Market Definition

Glycated albumin assays measure the concentration of glycated albumin in blood to monitor short-term blood glucose levels. These assays provide accurate information on glycemic control over the past two to three weeks and support disease management.

They are used in clinical diagnostics, diabetes monitoring, and metabolic research, with broad adoption across hospitals, diabetes care centers, diagnostic laboratories, and academic and research institutes to guide treatment decisions and evaluate therapeutic outcomes.

Glycated Albumin Assay Market Overview

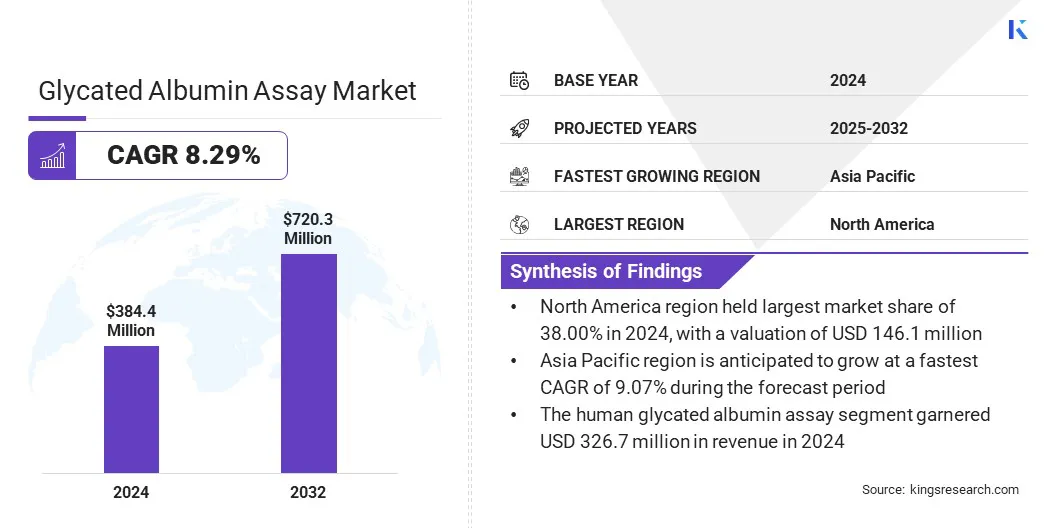

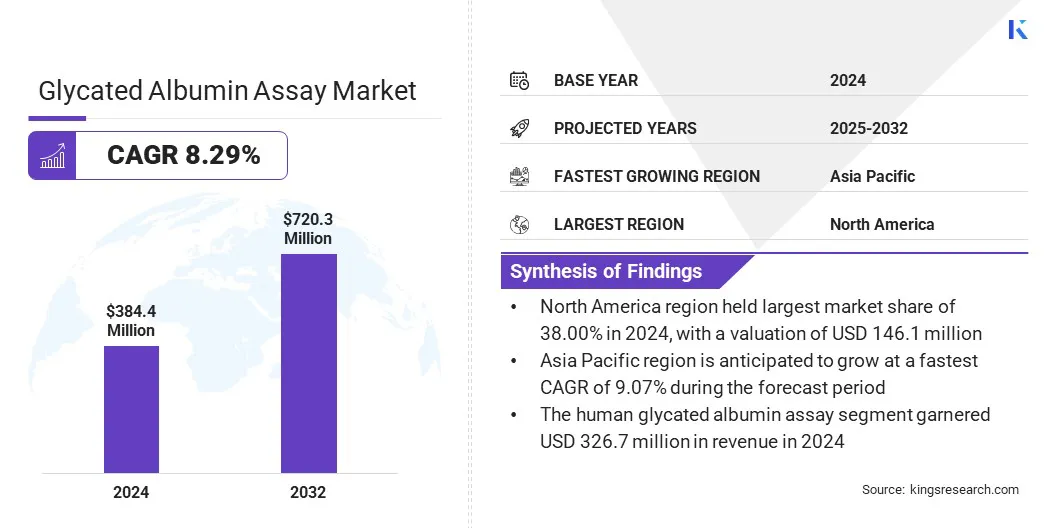

The global glycated albumin assay market size was valued at USD 384.4 million in 2024 and is projected to grow from USD 412.6 million in 2025 to USD 720.3 million by 2032, exhibiting a CAGR of 8.29% during the forecast period.

Market growth is driven by the increasing prevalence of diabetes globally, which has created a higher demand for accurate monitoring of short-term blood glucose levels. The market is also witnessing a shift toward rapid home glycated albumin measurement, as patients and healthcare providers seek convenient real-time solutions.

Key Highlights:

- The glycated albumin assay industry size was recorded at USD 384.4 million in 2024.

- The market is projected to grow at a CAGR of 8.29% from 2025 to 2032.

- North America held a share of 38.00% in 2024, valued at USD 146.1 million.

- The human glycated albumin assay segment garnered USD 326.7 million in revenue in 2024.

- The type 2 diabetes segment is projected to reach USD 357.8 million by 2032.

- The hospitals & diabetes care centers segment is expected to reach USD 444.5 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 9.07% over the forecast period.

Major companies operating in the glycated albumin assay market are Nagase Diagnostics Co., Ltd., Beijing Strong Biotechnologies, Inc., Diazyme Laboratories, Asahi Kasei Corporation, AFG Bioscience LLC, Biomatik, Assay Genie, Wuhan Fine Biotech Co., Ltd., CUSABIO TECHNOLOGY LLC, Krishgen Biosystems, Zhejiang Kangte Biotechnology Co., Ltd., Biocompare, and Randox Laboratories Ltd.

Market growth is propelled by the integration of advanced automated assay systems in clinical laboratories and diagnostic centers. These systems improve testing accuracy, reduce human error, and increase throughput, allowing laboratories to handle higher volumes of samples efficiently.

Automation also enables standardized procedures, ensuring consistent and reliable results across different settings. The adoption of these technologies supports faster turnaround times, enhancing overall operational efficiency and patient care in hospital and research settings.

Market Driver

Increasing Prevalence of Diabetes Globally

The expansion of the glycated albumin assay market is driven by the increasing prevalence of diabetes globally. Rising diabetes cases are creating a strong demand for precise monitoring of blood glucose levels.

Glycated albumin assays offer accurate insights into short-term glycemic control, enabling healthcare providers to adjust treatments effectively. The increasing need for regular monitoring in hospitals and diabetes care centers is boosting the adoption of these assays in clinical and research settings.

- In 2025, the International Diabetes Federation (IDF) estimates that 11.1% of adults aged 20–79, around one in nine, are living with diabetes, with over 40% undiagnosed. By 2050, this is projected to rise to one in eight adults, or approximately 853 million people, representing a 46% increase. Over 90% of cases are type 2 diabetes, primarily fueled by urbanization, ageing populations, reduced physical activity, and rising rates of overweight and obesity.

Market Challenge

High Cost of Glycated Albumin Assay Kits

A major challenge restraining the progress of the glycated albumin assay market is the high cost of assay kits, which limits adoption among smaller clinics and individual patients. This is particularly evident in emerging markets with budget-constrained healthcare systems, slowing overall growth and regional expansion.

To address this challenge, companies are developing cost-effective assay solutions and implementing bulk or subscription-based pricing models. They are also optimizing manufacturing processes to maintain accuracy while lowering production costs.

Market Trend

Shift toward Rapid Home Glycated Albumin Measurement

The glycated albumin assay Market is witnessing a growing shift toward rapid home glycated albumin measurement. Patients and healthcare providers are increasingly adopting home-based testing solutions to monitor short-term blood glucose levels conveniently.

These devices enable real-time tracking of glycemic control, reduce the need for frequent clinical visits, and support timely adjustments in therapy. The trend is fostering innovation in user-friendly, accurate point-of-care testing systems for at-home monitoring.

Glycated Albumin Assay Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Human Glycated Albumin Assay, Animal Glycated Albumin Assay

|

|

By Application

|

Type 2 Diabetes, Type 1 Diabetes, Prediabetes, Others

|

|

By End User

|

Hospitals & Diabetes Care Centers, Diagnostic Laboratories, Academic & Research Institutes, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Human Glycated Albumin Assay and Animal Glycated Albumin Assay): The human glycated albumin assay segment earned USD 326.7 million in 2024, mainly due to its widespread use in monitoring short-term glycemic levels in patients with diabetes.

- By Application (Type 2 Diabetes, Type 1 Diabetes, Prediabetes, and Others): The type 2 diabetes segment held a share of 50.00% in 2024, fueled by the high prevalence of the disease and the rising need for accurate glucose monitoring.

- By End User (Hospitals & Diabetes Care Centers, Diagnostic Laboratories, Academic & Research Institutes, and Others): The hospitals & diabetes care centers segment is projected to reach USD 444.5 million by 2032, owing to increasing patient visits and the demand for routine diabetes management services.

Glycated Albumin Assay Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America glycated albumin assay market share stood at 38.00% in 2024, valued at USD 146.1 million. This dominance is stimulated by advanced healthcare infrastructure and early adoption of innovative diagnostic technologies that enable accurate and frequent monitoring of blood glucose levels. Strong research and development activities and strategic collaborations in the healthcare sector have further reinforced North America’s leading market position.

The Asia-Pacific glycated albumin assay industry is poised to grow at a CAGR of 9.07% over the forecast period. This growth is propelled by the rapidly increasing prevalence of diabetes and rising awareness of short-term glycemic monitoring.

Expansion of healthcare infrastructure, rising investments in diagnostic services, and government initiatives to improve disease detection are accelerating the adoption of glycated albumin assays. Expanding patient populations and the rising demand for accessible and accurate diagnostic solutions are expected to support regional market expansion.

- In 2024, the IDF estimated 106.9 million adults (20–79 years) with diabetes in South-East Asia, up from 34.9 million in 2000. By 2050, this number is projected to reach 184.5 million, a 73% increase, with a prevalence of 13.2%. The region records the thirdhighest rate of undiagnosed diabetes at 42.7% and the highest share of pregnancies affected by hyperglycaemia at 27.8%.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates glycated albumin assays as in vitro diagnostic (IVD) devices. These assays require 510(k) clearance, demonstrating substantial equivalence to legally marketed devices.

- In Europe, glycated albumin assays must obtain CE marking under the In Vitro Diagnostic Medical Devices Regulation (IVDR). This process involves conformity assessment procedures to ensure the device meets EU safety and performance requirements.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) oversees the regulation of medical devices. Glycated albumin assays are classified as Class II medical devices, requiring certification under the Pharmaceutical and Medical Device Act.

- In India, the Central Drugs Standard Control Organisation (CDSCO) regulates medical devices, including in vitro diagnostic devices such as glycated albumin assays. These devices must comply with the Medical Devices Rules, 2017, which classify devices based on risk and intended use.

Competitive Landscape

Key players in the glycated albumin assay industry are forming strategic partnerships and research collaborations to expand their technological capabilities and product portfolios. Collaborations with academic institutions and research organizations focus on developing new assay methods and validating clinical applications.

Additionally, alliances with diagnostic laboratories and healthcare providers are supporting wider distribution and reach. These collaborations accelerate product development, improve regulatory compliance, and strengthen competitive positioning globally.

Key Companies in Glycated Albumin Assay Market:

- Nagase Diagnostics Co., Ltd.

- Beijing Strong Biotechnologies, Inc.

- Diazyme Laboratories

- Asahi Kasei Corporation

- AFG Bioscience LLC

- Biomatik

- Assay Genie

- Wuhan Fine Biotech Co., Ltd.

- CUSABIO TECHNOLOGY LLC

- Krishgen Biosystems

- Zhejiang Kangte Biotechnology Co., Ltd.

- Biocompare

- Randox Laboratories Ltd.

Recent Developments (Partnerships)

- In August 2025, Provigate, Inc. and Sysmex Corporation entered a basic agreement to jointly develop point-of-care testing (POCT) and diabetes management applications using glycated albumin (GA). The collaboration combines Provigate’s expertise in sensors and applications with Sysmex’s capabilities in in vitro diagnostics.