Surfactants Market size

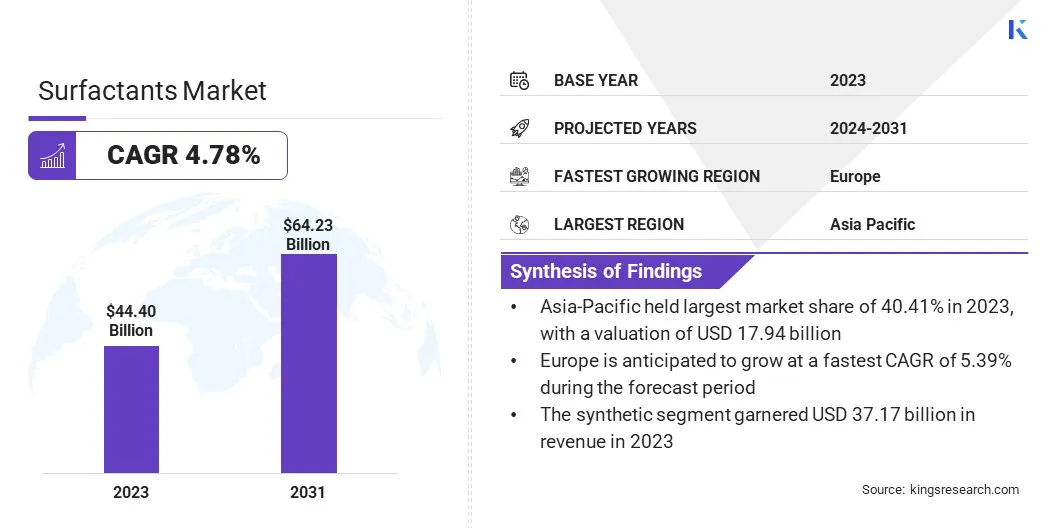

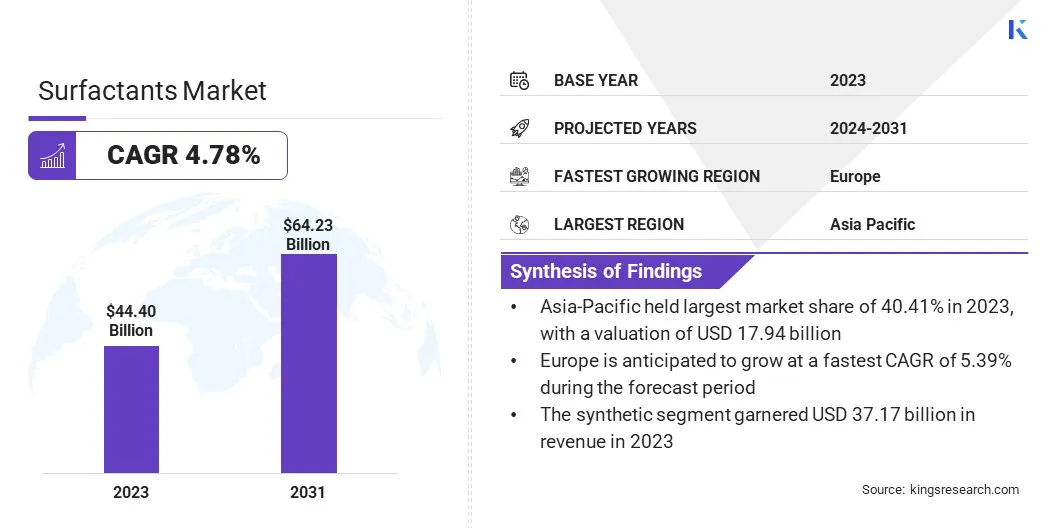

The global Surfactants Market size was valued at USD 44.40 billion in 2023, and is projected to grow from USD 46.32 billion in 2024 to USD 64.23 billion by 2031, exhibiting a CAGR of 4.78% during the forecast period.

The market is experiencing steady growth due to the increasing demand for household cleaning products and personal care products, including cosmetics, skincare, and haircare. Surfactants are crucial in improving the cleansing and foaming properties of formulations such as shower gels, lotions, and shampoos.

Additionally, the growing use of cleaning products used in car care is further boosting market expansion. In the scope of work, the report includes offered by companies such as Ashland Global Holdings Inc., BASF SE, Clariant, Dow, Evonik Industries AG, Godrej Industries Limited, Kao Corporation, Nouryon, Solvay, Stepan Company, and others.

The rapidly expanding food industry is propelling the growth of the surfactants market, fueled by their use in various food products such as gels, emulsions, and suspensions, as well as in applications such as mayonnaise, bakeries, deserts, salad creams.

Biodegradable, biocompatible, and nontoxic emulsion-based surfactant formulations of surfactants hold significant potential for future food processing applications.

For instance, in mayonnaise production, surfactants stabilize oil and water mixtures, enhancing the product's shelf life. Surfactants enhance the barrier properties of materials such as paper and plastic in food packaging by reducing surface tension, thereby creating a more effective and uniform shield against moisture and oxygen.

Surfactants are compounds with both hydrophilic (water-attracting) and hydrophobic (water-repelling) properties, playing a significant role in lowering surface tension between liquids and solids or liquids and gases. They are extensively used in various industries for maintaining emulsions, enhancing liquid wetting and spreading, and removing dirt and oil from surfaces.

Their applications extend to inks, de-icing agents, adhesives, herbicides, lubricants, fabric softeners, and emulsifiers. Companies are increasingly focusing on delivering sustainable and high-performance formulations to meet consumer and industrial demands.

Manufacturers must adhere to environmental and chemical regulations, such as the Chinese Ministry of Ecology and Environment (MEE) requirements for new chemical substances, including surfactants, and the Chemical Substances Control Law governing production and import.

Analyst’s Review

Surging awareness of personal health and hygiene is increasing, particularly in developing economies. Manufacturers focusing on developing effective products that cater to evolving consumer demands. The food industry, coupled with a rising preference for sedentary lifestyles, elevated the need for innovative product offerings.

To fulfil this need, companies are prioritizing the production of green and bio-based surfactants, driven by environmental concerns and stringent regulatory frameworks. Companies focusing on manufacturing eco-friendly products, owing to rising environmental awareness.

Key players in the market investing in research & development activities to offer advanced formulations that fulfil the surging demand of sustainable, and user friendly products.

- For instance, in March 2023, Evonic Industries launched bio-based surfactants, for their commitment towards sustainability, These surfactants utilized in applications such as personal care and industrial cleaning, offering high performance solutions, while reducing environmental impact

Surfactants Market Growth Factors

The expansion of the textile industry is fostering the growth of the surfactants market. They play a crucial role in the manufacturing processes such as wetting, scouring, emulsification, and fabric softening. They improve fabric wettability, remove impurities, enhance penetration uniformity of dry penetration, and ensure higher quality and efficiency.

Rising textile demand, fueled by increasing disposable income, population growth, and evolving, has highlighted the need for biodegradable surfactants, aligning with the shift toward sustainable and eco-friendly textiles. Advancements in textile technologies and the expanding fashion and home furnishing sectors are fostering surfactant adoption.

Companies investing in high amount to increase the production capacity of textiles. Developing countries such as China and India are witnessing rapid growth in the textile sector, supported by low labor costs and large-scale production facilities.

- For instance, in January 2023, BASF SE launched its portfolio of polyamides for the textile industry. The company's sustainable polyamide PA6 and PA6.6 product lines received certification under the Recycled Claim Standard for textile applications.

The surfactants market faces challenges from increasing competition and fluctuations in raw material prices. To meet growing demand, companies are expanding production capacities and diversifying product portfolio, which has influenced pricing dynamics.

Key raw materials, including benzene, ethylene, coconut oil, and palm oil, are affected by crude oil price volatility, supply chain disruptions, and geopolitical tensions.

Environmental concerns, such as surfactant toxicity and low degradability, further impact raw material prices. Furthermore, regional governments have introduced regulations to promote environmental protection and resource sustainability

Surfactants Industry Trends

Environmental regulations and favorable sustainability initiatives are fueling the growth of the surfactants market. Restriction on harmful or toxic surfactants, such as non-biodegradable alkyl phenol ethoxylates (APEOs), aim to mitigate their harmful effects on aquatic ecosystems and environmental persistence.

These measures have accelerated the adoption of bio-based or renewable surfactants, which offer improved biodegradability and reduced environmental impact. Additionally, rising consumer demand and corporate social responsibility efforts are fostering the integration of sustainable practices into product development plans, further promoting the use of environmentally friendly surfactants.

Rising demand for green surfactants are emerging as a notable trend in the surfactants market. As environmental awareness grows, consumers increasingly prefer biodegradable, sustainable, and non-toxic products. This shift is particularly evident in industries such ascleaning, personal care, where green surfactants are used as key components in soaps, detergent, and shampoos.

Technological advancements in biotechnology and green chemistry are further supporting market expansion. The increasing demand for sustainable technologies has fostered the shift toward alternatives to petroleum-based synthetic products.

Bio-surfactants serve various applications, including use as emulsifying agents, biocides for sulfate-reducing bacteria, anticorrosive solutions, and other innovative uses.

- For instance, in January 2024, Nouryon unveiled Berol Nexus, a versatile hydrotrope surfactant to enhance solubility and formulation efficiency, which can be ideal for personal care and household cleaning products.

Segmentation Analysis

The global market has been segmented based on type, origin, application, and geography.

By Type

Based on type, the market has been categorized into anionic surfactants, non-ionic surfactants, cationic surfactants, and amphoteric surfactants. The anionic surfactants segment led the surfactants market in 2023, reaching a valuation of USD 19.68 billion.

Surfactants, widely used in house cleaning products, are valued for their strong cleaning properties and foam production. Commonly found in detergents, shampoo, and dish soaps, the rising demand for liner alkyl benzene, a key ingredient in detergents, has boosted the demand for anionic surfactants.

These surfactants are cost-effective, biodegradable and environmentally friendly, making them ideal for sustainable product manufacturing. Additionally, they excel in removing grease, dirt, and other contaminants from different surfaces, thereby bolstering segmental expansion.

By Origin

Based on origin, the market has been bifurcated into synthetic and bio-based. The synthetic segment captured the largest revenue share of 83.72% in 2023. Synthetic surfactants, characterized by low production costs and easy availability, are widely used in industrial applications due to their performance.

These products are designed for specific functions such as wetting, emulsification, and improved foaming. The increasing demand for industrial and residential cleaning products, spurred by rapid urbanization and rising hygiene awareness, has contributed to their consistent growth.

By Application

Based on application, the market has been segmented into home care, personal care, industrial, food processing, oilfield chemicals, agricultural chemicals, and others. The home care segment is expected to garner the highest revenue of USD 23.24 billion by 2031.

Surfactants are extensively used in household cleaning products such as detergents, hand wash, cleaners, sanitizers, and dishwashing liquids. They also serve emulsifiers in cosmetic and personal care products, such as skincare and makeup.

With growing consumer preference for natural alternatives, market players are prioritizing the production of biodegradable surfactants obtained from plant oils and renewable feedstock.

Additionally, the rise of smart home technologies has spurred the integration of surfactants into innovative cleaning systems, providing efficiency and convenience in home maintenance.

Surfactants Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia-Pacific surfactants market accounted for the largest revenue share of 40.40% in 2023, with a valuation of USD 17.94 billion. The growing population, rapid urbanization and industrialization in developing countries such as India, Japan, and China have fueled the demand for surfactants across applications, including household cleaning, personal care, detergents and industrial cleaning.

Economic development has improved consumer lifestyles, creating a significant demand for personal care products such as shampoo, shaving cream, and hand soap. Low labor and manufacturing costs in emerging economies lead to global business expansion. Additionally, the focus on sustainabilitity and eco-friendly practices has spurred technological innovation.

Manufacturers in the Asia-Pacific are increasingly investing in research and development to manufacture high-performance, eco-friendly surfactants that comply with strict regulatory standards, promoting the adoption of green surfactants across industries.

The Europe surfactants market is projected to grow at a significant CAGR of 5.39% over the forecast period. This rapid growth is largely attributed to the expanding cosmetics and textiles industries, along with the increasing focus on fashion. Europe's emphasis on green chemistry and evolving economic principles promotes surfactant adoption.

The region's robust research and development ecosystem, fueled by collaboration between academia, business, and government, accelerates technological innovation. This collaboration supports the development and commercialization of new surfactants derived from plant oils and sugars.

Additionally, Europe's well-established manufacturing, supply chain, and distribution networks ensure timely product delivery, further strengthened by government financial support and favorable policies.

Competitive Landscape

The global surfactants market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding Origins, investing in research and development (R&D), establishing new Origin delivery centers, and optimizing their Origin delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Surfactants Market

- Ashland Global Holdings Inc.

- BASF SE

- Clariant

- Dow

- Evonik Industries AG

- Godrej Industries Limited

- Kao Corporation

- Nouryon

- Solvay

- Stepan Company

Key Industry Developments

- April 2024 (Launch): Nouryon introduced Structure M3, a co-surfactant featuring advanced biodegradable technology for personal care applications. This solution reduces irritation from standard surfactant systems while improving softness, washing efficacy, and foaming performance. It is ideal for shampoos, face cleansers, and body washes.

- October 2023 (Acquisition): Croda International Plc acquired Enza Biotech AB to develop next generation renewable surfactants using carbohydrate-based chemistry.

- September 2023 (Partnership): Dow partnered with LanzaTech to launch a biodegradable cleaning solution based on circular carbon capture technology. Dow also launched EcoSense 2470 Surfactant, developed in collaboration with LanzaTech Global, Inc.

The global Surfactants market has been segmented as:

By Type

- Anionic Surfactants

- Non-Ionic Surfactants

- Cationic Surfactants

- Amphoteric Surfactants

By Origin

By Application

- Home Care

- Personal Care

- Industrial

- Food Processing

- Oilfield Chemicals

- Agricultural Chemicals

- Others

By Region

- North America

- Europe

- France

- UK.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America