Market Definition

Hybrid printing is a printing technology that integrates digital and traditional printing methods and enables businesses to achieve high-quality output while maintaining flexibility and cost efficiency. Widely used in packaging, labels, and promotional materials, it offers an effective balance of quality and customization for diverse printing needs.

Hybrid Printing Market Overview

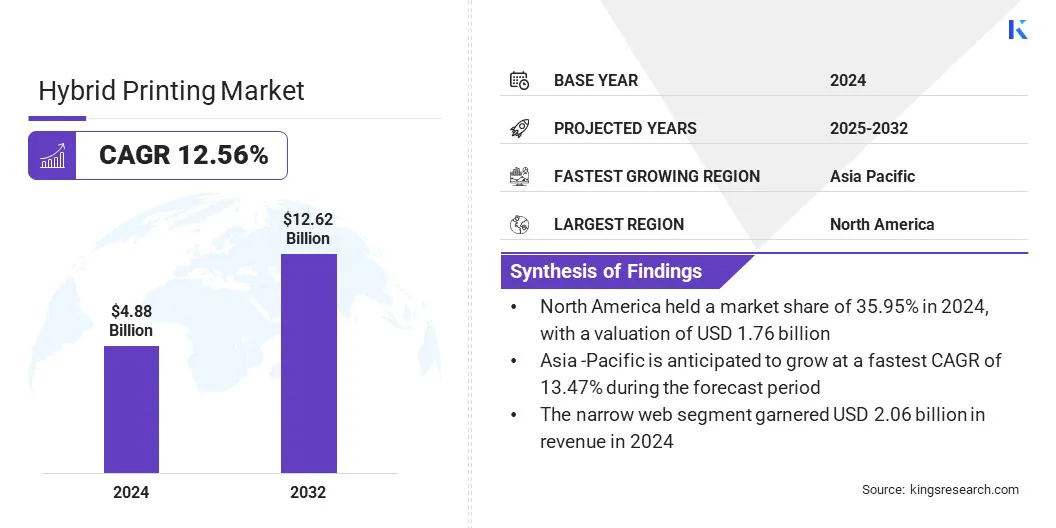

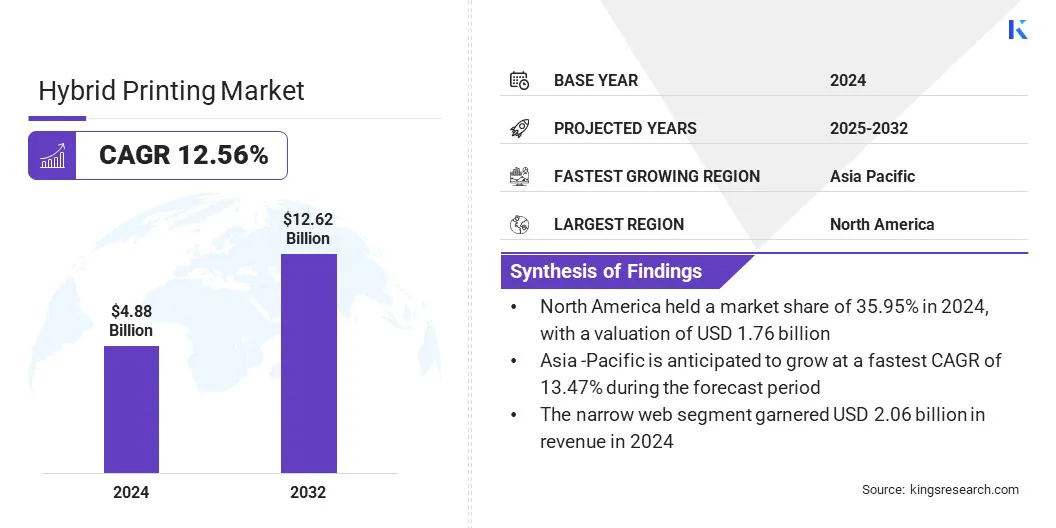

According to Kings Research, the global hybrid printing market size was valued at USD 4.88 billion in 2024 and is projected to grow from USD 5.49 billion in 2025 to USD 12.62 billion by 2032, exhibiting a CAGR of 12.56% during the forecast period.

This growth is driven by innovations in hybrid printing, including faster presses, improved digital-flexo integration, and smarter workflow software, which enable higher-quality, customizable prints with shorter turnaround times. The integration of AI further supports this growth by optimizing workflows, improving print quality, and accelerating customized production across packaging, labeling, and commercial printing.

Key Highlights:

- The hybrid printing industry size was recorded at USD 4.88 billion in 2024.

- The market is projected to grow at a CAGR of 12.56% from 2025 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 1.76 billion.

- The flexo + inkjet segment garnered USD 1.77 billion in revenue in 2024.

- The UV inkjet segment is expected to reach USD 3.55 billion by 2032.

- The mid web segment is anticipated to witness the fastest CAGR of 12.68% over the forecast period.

- The paper & cardboard segment held a share of 33.24% in 2024

- The food & beverage segment garnered USD 1.18 billion in revenue in 2024

- Asia Pacific is anticipated to grow at a CAGR of 13.47% over the forecast period.

Major companies operating in the hybrid printing market are HP Inc, Fujifilm Holdings Corporation, Ricoh, Inc, Konica Minolta Business Solutions, Inc, Electronics For Imaging, Inc, Seiko Epson Corporation, Koenig & Bauer AG, Heidelberger Druckmaschinen AG, MPS Systems B.V, Mark Andy Inc, Gallus Ferd. Rüesch AG, KOMORI-CHAMBON S.A.S, Kyocera Corporation, Memjet, and Xiamen Hanin Co., Ltd.

Rising demand for personalized products is fueling market expansion, as consumers increasingly seek customized packaging, labels, and promotional materials that reflect individuality and brand identity. Hybrid printing enables efficient.

- In March 2025, HP introduced the Latex R530 hybrid printer and Production Hub software at its Amplify conference in Nashville. The printer supports both flexible and rigid substrates, reduces reliance on print-and-mount techniques, lowers costs, and broadens application opportunities for print service providers.

Market Driver

Advancements in Printing Technology

The growth of the hybrid printing market is propelled by the continuous advancement of printing technologies that improve speed, accuracy, and versatility across packaging, labeling, and commercial printing applications.

These advancements also enable the use of multiple substrates, advanced ink systems, and automated workflows, making hybrid printing more scalable and cost-effective. The increasing availability of these innovative solutions is leading to the widespread adoption among printing firms of all sizes across packaging, labels, and promotional materials.

- In May 2024, Boston Micro Fabrication introduced the microArch D1025 dual-resolution 3D printer in the U.S. The system allows printing in 10µm, 25µm, or hybrid mode within a single build, enhancing flexibility, precision, and efficiency for healthcare, electronics, life sciences, and photonics applications.

Market Challenge

High Upfront Capital Investment

A key challenge restraining the progress of the hybrid printing market is the high upfront capital investment required for acquiring and integrating advanced hybrid printing systems.

These systems combine digital and traditional printing technologies, including sophisticated presses, automated workflow software, and quality control equipment, resulting in substantial implementation costs. The initial financial burden can deter small and medium-sized enterprises from adopting hybrid printing technology.

To address this challenge, market players are offering flexible financing options, leasing programs, and pay-per-use models to reduce upfront costs for businesses. They are also developing modular and scalable printing systems that allow gradual expansion based on demand for printing capacity, application diversity, and production volume.

Additionally, vendors provide comprehensive training and technical support to optimize system efficiency and reduce operational risks of equipment downtime, production errors, and workflow disruptions.

Market Trend

Rising Adoption of Automation and Smart Printing Technologies

A key trend influencing the hybrid printing market is the rising adoption of automation and smart printing technologies to streamline production workflows. Printing companies are integrating automated systems that manage pre-press tasks, control print operations, and reduce manual interventions.

Automation and smart printing technologies enable faster production and consistent quality, which in turn foster operational efficiency, reduce costs, and foster broader adoption of hybrid printing solutions across packaging, labels, and commercial printing sectors.

- In November 2024, Farb Technologies introduced Hybrid Packz and Cloudflow at Labelexpo 2024 in Greater Noida, India. The solutions automate workflows, reduce manual tasks, and improve the accuracy of pre-press operations.

Hybrid Printing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Flexo + Inkjet, Offset + Inkjet, Gravure + Inkjet, Others

|

|

By Ink

|

UV Inkjet, Aqueous Dye Inkjet, Eco-Solvent Inkjet, Latex Inkjet, Others

|

|

By Format

|

Narrow Web, Mid Web, Wide Web

|

|

By Substrate

|

Paper & Cardboard, Films, Plastics, Others

|

|

By End Use

|

Food & Beverage, Cosmetics & Personal Care, Pharma & Healthcare, Chemicals, Industrial, Retail, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Flexo + Inkjet, Offset + Inkjet, Gravure + Inkjet, and Others): The flexo + inkjet segment earned USD 1.77 billion in 2024, mainly due to its ability to combine high-speed production with digital flexibility for short-run and variable printing.

- By Ink (UV Inkjet, Aqueous Dye Inkjet, Eco-Solvent Inkjet, and Latex Inkjet): The UV inkjet segment held a share of 28.08% in 2024, fueled by its superior durability, faster curing, and compatibility with diverse substrates.

- By Format (Narrow Web, Mid Web, and Wide Web): The narrow web segment is projected to reach USD 5.27 billion by 2032, owing to its cost-effectiveness and rising demand in labels and flexible packaging.

- By Substrate (Paper & Cardboard, Films, Plastics, and Others): The films segment is anticipated to witness the fastest CAGR of 12.88% over the forecast period, primarily attributed to increasing adoption in flexible packaging and labeling applications.

- By End Use (Food & Beverage, Cosmetics & Personal Care, Pharma & Healthcare, Chemicals, Industrial, Retail, and Others): The food & beverage segment garnered USD 1.18 billion in revenue in 2024, propelled by the growing demand for customized, high-quality packaging and labeling solutions.

Hybrid Printing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America hybrid printing market share stood at around 35.95% in 2024, valued at USD 1.76 billion. This dominance is primarily reinforced by the rising demand for high-quality packaging and labeling across industries such as food, beverages, pharmaceuticals, and personal care. Increasing adoption of short-run and customized printing solutions is further accelerating the shift toward hybrid printing solutions.

Advancements in digital-flexographic integration are boosting the adoption of hybrid printing by reducing costs and turnaround times, enabling greater efficiency and flexibility. Additionally, ongoing investments by regional printing firms in advanced hybrid presses are enhancing production capabilities and contributing to regional market expansion.

- In July 2025, Steinhauser Inc., a Newport-based woman-owned label printing company, acquired its first hybrid press, the Mark Andy Digital Series HD, to expand digital label capabilities. The investment boosts productivity, supports multiple substrates, and enhances the company’s ability to deliver high-quality, versatile hybrid printing solutions.

The Asia-Pacific hybrid printing industry is set to grow at a robust CAGR of 13.47% over the forecast period. This growth is bolstered by the booming e-commerce and retail sectors, which are fueling demand for attractive, durable, and customized packaging solutions. Expanding textile and apparel industries in countries such as India, China, and Bangladesh are boosting the use of hybrid presses for high-volume and flexible production.

Rising investments from regional manufacturers in advanced hybrid printing technologies are further enhancing production capacities. Additionally, advancements in automation, including robotic material handling and inline quality inspection, are improving efficiency, thereby supporting regional market growth.

- In July 2025, Orange O Tec launched the ‘Rocket’ hybrid single-pass digital textile printer in India to expand advanced textile printing capabilities. The machine delivers speeds of up to 60,000 LM/day, supports multiple ink types, and automates end-to-end production, enhancing efficiency, flexibility, and sustainability for textile manufacturers in South Asia.

Regulatory Frameworks

- In the U.S., the Government Publishing Office (GPO) regulates federal printing, binding, and related services. It ensures procurement efficiency, quality control, and compliance with federal standards, centralizing printing operations to maintain consistency, reduce costs, and promote uniformity across government publications.

- In the UK, the Crown Commercial Service (CCS) governs public sector procurement of print services, including hybrid printing. It manages frameworks to ensure high-quality service, compliance with regulations, cost efficiency, and sustainability, while standardizing service delivery and promoting responsible printing practices.

- In China, the National Press and Publication Administration (NPPA) monitors the printing industry, including publications, packaging, and decoration materials. It enforces industry standards, safeguards lawful rights, and ensures cultural and ethical compliance, applying rules to printing operations to maintain quality and alignment with national policies.

- In India, the Ministry of Information and Broadcasting (MIB) regulates publications and media content under the Press and Registration of Books Act. It oversees newspaper and periodical registration, sets publication standards, and promotes ethical practices through recognition of self-regulatory bodies, indirectly influencing hybrid printing operations.

Competitive Landscape

Major players operating in the hybrid printing industry are adopting high-resolution hybrid presses to enhance the label and packaging quality of products. They are focusing on increasing print speed and accuracy to handle rising demand efficiently and ensure consistent delivery of high-quality output.

Companies are streamlining workflows to improve operational efficiency and reduce downtime of hybrid printing processes. Additionally, they are delivering versatile, high-quality solutions that address the requirements of sectors such as food, beverages, and chemicals.

- In May 2025, South Carolina-based Century Printing & Packaging invested in the first Durst 1200 dpi KJet hybrid press in North America to expand its label and packaging capabilities. The acquisition enhances high-speed, high-resolution printing, improves operational efficiency, and strengthens the company's ability to deliver versatile, high-quality labels for food, beverage, and chemical clients.

Key Companies in Hybrid Printing Market:

- HP Inc

- Fujifilm Holdings Corporation

- Ricoh, Inc

- Konica Minolta Business Solutions, Inc

- Electronics For Imaging, Inc

- Seiko Epson Corporation

- Koenig & Bauer AG

- Heidelberger Druckmaschinen AG

- MPS Systems B.V

- Mark Andy Inc

- Gallus Ferd. Rüesch AG

- KOMORI-CHAMBON S.A.S

- Kyocera Corporation

- Memjet

- Xiamen Hanin Co., Ltd.

Recent Developments (M&A/ Product Launch)

- In July 2025, Xerox Holdings Corporation completed the USD 1.5 billion acquisition of Lexmark International, Inc. The deal expands Xerox’s print and managed print services portfolio and broadens its global manufacturing and distribution network.

- In September 2024, Hybrid Services launched the Mimaki CJV200 Series and TS330-3200DS models at The Print Show in the UK. The CJV200 Series offers entry-level solvent integrated printer/cutters designed for improved efficiency.

- In January 2024, Agfa launched the next-generation Anapurna H3200 hybrid inkjet printer in Mortsel, Belgium. It delivers a 70% speed increase, enhanced print quality, and wider application support for sign and display printing.