital manufacturing offering for SMEs, positioning Verisurf as a separate unit within Sandvik Manufacturing and Machining Solutions.

Key Highlights:

Key Highlights:

- The industrial metrology industry size was recorded at USD 14.12 billion in 2023.

- The market is projected to grow at a CAGR of 7.15% from 2024 to 2031.

- Asia Pacific held a market share of 38.60% in 2023, with a valuation of USD 5.45

- The hardware segment garnered USD 9.78 billion in revenue in 2023.

- The optical digitizer and scanner (ODS) segment is expected to reach USD 6.58 billion by 2031.

- The quality control & inspection segment had a market of 60.49% in 2023.

- The aerospace & defense segment is anticipated to grow at a CAGR of 7.88% over the forecast period.

- North America is anticipated to grow at a CAGR of 7.39% through the projection period.

Market Driver

"Rising Demand for Precision"

The growing emphasis on precision and accuracy is a fueling the expansion of the industrial metrology market. As businesses seek to enhance quality assurance and meet stringent standards, precise measurement technologies are becoming essential across various operational stages.

Accurate data enables better control over production processes, reduces errors, and supports consistent product performance. This rising reliance on metrology solutions reflects a broader shift toward improved efficiency, digitalization, and quality control across multiple industry verticals.

- In September 2024, Leica Geosystems, part of Hexagon, launched the Leica iCON trades solution, introducing advanced AI-enabled digital construction layout tools. Featuring 6DoF tracking, automated pole detection, and AI-enabled workflows, the system reflects the expanding role of industrial metrology technologies in adjacent sectors such as construction.

Market Challenge

"Lack of Skilled Professionals"

A significant challenge impeding the growth of the industrial metrology market is the lack of skilled professionals capable of operating advanced measurement systems. These technologies demand expertise in software, hardware, and data interpretation; however, many organizations face a shortage of skilled professionals.

To address this, companies and industry bodies are increasingly investing in training programs, certifications, and partnerships with technical institutions. Additionally, advancements in user-friendly interfaces and automation features are lowering the skill barrier and promoting wider adoption across various industries.

Market Trend

"Digitalization of Metrology Workflows"

A key trend in the industrial metrology market is the increasing shift from traditional manual measurement processes to fully digital, software-driven quality management systems. This transition enhances operational efficiency, improves data accuracy, and ensures real-time visibility across the production process.

Digital solutions enable seamless integration of various metrology systems, allowing for better data management, traceability, and collaboration across global operations.

As industries prioritize automation and data-driven decision-making, the adoption of digital metrology workflows is becoming critical for maintaining competitiveness and ensuring high-quality standards.

- In November 2024, ZEISS Industrial Quality Solutions launched ZEISS CONNECTED QUALITY, a centralized software hub for global metrology operations. The platform streamlines data exchange, system monitoring, and quality management, advancing digital integration and enabling more efficient, secure, and collaborative industrial measurement processes worldwide.

Industrial Metrology Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Hardware, Software, Services

|

|

By Equipment

|

Coordinate Measuring Machine (CMM), Optical Digitizer and Scanner (ODS), Measuring instruments, X-ray and computed tomography, Automated optical inspection, Form measurement equipment, 2D equipment, Others

|

|

By Application

|

Quality control & inspection, Reverse engineering, Mapping & modelling, Others

|

|

By End-Use

|

Aerospace & defense, Automotive, Semiconductor, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (Hardware, Software, and Services): The hardware segment earned USD 9.78 billion in 2023, mainly due to increasing demand for high-precision measurement devices across industries such as automotive, aerospace, and manufacturing.

- By Equipment [Coordinate Measuring Machine (CMM), Optical Digitizer and Scanner (ODS), Measuring instruments, X-ray and computed tomography, Automated optical inspection, Form measurement equipment, 2D equipment, and Others]: The optical digitizer and scanner (ODS) segment held a share of 25.56% in 2023, attributed to their growing applications in 3D scanning, reverse engineering, and quality inspection across diverse industries.

- By Application (Quality control & inspection, Reverse engineering, Mapping & modelling, and Others): The Quality control & inspection segment is projected to reach USD 15.12 billion by 2031, fueled by rising demand for precision measurement and stringent quality standards across manufacturing sectors globally.

- By End-Use (Aerospace & defense, Automotive, Semiconductor, Manufacturing, and Others): The aerospace & defense segment is anticipated to grow at a CAGR of 7.88% over the forecast period, propelled by advancements in technology and increasing demand for high-precision systems in defense and aviation applications.

Industrial Metrology Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific industrial metrology market share stood at around 38.60% in 2023, valued at USD 5.45 billion. This dominance is reinforced by rapid industrialization, increasing manufacturing activities, and the growing demand for high-precision measurement solutions across industries such as automotive, aerospace, and electronics.

Asia Pacific industrial metrology market share stood at around 38.60% in 2023, valued at USD 5.45 billion. This dominance is reinforced by rapid industrialization, increasing manufacturing activities, and the growing demand for high-precision measurement solutions across industries such as automotive, aerospace, and electronics.

Countries like China, Japan, and India are witnessing substantial investments in advanced metrology technologies to improve product quality, streamline production processes, and meet stringent regulatory standards. Additionally, the region’s expanding manufacturing base and adoption of automation contribute to its leading position.

North America industrial metrology industry is set to grow at a robust CAGR of 7.39% over the forecast period. This growth is fostered by the increasing demand for high-precision measurement solutions across diverse industries.

The region's strong manufacturing base, coupled with advancements in automation, digitalization, and quality control standards, is fueling market expansion. Additionally, rising adoption of advanced metrology technologies to meet stringent regulatory requirements and improve production efficiency is further boosting this growth.

- In December 2024, Hexagon Manufacturing Intelligence strengthened its presence in Canada through a strategic partnership with Elliott Matsuura Canada Inc. This collaboration enhances access to Hexagon’s metrology solutions, providing localized support, technical expertise, and expanded training across Central and Western Canada.

Regulatory Frameworks

- In India, the Legal Metrology Act, 2009, governs weights and measures to ensure accuracy and transparency in trade. It applies to businesses involved in manufacturing, trade, and commerce, mandating compliance with measurement regulations.

- In the USA, the National Institute of Standards and Technology (NIST) oversees industrial metrology by maintaining national measurement standards, offering calibration, test methods, and evaluation tools to ensure accurate, reliable measurement processes and establish traceability for businesses across industries.

- In the EU, Directive 2004/22/EC regulates measuring instruments to ensure compliance with performance standards. It harmonizes metrology regulations across Member States, promotes market access, and safeguards trade fairness, public health, and safety.

Competitive Landscape

Companies in the industrial metrology industry are increasingly focusing on enhancing the efficiency and accuracy of measurement processes. They are developing advanced software and hardware solutions to streamline inspections, reduce reliance on traditional methods, and improve automation.

Additionally, there is a growing emphasis on integrating cutting-edge technologies such as 3D scanning, AI, and machine learning to offer faster, more reliable, and cost-effective alternatives. These innovations aim to meet industry demands for higher precision, quicker turnaround times, and greater flexibility in diverse applications.

- In March 2025, Creaform, a business of AMETEK, introduced the Sheet Metal Add-on for its Metrology Suite. This new software module enhances the accuracy and repeatability of 3D laser scanning for sheet metal inspection, providing a fast, flexible, and cost-effective alternative to traditional CMM systems, improving quality control and quality assurance across industries such as automotive and aerospace.

List of Key Companies in Industrial Metrology Market:

- Hexagon AB

- KLA Corporation

- FARO

- Creaform

- Baker Hughes Company

- ZEISS Group

- Mitutoyo Corporation

- AccuScan

- Nordson Corporation

- Nikon Corporation

- Renishaw plc.

- ATT Metrology Solutions

- LK Metrology

- Sandvik

- Precitec GmbH & Co. KG

Recent Developments (Partnerships/Product Launch)

- In December 2024, Nikon introduced the NEXIV VMF-K Series, a next-generation video measuring system designed for semiconductor and electronic component inspection. The system enhances measurement throughput, improves accuracy, and supports stringent quality control in industries requiring micron-level precision, such as advanced packaging and wafer inspection.

- In June 2023, Aeva announced a multi-year production agreement with Nikon, integrating its LiDAR-on-Chip technology into Nikon's industrial metrology and quality control products. This collaboration aims to enhance precision and speed for high-volume manufacturing in automotive, aerospace, and energy sectors, providing significant advancements in non-contact measurements and automated inspections.

Key Highlights:

Key Highlights: Asia Pacific industrial metrology market share stood at around 38.60% in 2023, valued at USD 5.45 billion. This dominance is reinforced by rapid industrialization, increasing manufacturing activities, and the growing demand for high-precision measurement solutions across industries such as automotive, aerospace, and electronics.

Asia Pacific industrial metrology market share stood at around 38.60% in 2023, valued at USD 5.45 billion. This dominance is reinforced by rapid industrialization, increasing manufacturing activities, and the growing demand for high-precision measurement solutions across industries such as automotive, aerospace, and electronics.