Market Definition

Augmented Reality (AR) is a technology that overlays digital content, including visuals and data, onto the physical environment using devices such as smartphones, tablets, and smart glasses.

The market includes hardware components such as sensors, cameras, displays, processors, and head-mounted devices, along with software platforms for application development, content creation, and data integration. AR is applied across industries including retail, healthcare, education, manufacturing, and gaming.

Organizations use AR to enhance user engagement, enable real-time visualization, and support remote collaboration.

Augmented Reality Market Overview

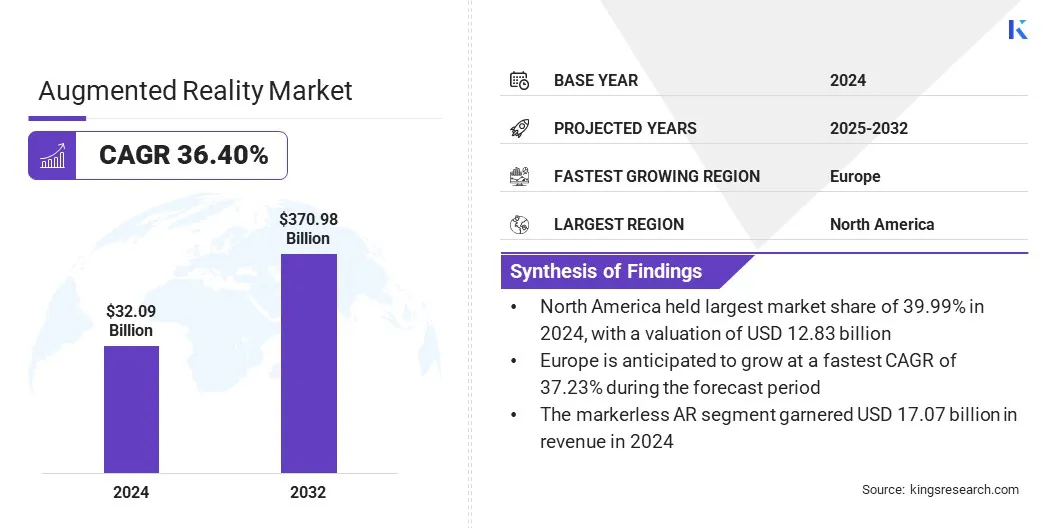

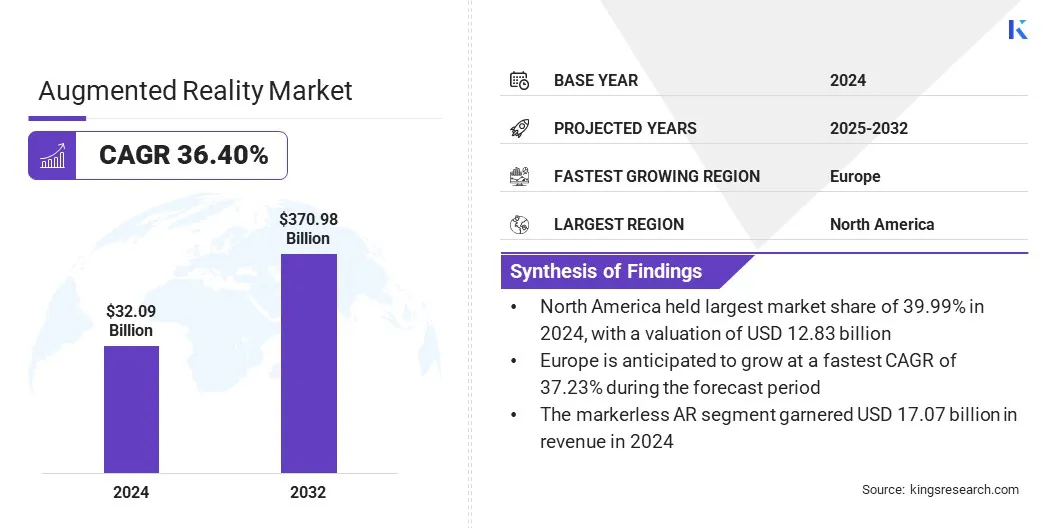

The global augmented reality market size was valued at USD 32.09 billion in 2024 and is projected to grow from USD 42.24 billion in 2025 to USD 370.98 billion by 2032, exhibiting a CAGR of 36.40% during the forecast period.

The market is expanding due to increasing enterprise adoption of immersive technologies for operational efficiency, remote collaboration, and real-time data visualization. Industries such as manufacturing, retail, logistics, and healthcare are integrating AR to reduce downtime, enhance accuracy, and streamline complex workflows.

Key Market Highlights:

- The augmented reality industry size was valued at USD 32.09 billion in 2024.

- The market is projected to grow at a CAGR of 36.40% from 2025 to 2032.

- North America held a market share of 39.99% in 2024, valued at USD 12.83 billion.

- The hardware segment garnered USD 16.78 billion in revenue in 2024.

- The markerless AR segment is expected to reach USD 180.71 billion by 2032.

- The AR head-mounted display (HMD) segment is estimated to generate a revenue of USD 147.24 billion by 2032.

- The gaming & entertainment segment is projected to reach USD 106.73 billion by 2032.

- The market in Europe is anticipated to grow at a CAGR of 37.23% over the forecast period.

Major companies operating in the augmented reality market are Apple Inc., Alphabet Inc., Meta, Microsoft, Magic Leap, Inc., Unity Technologies, PTC, Snap Inc., Qualcomm Technologies, Inc., EPSON, Blippar Group Limited, Niantic, Nanalyze, Perfect Corp, and zSpace, Inc.

The growing use of AR smart glasses in industrial and commercial settings is accelerating market growth. These wearables enable hands-free access to real-time data, digital instructions, and remote expert support, allowing workers to perform complex tasks more efficiently.

Advancements in display resolution, battery life, and on-device processing have improved their suitability for continuous use in demanding conditions.

Sectors such as manufacturing, logistics, and defense are increasingly integrating AR glasses into daily operations. This widespread adoption is boosting commercial demand and contributing to sustained market growth.

- In May 2025, Snap launched Specs, a lightweight AR wearable with see-through lenses, set for release in 2026. The device will feature advanced AI, spatial computing, and developer tools such as Snap OS updates, 3D object generation, and location-based AR features to enable immersive experiences in gaming, travel, education, and navigation.

Market Driver

Surging Use of AR-Powered Visualization Tools

The growth of the market is driven by the growing use of AR-powered visualization tools in the retail and home organization. These tools enable customers to preview products in real-world settings, enhancing purchase confidence and reducing product returns.

Retailers benefit from offering engaging, interactive, and personalized shopping experiences that meet evolving consumer expectations. AR visualization tools are becoming essential in improving customer satisfaction and driving sales growth.

This trend is accelerating the adoption of AR technologies and expanding the market across various consumer-focused industries.

- In June 2025, Inspired Closets launched Envision, an AR solution that allows customers to visualize home organization systems within their spaces. The solution enhances the shopping experience by ensuring optimal fit and style, reducing uncertainty and product returns.

Market Challenge

High Hardware Costs Limit Consumer Adoption

The augmented reality market faces a significant challenge due to high hardware costs, impeding widespread consumer adoption. AR devices depend on advanced components, including depth sensors, high-resolution displays, and powerful processors, which contribute to elevated manufacturing expenses.

Consequently, device prices remain high, limiting affordability and confining demand primarily to enterprise and specialized sectors. This cost barrier restricts AR’s penetration into the broader consumer market and constrains market growth.

Companies are implementing strategies such as modular designs and component integration to reduce hardware expenses.

Additionally, manufacturers are developing lighter, cost-effective AR wearables that retain essential features for productivity and communication. These measures aim to enhance mass-market adoption while maintaining device performance and usability.

Market Trend

Integration of Spatial Computing for Enhanced Interoperability

The market is experiencing a growing shift toward the integration of spatial computing. This trend supports the development of systems that recognize and respond to real-world environments with high accuracy.

AR devices now incorporate spatial mapping and positioning technologies to place digital content in contextually relevant spaces, enhancing user interaction with virtual elements.

Companies are developing AR platforms compatible across smartphones, laptops, and tablets, creating unified digital environments. This advancement is fostering AR adoption in enterprise workflows, professional collaboration, and mobile productivity.

- In June 2025, Rokid launched AR Spatial, a lightweight wearable combining Max 2 AR Glasses and Station 2 to support spatial computing. The device features a 300-inch virtual display, cross-platform compatibility, and runs on YodaOS Master. It targets mobile professionals and offers Bluetooth support, multi-screen control, and immersive content visualization.

Augmented Reality Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software, Services

|

|

By Technology

|

Marker-based AR, Markerless AR, Location-based AR

|

|

By Device Type

|

AR Head-Mounted Display (HMD), AR Smart Glasses, AR Handheld Devices, Others

|

|

By Application

|

Gaming & Entertainment, Healthcare, Retail & E-Commerce, Industrial & Manufacturing, Education & Training, Defense & Aerospace, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 16.78 billion in 2024, mainly due to rising demand for advanced AR devices and improved sensor technologies.

- By Technology (Marker-based AR, Markerless AR, and Location-based AR): The markerless AR segment held a share of 53.20% in 2024, fueled by its versatility in mobile applications and enhanced user experience.

- By Device Type (AR Head-Mounted Display (HMD), AR Smart Glasses, AR Handheld Devices, and Others): The AR head-mounted display (HMD) segment is projected to reach USD 147.24 billion by 2032, owing to increased enterprise adoption and improvements in display technology.

- By Application (Gaming & Entertainment, Healthcare, Retail & E-Commerce, Industrial & Manufacturing, Education & Training, Defense & Aerospace, and Others): The gaming & entertainment segment is estimated to reach USD 106.73 billion by 2032, supported by growing consumer interest and immersive content development.

Augmented Reality Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 39.99% share of the augmented reality market in 2024, with a valuation of USD 12.83 billion. This dominance is mainly attributed to the rising use of augmented reality in B2B applications such as real estate, defense, retail, and smart infrastructure.

Companies across the U.S. are launching enterprise-focused AR platforms that use geospatial data to enhance physical environments. This has increased AR adoption among commercial users, fostering platform development and subscription-based revenue models.

Additionally, government-backed defense programs are integrating AR into tactical systems, leading to increased demand. These initiatives create long-term public-private collaborations and accelerate product testing and deployment cycles.

Combined with strong venture capital support and an advanced tech ecosystem, these factors continue to solidify North America’s position as the leading market for AR technologies.

- In May 2025, Anduril Industries and Meta partnered to develop integrated XR products for the U.S. military, enhancing battlefield perception and control of autonomous systems. The collaboration leverages existing AI, AR, and hardware investments, integrates with Anduril’s Lattice platform, and supports the transition of IVAS to a field-tested Soldier-Borne Mission Command capability.

The Europe augmented reality industry is expected to register the fastest CAGR of 37.23% over the forecast period. This growth is bolstered by the increasing investment in immersive technologies across industrial training, manufacturing, and automotive sectors.

Organizations in the region are adopting AR to improve operational accuracy, reduce training time, and enhance workforce productivity. Government-backed digitalization programs and strategic funding initiatives are creating a supportive environment for technology integration.

This is prompting companies to scale AR applications beyond pilot phases and into routine operations. The region is seeing rapid development of enterprise-focused AR platforms and hardware.

The growing alignment between industrial needs and AR capabilities is solidifying Europe’s position as a major market for scalable and business-oriented AR solutions.

- In November 2024, the European Union announced an investment of USD 54 million in over six extended reality projects under the Horizon Europe Programme. These initiatives aim to develop AR/XR devices and applications, including AR eyewear and human-machine interaction tools, to strengthen technological autonomy and drive XR adoption across European industries.

Regulatory Frameworks

- In the U.S., augmented reality (AR) technologies are regulated under the Federal Communications Commission (FCC) for wireless communication standards and the Food and Drug Administration (FDA) when applied in medical devices, ensuring safety, privacy, and electromagnetic compliance. Additionally, the Federal Trade Commission (FTC) oversees consumer protection related to data privacy and advertising claims involving AR applications.

- In Europe, AR is regulated under the General Data Protection Regulation (GDPR) for data privacy, the Radio Equipment Directive (RED) for wireless communication, and the Medical Device Regulation (MDR) for healthcare applications.

- In Japan, AR devices are regulated by the Ministry of Internal Affairs and Communications (MIC) for radio frequency use and the Pharmaceuticals and Medical Devices Agency (PMDA) for medical AR applications.

Competitive Landscape

The augmented reality market is characterized by advancements in device performance, software development, and growing adoption in healthcare. Key players are enhancing AR hardware by developing lightweight headsets with improved battery efficiency, high-resolution displays, and faster processors.

These upgrades support uninterrupted use in demanding enterprise environments. Companies are expanding software capabilities by integrating AR platforms with cloud infrastructure, AI engines, and real-time data systems, enabling seamless deployment and improved functionality.

Additionally, organizations are incorporating AR into healthcare for surgical visualization, diagnostics, and remote collaboration. These applications improve procedural accuracy and enhance clinical training.

These combined efforts are strengthening AR’s position as a scalable solution and accelerating its adoption across industrial, commercial, and healthcare domains.

- In May 2025, HCLTech launched an augmented reality-based IT infrastructure management solution in collaboration with CareAR and ServiceNow. The solution integrates AR, AI, and automation to enhance remote support, reduce downtime, and improve operational resilience across industries such as manufacturing, energy, utilities, and retail.

- In September 2024, the U.S. Food and Drug Administration authorized a total of 69 medical devices that incorporate augmented and virtual reality technologies, following the latest revision of its recognized medical device list.

Key Companies in Augmented Reality Market:

- Apple Inc.

- Alphabet Inc.

- Meta

- Microsoft

- Magic Leap, Inc.

- Unity Technologies

- PTC

- Snap Inc.

- Qualcomm Technologies, Inc.

- EPSON

- Blippar Group Limited

- Niantic

- Nanalyze

- Perfect Corp

- zSpace, Inc.

Recent Developments (Acquisitions/ Product Launches)

- In June 2025, TDK Corporation acquired SoftEye, Inc., a U.S.-based company specializing in custom chips, cameras, and algorithms for smart glasses. The acquisition strengthens TDK’s position in the AI ecosystem by integrating SoftEye’s low-power eye tracking and object recognition technology, enabling advanced AR/VR systems and new human-machine interfaces through eye movement.

- In September 2024, Meta unveiled Orion, its first true augmented reality glasses featuring the largest field of view in the smallest form factor. The device integrates holographic displays with contextual AI in a lightweight design, aiming to advance human-computer interaction beyond smartphones.

- In November 2024, RealWear acquired Almer Technologies, a Swiss AR headset innovator, to strengthen its position in industrial wearables. Supported by TeamViewer, the acquisition combines RealWear’s durable devices with Almer’s compact, subscription-based AR devices to enhance productivity for frontline workers.

- In March 2024, Fresenius Medical Care launched Ready4 multiFiltratePRO AR an AR-based training application for ICU nurses operating its Continuous Kidney Replacement Therapy system. The solution uses AR glasses and digital content to provide immersive, on-demand training and address ICU staffing challenges across global markets..