Market Definition

The market encompasses the adoption of sustainable practices within the transportation, warehousing, and distribution sectors. It involves the integration of environmentally friendly solutions such as energy-efficient vehicles, renewable energy sources, and eco-friendly packaging.

This market focuses on reducing carbon footprints, minimizing waste, and optimizing supply chain operations to promote sustainability in global logistics and transportation systems. The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

Green Logistics Market Overview

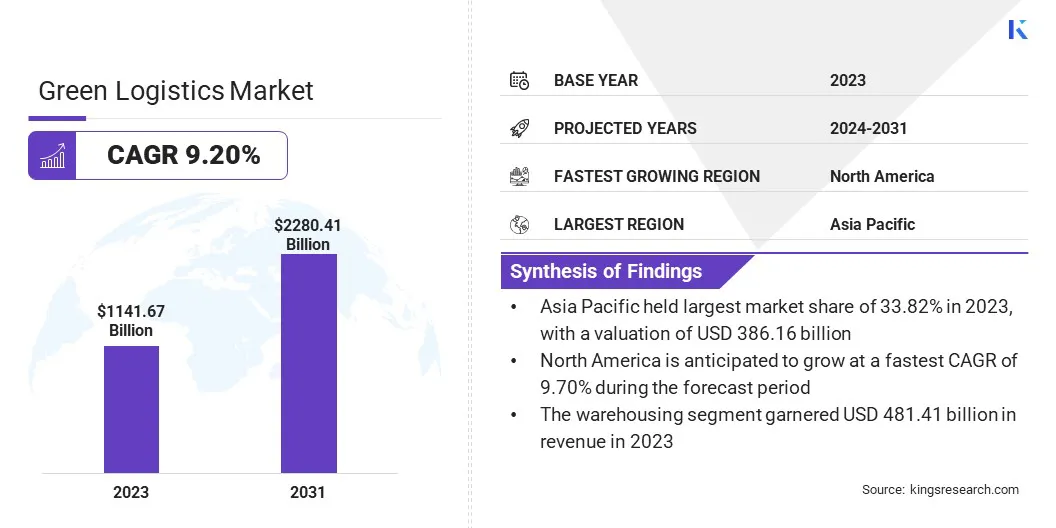

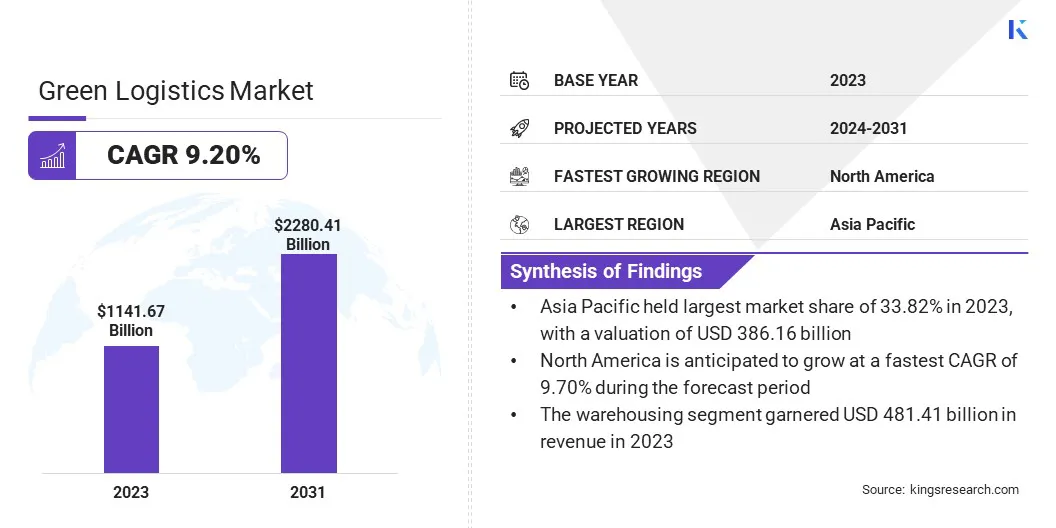

The global green logistics market size was valued at USD 1,141.67 billion in 2023 and is projected to grow from USD 1,231.63 billion in 2024 to USD 2,280.41 billion by 2031, exhibiting a CAGR of 9.20% during the forecast period.

The market is registering significant growth, driven by increasing environmental awareness, government regulations, and the push for sustainability across industries. Rising concerns over climate change and the need to reduce carbon emissions are prompting companies to adopt low-emission transportation strategies. Innovations in energy-efficient vehicles, electric trucks, and sustainable packaging are enhancing supply chain efficiency.

Major companies operating in the green logistics industry are Deutsche Post AG, United Parcel Service of America, Inc., FedEx, XPO, Inc., CEVA Logistics, A.P. Moller – Maersk, Kuehne+Nagel, DSV, C.H. Robinson Worldwide, Inc., NIPPON EXPRESS HOLDINGS, J.B. Hunt Transport, Inc., Amazon.com, Inc., Go Green Logistics, Rhenus Logistics SE & Co. KG, and Toll Holdings Limited.

The growing shift toward electric and hybrid vehicles, along with the optimization of supply chains through data-driven technologies like AI and blockchain, is driving efficiency and reducing emissions.

Moreover, the rising availability of renewable energy solutions and green infrastructure is further supporting the transition to more sustainable logistics models, enhancing the market's attractiveness to both businesses and investors.

- In September 2024, IntegrityNext launched an EUDR Compliance solution and an AI Multi-Tier Supply Chain Visibility platform to enhance multi-tier supply chain visibility and support compliance with the EU Deforestation-Free Products Regulation (EUDR). The solutions leverage AI-driven insights to provide businesses with detailed supply chain transparency and enable them to meet deforestation regulations efficiently.

Key Highlights

- The green logistics market size was valued at USD 1,141.67 billion in 2023.

- The market is projected to grow at a CAGR of 9.20% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 386.16 billion.

- The warehousing segment garnered USD 481.41 billion in revenue in 2023.

- The roadways segment is expected to reach USD 812.05 billion by 2031.

- The healthcare segment is expected to reach USD 551.41 billion by 2031.

- The market in North America is anticipated to grow at a CAGR of 9.70% during the forecast period.

Market Driver

Rising Demand for Carbon-neutral Supply Chains

The market is registering significant growth, driven primarily by the rising demand for carbon-neutral supply chains from businesses and consumers. Environmental concerns are gradually rising, thus, organizations are under growing pressure to minimize carbon footprints and adopt sustainable practices across their operations.

This demand is prompting logistics providers to integrate low-emission transportation modes, such as Electric Vehicles (EVs), biofuels, and sustainable aviation fuel, into their fleets. Additionally, there is a strong emphasis on energy-efficient practices, including the optimization of routes, use of renewable energy in warehouses, and automation to reduce waste and improve overall efficiency.

- In November 2024, CEVA Logistics launched its FORPLANET sub-brand to enhance its suite of low carbon and sustainable logistics solutions. The initiative focuses on reducing supply chain emissions through modal shifts, alternative fuels, and EVs, while also promoting circular economy practices such as reusable packaging and reverse logistics. The FORPLANET solutions offer precise CO₂e tracking and a five-step transformation program to help customers decarbonize their logistics operations.

Market Challenge

Limited Infrastructure for Sustainable Logistics

One of the major challenges in the green logistics market is the lack of adequate infrastructure to support environmentally friendly operations. There are still limited charging stations for electric trucks, insufficient rail and intermodal transport connectivity, and a shortage of renewable energy supply at key logistics hubs.

This restricts the ability of logistics companies to fully adopt low-emission transport and energy solutions across their entire network. Public and private sector collaboration is essential to overcome this challenge. Governments can invest in nationwide green transport infrastructure, while companies can form partnerships to develop shared logistics facilities powered by renewable energy.

Market Trend

Growth of Net-zero Logistics Hubs

A key trend in the market is the development of net-zero logistics hubs and infrastructure. Companies are increasingly investing in sustainable solutions such as energy-efficient warehouses, EV charging facilities, and integrating renewable energy sources into their operations. This shift indicates that the industry is focusing on reducing emissions across the entire logistics value chain, not just in transportation.

Incorporating clean energy, reducing waste, and adopting EVs can help businesses create more environmentally friendly and efficient supply chains. This shift is driven by the need to meet environmental goals and respond to the increasing demand for sustainable practices from customers and regulations.

- In July 2024, Envision Group and DHL Group entered into a strategic partnership to accelerate sustainability in logistics and energy through initiatives such as the supply of Sustainable Aviation Fuel (SAF), comprehensive green energy solutions, and the joint development of a Net Zero Industrial & Logistic Park. The collaboration aims to reduce carbon emissions in air transport, optimize global supply chains, and foster the development of green industrial ecosystems powered by clean energy.

Green Logistics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Business

|

Warehousing, Distribution, Value-added Services

|

|

By Mode of Operation

|

Storage, Roadways, Airways, Seaways

|

|

By End Use

|

Healthcare, Manufacturing, Automotive, BFSI, Retail, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Business (Warehousing, Distribution, and Value-added Services): The warehousing segment earned USD 481.41 billion in 2023, due to the growing demand for storage capacity and efficient inventory management in response to e-commerce growth and supply chain optimization.

- By Mode of Operation (Storage, Roadways, Airways, and Seaways): The roadways segment held 35.53% share of the market in 2023, due to its cost-effectiveness and extensive infrastructure, which supports flexible and fast delivery across domestic and regional markets.

- By End Use (Healthcare, Manufacturing, Automotive, BFSI, Retail, Others): The healthcare segment is projected to reach USD 551.41 billion by 2031, owing to the increasing need for temperature-sensitive product transportation and the growth of pharmaceuticals & medical supplies.

Green Logistics Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 33.82% share of the green logistics market in 2023, with a valuation of USD 386.16 billion. The region's dominance is largely attributed to its rapidly expanding industrial base, booming e-commerce sector, and significant investments in sustainable supply chain practices.

Countries like China and India are major contributors, where increasing urbanization and manufacturing activities drive the need for efficient, low-emission transportation strategies. Additionally, the strong manufacturing sector in Asia Pacific is adopting green logistics strategies to meet global sustainability expectations and improve supply chain efficiency, fueling the market in the region.

- In July 2024, the Department for Promotion of Industry and Internal Trade (DPIIT) announced a series of initiatives to promote the green logistics industry in India, focusing on balancing economic growth with environmental sustainability. Key developments included the implementation of digital platforms like ULIP and Logistics Data Bank to enhance multimodal connectivity, reduce carbon emissions, and improve logistics efficiency through digitalization, automation, and modal shift strategies.

The green logistics industry in North America is expected to register the fastest growth, with a projected CAGR of 9.70% over the forecast period. The region is particularly influenced by the shift toward electrification in logistics, led by major players in the U.S. The rise in e-commerce, coupled with the push toward last-mile delivery optimization using electric delivery vehicles and drones, is transforming logistics operations.

Moreover, the adoption of AI and ML in route planning and supply chain management is further contributing to reducing operational costs and carbon footprints. Furthermore, the increasing focus on reducing carbon footprints among multinational corporations, combined with strong consumer preference for sustainable practices, is further accelerating the demand for green logistics in the region.

Regulatory Frameworks

- In the U.S., green logistics is regulated by several environmental policies, including the EPA’s (Environmental Protection Agency) Clean Air Act by the Environmental Protection Agency (EPA), which sets air quality standards and regulates emissions from transportation vehicles.

- In the European Union (EU), green logistics is primarily governed by the European Commission, the Council of the European Union, and the European Parliament, alongside initiatives like the European Green Deal.

Competitive Landscape

The green logistics market is characterized by key players employing various strategies to maintain and expand their market presence. Companies in the market are increasingly investing in electric and hybrid vehicles to reduce carbon emissions, with many committing to transition their fleets to fully electric in the coming years.

In addition to fleet upgrades, significant efforts are being made in green warehousing, with automation and energy-efficient systems being implemented for a lower environmental impact. The integration of renewable energy sources, such as solar panels and wind energy, in logistics operations is becoming more common, further reducing environmental impact.

Moreover, some companies are forming strategic partnerships with technology providers to enhance their green logistics capabilities, particularly in data analytics and supply chain visibility, to track and manage emissions more effectively.

- In January 2025, Covestro and DB Cargo BTT partnered for the sustainable transport of chemicals to Poland. The collaboration focused on reducing CO₂ emissions by at least 70% through a combination of bio-fuel (HVO 100)-driven trucks and rail transport.

List of Key Companies in Green Logistics Market:

- Deutsche Post AG

- United Parcel Service of America, Inc.

- FedEx

- XPO, Inc.

- CEVA Logistics

- A.P. Moller - Maersk

- Kuehne+Nagel

- DSV

- C.H. Robinson Worldwide, Inc.

- NIPPON EXPRESS HOLDINGS

- J.B. Hunt Transport, Inc.

- Amazon.com, Inc.

- Go Green Logistics

- Rhenus Logistics SE & Co. KG

- Toll Holdings Limited

Recent Developments (Investment/Partnership/Collaboration/Facility Launch)

- In April 2025, GreenLine Mobility Solutions raised USD 275 million in equity. The funding will be used to expand its green fleet, scaling up to 10,000 LNG and electric trucks while establishing 100 LNG refuelling stations and EV charging points across India, in alignment with the country's low-carbon transition goals.

- In February 2025, Neste and DHL Group collaborated to reduce logistics emissions. The partnership focused on leveraging renewable diesel and sustainable aviation fuel to support DHL's decarbonization goals in air and road transportation.

- In January 2025, Sustainable Shared Transport Inc. (SST) and Fujitsu Limited partnered to launch a joint transportation and delivery system in Japan. The collaboration aims to enhance logistics efficiency through standardized pallet transportation and information exchange, focusing on sustainable supply chain practices and optimized transportation plans.

- In January 2025, Blue Dart launched India’s largest Low-emission Integrated Operating Facility at Bijwasan, Delhi. The facility focused on enhancing logistics efficiency with solar power installations and multimodal connectivity, aiming to support sustainable logistics practices and reduce carbon emissions.