Market Definition

Healthcare Extended Reality (XR) encompasses the use of immersive technologies including virtual reality, augmented reality, and mixed reality to advance clinical practice, medical education, and patient interaction. In healthcare, XR applications allow surgeons to rehearse complex procedures in controlled environments, lead clinicians to visualize intricate anatomical structures, facilitate remote consultations through interactive platforms.

XR also delivers therapeutic interventions for rehabilitation, pain management, and mental health care. Merging real and digitally simulated environments, healthcare XR enhances clinical decision-making, strengthens operational efficiency, and supports improved patient outcomes while optimizing training resources and expanding access to advanced care.

Healthcare Extended Reality Market Overview

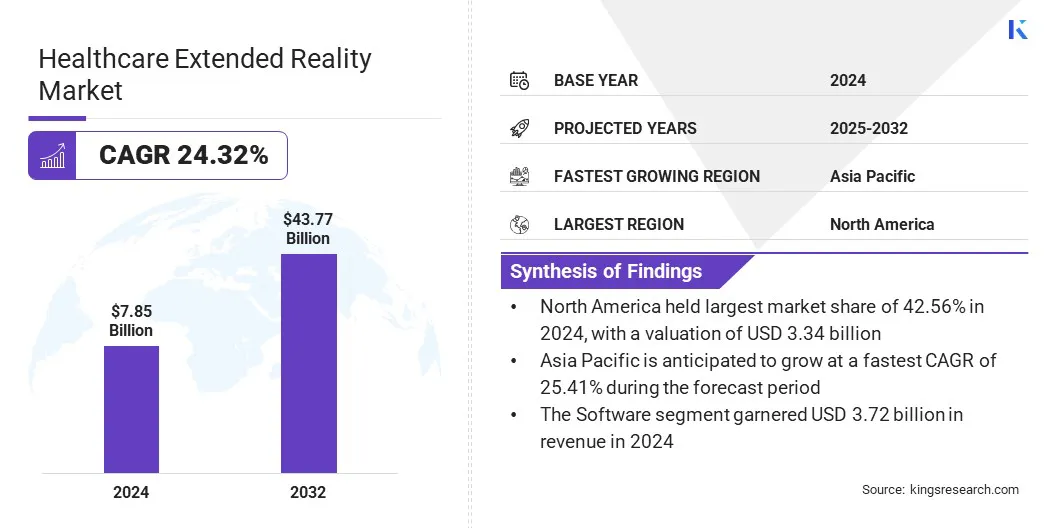

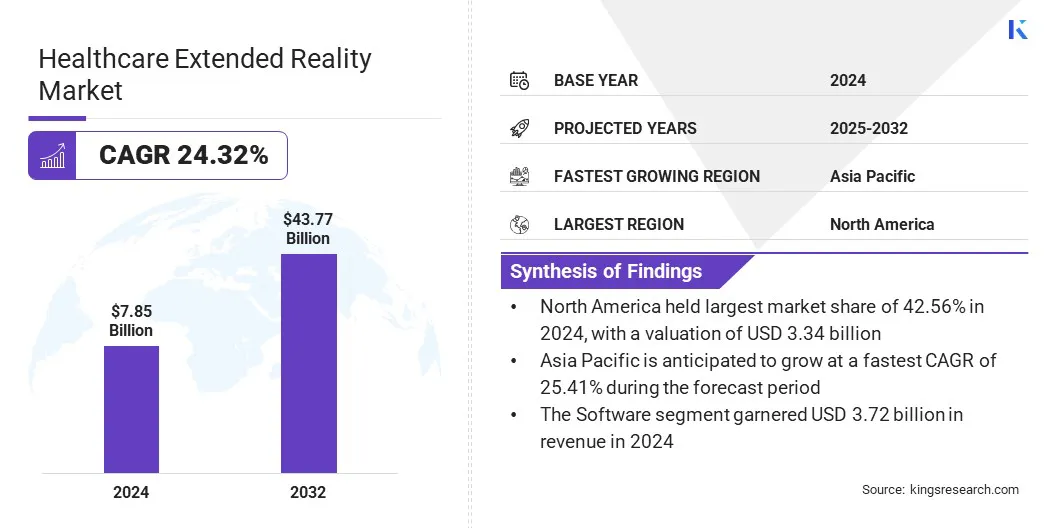

The global healthcare extended reality market size was valued at USD 7.85 billion in 2024 and is projected to grow from USD 9.53 billion in 2025 to USD 43.77 billion by 2032, exhibiting a CAGR of 24.32% over the forecast period.

The healthcare extended reality (XR) market is experiencing robust growth, driven by rising adoption of virtual reality, augmented reality, and mixed reality solutions in medical training, surgical planning, and patient care. Advancements in AR, VR, and MR solutions, along with increasing adoption in clinical care and rehabilitation, are further driving expansion across healthcare sector.

Key Highlights:

- The healthcare extended reality industry size was recorded at USD 7.85 billion in 2024.

- The market is projected to grow at a CAGR of 24.32% from 2024 to 2032.

- North America held a market share of 24.61% in 2024, with a valuation of USD 3.34 billion.

- The software segment garnered USD 3.72 billion in revenue in 2024.

- The augmented reality segment is expected to reach USD 19.61 billion by 2032.

- The surgery segment is expected to register a market share of 31.00% by 2032.

- The hospitals & clinics segment registered a market share of 53.80% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 25.41% over the forecast period.

Major companies operating in the healthcare extended reality market are Microsoft, Apple Inc., Osso VR, Inc., PrecisionOS, MEDIVIS, Augmedics, Surgical Theater, Inc., EchoPixel, Proprio, Medtronic, AccuVein, XRHealth, MindMaze, Virtuleap Inc, and Brainlab SE.

Market growth in the healthcare extended reality (XR) sector is being driven by continuous innovation and strategic initiatives from leading technology providers. Companies are increasingly introducing next-generation XR solutions that integrate advanced visualization, interoperability, and AI capabilities to enhance clinical adoption.

- For instance, in October 2024, Osso VR expanded into custom XR healthcare solutions designed specifically for pharmaceutical companies’ advanced products and treatments. This initiative allows pharmaceutical teams to visualize complex treatment protocols, conduct interactive demonstrations, and enhance clinical staff preparedness for new products.

Rising Demand for Patient-Centric Care and Engagement

The growth of the healthcare extended reality (XR) market is driven by the increasing application of immersive technologies in rehabilitation, pain management, and mental health therapy.

- According to the World Health Organization (WHO), nearly 1 in 8 people globally live with a mental health disorder, underscoring the need for innovative therapeutic approaches that extend beyond conventional care models.

XR-based platforms are enabling clinicians to provide more patient-centric care by offering innovative treatment modalities. Virtual reality (VR) environments are increasingly utilized to deliver distraction techniques that reduce reliance on pharmacological interventions for pain relief.

Moreover, augmented reality (AR) applications support guided physical therapy by providing real-time visual cues that enhance patient adherence and recovery outcomes. Similarly, VR-based cognitive behavioral therapy (CBT) modules are gaining adoption in the treatment of anxiety, post-traumatic stress disorder (PTSD), and related conditions, thereby driving the market demand.

Regulatory and Data Security Barriers

A key challenge in the healthcare extended reality (XR) market is the complexity of regulatory compliance and the increasing need for data security, which hampers large-scale adoption. XR platforms capture sensitive patient data, integrate with electronic health records (EHRs), and operate in telemedicine environments, making them subject to strict regulatory oversight.

Obtaining approvals from agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) involves lengthy evaluation processes that increase time-to-market and raise development costs.

To address this challenge, companies are investing in robust cybersecurity frameworks, enhancing encryption protocols, and adopting interoperability standards to ensure secure data exchange. Market players are collaborating with regulators to establish clearer compliance guidelines and accelerate approval timelines. These initiatives are aimed at making XR technologies more scalable and accessible across diverse healthcare settings, thereby supporting broader market adoption.

Integration of AI and Data Analytics in XR-Enabled Healthcare Solutions

A key trend shaping the healthcare extended reality (XR) market is the integration of artificial intelligence (AI) and data-driven analytics with healthcare extended reality (XR) platforms enhances therapeutic precision and improves clinical outcomes. AI-enabled XR platforms are enhancing personalized rehabilitation programs by optimizing patient engagement and adapting to treatment protocols in real time based on biometric and behavioral feedback.

These advancements support more effective therapy delivery, improve patient adherence, and allow healthcare providers to scale immersive care models across diverse clinical settings. The convergence of XR and AI enhances clinical analytics, improves procedural accuracy, and supports evidence-based decision-making, further contributing to market adoption.

- In November 2024, XRHealth launched an AI-powered medical XR platform, representing a notable advancement in the integration of artificial intelligence with immersive therapeutic technologies. The platform is designed to support clinical interventions and patient care by enhancing treatment precision, enabling data-driven decision-making, and improving measurable clinical outcomes.

Healthcare Extended Reality Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Technology

|

Augmented Reality (AR), Virtual Reality (VR), Mixed Reality (MR)

|

|

By Application

|

Surgery, Therapy, Education & Training, Rehabilitation, Others

|

|

By End-User

|

Hospitals & Clinics, Pharma Companies, Research Organizations & Diagnostic Laboratories, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Component (Hardware, Software, and Services): The hardware segment earned USD 2.56 billion in 2024, driven by growing adoption of advanced XR headsets, surgical displays, and motion-tracking devices.

- By Technology (Augmented Reality (AR), Virtual Reality (VR), and Mixed Reality (MR)): The augmented reality held 43.23% of the market in 2024, supported by its extensive use in surgical navigation, medical imaging overlays, and guided rehabilitation therapies.

- By Application (Surgery, Therapy, Education & Training, and Rehabilitation): The surgery segment is projected to reach USD 13.57 billion by 2032, owing to growing adoption of XR-assisted surgical planning, intraoperative visualization, and simulation-based practice.

- By End-User (Hospitals & Clinics, Pharma Companies, Research Organizations & Diagnostic Laboratories, and Others): The hospitals & clinics segment is expected to register a market share of 58.59% by 2032, driven by the adoption of XR technologies for advanced diagnostics, surgical planning, and patient care optimization.

Healthcare Extended Reality Market Regional Analysis

Based on region, the market is classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America healthcare extended reality market share stood at 24.61% in 2024, with a valuation of USD 3.34 billion. This dominance is attributed to a robust healthcare infrastructure, early technology adoption, and significant investment by public and private sectors in digital health solutions.

- For instance, in February 2024, Pixee Medical, a significant player in augmented reality navigation technologies for orthopedic surgery, raised USD 15 million in a funding round led by Relyens Innovation Santé, UI Investissement, Innovacom, Angelor, and Bpifrance. This is directed toward accelerating the company’s U.S. expansion and supporting the launch of its next-generation AR-based surgical solutions.

Furthermore, supportive reimbursement and favorable regulatory frameworks are accelerating the adoption of XR in surgical training, rehabilitation, and remote care across the region. Additionally, government-led deployments, such as the U.S. Department of Veterans Affairs (VA) implementing virtual reality programs for pain management and post-traumatic stress disorder (PTSD) therapy, demonstrate formal institutional adoption of XR technologies in clinical settings.

These programs highlight how healthcare institutions are actively integrating immersive solutions into standard care pathways, reflecting recognition of their therapeutic efficacy and operational value. Strategic collaborations between technology providers and healthcare systems are further reinforcing North America’s dominance in the global healthcare XR market.

Asia-Pacific is poised for significant growth at a robust CAGR of 25.41% over the forecast period. This growth is driven by expanding healthcare expenditure, rising patient volumes, and increasing adoption of digital health solutions.

Growing demand for skilled medical professionals has prompted governments and academic institutions in countries such as China, Japan, and India to adopt XR-based medical training platforms, reducing dependency on physical resources and enhancing clinical competencies.

Additionally, rising awareness of mental health and rehabilitation needs is encouraging the adoption of XR therapies tailored for pain management, anxiety, and post-traumatic stress disorder. Public–private collaborations are further accelerating the integration of XR into healthcare practices across the region.

- In May 2025, MediThinQ partnered with Sinopharm to distribute its XR surgical display, Scopeye, across China, marking the company’s entry into the market. The platform enhances surgeons’ real-time access to critical information during procedures.

Regulatory Frameworks

- In the U.S., the U.S. Food and Drug Administration (FDA) regulates healthcare XR solutions that qualify as medical devices, particularly those used for surgical navigation, rehabilitation, or diagnostics. Platforms must undergo 510(k) clearance, De Novo classification, or Premarket Approval (PMA), depending on risk. The FDA also enforces standards for Software as a Medical Device (SaMD), which applies to XR systems incorporating AI, data visualization, and clinical decision support.

- In the EU, the European Medicines Agency (EMA) and national authorities enforce the Medical Device Regulation (MDR), requiring CE marking for commercialization. XR medical systems must demonstrate safety, performance, and clinical evidence, while post-market surveillance and cybersecurity compliance are emphasized. The EU’s General Data Protection Regulation (GDPR) further governs the use of patient data in XR platforms.

- In China, the National Medical Products Administration (NMPA) oversees XR medical device approvals, with increased scrutiny on clinical validation and cybersecurity. Following national digital health initiatives, XR technologies used in hospitals must align with local standards, while partnerships with state-backed distributors are often required for market entry.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) regulates XR applications integrated into clinical practice. Streamlined review pathways for innovative digital health and rehabilitation technologies are being introduced, but strict clinical evidence requirements remain for surgical and diagnostic use cases.

- In South Korea, the Ministry of Food and Drug Safety (MFDS) has recognized XR platforms within its digital therapeutics framework, emphasizing patient safety, efficacy validation, and interoperability with electronic health records. National policies supporting smart hospitals are accelerating regulatory adoption.

- Globally, the International Medical Device Regulators Forum (IMDRF) is advancing harmonized guidelines for Software as a Medical Device, directly relevant to XR applications.

Competitive Landscape

Leading players in the global healthcare extended reality industry are prioritizing the development of immersive, high-fidelity solutions that enhance surgical accuracy, therapy outcomes, and medical training effectiveness. Strategic partnerships and collaborations are pursued to expand portfolios and accelerate adoption across hospitals, pharmaceutical companies, and research institutions.

In addition, manufacturers are integrating AI-driven analytics, haptic feedback, and cloud connectivity into XR platforms to improve interactivity and clinical decision-making. Companies are expanding XR applications in surgery, rehabilitation, and patient education to maintain a competitive edge and drive long-term market growth.

- In May 2025, Proprio received its second 510(k) clearance from the U.S. FDA for its AI-powered Paradigm platform. The clearance expands capabilities to include intraoperative measurements, making it the first technology to offer real-time, 3D dynamic and segmental viewing of anatomy, enabling surgeons to assess surgical success during live procedures.

Key Companies in Healthcare Extended Reality Market:

- Microsoft

- Apple Inc.

- Osso VR, Inc.

- PrecisionOS

- MEDIVIS

- Augmedics

- Surgical Theater, Inc.

- EchoPixel

- Proprio

- Medtronic

- AccuVein

- XRHealth

- MindMaze

- Virtuleap Inc

- Brainlab SE

Recent Developments

- In April 2025, Pixee Medical received FDA 510(k) clearance for Knee+ NexSight, its advanced AR navigation solution for total knee arthroplasty. Designed to meet the growing demand from ambulatory surgical centers (ASCs), the platform enhances precision and expands access to AR-guided orthopedic procedures.

- In July 2024, ImmersiveTouch Inc. announced that its augmented reality platform, ImmersiveAR, received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for clinical use in operating rooms.

- In February 2024, Sira Medical received FDA 510(k) clearance for its augmented reality preoperative surgical planning application. The solution addresses challenges of obscured anatomy in CT and MRI scans, providing clinicians with advanced imaging capabilities for improved surgical planning.

- In June 2023, Medivis, a U.S.-based medical technology company focused on augmented reality surgical navigation, secured a USD 20 million Series A funding round led by Thrive Capital, with participation from Mayo Clinic and other strategic investors. The funding is aimed at advancing AR-based surgical solutions and accelerating adoption in clinical settings.