Market Definition

The market encompasses the global industry involved in the use of trenchless methods for installing underground utilities such as pipelines and cables. It includes equipment, technologies, and services used to execute precise, steerable drilling operations beneath the surface.

The market serves applications across various sectors, offering solutions for subsurface construction with minimal surface disruption. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the market trajectory.

Horizontal Directional Drilling Market Overview

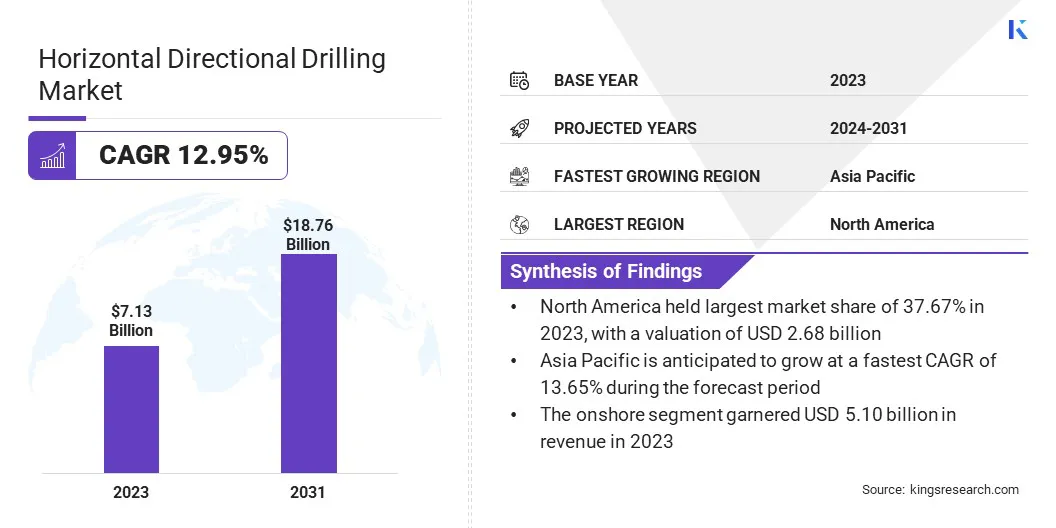

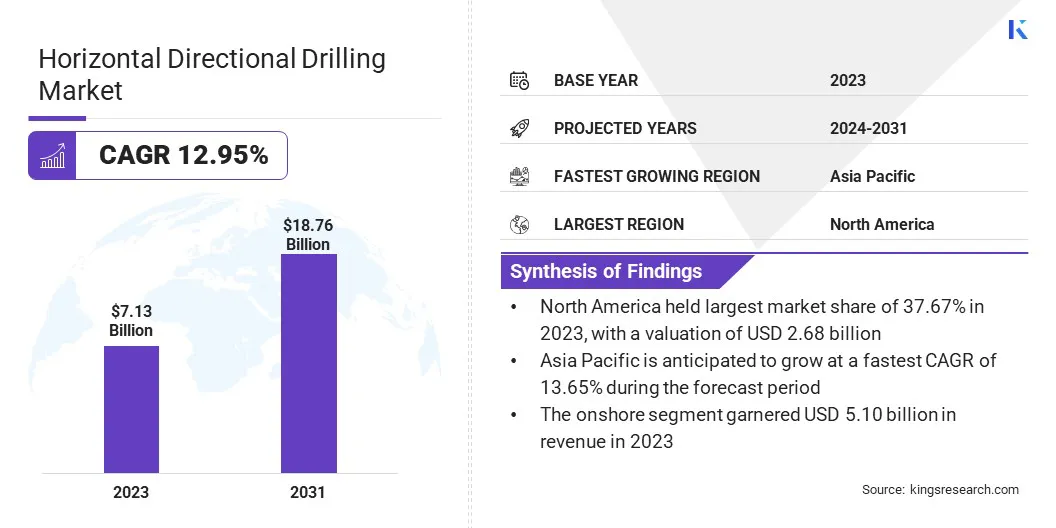

The global horizontal directional drilling market size was valued at USD 7.13 billion in 2023 and is projected to grow from USD 8.00 billion in 2024 to USD 18.76 billion by 2031, exhibiting a CAGR of 12.95% during the forecast period. The market is registering steady growth, due to the increasing demand for trenchless infrastructure solutions that minimize surface disruption in urban and environmentally sensitive areas.

One of the primary growth factors is the rising investment in utility infrastructure, particularly for oil & gas pipelines, water and wastewater systems, and underground power and telecommunication lines. HDD offers an efficient method for pipeline installation across rivers, roads, and congested zones without extensive excavation as global energy needs expand.

Key Market Highlights:

- The horizontal directional drilling industry size was valued at USD 7.13 billion in 2023.

- The market is projected to grow at a CAGR of 12.95% from 2024 to 2031.

- North America held a market share of 37.67% in 2023, with a valuation of USD 2.68 billion.

- The rigs segment garnered USD 2.38 billion in revenue in 2023.

- The oil and gas extraction segment is expected to reach USD 7.04 billion by 2031.

- The onshore segment is expected to reach USD 13.63 billion by 2031.

- The rotary steerable system (RSS) segment is expected to reach USD 11.79 billion by 2031.

- The water-based muds segment is expected to reach USD 9.73 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 13.65% during the forecast period.

Major companies operating in the horizontal directional drilling market are The Toro Company, Baker Hughes Company, Vermeer Corporation, TT Technologies, Inc., Herrenknecht AG, Wuhan Yichao Technology Equipment Co., Ltd, TERRA AG, Universal HDD, StraightLine HDD, Inc., Epiroc AB, Kym Machinery Solutions, Prime Drilling GmbH, Barbco Inc., Chongqing Gold Mechanical & Electrical Equipment Co., Ltd., and Apollo Techno Industries Ltd.

The expansion of high-speed internet and 5G networks has also significantly boosted the demand for underground fiber optic cable installations, further driving the market. Additionally, this market is benefiting from continuous technological advancements that enhance drilling accuracy, reduce project timelines, and improve cost-efficiency, making HDD an increasingly preferred solution across developed and emerging economies.

- In June 2024, American Augers launched the DD600 maxi-rig directional drill, designed to enhance jobsite productivity and uptime in horizontal directional drilling operations. Equipped with a 755 HP Stage engine that operates without diesel exhaust fluid, the DD600 offers increased reliability and ease of transport. With features like a hydraulic catwalk, transport-ready design, and customer-driven enhancements, the DD600 is built to meet the evolving demands of both small and large-scale HDD projects.

Rising Demand for Trenchless Utility

The horizontal directional drilling market is registering robust growth, primarily fueled by the increasing demand for trenchless utility and a surge in investments across oil & gas pipeline infrastructure. Installation of trenchless utility has become the go-to solution for urban and environmentally sensitive regions, as it allows underground utilities such as water lines, gas pipelines, electricity cables, and telecommunications networks to be installed or replaced without significant surface disruption.

This technique reduces the need for open-cut excavation, thereby minimizing environmental impact, lowering restoration costs, and ensuring minimal disturbance to public. Additionally, rising global investments in oil & gas and pipeline infrastructure are playing a pivotal role in driving HDD adoption.

The need for reliable and efficient pipeline installation methods that can traverse diverse geographies, including rivers, highways, and densely populated zones, is growing as countries seek to modernize and expand their energy distribution networks.

HDD offers the precision and durability needed for such complex installations, making it a preferred method in large-scale pipeline projects. The role of HDD in supporting long-distance pipeline connectivity and sustainable infrastructure development is becoming more critical than ever with global energy demands climbing and nations focusing on energy security and transition.

- In April 2025, Cairn Oil & Gas signed a strategic agreement with Parker Wellbore, recently acquired by Nabors Industries, to enhance its exploration and production operations in Rajasthan, India. The partnership involves the deployment of a high-performance 2000HP drilling rig equipped with advanced technologies such as a top drive system, automated pipe handling, and real-time data monitoring to support increased production and exploration efficiency in the Barmer region.

Subsurface Uncertainty

A major challenge in the horizontal directional drilling market is subsurface uncertainty, which stems from the unpredictable and often poorly documented conditions beneath the ground. HDD operations rely heavily on accurate geological and geotechnical data to ensure precise and efficient drilling.

However, in many instances, operators have limited knowledge of critical underground variables such as changing soil compositions, hidden rock formations, groundwater pockets, or unmarked utility infrastructure.

These unknowns can result in severe complications, including tool deflection, borehole collapse, premature wear of equipment, and deviations from the planned bore path. This unpredictability not only heightens the risk of technical failures but also leads to increased operational costs and delays due to troubleshooting, re-drilling, and damage control.

The challenge becomes particularly acute in urban environments and ecologically sensitive areas, where drilling precision is non-negotiable. HDD companies are increasingly adopting pre-drilling geotechnical investigations such as cone penetration testing, soil borings, and ground-penetrating radar to better assess underground conditions before drilling begins.

Furthermore, the use of real-time data acquisition systems and smart navigation technologies enables continuous monitoring and on-the-fly adjustments, significantly reducing the risk associated with unforeseen subsurface conditions.

Integration of Smart Technologies and Support for Renewable Energy Infrastructure

The horizontal directional drilling market is evolving rapidly, driven by two prominent trends: the integration of smart guidance and monitoring technologies, and the increasing use of HDD in renewable energy projects. The adoption of intelligent systems such as real-time data transmission, Machine Learning (ML) algorithms, downhole sensors, and automated navigation has significantly enhanced the accuracy and efficiency of HDD operations.

These technologies enable continuous monitoring of drilling parameters, provide predictive insights for steering adjustments, and minimize human error, leading to safer and more cost-effective project execution, particularly in complex geological environments. Additionally, the growing emphasis on clean energy and sustainable infrastructure is expanding the applications of HDD in renewable energy development.

HDD is increasingly being used to install underground power transmission lines, fiber optic cables, and conduit systems for offshore and onshore renewable energy facilities, such as wind farms and solar parks. This method allows for minimal surface disruption and environmental impact, making it ideal for routing infrastructure through protected or sensitive areas.

As nations scale up their renewable energy commitments, HDD is playing a pivotal role in enabling seamless and low-impact utility integration, solidifying its position as a critical technology in the transition to a sustainable energy future.

- In October 2024, Baltic Power successfully completed the first onshore connection for its offshore wind farm project in the Lubiatowo area through the use of horizontal directional drilling technology. The 1.4 km drill executed under the coastline, beach, and seabed with no direct environmental impact enables cable connections between the Baltic Power offshore wind farm and its onshore substation.

Horizontal Directional Drilling Market Report Snapshot

|

Segmentation

|

Details

|

|

By Parts

|

Rigs, Pipes, Bits, Reamers

|

|

By Application

|

Oil and Gas Extraction, Utility Installation, Telecommunication

|

|

By Location

|

Onshore, Offshore

|

|

By Technology

|

Conventional HDD, Rotary Steerable System (RSS)

|

|

By Drilling Fluid Type

|

Water-based Muds, Oil-based Muds, Synthetic-based Muds

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America : Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Parts (Rigs, Pipes, Bits, and Reamers): The rigs segment earned USD 2.38 billion in 2023, as several infrastructure projects require high-performance drilling equipment for precise underground installations.

- By Application (Oil and Gas Extraction, Utility Installation, Telecommunication): The oil and gas extraction segment held 36.32% share of the market in 2023, due to the increasing energy demand and the need for efficient pipeline deployment in complex terrains.

- By Location (Onshore, Offshore): The onshore segment is projected to reach USD 13.63 billion by 2031, owing to extensive utility and pipeline projects across urban and rural land-based locations.

- By Technology (Conventional HDD, Rotary Steerable System (RSS)): The rotary steerable system (RSS) segment is projected to reach USD 11.97 billion by 2031, owing to its superior directional control, improved drilling efficiency, and reduced downtime.

- By Drilling Fluid Type (Water-based Muds, Oil-based Muds, and Synthetic-based Muds): The water-based muds segment is projected to reach USD 9.73 billion by 2031, owing to their cost-effectiveness, environmental compatibility, and widespread use in standard drilling operations.

Horizontal Directional Drilling Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America horizontal directional drilling market share stood around 37.67% in 2023, with a valuation of USD 2.68 billion. This dominance is primarily attributed to the region’s advanced utility infrastructure and high demand for trenchless technology across oil & gas, telecommunications, and energy sectors. The U.S., in particular, has registered widespread deployment of HDD for shale gas exploration and pipeline replacements in aging urban infrastructure.

Additionally, the extensive roll-out of fiber-optic networks to support high-speed broadband and 5G connectivity has further boosted market demand. The presence of leading HDD equipment manufacturers and service providers in the region has also facilitated innovation and early adoption of advanced drilling technologies, contributing to sustained market leadership.

The horizontal directional drilling industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 13.65% over the forecast period. This rapid expansion is attributed to large-scale urbanization and infrastructure development across countries like China, India, and other Southeast Asian nations.

The increasing need for underground utility installation in densely populated cities, combined with the expansion of power grids, water supply networks, and cross-border pipeline projects, is fueling the demand for HDD solutions.

Moreover, Asia Pacific's investment in undersea cable systems and inter-regional oil & gas transport lines is encouraging the use of HDD technology in both onshore and coastal applications. The growing construction sector and expanding telecom industry in the region are also propelling the HDD market.

Regulatory Frameworks

- In the U.S., HDD is regulated under the Occupational Safety and Health Administration (OSHA) standards for construction safety, Environmental Protection Agency (EPA) guidelines for managing drilling fluids and environmental impact, and state-level permits for right-of-way and utility coordination.

- In the European Union (EU), HDD operations must comply with the EU Machinery Directive, on environmental impact assessment (EIA), and national construction and environmental regulations depending on the member state.

- In China, HDD is governed by technical standards issued by the Ministry of Housing and Urban-Rural Development (MOHURD) and environmental protection laws enforced by the Ministry of Ecology and Environment (MEE), including regulations on drilling fluid disposal and underground utility safety.

- In Japan, HDD is regulated under the Construction Business Act and Industrial Safety and Health Law, with oversight from the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) to ensure safe and compliant infrastructure development.

- In India, HDD activities must adhere to Ministry of Environment, Forest and Climate Change (MoEFCC) guidelines for environmental protection, and standards set by the Bureau of Indian Standards (BIS) and Ministry of Road Transport and Highways (MoRTH) for utility and infrastructure-related drilling.

Competitive Landscape

The horizontal directional drilling industry is characterized by the presence of numerous established players actively pursuing strategies to strengthen their market position and expand their geographic footprint. Key participants are focusing heavily on technological innovation, particularly in enhancing the precision, speed, and efficiency of drilling systems.

Strategic collaborations and joint ventures are common, enabling access to new markets and facilitating the sharing of technical expertise. Many companies are investing in expanding their rental fleets and service capabilities to cater to the growing demand in both mature and emerging markets. Additionally, players are increasingly diversifying their product portfolios by integrating advanced automation, real-time monitoring systems, and environmentally optimized drilling solutions.

Some are pursuing vertical integration strategies to streamline their supply chains and reduce operational costs. Others are enhancing customer support services and offering customized solutions tailored to complex project requirements, aiming to differentiate themselves in a crowded marketplace.

Key Companies in Horizontal Directional Drilling Market:

- The Toro Company

- Baker Hughes Company

- Vermeer Corporation

- TT Technologies, Inc.

- Herrenknecht AG

- Wuhan Yichao Technology Equipment Co., Ltd

- TERRA AG

- Universal HDD

- StraightLine HDD, Inc.

- Epiroc AB

- Kym Machinery Solutions

- Prime Drilling GmbH

- Barbco Inc.

- Chongqing Gold Mechanical & Electrical Equipment Co., Ltd.

- Apollo Techno Industries Ltd.

Recent Developments (Product Launches)

- In November 2024, Vermeer Corporation introduced its new D24 horizontal directional drill, designed specifically for urban utility installation projects. The equipment features automated rod exchange, advanced diagnostics, and a compact, low-noise design, aiming to enhance drilling efficiency and precision in confined urban environments.

- In June 2024, American Augers introduced its catch-rig technology to enhance the efficiency of intersect drilling operations in maxi horizontal directional drilling projects. The system eliminates the need for external swivels on the exit-side rig and allows hydraulic pipe handling through a neutral rotary function. Designed for long-distance and river-crossing bores, the technology reduces connection time, minimizes dwell time in fluid streams, and lowers labor requirements, ultimately accelerating project completion.