Market Definition

The market encompasses software solutions that facilitate communication, data integration, and interoperability among disparate healthcare information systems. Key components include enterprise application integration, messaging middleware, and database middleware.

The market covers services and products enabling clinical, financial, and administrative data exchange across hospitals, laboratories, and healthcare payers. Its scope spans electronic health records (EHR), telemedicine, and medical imaging systems, supporting enhanced workflow efficiency, compliance, and patient care delivery.

The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Healthcare Middleware Market Overview

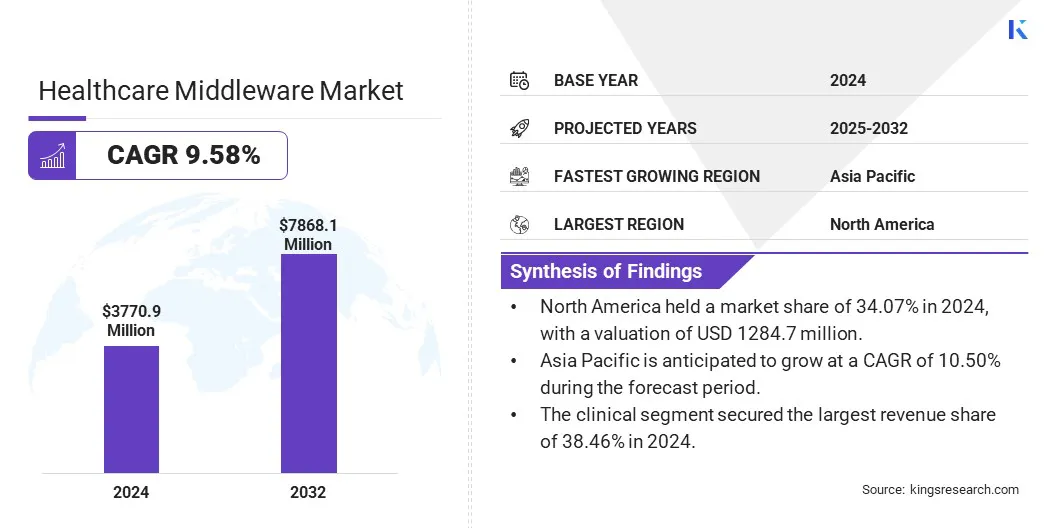

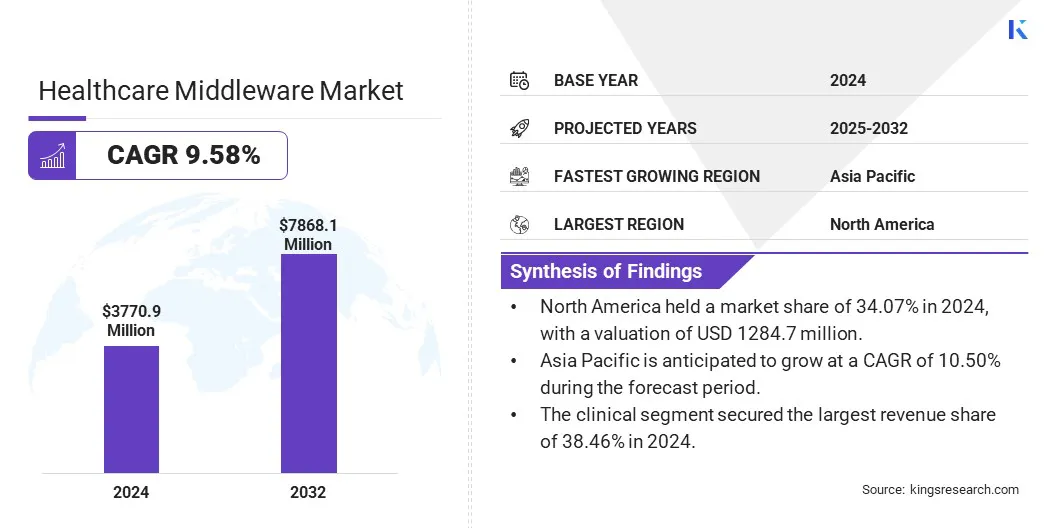

The global healthcare middleware market size was valued at USD 3770.9 million in 2024 and is projected to grow from USD 4123.4 million in 2025 to USD 7868.1 million by 2032, exhibiting a CAGR of 9.58% during the forecast period.

Rising government investments and the growing adoption of integrated EHR solutions are driving the growth of the market by enhancing interoperability, real-time data exchange for improved patient outcomes.

Key Market Highlights:

- The healthcare middleware market size was recorded at USD 3770.9 million in 2024.

- The market is projected to grow at a CAGR of 9.58% from 2025 to 2032.

- North America held a market share of 34.07% in 2024, with a valuation of USD 1284.7 million.

- The integration middleware segment garnered USD 1365.5 million in revenue in 2024.

- The on-premise segment is expected to reach USD 2937.8 million by 2032.

- The clinical segment secured the largest revenue share of 38.46% in 2024.

- The healthcare providers are poised for a robust CAGR of 9.86% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 10.50% during the forecast period.

Major companies operating in the healthcare middleware industry are eHealth Technologies, McKesson Medical-Surgical Inc., GE HealthCare., NXGN Management, LLC., InterSystems Corporation, Oracle, athenahealth, Siemens Healthcare Private Limited, SAP SE,Medical Information Technology, Inc., eClinicalWorks, LLC, Veradigm LLC, Cloud Software Group, Inc., Fujitsu, and Orion Health group of companies.

The rising adoption of electronic health records (EHRs) across healthcare facilities is accelerating demand for advanced middleware solutions. These platforms streamline data integration, enhance interoperability among disparate systems, and ensure real-time access to patient information.

Additionally, the growing regulatory mandates for secure, standardized data exchange are further fueling the demand for robust middleware for improved clinical outcomes and operational efficiency.

Market Driver

Government Healthcare Investments Fuel Middleware Adoption

Rising government investments in healthcare infrastructure are significantly driving the market. Strategic funding in healthcare IT modernization is strengthening digital health ecosystems, enabling seamless data integration, interoperability, and real-time analytics across healthcare systems.

These initiatives accelerate the adoption of advanced IT solutions that enable efficient clinical workflows and improved patient outcomes.

- In April 2025, the American Medical Association reported that U.S. health spending rose by 7.5% in 2023, reaching USD 4.9 trillion, or USD 14,570 per person. The total health expenditures accounted for 17.6% of the total GDP in 2023.

Market Challenge

Complexity in Integrating Fragmented Healthcare IT Ecosystems

The healthcare middleware market faces a significant challenge in integrating disparate healthcare IT systems, hindering seamless data exchange and interoperability. Legacy infrastructure and fragmented data environments impede real-time decision-making and patient care coordination.

To address this, manufacturers are investing in advanced middleware solutions with enhanced interoperability standards, cloud-based architecture, and API-driven frameworks. Strategic collaborations with healthcare providers and EHR vendors are also being pursued to ensure streamlined integration.

Additionally, manufacturers are focusing on scalable, modular platforms to accommodate diverse clinical workflows and regulatory requirements, thereby improving system efficiency and operational continuity.

Market Trend

Advancing Clinical Decision Support Through Integrated EHR Solutions

A prominent trend in the market is the increasing adoption of integrated EHR solutions to advance clinical decision support.

This shift toward enhanced interoperability and real-time data exchange is enabling healthcare providers to access comprehensive patient information effortlessly. It supports more accurate diagnostics and personalized treatment plans and supports the modernization of healthcare delivery systems.

- I In January 2025, Vim introduced Care Insights, an innovative solution that seamlessly integrates patient-specific, actionable data into native EHR workflows. Designed to enhance diagnosis accuracy and streamline care gap management.

Healthcare Middleware Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Integration Middleware (Enterprise Service Bus), Communication Middleware (Message-oriented Middleware, Multifunction Communication Middleware, Remote Procedure Calls), Platform Middleware (Application Servers, Web Portals and Servers, Database Middleware)

|

|

By Deployment

|

Cloud Based, On-Premise, Hybrid

|

|

By Application

|

Clinical, Financial, Operational & Administrative

|

|

By End User

|

Healthcare Payers, Healthcare Providers, Life Science Organizations, Clinical Laboratories

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Integration Middleware, Communication Middleware, Platform Middleware): The integration middleware segment earned USD 1365.5 million in 2024 due to its ability to enable seamless interoperability between disparate healthcare systems, facilitating efficient data exchange essential for improved clinical outcomes and regulatory compliance.

- By Deployment (Cloud Based, On-Premise, Hybrid): The on-premise segment held 37.70% of the market in 2024, due to its enhanced data security, greater control over system infrastructure, and compliance with strict healthcare regulations.

- By Application (Clinical, Financial, Operational & Administrative): The clinical segment is projected to reach USD 3029.2 million by 2032, owing to the growing need for real-time data integration and interoperability to support clinical decision-making, patient monitoring, and improved healthcare outcomes.

- By End User (Healthcare Payers, Healthcare Providers, Life Science Organizations, Clinical Laboratories): The healthcare payers segment earned USD 1407.8 million in 2024 due to the increasing demand for efficient claims processing, data management, and integration solutions that enhance operational efficiency and cost control.

Healthcare Middleware Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America healthcare middleware market share stood at around 34.07% in 2024 in the global market, with a valuation of USD 1284.7 million. This dominance is attributed to the high prevalence of chronic diseases, which requires advanced healthcare IT infrastructure to streamline clinical workflows and improve patient outcomes.

Moreover, the increasing adoption of electronic health records (EHRs), coupled with substantial investments in healthcare interoperability solutions, further drives demand. Additionally, favorable regulatory frameworks and the presence of leading market players are contributing to the market growth across the region.

- In April 2025, the U.S. National Institute for Health Care Management (NIHCM) reported a growing burden of chronic diseases, noting that 90% of the USD 4.5 trillion spent on U.S. healthcare in 2022 was allocated to treating individuals with chronic physical and mental health conditions.

Asia Pacific is poised for significant growth at a robust CAGR of 10.50% over the forecast period. The growth is driven by the rapid digitalization of healthcare infrastructure and increasing investments in health IT. Government initiatives supporting eHealth, expanding healthcare access, and rising demand for integrated clinical systems are further accelerating the market growth.

Additionally, the growing prevalence of chronic diseases and the presence of a large aging population is increasing the demand for efficient data integration, fueling demand for middleware solutions.

Regulatory Frameworks

- In the U.S., the Health Insurance Portability and Accountability Act (HIPAA) requires middleware handling electronic health records (EHRs) or patient data to comply with its regulations. It encompasses the Privacy Rule to protect PHI, the Security Rule for ePHI safeguards, and the Enforcement Rule detailing penalties for non-compliance.

- In India, the Digital Personal Data Protection Act (DPDPA), 2023, governs all digital processing of personal data, including sensitive health information. Middleware solutions involved in handling such data must ensure consent-based processing, implement appropriate security measures, and comply with data localization requirements.

Competitive Landscape

The healthcare middleware market is highly competitive with market players actively developing new products and strategic technologies. Key players are introducing advanced integration platforms and interoperability solutions to streamline clinical workflows and enhance data connectivity.

Moreover, there is increasing emphasis on real-time data exchange, cloud-based middleware, and scalable architectures to address the growing demand for healthcare digitization. These developments are positioning vendors to strengthen their market presence and meet evolving regulatory and operational requirements across diverse healthcare ecosystems.

- In May 2025, Pulmonary and Sleep of Tampa Bay, Florida implemented healow Genie an innovative, EHR-agnostic, AI-powered contact center solution developed by eClinicalWorks. With support for text, chatbot, and voice call interactions, healow Genie enables patients to access and engage with their health information around the clock. The AI agent handles tasks such as appointment scheduling and billing management.

Key Companies in Healthcare Middleware Market:

- eHealth Technologies

- McKesson Medical-Surgical Inc.

- GE HealthCare.

- NXGN Management, LLC.

- InterSystems Corporation

- Oracle

- athenahealth

- Siemens Healthcare Private Limited

- SAP SE

- Medical Information Technology, Inc.

- eClinicalWorks, LLC

- Veradigm LLC

- Cloud Software Group, Inc.

- Fujitsu

- Orion Health group of companies.

Recent Developments (Partnerships/Product Launch)

- In November 2024, Silk partnered with Franciscan Health to migrate and manage their Epic Electronic Health Records (EHR) on Microsoft Azure. This strategic move positions Franciscan Health as a healthcare industry leader, enhancing their ability to manage growing data, meet regulatory requirements, and leverage Artificial Intelligence. It supports delivering advanced patient care and ensures a seamless experience for patients, providers, and payers while preparing for future healthcare innovations.

- In March 2024, eHealth Technologies unveiled a major upgrade to its advanced technology platform. By incorporating artificial intelligence (AI), the company aims to accelerate patient treatment times by enhancing the efficiency of gathering, organizing, and delivering comprehensive medical histories to healthcare providers.

eClinicalWorks announced that