Market Definition

The market involves the design and deployment of integrated software platforms used to manage medical, administrative, financial, and legal operations within hospitals. These systems handle patient records, clinical workflows, appointment scheduling, billing, and laboratory data processing.

The market covers various modules, including electronic health records (EHR), pharmacy, radiology, and laboratory systems. Applications extend to inpatient and outpatient services, streamlining hospital functions and improving service delivery. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

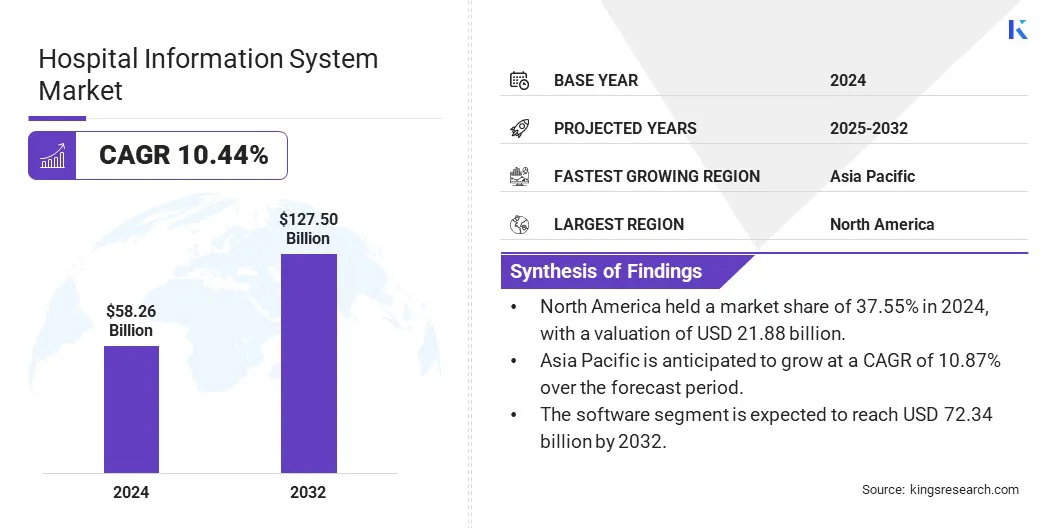

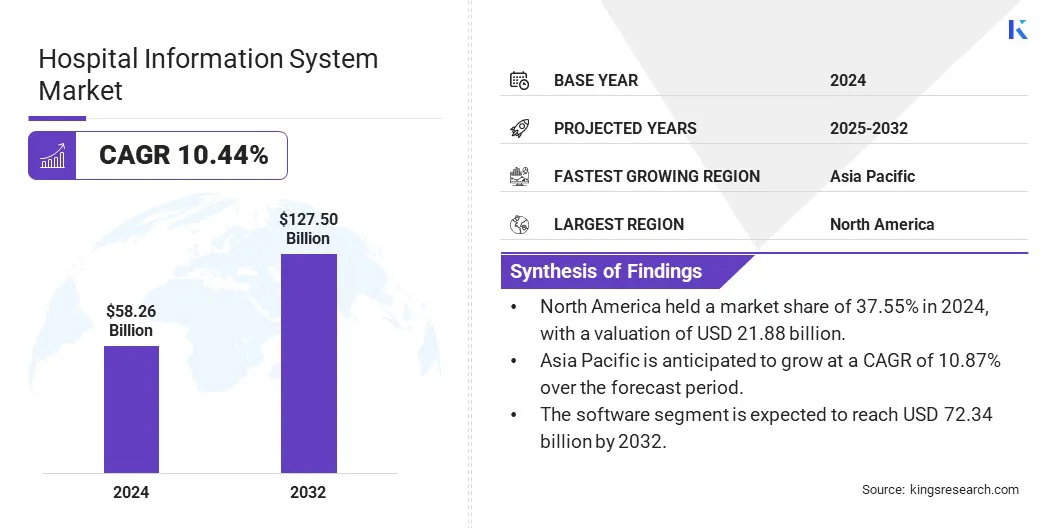

The global hospital information system market size was valued at USD 58.26 billion in 2024 and is projected to grow from USD 63.61 billion in 2025 to USD 127.50 billion by 2032, exhibiting a CAGR of 10.44% during the forecast period.

Market growth is propelled by the increasing adoption of electronic health records (EHR), which support accurate data access and streamlined care delivery. Expansion of telemedicine and remote patient monitoring is further driving demand, as providers seek integrated digital tools to manage patient care across multiple settings.

Major companies operating in the hospital information system industry are Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare, LLC., NantHealth, Inc., Medical Information Technology, Inc., McKesson Corporation, Siemens, General Electric Company, Koninklijke Philips N.V., Dedalus S.p.A., Infor, NXGN Management, LLC., eClinicalWorks, LLC., AdvancedMD, Inc., and Orion Health.

The growth of the market is fueled by the increasing need to efficiently manage vast volumes of patient data. Hospitals require seamless digital platforms to record, store, and access medical records quickly.

This improves clinical decision-making and reduces errors. As healthcare providers focus on accuracy and timely care, hospital information systems become essential to streamline data flow across departments, enhancing overall operational efficiency.

- In March 2025, the Health Service Executive (HSE) of Ireland launched the HSE Health App under the Digital For Care initiative. Accessible via MyGov accounts for individuals aged 16 and above, the app enables users to store medications and medical cards, access vaccination records, and view HSE services information. It aims to digitize patient health records and enhance healthcare accessibility and efficiency.

Key Highlights

- The hospital information system industry size was valued at USD 58.26 billion in 2024.

- The market is projected to grow at a CAGR of 10.44% from 2025 to 2032.

- North America held a market share of 37.55% in 2024, with a valuation of USD 21.88 billion.

- The electronic health record segment garnered USD 21.88 billion in revenue in 2024.

- The software segment is expected to reach USD 72.34 billion by 2032.

- The web-based segment secured the largest revenue share of 47.44% in 2024.

- The diagnostic centers is poised to grow at a a robust CAGR of 10.79% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 10.87% over the forecast period.

Market Driver

Increasing Adoption of Electronic Health Records (EHR)

The hospital information system market is growing steadily due to the widespread adoption of electronic health records. EHR systems help digitize patient histories, diagnostics, and treatment plans, simplifying documentation.

This shift from paper to digital records improves patient safety and compliance with regulations. Growing government mandates and incentives for EHR usage accelerate the demand for hospital information systems equipped with advanced EHR capabilities.

- In March 2025, InterSystems unveiled IntelliCare, an AI-powered EHR system, at the HIMSS25 Global Health Conference. Built on the TrakCare platform, IntelliCare integrates generative AI to streamline clinical workflows, reduce administrative burdens, and enhance patient interactions. Features include real-time documentation, natural language processing, and automated billing code generation. The system is currently available in countries such as Australia, Chile, Indonesia, Saudi Arabia, New Zealand, Thailand, and the United Arab Emirates.

Market Challenge

Data Security and Privacy Concerns

A major challenge limiting the progress of the hospital information system market is ensuring the security and privacy of patient data. With growing digitization, systems are increasingly vulnerable to cyber threats, data breaches, and unauthorized access. This raises concerns among healthcare providers and patients due to the sensitivity of medical information.

To address this challenge, companies are strengthening encryption protocols, adopting multi-factor authentication, and complying with region-specific data protection laws such as HIPAA and GDPR. Regular security audits, staff training, and advanced threat detection tools are being implemented to safeguard data and build trust in digital healthcare systems.

Market Trend

Expansion of Telemedicine and Remote Patient Monitoring

The rapid growth of telemedicine and remote monitoring is fueling demand for integrated digital platforms, supporting the growth of the hospital information system market. HIS platforms support virtual consultations, remote data collection, and continuous patient monitoring. These capabilities expand healthcare access beyond hospital settings, positioning hospital information systems as essential components of modern care delivery.

- In March 2025, LifeSignals received FDA 510(k) approval for its UbiqVue 2A Multiparameter System, marking a significant milestone in continuous wireless patient monitoring. The system can be deployed in home, remote, and hospital settings to continuously monitor patients' physiological data, enhancing patient safety and replacing laborious and potentially inaccurate spot-checks.

|

Segmentation

|

Details

|

|

By Type

|

Electronic Health Record, Electronic Medical Record, Patient Engagement Solutions, Others

|

|

By Component

|

Software, Services

|

|

By Deployment

|

Web-based, On-premises, Cloud-based

|

|

By End User

|

Hospitals and Ambulatory Services, Diagnostic Centers, Academic & Research Institutes

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Electronic Health Record, Electronic Medical Record, Patient Engagement Solutions, and Others): The electronic health record segment earned USD 21.88 billion in 2024 due to its critical role in centralizing patient data, improving care coordination, and enhancing clinical decision-making across healthcare facilities.

- By Component (Software and Services): The software segment held a share of 57.44% in 2024, fueled by its critical role in enabling efficient data management, seamless integration, and improved clinical decision-making across healthcare facilities.

- By Deployment (Web-based, On-premises, and Cloud-based): The web-based segment is projected to reach USD 59.08 billion by 2032, propelled by its ease of access, lower upfront costs, and scalability that align with healthcare providers' need for flexible and efficient digital solutions.

- By End User (Hospitals and Ambulatory Services, Diagnostic Centers, and Academic & Research Institutes): The diagnostic centers segment is estimated to grow at a CAGR of 79% through the forecast period, largely attributed to high demand for efficient data management and rapid reporting to support accurate and timely diagnosis.

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America hospital information system market share stood at around 37.55% in 2024, valued at USD 21.88 billion. North America's mature electronic health record (EHR) ecosystem, with widespread implementation across hospitals and clinics, has created a strong demand for hospital information systems.

Existing infrastructure supports the integration of advanced modules, enabling providers to streamline operations. Moreover, with rising cyber threats, hospitals in North America are investing heavily in secure IT systems. Demand for hospital information systems that offer advanced encryption, access control, and audit capabilities is rising, aiding regional market expansion.

- In January 2025, the U.S. Department of Health and Human Services (HHS) proposed significant revisions to the HIPAA Security Rule, marking the first in over a decade. The proposed changes aim to strengthen cybersecurity measures, including mandatory multi-factor authentication, enhanced encryption standards, and regular risk assessments. These updates respond to the increasing cyber threats targeting healthcare institutions.

The Asia-Pacific hospital information system industry is set to grow at a robust CAGR of 10.87% over the forecast period. Governments in Asia Pacific are launching structured digital health missions and e-health initiatives to modernize public hospitals.

These programs often involve deploying electronic health records, cloud-based platforms, and health data networks. The involvement of public institutions in digital infrastructure development is creating steady demand for hospital information systems.

- In September 2024, SingHealth in Singapore reported conducting over 69,000 video consultations across its hospitals and polyclinics as of August 2024. As part of its telemedicine expansion, the upcoming Eastern General Hospital Campus plans to launch virtual wards by 2026, four years before becoming fully operational. Care will be delivered through tele-consultations and remote monitoring.

Furthermore, several large hospitals in Asia Pacific are adopting smart hospital models, integrating technology across all levels of care. The shift toward smart infrastructure is accelerating HIS deployment in advanced facilities.

Regulatory Frameworks

- The U.S. enforces the Health Insurance Portability and Accountability Act (HIPAA), which sets strict rules for protecting patient health information and securing electronic health records. The Health Information Technology for Economic and Clinical Health (HITECH) Act further promotes electronic health record adoption and strengthens privacy and breach notification requirements.

- The European Union’s General Data Protection Regulation (GDPR) provides a comprehensive framework for protecting personal health data, focusing on consent, data minimization, and individual rights. The Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) govern software safety and cybersecurity used in hospital information systems.

- China’s healthcare data regulations include the National Health Care Big Data Standards, which define data classification, encryption, and backup protocols to safeguard health information. The National Medical Products Administration issues guidelines for artificial intelligence medical software, including hospital information systems with AI components, ensuring compliance and safety.

- India’s Information Technology Act 2000 establishes legal framework for electronic data security, including patient health information. The National Medical Device Policy 2023 focuses on quality and standardization of medical devices, including hospital information systems, to ensure reliability and safety. These regulations guide the secure digital transformation of healthcare data management in India’s hospital systems.

Competitive Landscape

Prominent players in the hospital information system industry are adopting strategies such as integrating AI-powered contact centers to streamline front-office operations. These solutions are designed to manage tasks such as appointment scheduling, prescription handling, and routine patient queries without manual intervention.

This approach helps healthcare providers improve workflow efficiency, enhance patient support, and reduce administrative burden. By focusing on intelligent automation and real-time communication, companies are reinforcing the value of hospital information systems in day-to-day clinical settings.

- In October 2024, eClinicalWorks introduced healow Genie, an AI-powered contact center integrated into its EHR system. This solution provides 24/7 support through voice, text, and chatbot interactions, handling tasks such as appointment scheduling, prescription refills, and answering common patient inquiries. By automating these front-office functions, healow Genie aims to enhance patient engagement, reduce staff workload, and improve operational efficiency for healthcare providers.

List of Key Companies in Hospital Information System Market:

- Cerner Corporation

- Epic Systems Corporation

- Allscripts Healthcare, LLC.

- hospital information system

- Medical Information Technology, Inc.

- McKesson Corporation

- Siemens

- General Electric Company.

- Koninklijke Philips N.V.

- Dedalus S.p.A.

- Infor

- NXGN Management, LLC.

- eClinicalWorks, LLC.

- AdvancedMD, Inc.

- Orion Health

Recent Developments (Product Launch)

- In February 2025, AdvancedMD rolled out its Winter 2025 product release, introducing over 20 updates across its practice management, EHR, and patient engagement platforms. Key enhancements included improved patient and responsible party cards, designed to streamline administrative tasks and enhance user experience for independent medical practices.