Market Definition

Human nutrition refers to the intake of essential nutrients necessary to support growth, development, and overall health. It includes vitamins, minerals, proteins, amino acids, probiotics, carbohydrates, and fats that provide energy and maintain body functions.

Nutrition products are sold through prescription and over-the-counter channels to meet diverse consumer needs. Their major applications include dietary supplements, functional foods, medical nutrition, sports nutrition, and infant nutrition, focusing on preventive health and specific dietary requirements.

Human Nutrition Market Overview

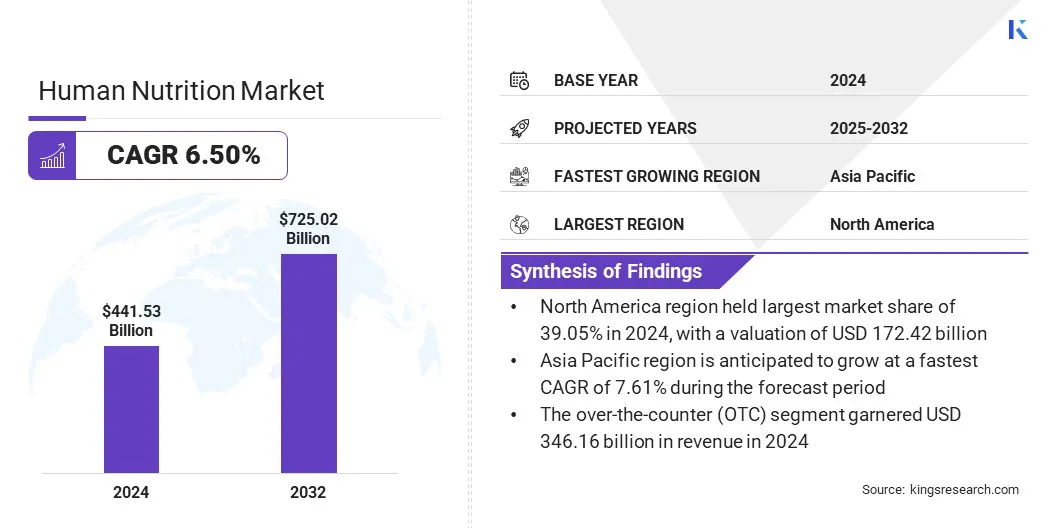

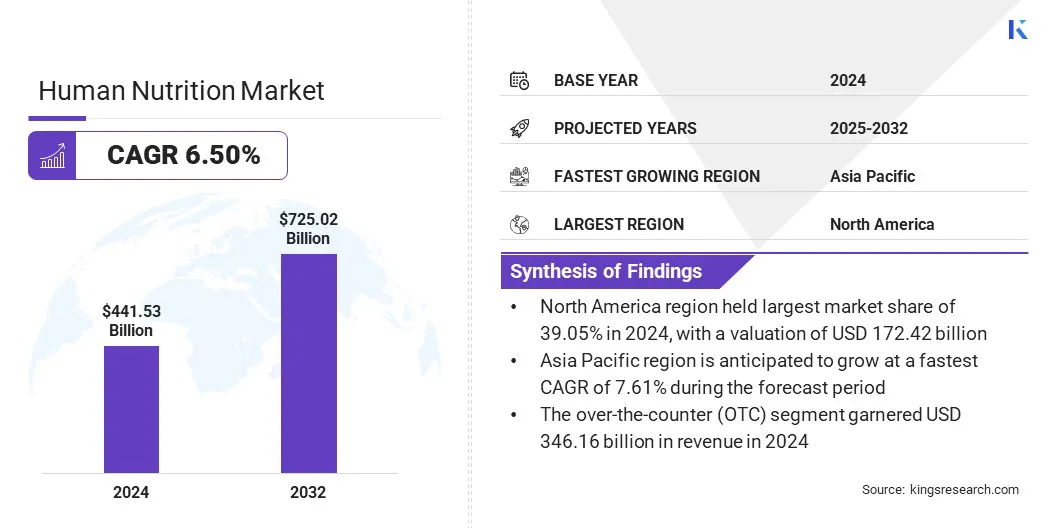

According to Kings Research, the global human nutrition market size was valued at USD 441.53 billion in 2024 and is projected to grow from USD 466.52 billion in 2025 to USD 725.02 billion by 2032, exhibiting a CAGR of 6.50% over the forecast period. This growth is driven by rising undernutrition-linked health risks, which is increasing the demand for dietary supplements, protein-rich products, and targeted nutrition solutions.

The market is witnessing a major trend of innovative multivitamin solutions, as a result of technological advancements driving the development of formulations that combine multiple essential nutrients to meet diverse health and lifestyle requirements.

Key Highlights:

- The human nutrition industry size was recorded at USD 441.53 billion in 2024.

- The market is projected to grow at a CAGR of 6.50% from 2025 to 2032.

- North America held a market share of 39.05% in 2024, with a valuation of USD 172.42 billion.

- The vitamins segment generated USD 126.72 billion in revenue in 2024.

- The over-the-counter (OTC) segment is expected to reach USD 573.15 billion by 2032.

- The dietary supplements segment is expected to reach USD 289.92 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 7.61% over the forecast period.

Major companies operating in the human nutrition market are Abbott, Nestlé, Glanbia PLC, Herbalife International, Inc., Amway, BASF, dsm-firmenich, DuPont de Nemours, Inc., Kerry, Pfizer Inc., Sanofi, Unilever, Meyer Organics Pvt Ltd (Vitabiotics India), AbbVie Inc., and ADM.

Companies are developing a number of plant-based protein blends. These variants combine multiple protein sources to offer complete amino acid profiles, improved digestibility, and superior functional properties in supplements and functional foods. These innovations address the increasing demand for high-protein, sustainable, and plant-based nutrition options across diverse consumer segments. The development of these convenient and targeted nutrition solutions allow consumers to meet protein requirements efficiently.

- In January 2025, GoodMills Innovation launched GoWell Tasty Protein, a plant-based protein blend for baked goods. The blend combines fava beans, yellow peas, sunflower seeds, and wheat to provide 60% protein and a balanced amino acid profile. It delivers neutral to slightly nutty flavor and preserves the sensory qualities of baked products.

Market Driver

Rising Undernutrition-Linked Health Risks

The human nutrition market is primarily driven by the rise in undernutrition-linked medical issues and associated fatalities globally. Nutrient deficiencies, including insufficient intake of vitamins, minerals, and proteins, are contributing to higher rates of illness and mortality, fueling the demand for targeted nutritional solutions.

According to the World Health Organization (March 2024), 2.5 billion adults were overweight, including 890 million with obesity, while 390 million were underweight. Among children under five, 149 million were stunted, 45 million were wasted, and 37 million were overweight or obese.

Nearly half of the deaths in this age group were associated with undernutrition, primarily in low- and middle-income countries. This growing burden is driving the adoption of dietary supplements, fortified foods, and specialized nutrition products designed to address specific health needs.

Market Challenge

Quality and Safety Compliance

A significant challenge in the human nutrition market is the need for consistent quality and regulatory compliance across diverse product categories, including vitamins, minerals, and protein supplements. Variability in ingredient sourcing, manufacturing practices, and regional regulations increase the risk of non-compliance and may impact consumer confidence.

This challenge can limit market growth as companies face potential recalls, regulatory interventions, and reputational risks. In response, manufacturers are implementing rigorous quality control at par with Good Manufacturing Practices (GMP), and investing in advanced testing and traceability technologies to ensure product safety and compliance.

Market Trend

Technological Advancements Driving Innovative Multivitamin Solutions

The human nutrition market is experiencing a notable trend toward innovative multivitamin solutions. Technological advancements in formulation and nutrient delivery are allowing the development of products that integrate multiple essential nutrients to address the health and lifestyle requirements of consumers.

These products are designed to support specific health goals, such as immunity enhancement, cognitive function, or energy management, across age groups, activity levels, and dietary preferences.

- In November 2024, dsm-firmenich, in collaboration with Rohto Pharmaceutical, launched a multivitamin solution for Japanese seniors using its patented Sprinkle It Technology (SIT) which produces stable, multi-layered nutrient granules that integrate seamlessly into food while preserving vitamin potency and taste. This innovation addresses micronutrient insufficiencies and supports healthy longevity.

Human Nutrition Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Vitamins, Minerals, Proteins & Amino Acids, Probiotics, Carbohydrates, Fats & Fatty Acids, Others

|

|

By Distribution Channel

|

Over-the-Counter (OTC), Prescription

|

|

By Application

|

Dietary Supplements, Functional Foods, Medical Nutrition, Sports Nutrition, Infant Nutrition

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Vitamins, Minerals, Proteins & Amino Acids, Probiotics, Carbohydrates, Fats & Fatty Acids, and Others): The vitamins segment earned USD 126.72 billion in 2024 due to rising demand for immunity-boosting and preventive health products.

- By Distribution Channel (Over-the-Counter (OTC), Prescription): The over-the-counter (OTC) segment held 78.40% of the market in 2024, due to easy accessibility and broad consumer adoption.

- By Application (Dietary Supplements, Functional Foods, Medical Nutrition, Sports Nutrition, and Infant Nutrition): The dietary supplements segment is projected to reach USD 289.92 billion by 2032, owing to increasing health awareness and personalized nutrition trends.

Human Nutrition Market Regional Analysis

The market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America, based on region.

The North America human nutrition market share stood at around 39.05% in 2024, with a valuation of USD 172.42 billion in the global market. This dominance is driven by government initiatives and strong R&D in nutritional sciences, supporting innovation and evidence-based formulations. These initiatives improve product efficiency and safety, strengthen consumer trust, and allow companies to launch advanced nutrition solutions, supporting the region's dominance in the market.

- In May 2025, the U.S. Food and Drug Administration and the National Institutes of Health launched the Nutrition Regulatory Science Program to advance research on diet-related chronic diseases. The program focuses on assessing the health impacts of ultra-processed foods, food additives, and maternal and infant dietary exposures. It integrates expertise in nutrition, toxicology, risk analysis, and behavioral science to generate evidence that informs food and nutrition policies.

Asia Pacific human nutrition industry is poised to grow at a significant CAGR of 7.61% over the forecast period. This growth is driven by product launches by key players to meet the rising demand for high-protein nutrition across the region. These launches aim to provide protein-rich supplements, functional foods, and sports nutrition products catering to local dietary preferences and active lifestyles.

Expanding the availability of high-protein products increases consumer adoption and addresses nutritional gaps, which accelerates market penetration and drives sustained growth across Asia Pacific.

- In July 2025, Nestlé launched Milo Pro, a high-protein drink available in ready-to-drink and powder formats, targeting active teens and young adults in Southeast Asia. This product contains three times more protein than traditional Milo drinks to help adolescents meet daily protein requirements and support growth and development.

Regulatory Frameworks

- In the U.S, the Food and Drug Administration (FDA) regulates human nutrition products under the Federal Food, Drug, and Cosmetic Act and the Dietary Supplement Health and Education Act (DSHEA). These frameworks set requirements for labeling, safety, and manufacturing standards to ensure consumer protection and product quality.

- In Europe, the European Food Safety Authority (EFSA) oversees human nutrition under the General Food Law Regulation (EC) No 178/2002 and related directives on food supplements. EFSA evaluates scientific evidence, sets nutrient reference values, and ensures harmonized safety standards across member states.

- In India, the Food Safety and Standards Authority of India (FSSAI) governs human nutrition under the Food Safety and Standards Act, 2006. FSSAI establishes guidelines for fortified foods, dietary supplements, and labeling requirements to maintain product safety and consumer trust.

- In Japan, the Consumer Affairs Agency (CAA) regulates functional and nutritional foods under the Food Labeling Act and the Health Promotion Act. These regulations classify foods with functional claims, mandate evidence-based labeling, and monitor compliance to protect public health.

Competitive Landscape

Key players in the human nutrition industry are focusing on geographic expansion and product innovation to strengthen their competitive positioning. Companies are entering new regional markets through strategic collaborations, distribution networks, and localized production facilities to broaden their presence.

They are introducing specialized nutrition products aimed at active millennials, including protein supplements, functional foods, and probiotic-based offerings tailored to fitness-oriented lifestyles. Market participants are also diversifying their portfolios with plant-based and clean-label formulations to address regional demand shifts and strengthen global competitiveness.

- In February 2024, Nestlé India launched Resource Activ, a high-protein, multi-benefit supplement designed for active millennials. This product combines quality proteins for muscle health, calcium and vitamin D for bones, hyaluronate for skin, fiber, and immunonutrients. Resource Activ addresses nutritional gaps associated with age-related muscle and bone loss while supporting energy and overall wellness.

Top Key Companies in Human Nutrition Market:

- Abbott

- Nestlé

- Glanbia PLC

- Herbalife International, Inc.

- Amway

- BASF

- dsm-firmenich

- DuPont de Nemours, Inc.

- Kerry

- Pfizer Inc.

- Sanofi

- Unilever

- Meyer Organics Pvt Ltd (Vitabiotics India)

- AbbVie Inc.

- ADM

Recent Developments

- In November 2024, MilkyMist partnered with SIG and AnaBio Technologies to launch the world’s first long-life probiotic buttermilk in aseptic carton packs. This product uses AnaBio’s encapsulation technology to protect probiotics during processing and SIG’s aseptic filling to ensure stability without refrigeration.

- In May 2024, Haleon launched the ‘Your Nutrition Matters’ initiative in India to promote awareness of multivitamins and micronutrient intake. The program provides educational resources on Recommended Dietary Allowances (RDAs) and highlights the role of multivitamins in supporting long-term health across different age groups.

- In January 2024, Abbott launched the PROTALITY brand, a high-protein nutrition shake designed to support adults pursuing weight loss while preserving muscle mass. This shake combines fast- and slow-digesting proteins and includes essential vitamins, minerals, and fiber to address potential nutritional gaps during calorie restriction.