Market Definition

The market refers to the industry in which third-party manufacturers produce generic drugs on behalf of pharmaceutical companies.

This market encompasses a wide range of services, including the manufacturing of Active Pharmaceutical Ingredients (API) and finished drugs, ensuring cost efficiency and scalability for pharmaceutical companies. It covers various routes of administration, including oral, parenteral, topical, and others, catering to diverse therapeutic applications.

Generic Pharmaceuticals Contract Manufacturing Market Overview

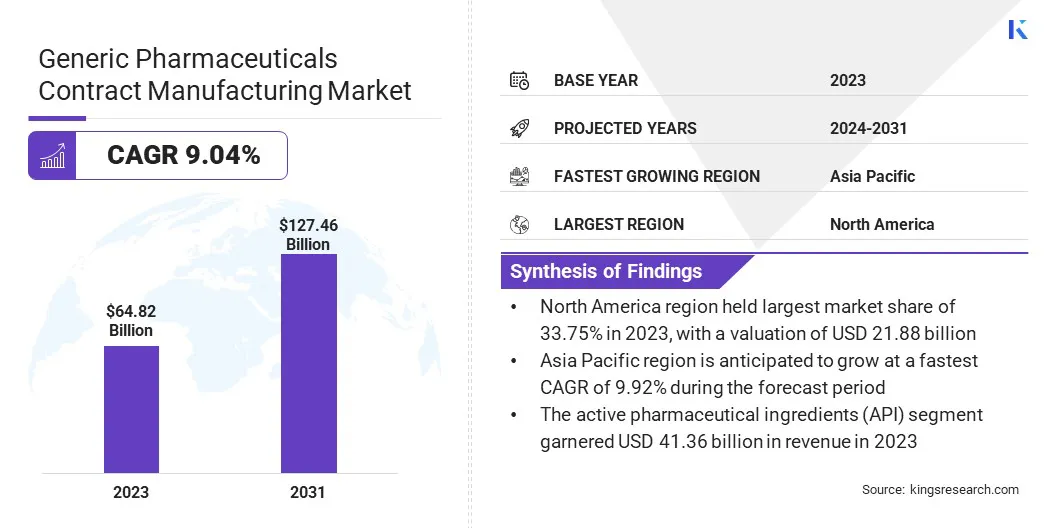

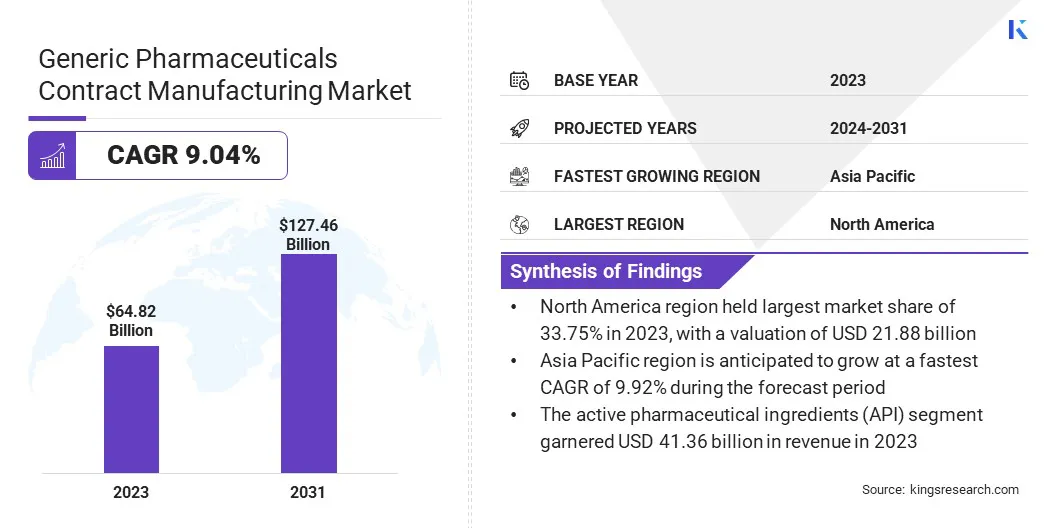

The global generic pharmaceuticals contract manufacturing market size was valued at USD 64.82 billion in 2023 and is projected to grow from USD 69.53 billion in 2024 to USD 127.46 billion by 2031, exhibiting a CAGR of 9.04% during the forecast period.

The growth of the market is attributed to the rising demand for cost-effective medicines, increasing outsourcing by pharmaceutical companies, and the need for scalable production solutions. The growing prevalence of chronic diseases, coupled with patent expirations of branded drugs, has further fueled the market.

Major companies operating in the generic pharmaceuticals contract manufacturing industry are AJINOMOTO CO., INC., Recipharm AB., Vetter, Lonza, Piramal Enterprises Ltd., Thermo Fisher Scientific Inc., Cambrex Corporation, Polpharma, Curia Global, Inc., Catalent, Inc, Aenova Group, Jubilant Pharma Limited, Fareva Group, WuXi AppTec, and Siegfried Holding AG.

Additionally, advancements in manufacturing technologies, cost pressures on pharmaceutical firms, and increasing regulatory compliance requirements have encouraged companies to partner with contract manufacturers.

These partnerships help streamline production, ensure consistent product quality, enhance cost efficiency, and support pharmaceutical firms in expanding their presence across global markets while focusing on core competencies.

Key Highlights:

- The generic pharmaceuticals contract manufacturing industry size was valued at USD 64.82 billion in 2023.

- The market is projected to grow at a CAGR of 9.04% from 2024 to 2031.

- North America held a market share of 33.75% in 2023, with a valuation of USD 21.88 billion.

- The branded segment garnered USD 38.59 billion in revenue in 2023.

- The active pharmaceutical ingredients (API) segment is expected to reach USD 81.23 billion by 2031.

- The oral segment is expected to reach USD 40.43 billion by 2031.

- The oncology segment is expected to reach USD 15.29 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.92% during the forecast period.

Market Driver

Increasing Demand for Affordable Generic Drugs and Outsourcing of Manufacturing

The market is driven by the rising demand for affordable generic drugs and the increasing outsourcing of manufacturing to Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs).

Governments and healthcare providers are actively promoting cost-effective generic alternatives to ensure broader patient access to essential medications amid rising healthcare costs.

This growing demand has led pharmaceutical companies to seek contract manufacturers that offer high-quality production at competitive costs, allowing them to meet regulatory standards while maintaining profitability. Additionally, pharmaceutical companies are increasingly turning to CMOs and CDMOs to streamline operations, reduce capital expenditures, and accelerate product launches.

Outsourcing manufacturing can help companies focus on drug research, innovation, and market expansion, while leveraging the specialized capabilities of contract manufacturers for large-scale and complex generic drug production.

Market Challenge

Supply Chain Disruptions and Raw Material Shortages

The generic pharmaceuticals contract manufacturing market faces significant challenges, due to supply chain disruptions and raw material shortages. Factors such as geopolitical tensions, fluctuating raw material prices, and dependency on a limited number of suppliers, especially for APIs sourced from regions like China and India, can lead to delays in production, increased costs, and inconsistency in drug supply.

These disruptions can impact timely delivery commitments, affecting both contract manufacturers and their pharmaceutical clients. Thus, contract manufacturers are diversifying their supplier base by sourcing raw materials from multiple regions and investing in strategic partnerships with alternative suppliers.

Additionally, companies are focusing on localizing API production and expanding in-house manufacturing capabilities to reduce reliance on external suppliers. Implementing advanced supply chain management systems, including AI-driven demand forecasting and real-time inventory tracking, can further enhance resilience, cost efficiency, and production continuity, ensuring a steady supply of generic pharmaceuticals.

Market Trend

Focus On High-Potency Active Pharmaceutical Ingredient (HPAPI) Manufacturing

The market is registering a significant shift with the expansion of HPAPI manufacturing. Contract manufacturers are investing in specialized facilities, containment technologies, and advanced processing capabilities to handle high-potency compounds safely and efficiently as the demand for targeted therapies grows, particularly in oncology and autoimmune diseases.

These investments enable the production of complex generics that require precise formulation, high safety standards, and specialized expertise. Contract manufacturers are strengthening their service portfolios, due to the increasing focus on high-potency APIs, allowing pharmaceutical companies to outsource the development and production of potent and effective generic treatments while ensuring regulatory compliance and cost efficiency.

- In July 2023, Evonik and Heraeus Precious Metals announced their collaboration to expand services for HPAPIs. The partnership leverages the expertise of both companies to provide a fully integrated offering from the pre-clinical stage to commercial manufacturing. Customers will benefit from a streamlined transition between small and large-scale production, supported by the proximity of their Hanau manufacturing sites and an in-depth understanding of each other’s capabilities.

Generic Pharmaceuticals Contract Manufacturing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Drug

|

Branded, Unbranded

|

|

By Product

|

Active Pharmaceutical Ingredients (API), Finished Drug

|

|

By Route of Administration

|

Oral, Parenteral, Topical, Others

|

|

By Application

|

Oncology, Immunology, Antidiabetic, Neurology, Anticoagulants, Cardiovascular, Respiratory, Pain, HIV antivirals, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Drug (Branded, Unbranded): The branded segment earned USD 38.59 billion in 2023, due to the growing preference for high-quality generics and strong brand recognition among healthcare providers and patients.

- By Product (Active Pharmaceutical Ingredients (API), Finished Drug): The active pharmaceutical ingredients (API) segment held 63.80% share of the market in 2023, due to the increasing outsourcing of API production to specialized contract manufacturers to reduce costs and ensure regulatory compliance.

- By Route of Administration (Oral, Parenteral, Topical, and Others): The oral segment is projected to reach USD 40.43 billion by 2031, owing to the widespread adoption of oral dosage forms on account of patient convenience, high bioavailability, and ease of manufacturing.

- By Application (Oncology, Immunology, Antidiabetic, and Neurology): The oncology segment is projected to reach USD 15.29 billion by 2031, owing to the rising prevalence of cancer, increasing demand for cost-effective treatment options, and growing investments in generic oncology drug development.

Generic Pharmaceuticals Contract Manufacturing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial market share of 33.75% in 2023, with a valuation of USD 21.88 billion. The market in the region is driven by several key factors. The region benefits from a well-established pharmaceutical industry, a strong regulatory framework ensuring high-quality manufacturing standards, and high demand for cost-effective generic pharmaceuticals due to rising healthcare costs.

Additionally, the presence of leading CMOs, significant investments in advanced manufacturing technologies, and a growing number of patent expirations have further strengthened the market position of North America. The U.S., in particular, remains a major contributor, due to its robust generic drug approval pipeline, strong distribution networks, and strategic partnerships between pharmaceutical firms and CMOs.

The market in Asia Pacific is poised to grow at a significant CAGR of 9.92% over the forecast period, driven by low-cost manufacturing advantages, expanding pharmaceutical infrastructure, and increasing demand for affordable generics.

Countries such as China and India have emerged as global hubs for generic pharmaceutical contract manufacturing, due to their large-scale API production capabilities, cost-efficient labor, and supportive government initiatives promoting pharmaceutical exports.

The region also benefits from a rapidly growing patient population, increasing healthcare expenditure, and rising contract manufacturing collaborations with global pharmaceutical companies. Furthermore, regulatory reforms aimed at improving drug quality standards and expanding production capacities of CMOs are expected to further accelerate the market growth in Asia Pacific.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates the market by overseeing the approval, production, and quality control of generic drugs. The FDA's Center for Drug Evaluation and Research (CDER) ensures that contract manufacturers comply with current good manufacturing practices (cGMPs) to maintain product safety, efficacy, and quality.

- In Europe, the European Medicines Agency (EMA) regulates the authorization, supervision, and pharmacovigilance of medicines, ensuring that generic pharmaceuticals and CMOs comply with the pharmaceutical regulations of the European Union (EU).

Competitive Landscape:

The generic pharmaceuticals contract manufacturing industry is characterized by intense competition, strategic partnerships, and a strong focus on cost efficiency and regulatory compliance. Leading CMOs compete based on manufacturing capabilities, geographic presence, service offerings, and adherence to quality standards.

The market is driven by mergers and acquisitions, capacity expansions, and investments in advanced technologies to enhance production efficiency and meet growing demand. Additionally, long-term collaborations between pharmaceutical companies and CMOs play a crucial role in ensuring stable supply chains and optimizing production costs.

The rising emphasis on specialized formulations, complex generics, and HPAPIs has intensified competition. Companies are also expanding their presence in emerging markets, particularly in Asia Pacific, to leverage low-cost production advantages and growing demand for affordable medicines. Strict regulatory oversight and evolving global healthcare policies continue to shape the industry's competitive dynamics.

- In March 2025, Vetter announced a significant expansion of its materials warehouse for pharmaceuticals in Ravensburg, Germany, to meet the growing market demand and support its organic growth. A globally operating CDMO, Vetter, is investing over USD 162 million to add 16,000 more pallet spaces to its existing 13,000 pallet spaces in cool storage. After the expansion, the company will boast a total of 68,000 pallet spaces designed for various temperature requirements, ensuring enhanced storage capabilities for temperature-sensitive medications.

List of Key Companies in Generic Pharmaceuticals Contract Manufacturing Market:

- AJINOMOTO CO., INC.

- Recipharm AB.

- Vetter

- Lonza

- Piramal Enterprises Ltd.

- Thermo Fisher Scientific Inc.

- Cambrex Corporation

- Polpharma

- Curia Global, Inc.

- Catalent, Inc

- Aenova Group

- Jubilant Pharma Limited

- Fareva Group

- WuXi AppTec

- Siegfried Holding AG

Recent Developments (Product Launch)

- In October 2024, Thermo Fisher Scientific launched Accelerator Drug Development, its comprehensive 360° CDMO and CRO solution suite, delivering end-to-end drug development services. Unveiled at CPHI Milan 2024, this initiative supports biotech and large pharmaceutical companies by offering customizable manufacturing, clinical research, and clinical supply chain services for small molecules, biologics, and cell & gene therapies. This launch underscores Thermo Fisher’s commitment to transforming the pharmaceutical value chain, ensuring seamless transitions from discovery to delivery, mitigating risks, and accelerating innovation at every stage.

- In October 2023, Egis Pharmaceuticals PLC announced the expansion of its portfolio by introducing API contract development and contract manufacturing services under the name Egis Pharma Services. This strategic move aligns with the company’s decade-long investments exceeding USD 277.97 million in Hungary, aimed at modernizing API production and enhancing manufacturing capabilities.