Market Definition

The market is a rapidly growing sector focused on harnessing the Earth's natural heat to generate electricity and provide heating solutions. With increasing demand for renewable energy and sustainable power generation, the market is expanding due to advancements in drilling, energy efficiency, and resource management.

Key growth factors include government incentives, favorable regulatory frameworks, and the potential for long-term, low-carbon energy solutions across residential, commercial, and industrial applications.The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Geothermal Power Market Overview

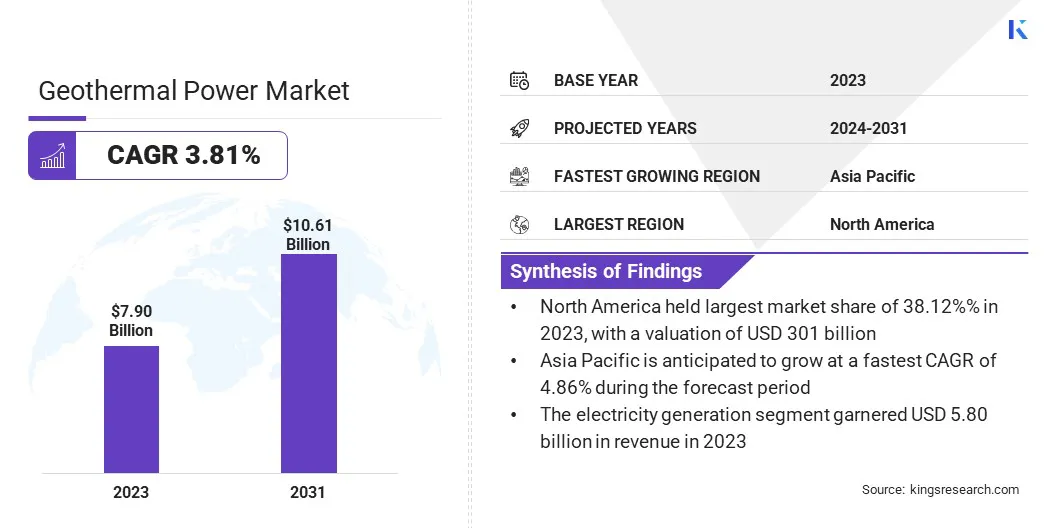

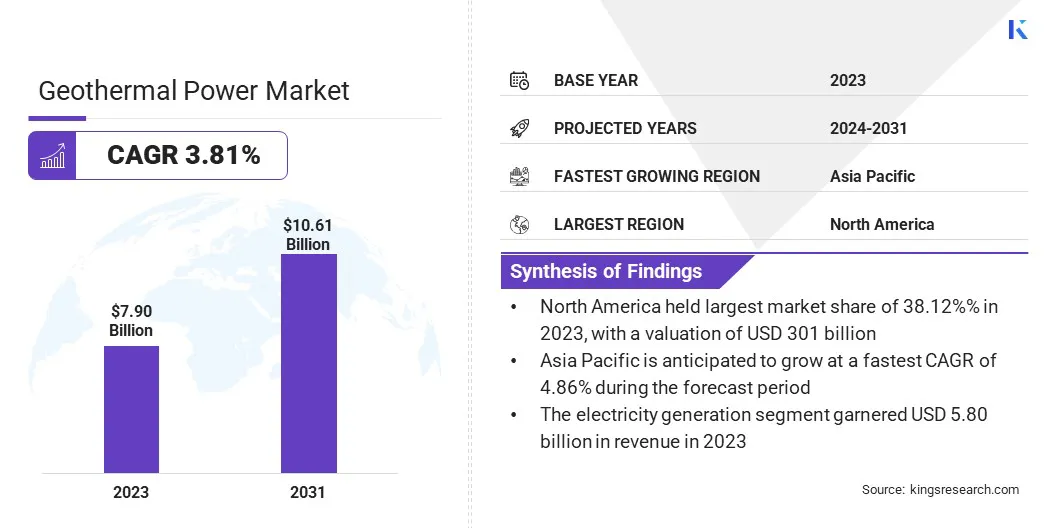

The global geothermal power market size was valued at USD 7.90 billion in 2023 and is projected to grow from USD 8.16 billion in 2024 to USD 10.61 billion by 2031, exhibiting a CAGR of 3.81% during the forecast period.

The growing demand for reliable, renewable energy is driving the market. With increasing investments in direct geothermal heat applications and advancements in technology, geothermal energy is seen as a sustainable solution for reducing emissions, enhancing energy security, and supporting climate objectives.

Major companies operating in the geothermal power industry are Turboden S.p.A., Ormat, MITSUBISHI HEAVY INDUSTRIES, LTD, Baker Hughes, NIBE Group, SLB, Atlas Copco, Exergy International S.r.l, Toshiba Energy Systems & Solutions Corporation, General Electric, Ansaldo Energia, Siemens, Yokogawa India Ltd., Ethos Energy Group Limited, and Calpine Corporation.

The market is growing as the need for reliable and renewable energy increases. As countries are increasing their efforts to reduce the use of fossil fuels, they are turning to clean energy sources like geothermal. Geothermal provides constant, low-emission power, helping reduce environmental impact.

Governments and businesses view geothermal energy as a way to improve energy security, lower long-term costs, and support climate goals while ensuring a steady and dependable electricity supply.

- In October 2024, The Indian Ministry of New and Renewable Energy reported that India’s renewable energy capacity reached 203.18 GW, reflecting a 13.5% increase in one year.

Key Highlights

- The geothermal power market size was recorded at USD 7.90 billion in 2023.

- The market is projected to grow at a CAGR of 3.81% from 2024 to 2031.

- North America held a market share of 38.12% in 2023, with a valuation of USD 3.01 billion.

- The flash steam power stations segment garnered USD 4.59 billion in revenue in 2023.

- The electricity generation segment is expected to reach USD 7.72 billion by 2031.

- The industrial segment is anticipated to witness the fastest CAGR of 5.41% during the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 4.86% during the forecast period.

Market Driver

Growing demand for renewable energy

The market is driven by the growing demand for renewable energy to reduce carbon emissions and address climate change. As businesses, governments, and consumers prioritize sustainability, there is a shift towards clean energy sources like geothermal.

This demand is also fueled by the need for energy security, cost efficiency, and regulatory pressure. The market is expanding rapidly with continuous advancements in renewable technologies and contributing to the transformation of the global energy landscape.

- According to the International Energy Agency (IEA) report publish in december 2024, geothermal energy is expected to meet 15% of global electricity demand by 2050, with the potential to deploy 800 GW of capacity. This will provide an output equivalent to the combined electricity demand of the U.S. and India.

Market Challenge

Dependence on specific geological conditions

Resource risk and site dependency are key challenges in the geothermal power market. The viability of projects depends heavily on specific geological conditions, limiting development to certain regions.

This site-specific nature creates significant resource risk, as even exploratory efforts may not confirm the presence of commercially viable heat reservoirs. Inaccurate assessments can lead to costly delays and sunk investment in non-productive sites.

To address this challenge, industry players are increasingly adopting advanced exploration technologies such as 3D reservoir modeling, seismic imaging, and geophysical surveys.

These tools improve the accuracy of subsurface evaluations and reduce the likelihood of unsuccessful drilling. Collaboration with academic institutions and access to public-sector exploration data have also enhanced site selection processes, enabling more informed decisions and reducing uncertainty in early project phases.

Market Trend

Increasing capital flow into direct geothermal heat utilization

The market is witnessing rising investment in direct-use geothermal heat applications, indicating a broadening focus beyond electricity generation. Sectors such as district heating, greenhouse farming, and industrial processes are increasingly leveraging geothermal heat for its reliability and low emissions.

These applications offer steady returns while reducing reliance on fossil fuels. Supportive government frameworks and ongoing technological advancements are making direct-use projects more commercially viable, contributing to geothermal energy’s expanding role in the global clean energy.

- In March 2025, the World Bank approved a project to boost El Salvador’s renewable energy capacity through geothermal development. Implemented by state-owned LaGeo, the project includes building a 25 MW geothermal plant in the Chinameca Field, with potential expansion to 40 MW. It also involves resource exploration and will generate local employment during construction and operation phases.

Geothermal Power Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Dry Steam Power Stations (Conventional dry steam, Enhanced geothermal systems (EGS)), Flash Steam Power Stations (Single-flash, Double-flash, Triple-flash), Binary Cycle Power Stations(Organic Rankine Cycle (ORC), Kalina Cycle)

|

|

By Application

|

Electricity Generation, Direct Use

|

|

By End Use Industry

|

Residential, Commercial, Industrial, Utility-scale Projects

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Dry Steam Power Stations, Flash Steam Power Stations, Binary Cycle Power Stations): The flash steam power stations segment earned USD 4.59 billion in 2023 due to their ability to efficiently harness medium- to high-temperature geothermal resources for reliable power generation.

- By Application (Electricity Generation, Direct Use): The electricity generation held 73.43% of the market in 2023, due to the increasing global demand for renewable energy and the scalability of geothermal power plants.

- By End Use Industry (Residential, Commercial, Industrial, and Utility-scale Projects): The industrial segment is projected to reach USD 4.8 billion by 2031, owing to the growing demand for sustainable and cost-effective energy solutions in energy-intensive industries.

Geothermal Power Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America geothermal power market share stood around 38.12% in 2023 in the global market, with a valuation of USD 3.01 billion. North America’s dominance in the market is attributed to several strategic factors.

These include strong government support, coupled with favorable regulatory frameworks, and substential investment from public and private sectors. The presence of advanced technology providers and a highly skilled workforce also contribute to accelerating project execution..

- In June 2024, the U.S. Department of Energy’s Geothermal Technologies Office (GTO) announced the GRID Funding Opportunity to support regional grid modeling studies. The initiative aims to highlight geothermal energy’s role in delivering reliable, clean power to over 65 million homes, develop new valuation metrics, promote equitable deployment, and create visual tools to communicate geothermal energy’s economic and reliability benefits.

Asia Pacific is poised for significant growth at a robust CAGR of 4.86% over the forecast period. A key factor driving the growth of the geothermal power industry in the Asia-Pacific region is the region’s abundant geothermal resources, coupled with rising energy demands and a strong push for sustainable energy solutions.

Governments are increasingly offering incentives and implementing favorable policies to encourage geothermal development. Technological advancements in exploration and drilling, along with growing awareness of low-carbon energy options, further support the expansion of geothermal power, making it a strategic choice for energy security and environmental sustainability in the region.

Regulatory Framework

- In the U.S., the Bureau of Land Management (BLM), a division of the Department of the Interior, supervises geothermal power development on public lands. It manages geothermal leases to facilitate project development and regulates operations to ensure environmental sustainability and responsible resource management.

- In India, the Ministry of New and Renewable Energy (MNRE) is the key authority overseeing geothermal regulations.

- In Europe, the European Geothermal Energy Council (EGEC) advocates for the industry and drives improvements in regulatory frameworks to support geothermal energy development.

Competitive Landscape

The geothermal power market is characterized by a large number of participants, including both established corporations and rising organizations. Companies are leveraging strategies such as mergers and acquisitions, along with new product launches.. Key players are enhancing their market position and expanding their technological capabilities by acquiring other market players and forming strategic partnerships.

- In July 2024, Turboden S.p.A., part of Mitsubishi Heavy Industries, announced the successful launch of a 28.9 MWe geothermal power plant at Energy Development Corporation’s Palayan Bayan expansion in the Philippines. The plant is expected to generate 253,000 MWh annually, reducing carbon emissions by 72,200 tons per year, equivalent to the CO2 absorption of a forest 4.7 times the size of Manila.

List of Key Companies in Geothermal Power Market:

- Turboden S.p.A.

- Ormat

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Baker Hughes

- NIBE Group

- SLB

- Atlas Copco

- Exergy International S.r.l.

- Toshiba Energy Systems & Solutions Corporation

- General Electric

- Ansaldo Energia

- Siemens

- Yokogawa India Ltd.

- Ethos Energy Group Limited

- Calpine Corporation

Recent Developments

- In April 2024, Turboden collaborated with Fervo Energy to advance continuous, carbon-free energy generation and drive innovation in the geothermal sector, strengthening its position in the evolving clean energy landscape.

- In February 2024, Mitsubishi Heavy Industries invested in Fervo Energy to advance decarbonization by integrating Fervo's innovative geothermal solutions with Mitsubishi's power generation portfolio. Enhanced geothermal offers dispatchable, carbon-free energy, addressing intermittency issues of solar and wind, especially for industrial applications.

- In January 2024, Ormat acquired 100% equity interest in a portfolio of operating geothermal and solar assets from Enel Green Power North America for USD 271 million. The portfolio includes two geothermal plants, a hybrid geothermal-solar facility (totaling 60 MW), two solar projects (40 MW), and two greenfield assets, strengthening Ormat’s renewable energy footprint and generation capacity.

- In March 2023, Ecopetrol, Baker Hughes, and the hydroelectric power plant signed a memorandum of understanding to conduct feasibility studies for a geothermal power project in Colombia’s Nereidas Valley. The proposed project aims to generate 50-100 MW of renewable energy using underground heat sources, with the potential to supply electricity to over 250,000 households.

, a Houston-based enhanced geothermal technology startup. Joining a consortium of strategic investors, MHI aims