Digital Therapeutics Market Size

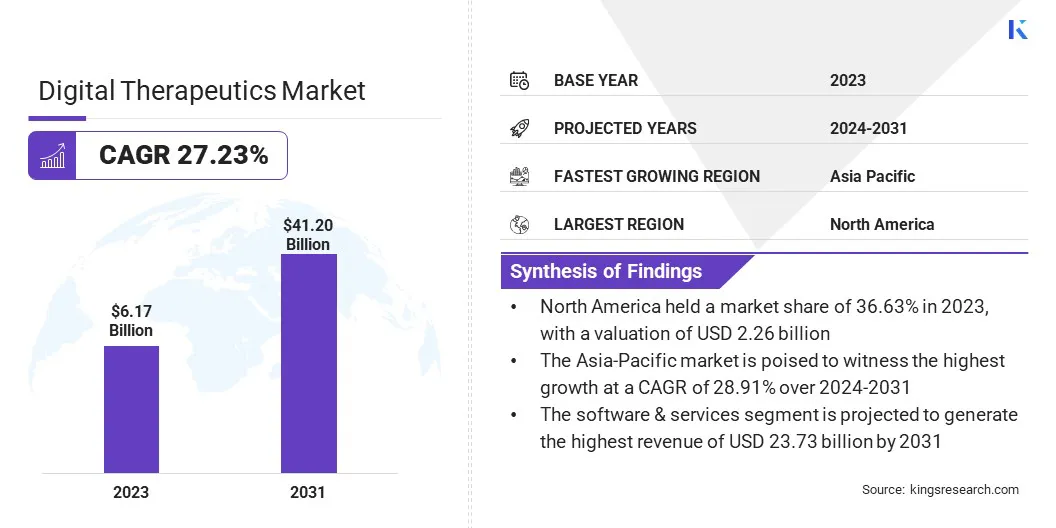

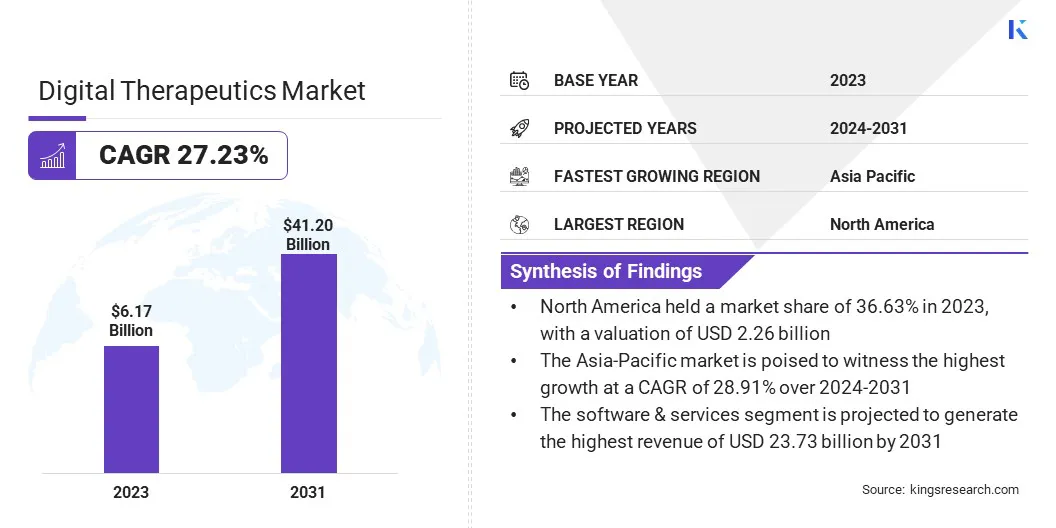

The Global Digital Therapeutics Market was valued at USD 6.17 billion in 2023 and is projected to reach USD 41.20 billion by 2031, growing at a CAGR of 27.23% from 2024 to 2031. The market is experiencing robust growth, driven by technological advancements and the increasing adoption of digital health solutions.

Moreover, the increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and obesity worldwide is propelling market expansion. In the scope of work, the report includes products offered by companies such as Teladoc Health, Inc., Omada Health Inc., Akili, Inc., Welldoc, Inc., Voluntis, mySugr GmbH, Better Therapeutics, Inc., Click Therapeutics, Inc., Cognoa, Inc., Wellthy Therapeutics Pvt Ltd and Others.

The adoption of digital therapeutics is emerging as an effective solution for managing and treating chronic conditions. This trend is further supported by the rise in telehealth and remote patient monitoring, which has boosted the demand for digital therapeutic solutions. Additionally, favorable government policies and increased investments by key players in research and development are expected to aid market growth.

- For instance, in June 2024, the Digital Therapeutics Alliance (DTA), in collaboration with DirectTrust, announced its plans to introduce an accreditation program for digital therapeutics. The program, unveiled at the DTA conference, aims to enhance industry confidence by establishing strict standards for assessing product efficacy, privacy, and interoperability.

Such developments are expected to standardize the market, enabling the broader adoption of digital therapeutic solutions across healthcare systems. Additionally, the growing focus on preventive care, cost-effectiveness, and the increasing prevalence of chronic diseases like diabetes and cardiovascular conditions are further driving the adoption of these technologies.

Digital therapeutics refers to evidence-based interventions aimed at preventing, managing, or treating medical conditions. These interventions are designed to modify patient behavior and provide therapeutic benefits alongside conventional medical treatments.

Digital therapeutics typically utilize technologies such as mobile apps, wearables, and online platforms to deliver personalized interventions, track patient progress, and collect real-time health data. Unlike traditional pharmaceutical interventions, digital therapeutics often incorporate cognitive behavioral therapy, mindfulness techniques, and educational content to enable patients to manage their health conditions independently.

Analyst’s Review

Analyst’s Review

The digital therapeutics market is poised to witness exponential growth, mainly due to ongoing technological advancements, growing patient acceptance, and increasing integration with healthcare systems.

Strategic collaborations, partnerships, and mergers and acquisitions among pharmaceutical companies, technology firms, and healthcare providers are supporting market expansion by advancing the development and commercialization of innovative digital therapeutics solutions.

- In May 2024, Otsuka Pharmaceutical launched a new subsidiary to commercialize its digital therapeutic, Rejoyn, and expand its presence in digital therapeutics and connected health products. Rejoyn, developed in partnership with Click Therapeutics, received FDA clearance in April 2024 as the first prescription digital therapeutic for major depressive disorder.

The app seeks to facilitate behavioral change through interactive lessons and exercises, representing a significant advancement in the digital mental health treatment landscape. This new subsidiary aims to concentrate on advancing Rejoyn and other digital health innovations. These strategic developments by key players are expected to propel the growth of the market in the coming years.

Digital Therapeutics Market Growth Factors

The rising healthcare costs and the increasing prevalence of chronic diseases are major factors supporting the growth of the digital therapeutics market. These solutions offer cost-effective alternatives for managing chronic conditions, potentially reducing hospital visits and medication expenses. For instance, programs focused on pain management reduce healthcare costs and optimize patient outcomes.

The integration of AI-driven personalized navigation and community support features in digital health solutions is enhancing patient engagement and treatment outcomes. Advancements in mobile health (mHealth) and artificial intelligence (AI) technologies are transforming digital therapeutics by enabling personalized and interactive programs that improve patient engagement and treatment efficacy.

- In September 2024, DarioHealth Corp. announced the integration of condition-specific communities and peer groups with personalized navigation into its cardiometabolic solution. This innovation enhances outcomes-based engagement and represents a significant advancement in the Dario-Twill product offering.

Furthermore, the growing acceptance of remote patient monitoring and telehealth facilitates the integration of these solutions into healthcare practices, enabling continuous monitoring and enhancing care coordination. This integration aids market expansion by providing timely interventions and improving patient outcomes, as demonstrated in DTx programs for conditions such as heart failure.

However, the market faces several challenges such as regulatory hurdles, data privacy concerns, and reimbursement issues. Ensuring compliance with stringent regulatory requirements while navigating constantly evolving frameworks poses a significant challenge for market players. Moreover, safeguarding patient data privacy and addressing cybersecurity threats are paramount.

Additionally, establishing reimbursement mechanisms for DTx interventions remains a major challenge, hindering widespread adoption. Ongoing developments among key players, along with the establishment of standardized regulations, are anticipated to address these challenges over the forecast period.

Digital Therapeutics Market Trends

The evolving healthcare landscape, which emphasizes preventive care and self-management, is creating a favorable environment for digital therapeutics solutions, empowering individuals to proactively manage their health. This trend is evident in sleep management programs that offer personalized recommendations to improve sleep habits, reflecting the growing emphasis on holistic well-being.

Moreover, the increasing focus on patient engagement and treatment adherence is driving the integration of interactive features and gamification into digital therapeutics solutions.

The integration of Health Economics and Outcomes Research (HEOR) into clinical trials is emerging as a key trend for assessing the financial value and market potential of innovative therapies, including digital therapeutics.

- In November 2023, virtual contract research organization Curavit Clinical Research introduced a Health Economics and Outcomes Research (HEOR) service for clinical trials to help medicine manufacturers assess product value and market potential.

Additionally, the integration of wearables and biosensors enables real-time data collection and feedback within these interventions, facilitating personalized, data-driven therapeutic approaches. This is particularly beneficial in anxiety management programs, where wearable biosensors track physiological responses to enable timely interventions and tailored relaxation techniques.

Segmentation Analysis

The global digital therapeutics market has been segmented based on indication, application, type, and geography.

By Indication

Based on indication, the market has been categorized into obesity, diabetes, central nervous system (CNS) disease, gastrointestinal disorder (GID), cardiovascular disease (CVD), respiratory disease, musculoskeletal disorders, and others. The diabetes segment generated the highest revenue of USD 1.58 billion in 2023. The increasing prevalence of diabetes globally due to sedentary lifestyles and unhealthy dietary habits is contributing to the growth of the segment.

- According to the World Health Organization (WHO), the number of people living with diabetes increased from 200 million in 1990 to 830 million in 2022.

Moreover, the development of innovative digital therapeutics interventions for diabetes, including glucose monitoring apps and insulin dose calculators, is supporting this growth. Additionally, several factors such as an aging population and genetic predispositions are contributing to the growing cases of diabetes, thereby propelling segmental expansion.

By Application

Based on application, the market has been divided into treatment, diagnosis, and disease management. The treatment segment captured the largest revenue share of 45.68% in 2023. The rising prevalence of chronic diseases is leading to the increased demand for non-invasive and cost-effective treatment options, thereby propelling the growth of the segment.

Moreover, advancements in technology enabling personalized treatment plans and remote monitoring are bolstering the adoption of digital therapeutics in treatment applications. Additionally, the increasing focus on patient-centered care and the integration of digital therapeutics into traditional healthcare pathways is fueling the expansion of the treatment segment.

By Type

Based on type, the market has been bifurcated into devices and software & services. The software & services segment is projected to generate the highest revenue of USD 23.73 billion by 2031. Increasing adoption of mobile health (mHealth) technologies, cloud-based platforms, and software applications is creating the demand for software & services solutions.

Moreover, the emphasis on personalized patient care and the integration of data analytics and artificial intelligence (AI) is bolstering segmental expansion. Additionally, the scalability and cost-effectiveness of software-based solutions, along with the growing demand for remote monitoring and telehealth services, are set to fuel the adoption of digital therapeutics software & services.

Digital Therapeutics Market Regional Analysis

Based on region, the global digital therapeutics market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America digital therapeutics market held a substantial share of around 36.63% in 2023, with a valuation of USD 2.26 billion. The region's high healthcare expenditure is increasing demand for cost-effective solutions, positioning digital therapeutics as a viable alternative to traditional medical practices.

Moreover, the regional market benefits from an established regulatory framework, particularly through FDA pathways, offering clarity and assurance to market players. The presence of major digital therapeutic companies such as Livongo Health and Omada Health is fostering innovation, propelling regional market expansion.

Additionally, North America boasts a developed telehealth infrastructure, facilitating seamless integration of these programs with remote patient monitoring and virtual consultations. The region's high smartphone penetration is bolstering digital therapeutics adoption, enabling widespread access and engagement with mobile applications.

The Asia-Pacific digital therapeutics market is poised to witness the highest growth, registering a staggering CAGR of 28.91% over 2024-2031. The rising affordability of therapeutics due to increasing purchasing capacities is creating a favorable environment for digital therapeutics solutions. Additionally, the region’s rising prevalence of chronic diseases, such as diabetes, necessitates effective management solutions, thereby fueling demand for therapeutic interventions.

Furthermore, government initiatives promoting digital healthcare adoption, including the integration of digital therapeutic solutions, are propelling regional market expansion. High mobile phone and internet usage in the region creates a conducive environment for the widespread adoption of digital therapeutic mobile applications, supported by growing awareness of their benefits.

Competitive Landscape

The global digital therapeutics market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are adopting lucrative measures including broadening their range of services, allocating resources to research and development (R&D), establishing state-of-the-art service delivery centers, and streamlining their service delivery processes, to gain a strong foothold in the market.

List of Key Companies in Digital Therapeutics Market

- Teladoc Health, Inc.

- Omada Health Inc.

- Akili, Inc.

- Welldoc, Inc.

- Voluntis

- mySugr GmbH

- Better Therapeutics, Inc.

- Click Therapeutics, Inc.

- Cognoa, Inc.

- Wellthy Therapeutics Pvt Ltd

Key Industry Development

- February 2024 (Acquisition): TruDoc Healthcare, the primary virtual primary care provider in the GCC region, acquired Wellthy Therapeutics, a pioneer in clinically validated chronic disease management platforms across Asia. This acquisition enhances healthcare standards, patient experience, and quality outcomes in the region, while positioning TruDoc for expansion into emerging markets, including India.

- July 2024 (Partnership): Otsuka Pharmaceutical Europe Ltd. and Otsuka Pharmaceuticals (U.K.) Ltd. partnered with Oxford HIN to evaluate the implementation and integration of CARE for MDD, a new digital therapeutic designed to support the treatment of major depressive disorder, commonly known as clinical depression.

The Global Digital Therapeutics Market is segmented as:

By Indication

- Obesity

- Diabetes

- Central Nervous System (CNS) Disease

- Gastrointestinal Disorder (GID)

- Cardiovascular Disease (CVD)

- Respiratory Disease

- Musculoskeletal Disorders

- Others

By Application

- Treatment

- Diagnosis

- Disease Management

By Type

- Device

- Software & Services

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America