Market Definition

The market refers to the development, production, and distribution of sustainable semiconductor components. It includes energy-efficient chips, eco-friendly manufacturing processes, and recyclable materials aimed at reducing carbon emissions and minimizing hazardous waste.

These semiconductors are used across consumer electronics, automotive, industrial, and renewable energy applications, supporting broader environmental and regulatory goals focused on sustainability in electronics. The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Green Semiconductor Market Overview

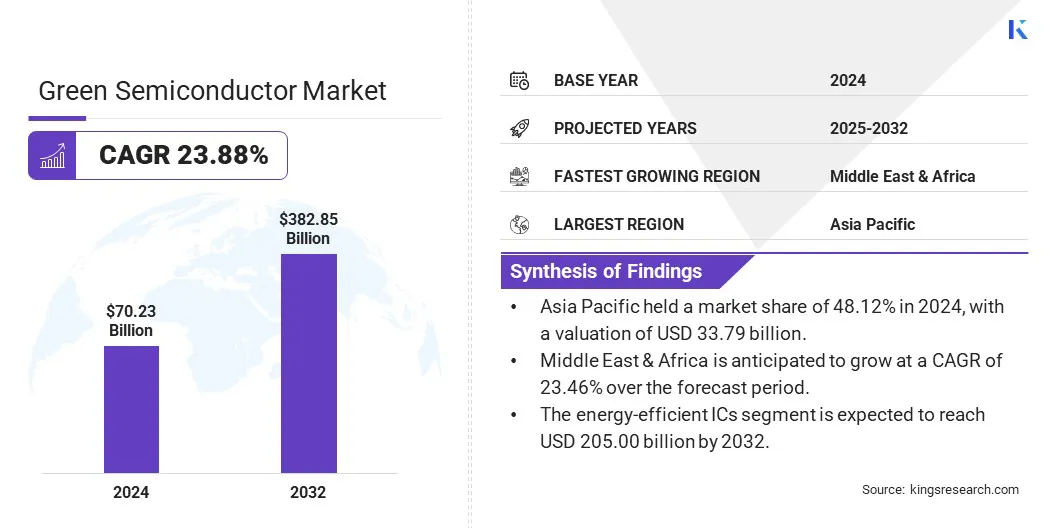

The global green semiconductor market size was valued at USD 70.23 billion in 2024 and is projected to grow from USD 85.49 billion in 2025 to USD 382.85 billion by 2032, exhibiting a CAGR of 23.88% during the forecast period.

The growing adoption of energy-efficient electronics in consumer and industrial applications is driving the market. Manufacturers are focusing on developing low-power, high-performance chips to meet sustainability goals and reduce environmental impact.

Major companies operating in the green semiconductor industry are Applied Materials, Inc, Micron Technology, Samsung, Taiwan Semiconductor Manufacturing Company Limited, Advanced Micro Devices, Inc., Intel Corporation, Qualcomm Technologies, Inc, IBM Corporation, RIR Power Electronics Ltd, Semiconductor Components Industries, LLC, Toshiba, Lenovo, Hitachi Energy Ltd, Hewlett Packard Enterprise Development LP and SK hynix Inc.

Rising demand for energy-efficient electronics is significantly driving the market. Growing consumer preference for low-power, high-performance devices is prompting manufacturers to develop energy-saving chips and components, thereby supporting sustained market growth.

- According to the International Energy Agency (IEA) Global Energy Review Report 2025, global energy demand rose by 2.2% in 2024. This exceeded the average annual growth rate of 1.3% recorded between 2013 and 2023. The power sector was the main contributor, with electricity demand rising by 4.3%.

Key Highlights:

- The green semiconductor market size was valued at USD 70.23 billion in 2024.

- The market is projected to grow at a CAGR of 23.88% from 2025 to 2032.

- Asia Pacific held a market share of 48.12% in 2024, with a valuation of USD 33.79 billion.

- The organic semiconductors segment garnered USD 35.20 billion in revenue in 2024.

- The energy-efficient ICs segment is expected to reach USD 205.00 billion by 2032.

- The industrial segment is anticipated to witness the fastest CAGR of 29.27% during the forecast period.

- Middle East & Africa is anticipated to grow at a CAGR of 23.46% over the forecast period.

Market Driver

Growth in Renewable Energy and EVs Fueling Demand

The rapid growth in renewable energy and electric vehicles (EVs) is fueling demand for green semiconductors, which are essential for efficient power conversion, energy management, and system control. with the rising solar, wind, and EV adoption the need for high-performance semiconductors that can operate reliably under varying power loads and environmental conditions.

This high-performance semiconductors enable improved energy efficiency, longer battery life, and better system performance, making them critical to advancing clean energy technologies and supporting global decarburization goals.

- According to the World Economic Forum (WEF), global renewable energy capacity grew by 15.1% in 2024, reaching a total of 4,448 gigawatts (GW).

Market Challenge

Technological Complexity

The green semiconductor market is constrained by the technological complexity of designing components that simultaneously deliver high performance, energy efficiency, and environmental sustainability. Developing such semiconductors requires advanced materials, precision manufacturing techniques, and substantial R&D investment, making widespread adoption difficult and increasing production costs.

To address this, companies are investing in advanced fabrication processes, exploring eco-friendly materials, and integrating energy-efficient circuit designs. They are also collaborating with research institutions to accelerate innovation and streamline the development of sustainable semiconductor technologies.

Market Trend

Green Energy Integration in Semiconductor Production Facilities

The semiconductor industry is increasingly adopting green energy sources to power production facilities, significantly reducing environmental impact and carbon emissions. Companies are investing in renewable energy sources such as solar and wind to support their manufacturing processes. This transition supports broader ESG goals and reflects the industry’s shift toward low-carbon manufacturing practices.

- In March 2025, In March 2025, GlobalWafers secured USD 8.8 million in green financing from Crédit Agricole CIB to support its sustainable semiconductor manufacturing initiatives. The capital isallocated to its Danish subsidiary, Topsil, for the development of a solar power plant aimed at supplying clean energy to its crystal production facility.

Green Semiconductor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material Type

|

Organic Semiconductors, Silicon Carbide (SiC), Gallium Nitride (GaN), Others

|

|

By Technology

|

Energy-efficient ICs, Eco-friendly Manufacturing, Recyclable Chip Design

|

|

By End Use Industry

|

Consumer Electronics, Automotive (EVs), Telecommunication, Industrial, Energy & Utilities, Healthcare

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Material Type (Organic Semiconductors, Silicon Carbide (SiC), Gallium Nitride (GaN), Others): The organic semiconductors segment earned USD 35.20 billion in 2024 due to their flexibility, low-cost production, and growing use in wearable and flexible electronics.

- By Technology (Energy-efficient ICs, Eco-friendly Manufacturing, Recyclable Chip Design): The energy-efficient ICs segment held 55.58% of the market in 2024, due to the increasing demand for low-power devices and sustainable technology solutions.

- By End Use Industry (Consumer Electronics, Automotive (EVs), Telecommunication, and Industrial): The consumer electronics segment is projected to reach USD 145.28 billion by 2032, owing to the rising adoption of smart devices and connected technologies worldwide.

Green Semiconductor Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific green semiconductor market accounted for a share of 48.12% in 2024, with a valuation of USD 33.79 billion. This dominance is attributed to the rapid industrialization and technological advancements in asia pacific.

Manufacturers in the Asia Pacific region are increasingly focusing on low-power semiconductor technologies to support the rapid expansion of electric vehicles, renewable energy systems, and smart consumer electronics.. Strong government initiatives promoting sustainability in renewable energy and smart manufacturing, are further accelerating market growth across this region.

The green semiconductor industry in the Middle East & Africa is set to grow at a robust CAGR of 23.46% over the forecast period. This growth is fueled by increasing investments in sustainable manufacturing and clean energy initiatives.

Collaborations between major technology companies are establishing smart production facilities powered by renewable energy, supporting the shift toward eco-friendly semiconductor fabrication. These developments are enhancing local manufacturing capabilities while aligning with broader economic goals focused on sustainability and technological innovation. This focus on green manufacturing infrastructure is a key factor fueling the market’s rapid expansion.

- In May 2024, Alat, a Public Investment Fund (PIF) company headquartered in Riyadh, Saudi Arabia, entered a strategic collaboration and investment agreement with Lenovo. Under this partnership, Lenovo will establish its regional headquarters for the Middle East and Africa (MEA) region in Riyadh, along with a new smart, sustainable manufacturing hub in the Kingdom. The facility will focus on clean energy-powered manufacturing to serve MEA customers.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates the green semiconductor. The EPA works with the semiconductor industry through Greenhouse Gas Reporting Program to track and reduce high GWP greenhouse gas emissions.

- In India, the Ministry of Electronics and Information Technology (MeitY) is the primary regulatory body overseeing the semiconductor industry. It is responsible for formulating and implementing policies that promote sustainable practices and support the development of environmentally responsible electronics manufacturing.

Competitive Landscape

Major players in the green semiconductor market are focusing on expanding their technology portfolios through strategic acquisitions and investments to enhance energy efficiency and power density. They are prioritizing innovations that support high-performance applications in AI, automotive, and industrial sectors.

Strengthening capabilities in wide-bandgap semiconductor technologies and advancing sustainable manufacturing processes help companies maintain competitive advantages while meeting increasing demand for low-power, efficient, and eco-friendly solutions across diverse end-use industries.

- In January 2025, onsemi completed the acquisition of the Silicon Carbide Junction Field-Effect Transistor (SiC JFET) technology business, including United Silicon Carbide, from Qorvo for USD 115 million. This acquisition enhances onsemi’s EliteSiC power portfolio, enabling improved energy efficiency and power density in AI data center power supplies, electric vehicle battery disconnects units, and industrial energy storage systems.

List of Key Companies in Green Semiconductor Market:

- Applied Materials, Inc

- Micron Technology

- Samsung

- Taiwan Semiconductor Manufacturing Company Limited

- Advanced Micro Devices, Inc.

- Intel Corporation

- Qualcomm Technologies, Inc

- IBM Corporation

- RIR Power Electronics Ltd

- Semiconductor Components Industries, LLC

- Toshiba

- Lenovo

- Hitachi Energy Ltd

- Hewlett Packard Enterprise Development LP

- SK hynix Inc.

Recent Developments

- In July 2024, SK hynix showcased its “Journey to Decarbonization” plan at SEMICON West 2024 in San Francisco, demonstrating its strong commitment to sustainability in the semiconductor industry.

atributed