Market Definition

A hemostasis valve is a specialized medical device designed to maintain a secure seal around interventional instruments during catheter-based procedures, thereby minimizing blood loss and preserving procedural integrity.

The market includes a range of devices used in minimally invasive procedures across interventional cardiology, radiology, and related disciplines. It covers product variations suited to specific clinical needs, with utilization spanning hospitals, surgical centers, and specialty clinics for both diagnostic and therapeutic purposes.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Hemostasis Valve Market Overview

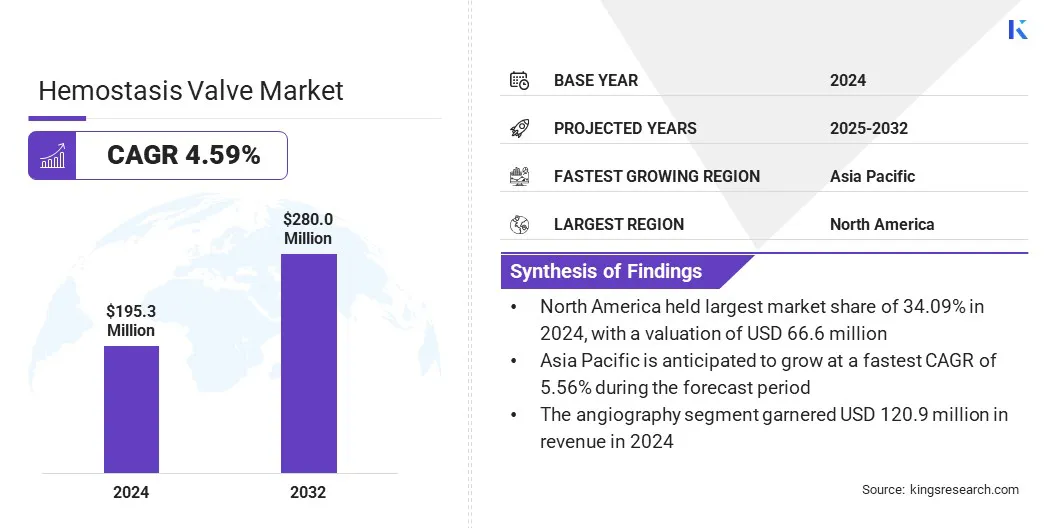

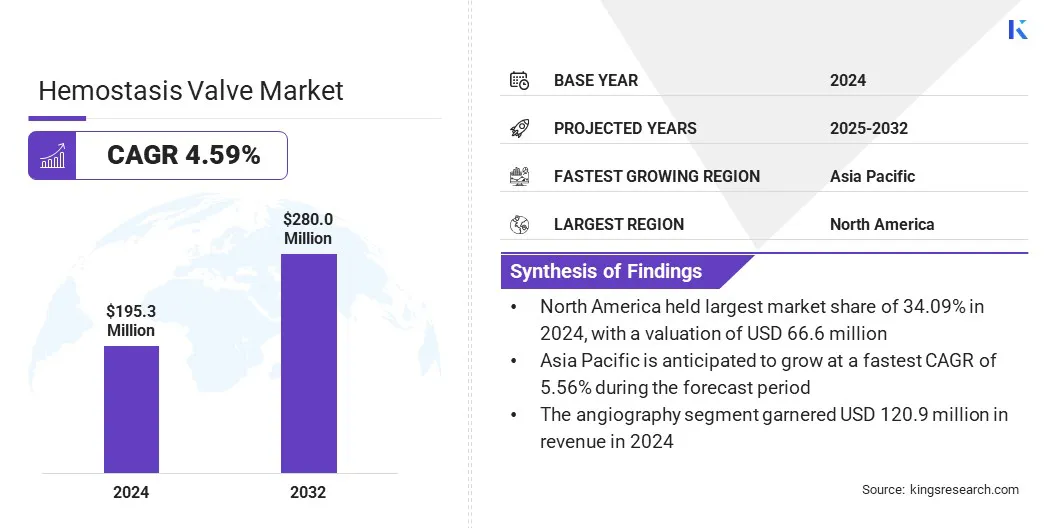

According to Kings Research, the global hemostasis valve market size was valued at USD 195.3 million in 2024 and is projected to grow from USD 204.1 million in 2025 to USD 280.0 million by 2032, exhibiting a CAGR of 4.59% during the forecast period.

The market is witnessing growth due to the rising adoption of minimally invasive procedures across interventional cardiology, radiology, and other specialties. The increasing use of catheter-based techniques is driving the demand for devices that ensure effective vascular access and bleeding control.

Key Market Highlights:

- The hemostasis valve market size was valued at USD 195.3 million in 2024.

- The market is projected to grow at a CAGR of 4.59% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 66.6 million.

- The hemostasis valve y-connectors segment garnered USD 70.7 million in revenue in 2024.

- The angiography segment is expected to reach USD 169.2 million by 2032.

- The hospitals segment is expected to reach USD 112.1 million by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.56% during the forecast period.

Major companies operating in the hemostasis valve industry are Boston Scientific Corporation, Merit Medical Systems, Teleflex Incorporated, TERUMO CORPORATION, Freudenberg Medical, Argon Medical Devices, B. Braun SE, Shenzhen Antmed Co., Ltd., Medline Industries, LP, DeRoyal Industries, Inc., Lepu Medical Technology(Beijing)Co., Ltd., Qosina, SCW Medicath Ltd, Excel Medical Products, Inc., and Galt Medical Corp.

Advancements in valve technology are improving procedural safety and efficiency, which is encouraging utilization across hospital and ambulatory care settings.

In addition, the expanding elderly population and the rise in chronic vascular conditions are contributing to a higher number of vascular procedures being performed across hospitals and specialty clinics. These factors are contributing to the sustained growth of the global market.

Rising Demand for Reliable Valve Systems in Minimally Invasive Procedures

The market is propelled by the growing prevalence of minimally invasive surgeries and catheter-based interventions. These procedures require effective control of blood flow to prevent blood loss and ensure patient safety.

Hemostasis valves help maintain vascular access-site integrity, which is crucial during complex interventions. Advancements in medical technology and a preference for less invasive methods are driving steady growth in these procedures.

This trend drives higher demand for reliable, high-performance valve systems that can support safe and efficient operations. Additionally, the expanding use of minimally invasive techniques serves as a major market driver, boosting the adoption of hemostasis valves across various healthcare settings worldwide.

Material Compatibility and Leakage Issues in Hemostasis Valves

A major challenge in the hemostasis valve market is ensuring material compatibility and preventing leakage during complex procedures. Incompatible materials can cause valve degradation or malfunction, leading to blood loss and procedural complications.

Additionally, maintaining a secure seal under varying pressure conditions is critical but difficult to achieve consistently. To overcome this, manufacturers are focusing on innovative biomaterials and precision engineering to enhance valve durability and sealing performance.

Innovations such as multi-layer valve designs and improved elastomer formulations help minimize leakage risks and extend device lifespan. These solutions contribute to safer procedures and increased clinician confidence, helping to address one of the key barriers limiting broader adoption of hemostasis valves.

Advancements in Design and Technology Enhancing Hemostasis Valve Efficiency

A key trend in the market is ongoing innovation and evolving technology in response to the growing need for improved device performance in complex interventional procedures. Manufacturers are focused on developing advanced valve designs that enhance precision, durability, and ease of use during minimally invasive procedures.

These technological improvements include integrated sealing mechanisms, enhanced material quality, and compatibility with a broader range of catheter sizes. Such advancements aim to reduce blood loss, improve procedural efficiency, and increase patient safety.

The continuous evolution of hemostasis valve technology is crucial to meeting the growing demands of complex interventional procedures and supporting the shift toward less invasive treatment options.

- In January 2025, Penumbra, Inc. launched the Element Vascular Access System, featuring the HemoLock Valve System with dual-valve engineering to ensure effective hemostasis during venous thromboembolism procedures. The system is designed for use with the Lightning Flash 2.0 thrombectomy device and includes a laser-cut hypotube sheath engineered for enhanced flexibility, support, and procedural control.

Hemostasis Valve Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Hemostasis Valve Y-Connectors, Double Y-Connector Hemostasis Valves, One-Handed Hemostasis Valves, Others

|

|

By Application

|

Angiography, Angioplasty

|

|

By End Use

|

Hospitals, Ambulatory Surgical Centers, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Hemostasis Valve Y-Connectors, Double Y-Connector Hemostasis Valves, One-Handed Hemostasis Valves, and Others): The hemostasis valve Y-connectors segment earned USD 7 million in 2024 due to their widespread use in guiding catheters and ensuring secure vascular access during interventional procedures.

- By Application (Angiography and Angioplasty): The angiography segment held 61.92% of the market in 2024, due to the high frequency of diagnostic imaging procedures requiring controlled arterial access.

- By End Use (Hospitals, Ambulatory Surgical Centers, and Others): The hospitals segment is projected to reach USD 112.1 million by 2032, owing to the growing number of complex interventions performed in inpatient settings supported by advanced infrastructure.

Hemostasis Valve Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for a substantial share of 34.09% in 2024 in the global market, with a valuation of USD 66.6 million. This region holds a significant share of the hemostasis valve market due to the widespread use of interventional procedures across large hospital networks and cardiac centers.

The increasing prevalence of cardiovascular diseases is driving higher demand for vascular procedures in tertiary care centers. High procedural volumes, especially in cardiovascular and peripheral vascular applications, is driving consistent demand for vascular access devices across this region.

Moreover, the presence of leading medical device manufacturers and research institutions that facilitate early access to advanced valve technologies is further driving market growth. Additionally, well-established distribution networks and continuous investments by key players and the private healthcare sector in interventional care contribute to the region’s steady position in the global market.

- In October 2024, the Centers for Disease Control and Prevention (CDC) reported heart disease as the leading cause of death in the U.S., accounting for one in every five deaths in 2022.

The hemostasis valve industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 5.56% over the forecast period. This region is experiencing rapid growth in interventional healthcare services, fueled by expanding hospital infrastructure across key countries.

Healthcare professionals routinely use hemostasis valves during angiographic and endovascular interventions to improve procedural control. Early adoption of minimally invasive technologies is sustaining steady market demand.

Additionally, the rise of private healthcare providers and advancements in clinical expertise are promoting wider use of hemostasis valves across various medical specialties throughout the region.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates hemostasis valves to ensure their safety and effectiveness. The FDA’s Center for Devices and Radiological Health (CDRH) evaluates device submissions, oversees post-market surveillance, and enforces quality standards to confirm that the valves comply with safety and performance requirements throughout their lifecycle.

- In Europe, hemostasis valves are regulated under the Medical Devices Regulation (MDR). This regulation is enforced by notified bodies designated by European Union member states, which assess the conformity, safety, and performance of medical devices before granting market approval.

Competitive Landscape

The hemostasis valve market is characterized by key players focusing on strategic initiatives to strengthen their positions. Product innovation remains a key priority, with companies enhancing valve designs to improve usability and compatibility with various medical devices.

Strategic collaborations and partnerships accelerate product development and broaden market presence. Geographic expansion through subsidiaries and regional offices facilitates access to emerging markets. Mergers and acquisitions are undertaken to diversify product portfolios and incorporate advanced technologies.

Compliance with regulatory standards and quality requirements supports smooth market entry. These approaches enable organizations to sustain growth and effectively address evolving market demands.

- In June 2023, SYNDEO Medical launched Rover SA, a spring-actuated hemostasis valve designed to support interventional procedures. The device features a two-seal mechanism to minimize blood loss and is compatible with up to 9.5 French devices. Rover SA is offered both as a standalone product and as part of the SYNDEOPack interventional procedure kits.

Key Companies in Hemostasis Valve Market:

- Boston Scientific Corporation

- Merit Medical Systems

- Teleflex Incorporated

- TERUMO CORPORATION

- Freudenberg Medical

- Argon Medical Devices

- B. Braun SE

- Shenzhen Antmed Co., Ltd.

- Medline Industries, LP

- DeRoyal Industries, Inc.

- Lepu Medical Technology(Beijing)Co., Ltd.

- Qosina

- SCW Medicath Ltd

- Excel Medical Products, Inc.

- Galt Medical Corp.

Together