Market Definition

The market involves the production and distribution of printed materials for businesses in sectors like advertising, publishing, and packaging. Utilizing technologies such as offset, digital, and flexographic printing, it caters to B2B needs for branding, marketing, and packaging, emphasizing digital innovation, cost-efficiency, and sustainability.

The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Commercial Printing Market Overview

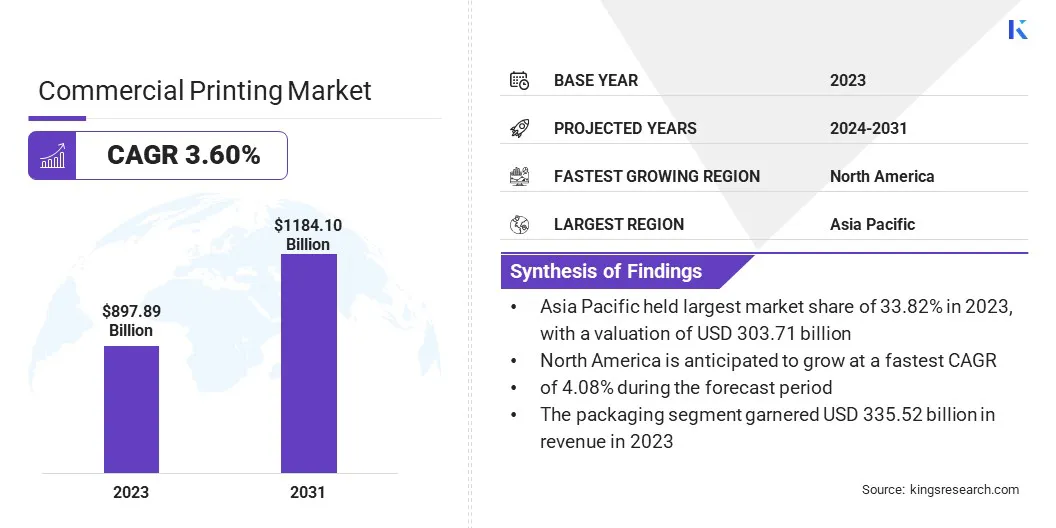

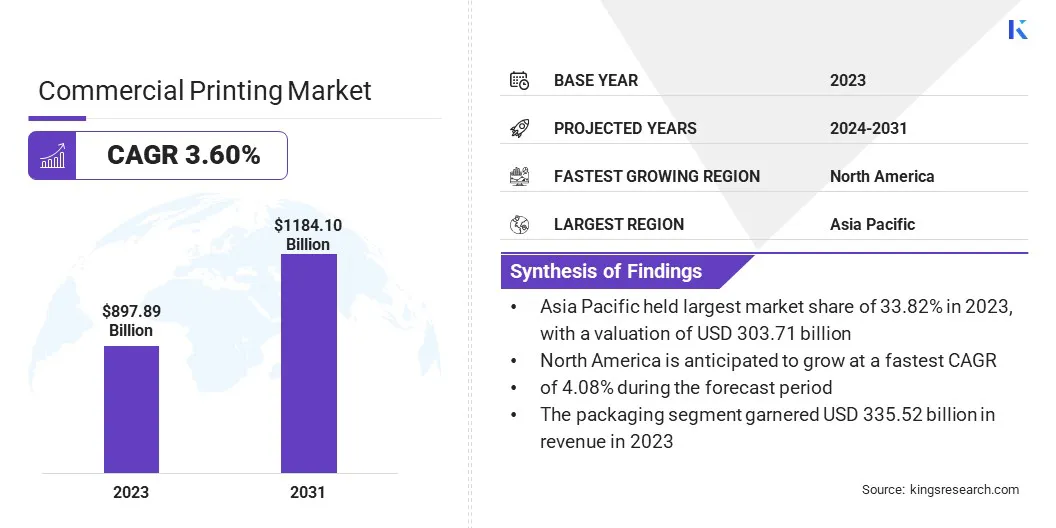

The global commercial printing market size was valued at USD 897.89 billion in 2023 and is projected to grow from USD 924.47 billion in 2024 to USD 1184.10 billion by 2031, exhibiting a CAGR of 3.60% during the forecast period. The rising demand for customized, high-quality prints drives businesses to invest in advanced digital technologies, improving efficiency, reducing costs, and enabling faster turnaround.

Major companies operating in the commercial printing industry are Quad, Cenveo Worldwide Limited, ACME PRINT CO., R.R. Donnelley & Sons Company, Transcontinental Inc., LSC Communications LLC., Dai Nippon Printing Co., Ltd., Duncan Print Group, Quebecor Inc., TOPPAN Holdings Inc., Bertelsmann S.E. and Co. KGaA, Ennis Inc., Taylor Communications, Deluxe Enterprise Operations LLC, and Print Group Inc.

The market is registering growth as businesses seek to differentiate themselves in a competitive environment. Industries such as retail, advertising, and publishing require customized, high-quality prints to strengthen brand identity, engage consumers, and provide personalized experiences.

This trend is driving investments in advanced printing technologies that offer flexibility, precision, and efficiency, enabling companies to achieve market differentiation and meet evolving customer expectations.

- In October 2023, Canon responded to the growing demand for commercial printing for high-speed, high-quality digital presses with a small footprint and versatile paper stock compatibility. The company developed compact digital presses that integrate three key technologies, including an ink-circulating print head, high-concentration latex ink, and a closed heater process, delivering superior print media compatibility and improved operational efficiency.

Key Highlights:

- The global commercial printing market size was valued at USD 897.89 billion in 2023.

- The market is projected to grow at a CAGR of 3.60% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 303.71 billion

- The offset lithography segment garnered USD 223.41 billion in revenue in 2023.

- The advertising segment is expected to reach USD 377.06 billion by 2031.

- The market in North America is anticipated to grow at a CAGR of 4.08% during the forecast period

Market Driver

Digital Printing Innovations Driving Faster Turnaround and Cost Efficiency

The commercial printing market has greatly benefited from advancements in digital printing technologies, improving operational efficiency by reducing production costs and enabling faster turnaround times.

Innovations such as enhanced print head technology and high-speed processing allow businesses to produce high-quality, on-demand prints, minimizing waste and inventory costs. This enables companies to meet tighter deadlines, optimize resources, and better respond to the dynamic demands of the market.

- In March 2024, HP set a new industry standard in digital printing with its latest lineup of advanced presses and intelligent solutions, designed to tackle current production challenges in commercial printing and labels/packaging industries. In the face of inflation, labor shortages, material scarcity, and environmental concerns, offset printers must leverage digital technology and intelligent automation to unlock new growth opportunities and drive sustainable business growth.

Market Challenge

Rising Raw Material Costs and Supply Chain Disruptions

Rising raw material costs and ongoing supply chain disruptions pose significant challenges to the commercial printing industry, impacting production timelines and profit margins. Increased costs for key materials like paper, ink, and other consumables have compelled printers to adjust pricing structures, which can affect client relationships.

Furthermore, supply chain delays hinder timely delivery, leading to potential contract breaches and decreased customer satisfaction. Businesses have adopted strategic sourcing, enhanced inventory management, and explored more efficient production processes to maintain profitability.

Market Trend

Growing emphasis on sustainable and eco-friendly printing solutions

The market is evolving rapidly as sustainability takes center stage. Businesses are increasingly turning to eco-friendly materials, energy-efficient technologies, and waste-reduction practices to meet rising consumer expectations and comply with regulatory demands.

Companies not only reduce their environmental footprint but also enhance their brand reputation by adopting sustainable inks, substrates, and processes, positioning themselves for long-term success and gaining a competitive advantage in the market.

- In May 2024, ColorJet, a leader in printing innovation, introduced its Polo Earth 3.2-meter eco-solvent printer at the Media Expo in Mumbai. Alongside this launch, ColorJet unveiled a sustainable polyethylene substrate, developed with Kromodyne Digital Solutions, marking a significant move toward eco-friendly printing. The Polo Earth printer offers high performance, ecological efficiency, and low operating costs, making it suitable for both indoor and outdoor printing needs.

Commercial Printing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Offset Lithography, Inkjet, Flexographic, Screen, Gravure, Others

|

|

By Application

|

Packaging, Advertising, Publishing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Offset Lithography, Inkjet, Flexographic, Screen, and Gravure): The offset lithography segment earned USD 223.41 billion in 2023, due to its ability to deliver high-quality, cost-effective, and high-volume printing solutions for various applications, including commercial, packaging, and publication printing.

- By Application (Packaging, Advertising, Publishing, and Others): The packaging segment held 37.37% share of the market in 2023, due to the growing demand for customized, sustainable packaging solutions driven by e-commerce growth and consumer preference for branded, eco-friendly packaging.

Commercial Printing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 33.82% share of the commercial printing market in 2023, with a valuation of USD 303.71 billion. The market is driven by rapid industrialization, a large consumer base, and the growing demand for packaging, labeling, and customized prints. The region's strong manufacturing sector, coupled with advancements in digital printing technology, enhances production efficiency and flexibility.

Additionally, expanding e-commerce, rising disposable incomes, and government initiatives to promote sustainable practices further contribute to the region’s market leadership, making it a hub for innovation and growth in the market.

The commercial printing industry in North America is poised for significant growth at a robust CAGR of 4.08% over the forecast period. The growing demand for energy-efficient and high-performance printing solutions in North America is driving the market. Businesses increasingly prioritize cost-effective, sustainable technologies that enhance productivity and reduce environmental impact.

The need for reliable, fast, and affordable printing solutions that align with both operational and sustainability goals continues to accelerate market expansion in the region as organizations adopt eco-friendly practices.

- In November 2024, Epson's introduction of the EM-C7100 MFP and EP-C7000 color printer to its WorkForce Pro portfolio is driving growth in North America by addressing the demand for reliable, high-performance, and energy-efficient printing solutions. These innovations, powered by PrecisionCore technology, offer fast print speeds, high-quality output, and low power consumption, meeting the needs of diverse business environments and supporting sustainability goals, positioning Epson as a leader in the region.

Regulatory Framework

- In China, the market is governed by the Environmental Protection Law (2015), which mandates strict compliance with pollution control standards. Printing companies must implement measures for emissions control, wastewater management, and waste disposal, adopting eco-friendly technologies to reduce the environmental impact of inks, chemicals, and solvents.

- In India, the market is regulated by the Environment Protection Act (1986) and the Air and Water (Prevention and Control of Pollution) Acts. Printing companies must adhere to emission standards and waste management protocols, ensuring compliance with eco-friendly practices to reduce environmental impact and pollution.

- In North America, the market is governed by regulations such as the Clean Air Act, Clean Water Act, and Resource Conservation and Recovery Act (RCRA). These laws enforce pollution control, waste management, and sustainable practices, ensuring that printing companies comply with environmental standards for emissions, water usage, and waste disposal.

Competitive Landscape

The commercial printing market is characterized by several participants, including both established corporations and rising organizations. Key market players in the market are employing strategies such as mergers and acquisitions, alongside product launches, to drive growth and expand market share.

These strategic initiatives allow businesses to enhance their service offerings, integrate innovative technologies, and diversify their portfolios. Leveraging acquisitions and introducing new solutions helps companies strengthen their competitive positioning, meet evolving customer demands, and capitalize on emerging market opportunities, ultimately fostering long-term growth and profitability in the market.

- In September 2024, Artisan Colour, a commercial printing firm, acquired MarComm, a digital marketing agency. This strategic acquisition establishes it as the first fully integrated solution combining print and digital marketing. Merging their expertise, the companies aim to set a new benchmark in marketing effectiveness, optimizing both print and digital channels for maximum impact and return on investment.

List of Key Companies in Commercial Printing Market:

- Quad

- Cenveo Worldwide Limited

- ACME PRINT CO.

- R. Donnelley & Sons Company

- Transcontinental Inc.

- LSC Communications LLC.

- Dai Nippon Printing Co. Ltd.

- Duncan Print Group

- Quebecor Inc.

- TOPPAN Holdings Inc.

- Bertelsmann S.E. and Co. KGaA

- Ennis Inc.

- Taylor Communications

- Deluxe Enterprise Operations LLC

- Print Group Inc.

Recent Developments

- In February 2025, HP launched the pagewide T4250 HDR and T500M HD presses, redefining high-speed, high-quality print production. These new presses enable businesses in direct mail, commercial print, and publishing to increase productivity, handle more diverse print jobs, and improve sustainability through advanced technology and reduced energy consumption.

- In May 2024, Sharp Imaging and Information Company of America introduced three new A4 color multifunction printers. These models are designed for SMBs, legal firms, commercial printing environments, and educational institutions, offering the capabilities of larger A3 color Multifunction Printers (MFPs) in a more compact form.