Market Definition

The market includes all businesses and activities involved in making and using eco-friendly surfactants. These are cleaning and foaming agents made from natural sources like plants and sugars. The market covers their production, sale, and use in areas such as personal care, home cleaning, farming, and industry, focusing on products that are safer for people and the environment.

The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting the market growth through the projection period.

Green Surfactants Market Overview

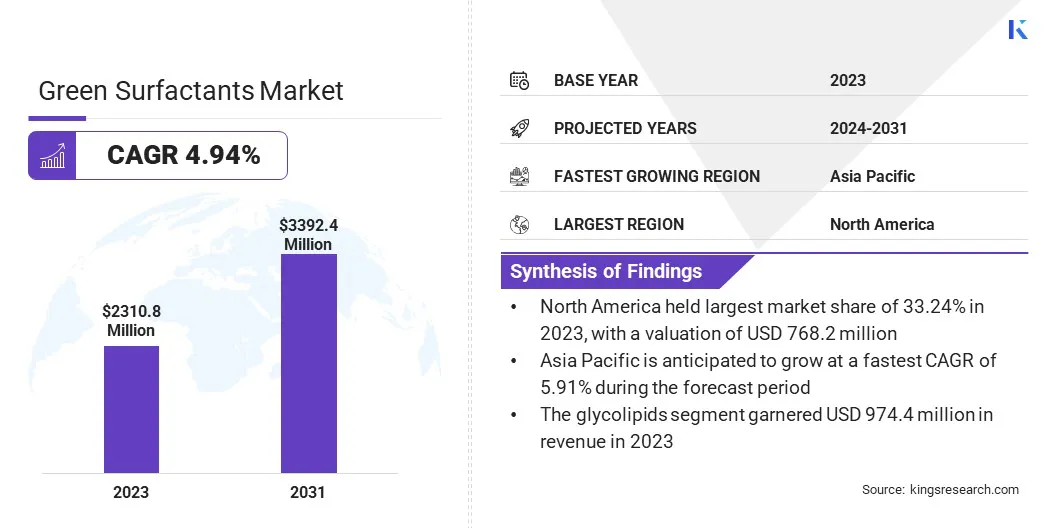

The global green surfactants market size was valued at USD 2,310.8 million in 2023 and is projected to grow from USD 2,420.6 million in 2024 to USD 3,392.4 million by 2031, exhibiting a CAGR of 4.94% during the forecast period.

The market is registering steady growth, due to the rising demand for sustainable and environmentally friendly products across various industries. Increased consumer awareness about the harmful effects of synthetic chemicals has driven the shift toward natural and biodegradable alternatives. Regulatory support for eco-friendly formulations and strict environmental standards are further encouraging manufacturers to adopt green surfactants.

Major companies operating in the green surfactants industry are BASF, Clariant, RAG-Stiftung, Croda International Plc, Solvay, Dow, Akzo Nobel N.V., Kao Corporation, S.C. Johnson & Son Inc., Innospec, Azelis, Sasol Limited, Berg + Schmidt GmbH & Co. KG, AGAE Technologies, LLC, and Givaudan.

The push for corporate sustainability and green labeling is influencing product development and marketing strategies. Advancements in biotechnology are also helping improve the efficiency and cost-effectiveness of green surfactants.

- In October 2024, Locus Ingredients confirmed that its expanded Amphi biosurfactant line, based on sophorolipids, received TSCA registration from the U.S. Environmental Protection Agency (EPA). This milestone makes the Amphi line the first domestically produced sophorolipid biosurfactants available at commercial scale in the U.S. Marketed as 100% bio-based, non-GMO, and palm oil-free, these biosurfactants offer enhanced cleaning, degreasing, and corrosion resistance for consumer and industrial applications.

Key Highlights

- The green surfactants market size was valued at USD 2,310.8 million in 2023.

- The market is projected to grow at a CAGR of 4.94% from 2024 to 2031.

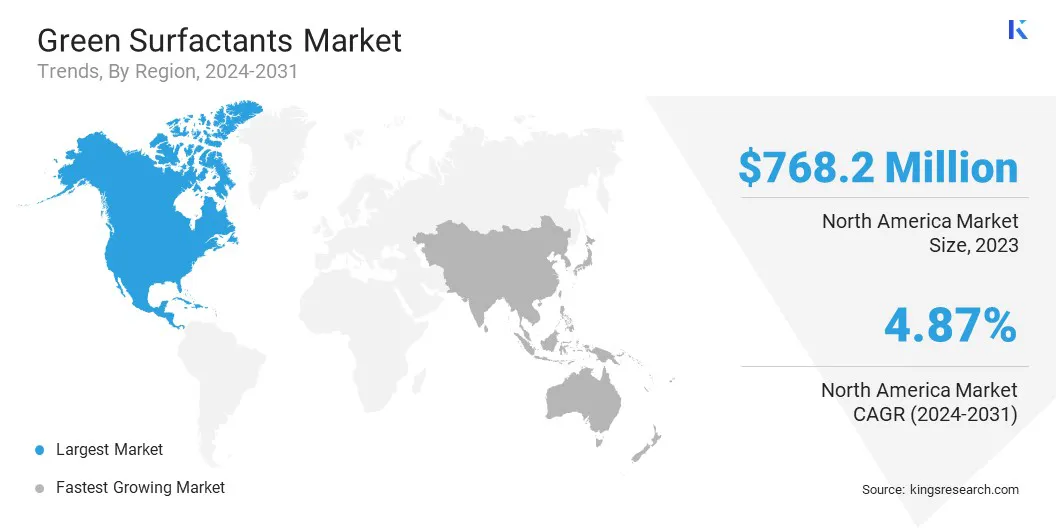

- North America held a market share of 33.24% in 2023, with a valuation of USD 768.2 million.

- The glycolipids segment garnered USD 974.4 million in revenue in 2023.

- The food & beverages segment is expected to reach USD 1,206.1 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 5.91% during the forecast period.

How are changing trends in sustainability affecting the market?

The market is mainly driven by the growing industrial demand for sustainable and eco-friendly products. Amid rising environmental concerns, industries are seeking alternatives to traditional petrochemical surfactants that are harmful to the environment.

Green surfactants, made from renewable and biodegradable resources, offer a safer and more sustainable option without compromising performance.

With regulations on chemical use and waste disposal, industries such as cleaning, personal care, and agriculture are increasingly turning to green surfactants to meet both environmental standards and consumer expectations for safer, eco-friendly products. This shift is motivating manufacturers to invest more in developing and scaling up these sustainable alternatives.

- In March 2025, Sironix Renewables secured USD 3.5 million in funding to scale up its manufacturing operations for the Eosix Surfactant, a 100% plant-based, non-toxic, and eco-friendly surfactant. Sironix aims to transition from bench-scale to high-volume manufacturing, meeting the growing demand for sustainable ingredients in the cleaning and personal care industries.

How limited renewable feedstocks pose an obstacle to market growth?

A significant challenge in the green surfactants market is the limited availability and supply of renewable feedstocks. Green surfactants are derived from natural sources such as plant-based oils, sugars, and fats and the supply of these raw materials can be impacted by factors like seasonal variations, agricultural yield fluctuations, and land use competition.

The pressure on these feedstocks intensifies as the demand for green surfactants grows. This can lead to supply shortages and price volatility. This challenge can be addressed by diversifying feedstock sources and investing in alternative raw materials that are abundant and sustainable.

Researchers are exploring options such as algae, waste oils, and other plant-based sources that can be cultivated with minimal environmental impact.

How do changing trends in personal care affect this market?

The market is registering the trend of using biodegradable and non-toxic ingredients, particularly in the personal care industry. As consumers become more environmentally conscious and health-aware, they are increasingly seeking personal care products that are safe for both their skin and the environment.

Biodegradable and non-toxic green surfactants, derived from natural sources, are gaining popularity, as they offer a sustainable alternative to traditional chemical-based ingredients. These surfactants not only meet consumer preferences for products that are gentle on the skin but also align with growing regulatory pressures to reduce harmful substances in personal care formulations.

This trend is pushing manufacturers to innovate and incorporate more sustainable, eco-friendly ingredients in their product lines, fostering a shift toward cleaner, safer personal care options.

- In April 2025, Nouryon launched Armocare Aqua 12 surfactant at in-cosmetics Global in Amsterdam. The product is a biodegradable, non-quat hair conditioning agent made from ISCC PLUS certified renewable feedstocks, offering a sustainable alternative for hair care formulations.

Green Surfactants Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Glycolipids, Lipoproteins, Others

|

|

By Application

|

Food & Beverages, Cosmetic & Personal Care, Agriculture, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Glycolipids, Lipoproteins, Others): The glycolipids segment earned USD 974.4 million in 2023, due to their high biodegradability, low toxicity, and wide usage in personal care and industrial cleaning applications.

- By Application (Food & Beverages, Cosmetic & Personal Care, Agriculture, Others): The food & beverages segment held 35.65% share of the market in 2023, due to the increasing demand for natural emulsifiers and stabilizers in clean-label and organic food products.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 33.24% share of the green surfactants market in 2023, with a valuation of USD 768.2 million. This dominance is largely driven by the strong consumer demand for sustainable products in the U.S. and Canada, particularly in personal care and household cleaning.

The region’s well-established presence of major green surfactant producers, along with advanced R&D capabilities and a mature bio-based chemical industry, has significantly contributed to the market growth. Additionally, the growing preference among large retailers and manufacturers for eco-labeled and plant-based ingredients has reinforced the market’s position in North America.

- In March 2025, Evonik signed an exclusive U.S. distribution agreement with Sea-Land Chemical for the distribution of its sustainable cleaning solutions. The agreement expands the reach of Evonik’s cleaning solutions, including rhamnolipid biosurfactants, to the entire U.S., supporting the demand for eco-friendly cleaning products.

The green surfactants industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 5.91% over the forecast period. Rapid industrialization, urbanization, and rising awareness of sustainable products among the expanding middle-class population in countries like China, India, and Japan are key factors fueling demand.

Local manufacturers are increasingly integrating green surfactants into products across sectors such as food processing, cosmetics, and agriculture. Moreover, the region's abundant availability of raw materials such as coconut oil, palm oil, and sugarcane provides a cost-effective foundation for large-scale production, attracting investments in bio-based surfactant manufacturing.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) is the primary regulatory authority for green surfactants, including biosurfactants. The EPA also uses the Toxic Substances Control Act (TSCA) to regulate the production and use of certain chemicals, including biosurfactants.

- In Europe, the regulatory body for green surfactants is the European Commission, which oversees the Detergent Regulation and the REACH Regulation. The European Parliament and the Council of the European Union (EU) also play a role in approving legislation related to detergents and surfactants.

Competitive Landscape

The green surfactants market is characterized by key players focusing on expanding their product portfolios through bio-based and high-performance formulations. Strategic collaborations and partnerships with biotechnology firms are commonly pursued to enhance R&D capabilities and accelerate the development of advanced surfactant technologies.

Companies are also investing in the optimization of production processes to reduce costs and increase the scalability of green surfactants. Additionally, many companies are strengthening their presence in emerging markets through regional expansion and the establishment of localized production facilities.

Branding strategies centered on sustainability credentials and certifications are used to differentiate products and capture environmentally conscious consumers.

- In January 2025, Pilot Chemical Company and Kao Corporation partnered to bring Bio IOS biobased internal olefin sulfonates to the North American market. The collaboration focused on leveraging Kao’s Bio IOS technology to offer sustainable surfactants for household, industrial, institutional, and personal care applications.

Key Companies in Green Surfactants Market:

- BASF

- Clariant

- RAG-Stiftung

- Croda International Plc

- Solvay

- Dow

- Akzo Nobel N.V.

- Kao Corporation

- S.C. Johnson & Son Inc.

- Innospec

- Azelis

- Sasol Limited

- Berg + Schmidt GmbH & Co. KG

- AGAE Technologies, LLC

- Givaudan

Recent Developments (Product Launch/Investment)

- In September 2024, Evonik Coating Additives launched two new biosurfactants, TEGO Wet 570 Terra and TEGO Wet 580 Terra, designed for coatings and inks. Produced through a fermentation-based process using renewable resources, these 100% natural and readily biodegradable biosurfactants offer high performance with low VOC levels. The products improve pigment and substrate wetting, reduce grinding time and energy consumption, and comply with EU Ecolabel standards.

- In May 2023, SurfactGreen, a French start-up based in Rennes, announced a USD 11 million investment to accelerate its marketing and industrial development in the market. Specializing in eco-responsible alternatives to petroleum-based cationic surfactants, SurfactGreen has partnered with over 100 customers across 26 countries.

As demand for green surfactants grows,