Market Definition

The market encompasses systems, components, and technologies that regulate, monitor, and automate industrial processes across sectors such as manufacturing, energy, utilities, and transportation. It includes automation infrastructure, control systems, software, and related services that enhance operational efficiency, safety, and productivity.

The market supports digital transformation through integration with IoT, AI, and data analytics in industrial environments. The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Industrial Controls Market Overview

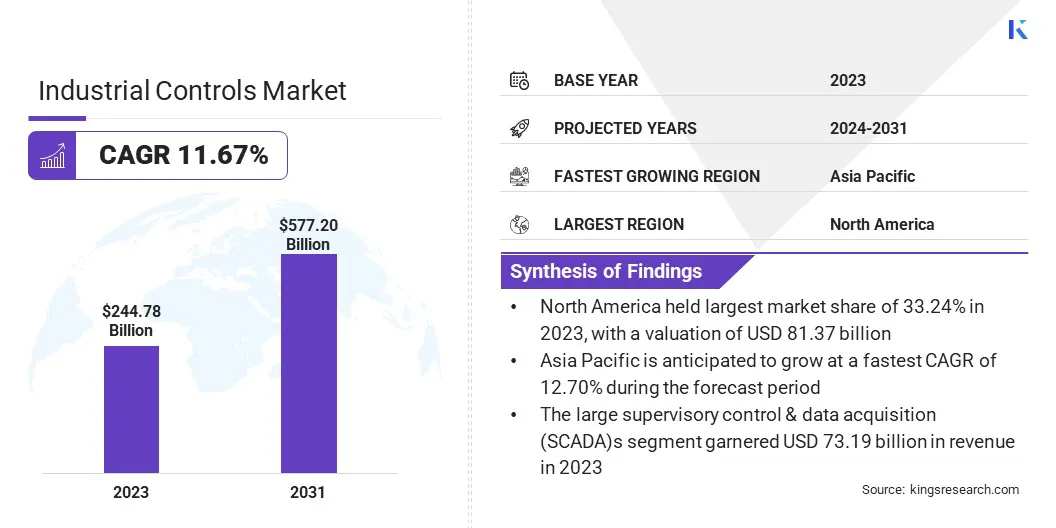

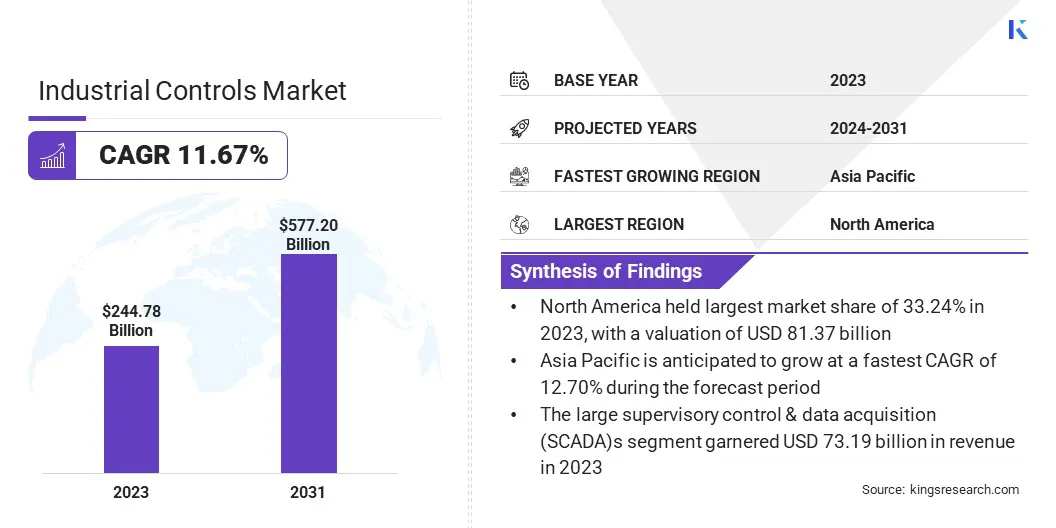

The global industrial controls market size was valued at USD 244.78 billion in 2023 and is projected to grow from USD 266.61 billion in 2024 to USD 577.20 billion by 2031, exhibiting a CAGR of 11.67% during the forecast period.

This strong growth is driven by the rising adoption of automation across manufacturing and process industries. As companies seek to improve operational efficiency, reduce energy consumption, and enhance production accuracy, demand for advanced control systems is increasing.

Integration of industrial IoT, artificial intelligence, and data analytics is modernizing control architectures through real-time monitoring and predictive maintenance. Government support for smart manufacturing and Industry 4.0 is further accelerating investment in industrial automation.

Major companies operating in the industrial controls industry are Siemens AG, ABB, Emerson Electric Co., Rockwell Automation, Schneider Electric, OMRON Corporation, Yokogawa India Ltd., General Electric, Mitsubishi Group, Texas Instruments Incorporated, Honeywell International Inc, Robert Bosch Stiftung GmbH, Panasonic Industry Co., Ltd., FANUC CORPORATION, and Hitachi, Ltd.

Additionally, the growing emphasis on workplace safety and the need for consistent product quality are prompting industries to implement automated control systems. The shift toward renewable energy and sustainable industrial operations is further contributing to market expansion, as control systems are vital for managing energy flow and process optimization.

- In November 2024, Red Hat, Inc. and Tyrrell Products collaborated to launch a converged smart building and industrial automation controller, combining Red Hat Device Edge, Tyrrell’s IONA-XP hardware, and Intel processors. The partnership aims to empower manufacturers with scalable, edge-optimized industrial automation solutions for real-time performance, enhanced security, and integration of emerging technologies such as AI and computer vision.

Key Highlights:

- The industrial controls industry size was valued at USD 244.78 billion in 2023.

- The market is projected to grow at a CAGR of 11.67% from 2024 to 2031.

- North America held a share of 33.24% in 2023, valued at USD 81.37 billion.

- The supervisory control & data acquisition (SCADA) segment garnered USD 73.19 billion in revenue in 2023.

- The automotive segment is expected to reach USD 144.95 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 12.70 % over the forecast period.

Market Driver

Rising Demand for Automation and Sustainability

The market is witnessing significant growth, largely fueled by the increasing demand for automation in manufacturing processes and increased focus on energy efficiency and sustainability. As global competition intensifies, manufacturers face pressure to boost productivity, maintain consistent quality, and reduce downtime.

Automation technologies such as programmable logic controllers (PLCs), distributed control systems (DCS), and human-machine interfaces (HMIs) are helping companies streamline operations, cut labor costs, and adapt to changing production requirements.

The growing emphasis on sustainability and energy efficiency is prompting industries to modernize infrastructure with control systems that enable real-time energy monitoring and optimization. These solutions minimize energy waste, improve equipment lifespan, and ensure compliance with environmental regulations. This is particularly important as industries face mounting pressure to reduce carbon emissions and adopt sustainable practices.

- In April 2024, ABB India launched two new energy-efficient motor ranges such as IE4 cast iron super premium efficiency motors and IE3 aluminum motors. Developed under the "Make in India" initiative, the motors are designed to enhance productivity, reduce emissions, and support industrial control systems across sectors such as HVAC, water & wastewater, and manufacturing.

Market Challenge

Rising Cybersecurity Risks

A major challenge impeding the expansion of the industrial controls market is the growing exposure to cybersecurity threats as control systems become increasingly interconnected. Traditionally, industrial control systems (ICS) and supervisory control and data acquisition (SCADA) systems were isolated from external networks.

However, with the rise of digital transformation, cloud computing, and the Industrial Internet of Things (IIoT), these systems are now often linked to corporate IT networks and the internet. This convergence increases the attack surface, making industrial environments more vulnerable to cyber intrusions, ransomware attacks, and advanced persistent threats (APTs).

The risk is particularly critical in industries like power generation, oil and gas, manufacturing, and water treatment, where cyberattacks can lead to operational downtime, safety hazards, and environmental damage.

Many existing ICS architectures lack essential features such as encryption, authentication, or intrusion detection, making them more vulnerable to attacks. Additionally, legacy systems, often in use for decades, may also be incompatible with modern security solutions,. To mitigate these risks, industrial operators are adopting a defense-in-depth strategy, incorporating multiple security controls, such as firewalls, intrusion detection/prevention systems, zero-trust architectures, and secure remote access protocols.

Market Trend

Integration of Artificial Intelligence and Edge Computing

The market is experiencing rising integration of artificial intelligence (AI) and machine learning (ML) into control systems. These technologies are transforming traditional automation by enabling systems to analyze real-time data, detect anomalies, and self-optimize processes without human intervention.

AI and ML allow for advanced capabilities such as predictive maintenance, where potential equipment failures are identified before they occur, and adaptive process control, where the system continuously learns and adjusts parameters for optimal performance. This results in improved efficiency, product quality, and operational uptime.

- In July 2024, Nozomi Networks Inc. and Mitsubishi Electric launched Arc Embedded, the world’s first OT and IoT security sensor embedded directly in programmable logic controllers (PLCs). The collaboration enables real-time visibility and advanced threat detection at the process level, enhancing cybersecurity across industrial control systems without disrupting critical operations.

Additionally, there is a notable shift toward edge computing and the Industrial Internet of Things (IIoT). Rather than sending all operational data to centralized cloud servers, edge computing enables data processing to occur directly at the source on devices such as sensors, controllers, and gateways.

This reduces latency, enhances real-time responsiveness, and improves data security by limiting external data exposure. When integrated with IIoT, which connects a vast array of smart devices across industrial settings, it enables seamless communication and interoperability.

Industrial Controls Market Report Snapshot

|

Segmentation

|

Details

|

|

By System

|

Supervisory Control & Data Acquisition (SCADA), Distributed Control System (DCS), Programmable Logic Controller (PLC), Intelligent Electronic Devices (IED), Human Machine Interface (HMI)

|

|

By Vertical

|

Oil & Gas, Power & Utilities, Automotive, Healthcare, Metal & Mining, Electronics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By System (Supervisory Control & Data Acquisition (SCADA), Distributed Control System (DCS), Programmable Logic Controller (PLC), Intelligent Electronic Devices (IED), and Human Machine Interface (HMI), and Others): The supervisory control & data acquisition (SCADA) segment earned USD 73.19 billion in 2023 due to its widespread adoption for real-time monitoring and control of complex industrial operations across utilities and manufacturing.

- By Vertical (Oil & Gas, Power & Utilities, Automotive, Healthcare, Electronics, and Others): The automotive segment held a share of 24.47% in 2023, attributed to increasing automation in production lines and the integration of advanced control systems to enhance precision and efficiency.

Industrial Controls Market Regional Analysis

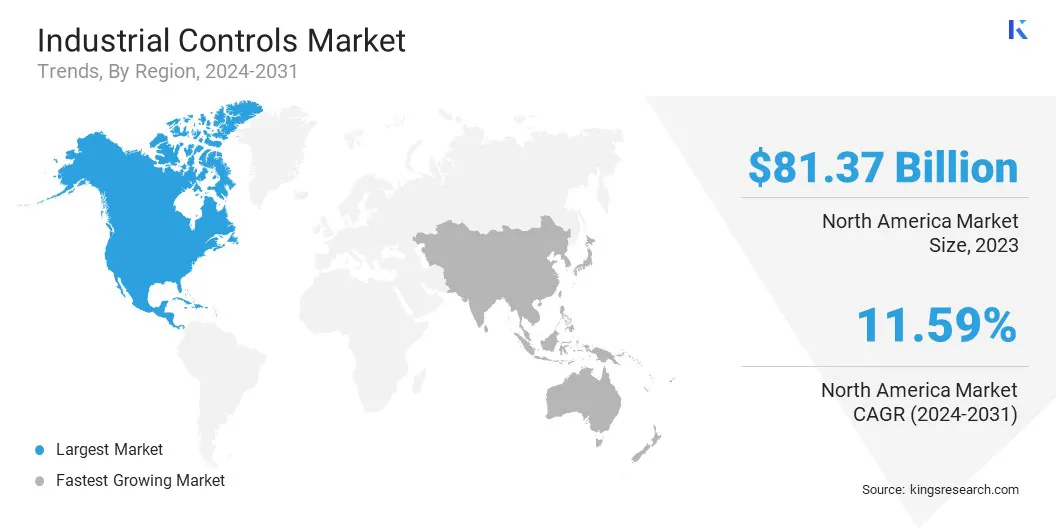

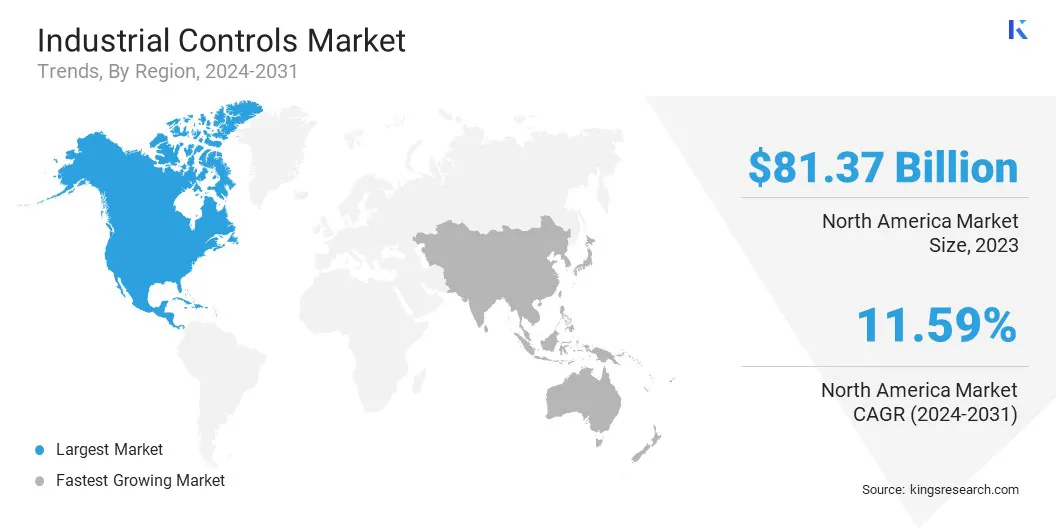

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America industrial controls market accounted for a substantial share of 33.24% in 2023, valued at USD 81.37 billion. This dominance is largely attributed to the presence of a well-established industrial base, particularly in the U.S. and Canada, where advanced manufacturing practices and early adoption of automation technologies are deeply integrated.

Leading automation solution providers maintain major production and R&D facilities across this region, supporting continuous innovation in control systems such as PLCs and SCADA. Moreover, significant investments in sectors such as automotive, aerospace, and energy, particularly in upgrading legacy systems, have contributed to regional market expansion.

The growing trend of digital factories and retrofitting of industrial facilities with smart controls has further reinforced North America’s leading position. The presence of advanced research and development centers, collaboration between technology firms and manufacturers, and the strong adoption of industrial IoT platforms have further fueled regional market growth.

Asia Pacific industrial controls industry is expected to register the fastest CAGR of 12.70% over the forecast period. This growth is propelled by rapid industrialization in countries such as China, India, and Southeast Asian economies, where there is a surge in manufacturing activities and demand for automation to improve production output and efficiency. China's dominance in global manufacturing, along with its shift toward factory automation and smart industrial infrastructure, is supporting this growth.

In India, the expansion of the automotive and process industries, along with rising foreign direct investments in industrial projects, is boosting demand for programmable logic controllers and distributed control systems.

Japan and South Korea, with their highly advanced electronics and robotics sectors, continue to adopt cutting-edge control technologies to maintain global leadership in precision manufacturing. Additionally, the development of smart cities and infrastructure megaprojects across Southeast Asia is creating opportunities for SCADA and HMI systems in utilities and energy sectors, contributing to regional market growth.

- In December 2024, Schaeffler AG, through its subsidiary Industriewerk Schaeffler INA-Ingenieurdienst GmbH, acquired Dhruva Automation & Controls (P) Ltd., an Indian provider of smart industrial automation solutions. The acquisition aims to strengthen Schaeffler’s digitalization strategy, expand its presence in the Asia/Pacific region, and enhance its capabilities in machine data analysis, predictive maintenance, and sustainable industrial operations.

Regulatory Frameworks

- In the United States, industrial controls are regulated under the National Electrical Code (NEC) and Occupational Safety and Health Administration (OSHA) standards, with additional certification requirements from Underwriters Laboratories for industrial control panels.

- In the European Union, industrial controls must comply with the Low Voltage Directive, the Electromagnetic Compatibility Directive, and the Machinery Directive, along with harmonized standards for the safety of electrical equipment in machinery.

- In China, industrial controls are governed by national standards set by the Standardization Administration of China (SAC) and regulations from the Ministry of Industry and Information Technology (MIIT).

- In Japan, industrial control equipment is regulated under the Electrical Appliance and Material Safety Act (DENAN), with conformity to Japanese Industrial Standards (JIS) and oversight by the Ministry of Economy, Trade and Industry (METI).

- In India, industrial controls fall under the purview of the Central Electricity Authority (CEA) and the Bureau of Indian Standards (BIS), ensuring compliance with safety standards for electrical control systems in machinery.

Competitive Landscape

Leading players in the industrial controls market are focusing on enhancing their portfolios through the integration of advanced technologies such as AI, machine learning, and industrial IoT to deliver more intelligent and adaptive control solutions.

Strategic partnerships and collaborations with software developers, system integrators, and cloud service providers are increasingly being adopted to offer end-to-end automation ecosystems tailored to specific industry needs.

Mergers and acquisitions have also been a key strategy to strengthen market presence and expand into high-growth regions. Additionally, companies are investing heavily in R&D to develop modular and scalable control systems that can cater to both large-scale operations and small-to-medium enterprises.

- In June 2024, Schneider Electric, in collaboration with Intel and Red Hat, launched a Distributed Control Node (DCN) software framework as an extension of its EcoStruxure Automation Expert platform. This partnership focuses on delivering a next-generation, open automation infrastructure that replaces vendor-specific hardware with a plug-and-produce solution, enabling interoperability, portability, and software-defined industrial control systems.

List of Key Companies in Industrial Controls Market:

- Siemens AG

- ABB

- Emerson Electric Co.

- Rockwell Automation

- Schneider Electric

- OMRON Corporation

- Yokogawa India Ltd.

- General Electric

- Mitsubishi Group

- Texas Instruments Incorporated

- Honeywell International Inc

- Robert Bosch Stiftung GmbH

- Panasonic Industry Co., Ltd.

- FANUC CORPORATION

- Hitachi, Ltd.

Recent Developments (Acquisitions/Collaboration/Product Launches)

- In March 2025, Siemens showcased advancements in industrial AI, software-defined automation, and digital twin technology at Hannover Messe. The company highlighted its collaboration with Audi on virtual programmable logic controllers (vPLCs), a key step in AI-enabled manufacturing. Siemens also announced the development of the first industrial foundation model (IFM) with Microsoft, and emphasized ecosystem collaborations with Accenture, NVIDIA, Microsoft, and AWS to accelerate industrial digital transformation.

- In January 2025, Blackford Capital acquired Ace Controls, a Houston-based industrial control panel fabricator, as the third add-on to its PACIV (Process Automation Control Integration and Validation) industrial automation platform. The acquisition enhances PACIV’s presence in the water and wastewater sector, strengthens its control panel offerings, and extends its geographic reach.

- In December 2024, DE-STA-CO, a subsidiary of Dover Corporation, acquired Industrial Motion Control, LLC (IMC), a manufacturer of mechanical motion control products. The acquisition aims to expand DE-STA-CO’s industrial automation capabilities and offer more comprehensive automation solutions across industries such as packaging, automotive, and pharmaceuticals.

- In November 2024, Renesas Electronics Corporation launched the RZ/T2H microprocessor (MPU) for industrial robots, PLCs, and motion controllers. The MPU integrates high-performance application processing with real-time control, enabling 9-axis motor control and support for Industrial Ethernet support on a single chip, streamlining automation system development.