Market Definition

The market covers the development and use of metal alloys made from five or more principal elements in near-equal ratios. These alloys are formed through advanced solid-state processing or arc melting techniques, resulting in materials with high strength, corrosion resistance, and thermal stability.

They are used in aerospace, defense, marine, and energy sectors for components exposed to extreme conditions. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

High-Entropy Alloys Market Overview

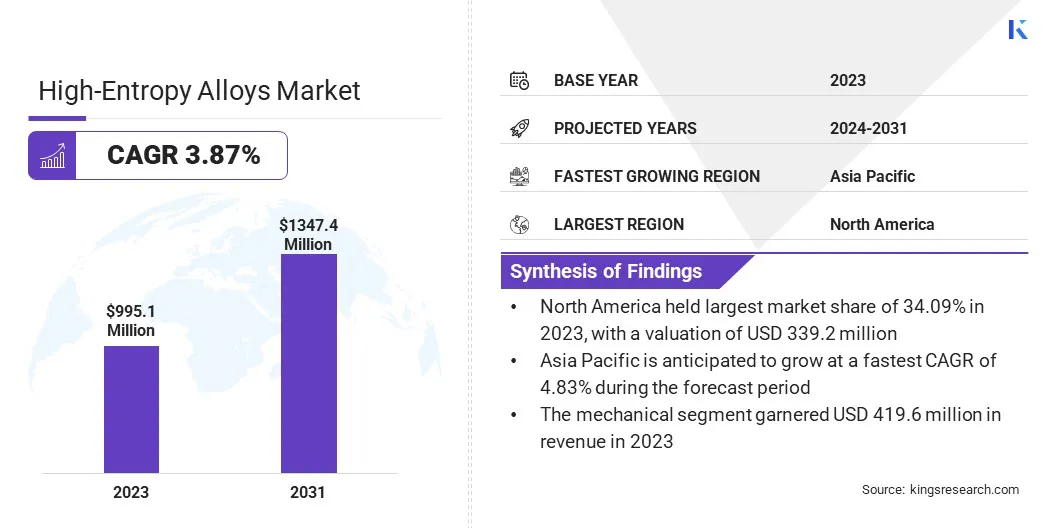

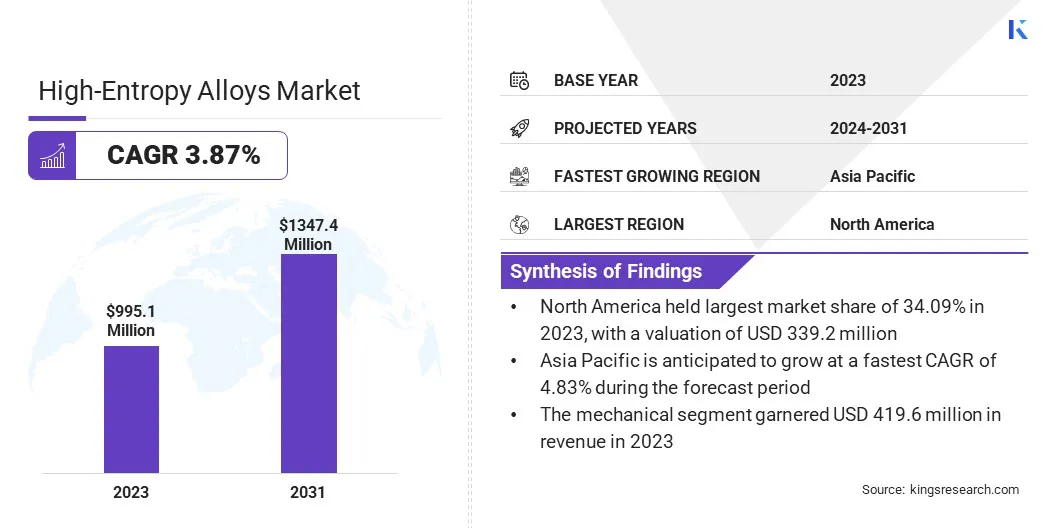

The global high-entropy alloys market size was valued at USD 995.1 million in 2023 and is projected to grow from USD 1032.9 million in 2024 to USD 1347.4 million by 2031, exhibiting a CAGR of 3.87% during the forecast period.

The growth of the market is driven by the increasing demand for advanced materials in the aerospace, automotive, and energy sectors. Their properties, like high strength and corrosion resistance, make them ideal for critical applications. Additionally, ongoing research and development in material science is fostering innovation, and supporting market expansion.

Major companies operating in the high-entropy alloys industry are Heeger Materials Inc., Stanford Advanced Materials, American Elements, 6K Inc., CRS Holdings, LLC., Plansee SE, Sandvik AB, Heraeus Holding GmbH, Aperam S.A., Nippon Yakin Kogyo Co., Ltd., Advanced Technology & Materials Co., Ltd., TANAKA PRECIOUS METAL GROUP Co., Ltd., Allegheny Technologies Incorporated, QuesTek Innovations LLC, and VDM Metals GmbH.

The growth of the market is accelerated by the expansion of additive manufacturing. HEAs are well-suited for 3D printing due to their uniform microstructure and customizable composition. Industries are investing in HEA powders, for producing complex parts with minimal material waste.

This shift toward precision and sustainability in manufacturing is creating long-term growth opportunities for HEA producers, especially in the automotive, medical devices, and aerospace sectors.

- In March 2025, researchers at the University of Tokyo unveiled a novel cellular structure within high-entropy alloys (HEAs) that significantly enhances their strength. This HEA structure is particularly promising for use in high-stress applications such as aerospace, energy, and medical industries. This discovery is expected to improve the material’s resistance to fatigue, heat, and corrosion, which are critical in high-demand sectors.

Key Highlights

Key Highlights

- The high-entropy alloys industry size was valued at USD 995.1 million in 2023.

- The market is projected to grow at a CAGR of 3.87% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 339.2 million.

- The Less than 5 Base Metals segment garnered USD 572.9 million in revenue in 2023.

- The Mechanical segment is expected to reach USD 562.2 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 4.83% during the forecast period.

Market Driver

Growing Focus on Lightweight Materials in the Automotive Sector

Automotive manufacturers are under pressure to improve fuel efficiency and reduce emissions. This shift is driving interest in lightweight and high-strength materials. The U.S. Department of Energy, states that lightweight materials hold strong potential to improve vehicle efficiency. Reducing a vehicle’s weight by 10% can lead to a 6 to 8% improvement in fuel economy.

Replacing conventional cast iron and steel with materials like high-strength steel, aluminum alloys, magnesium alloys, carbon fiber, and polymer composites can cut the weight of a vehicle’s body and chassis by up to 50%, significantly lowering fuel consumption. Integrating such materials into just 25% of the U.S. vehicle fleet could save over 5 billion gallons of fuel annually by 2030.

HEAs offer a promising alternative to conventional steels and alloys due to their exceptional mechanical properties. Their use in electric vehicle components, structural frames, and crash-resistant parts is gaining momentum, making the automotive sector a key contributor to the growth of the high-entropy alloys market globally.

Market Challenge

"High Production Costs and Complex Manufacturing"

A significant challenge the high-entropy alloys market faces is the high production costs and complex manufacturing processes involved in producing these alloys. The use of multiple elements in the composition of HEAs increases material costs and complicates the production process.

To address this challenge, key players are focusing on developing more efficient manufacturing methods, such as additive manufacturing and powder metallurgy, which reduce material waste and production time.

Additionally, advancements in alloy design and process optimization are helping to lower costs, while maintaining the high-performance characteristics of these materials.

Market Trend

"Technological Advancements in Alloy Design"

Advances in computational materials, and science and alloy formulation are helping manufacturers design HEAs with targeted properties. Predictive modeling, thermodynamic simulations, and machine learning tools are allowing for the faster development of application-specific alloys.

These innovations are reducing development costs and timelines, encouraging broader industry adoption. The resulting improvements in efficiency and performance are influencing the expansion of the high-entropy alloys market across industrial applications.

- In February 2025, a research team of the Centre for Nano and Soft Matter Sciences (CeNS) in Bengaluru, India, introduced a new high-entropy alloy (HEA) catalyst, designed to improve green hydrogen production via water electrolysis. This breakthrough aims to provide a more cost-effective alternative to platinum-based materials typically used in clean energy technologies.

High-Entropy Alloys Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Less than 5 Base Metals, Equal & Above 5 Base Metals

|

|

By Application

|

Mechanical, Electrical, Magnetic

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Less than 5 Base Metals, Equal & Above 5 Base Metals): The less than 5 base metals segment earned USD 572.9 million in 2023, due to its cost-effectiveness, simplified production processes, and ability to deliver high-performance materials for a wide range of applications.

- By Application (Mechanical, Electrical, Magnetic): The mechanical segment held 42.17% of the market in 2023, due to the alloys' superior strength, durability, and resistance to wear and corrosion, making them ideal for high-performance applications in industries such as aerospace, automotive, and energy.

High-Entropy Alloys Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America high-entropy alloys market share stood around 34.09% in 2023 in the global market, with a valuation of USD 339.2 million. North America has a mature aerospace and defense industry, that actively invests in advanced materials, boosting the growth of the market.

The North America high-entropy alloys market share stood around 34.09% in 2023 in the global market, with a valuation of USD 339.2 million. North America has a mature aerospace and defense industry, that actively invests in advanced materials, boosting the growth of the market.

Major manufacturers are adopting HEAs to meet performance demands while improving fuel efficiency and reducing maintenance costs. This shift is fueling consistent demand for HEAs in high-specification applications.

Moreover, the region is home to national labs and universities, with a strong focus on material science, including Oak Ridge National Laboratory, MIT, and others. These institutions conduct extensive research into alloy design and performance modeling, influencing the commercial-scale development of HEAs, and speeding up their adoption in critical sectors.

The Asia Pacific high-entropy alloys industry is poised for significant growth at a robust CAGR of 4.83% over the forecast period. The Asia Pacific region is witnessing the rapid adoption of advanced manufacturing technologies in sectors like automotive, electronics, and aerospace.

High-entropy alloys are increasingly used in these areas due to their high strength, corrosion resistance, and thermal stability. The growing integration of additive manufacturing and precision casting processes has supported the demand for HEA powders and components, contributing to the growth of the market in the region.

- In March 2025, Shenzhen Addireen Technologies unveiled the XH-M660G system, a green laser metal additive manufacturing solution designed for high-performance production. The machine is equipped with four proprietary single-mode green fiber lasers, bidirectional recoating, and precision optical calibration. It is optimized for printing highly reflective materials such as pure copper and copper alloys.

Regulatory Frameworks

- In the U.S., HEAs are subject to regulations under the Toxic Substances Control Act (TSCA), administered by the Environmental Protection Agency (EPA). Manufacturers must ensure that chemical substances used in HEAs, are listed on the TSCA Inventory or have appropriate exemptions.

- The European Union regulates chemical substances through the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) Regulation. Under REACH, manufacturers and importers must register chemical substances used in HEAs, providing data on their properties and safe use. This ensures a high level of protection for human health and the environment.

- China's Ministry of Industry and Information Technology (MIIT), oversees industrial policies affecting HEAs. Recent regulations aim to tighten control over critical materials, including rare earth elements essential for HEA production. These measures include quotas for mining and smelting, as well as a traceability system for rare earth products, to protect domestic supply and national security interests.

Competitive Landscape

Market players are adopting strategies such as the development of new products and expanding their product portfolios, which is contributing to the growth of the market.

By introducing innovative solutions like high-entropy alloy powders made from precious metals, companies are enhancing their competitive edge and meeting the growing demand for advanced materials in various industries.

- In October 2023, TANAKA Kikinzoku Kogyo launched a high-entropy alloy powder made from precious metals, featuring a fine particle size of 10µm or smaller, with high crystallinity and exceptional composition uniformity. This product is the world’s first high-entropy alloy powder, composed solely of five precious metals: platinum (Pt), palladium (Pd), iridium (Ir), ruthenium (Ru), and rhodium (Rh).

List of Key Companies in High-Entropy Alloys Market:

- Heeger Materials Inc

- Stanford Advanced Materials

- American Elements

- 6K Inc.

- CRS Holdings, LLC.

- Plansee SE

- Sandvik AB

- Heraeus Holding GmbH

- Aperam S.A.

- Nippon Yakin Kogyo Co., Ltd.

- Advanced Technology & Materials Co., Ltd.

- TANAKA PRECIOUS METAL GROUP Co., Ltd.

- Allegheny Technologies Incorporated

- QuesTek Innovations LLC

- VDM Metals GmbH

Recent Developments (Product Launch)

- In April 2025, QuesTek Innovations launched a novel high-entropy alloy (HEA) tailored for aerospace and defense applications. Utilizing their Integrated Computational Materials Design (ICMD) platform, QuesTek engineered this HEA to exhibit exceptional strength-to-weight ratios and thermal stability, meeting the stringent requirements of next-generation aircraft and defense systems.

Key Highlights

Key Highlights The North America high-entropy alloys market share stood around 34.09% in 2023 in the global market, with a valuation of USD 339.2 million. North America has a mature aerospace and defense industry, that actively invests in advanced materials, boosting the growth of the market.

The North America high-entropy alloys market share stood around 34.09% in 2023 in the global market, with a valuation of USD 339.2 million. North America has a mature aerospace and defense industry, that actively invests in advanced materials, boosting the growth of the market.