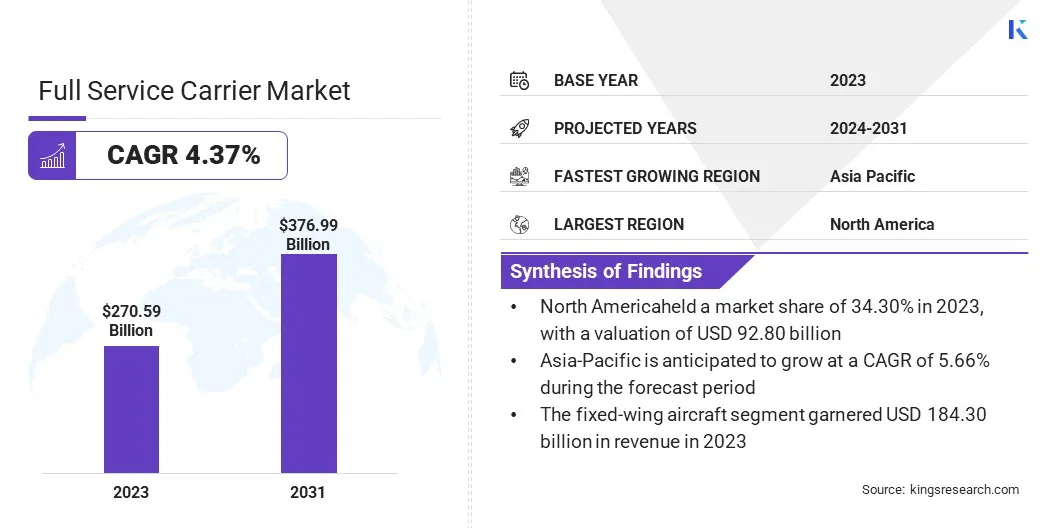

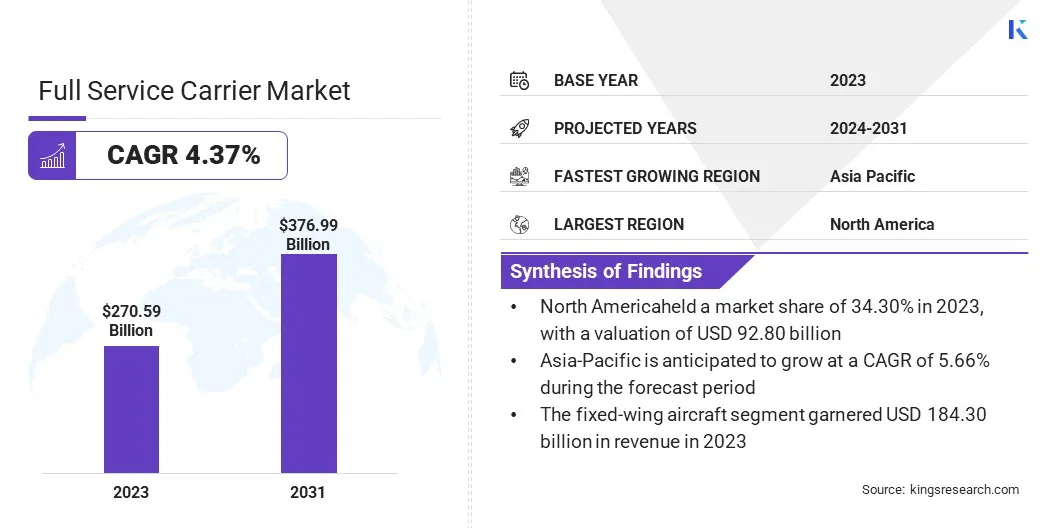

Full Service Carrier Market Size

The global Full Service Carrier Market size was valued at USD 270.59 billion in 2023 and is projected to grow from USD 279.37 billion in 2024 to USD 376.99 billion by 2031, exhibiting a CAGR of 4.37% during the forecast period. Rising global travel demand, rapid economic growth, increased disposable incomes, continual technological advancements in aviation, strategic airline alliances, favorable government support, and a growing consumer preference for premium services are driving the expansion of the market.

In the scope of work, the report includes solutions offered by companies such as Delta Air Lines, Inc., Etihad Airways, IAG International Airlines Group., Lufthansa Group, Qatar Airways, The Emirates Group, Turkish Airlines, United Airlines, Inc., JAPAN AIRLINES, SINGAPORE AIRLINES GROUP, and others.

Technological advancements in aviation, such as more fuel-efficient aircraft and enhanced customer service systems, further propel market growth. Strategic alliances and mergers among airlines contribute to expanded route networks and better service offerings, thereby attracting more customers.

Additionally, government support and investment in aviation infrastructure, coupled with deregulation policies in many regions, facilitate market expansion. Consumer preference for premium services, including in-flight entertainment, extra legroom, and superior customer service, further boosts market development.

The full service carrier market is dominated by established airlines, and is marked by intense competition, especially in regions with high air traffic. North America is the leading market due to its robust aviation infrastructure and high travel demand. Asia-Pacific is emerging as a major region, largely attributed to rapid economic growth and an increasing middle-class population.

The market is faced several challenges such as fluctuating fuel prices, stringent regulatory requirements, and competition from low-cost carriers. However, the growing focus on enhancing passenger experience and expanding global connectivity is boosting market growth.

- According to the International Air Transport Association (IATA), in February 2024, international passenger markets globally experienced robust growth compared to February 2023, with all regions showing significant year-on-year increases. This surge marked the first time that demand surpassed pre-pandemic levels, though it was partially influenced by the leap-year effect in February 2024. Key highlights included Asia-Pacific airlines achieving a substantial 53.2% rise in demand alongside increased capacity and load factors. Furthermore, European carriers saw a notable 15.9% increase in demand, with capacity closely matching this growth. Middle Eastern, North American, Latin American, and African airlines reported strong demand growth, reflecting varied impacts on load factors compared to the previous year.

Full service carriers (FSCs) are airlines that offer a comprehensive range of in-flight and ground services included in the ticket price. Unlike low-cost carriers, FSCs provide amenities such as checked baggage, meals, and entertainment. These airlines operate on both domestic and international routes, catering to leisure and business travelers. FSCs maintain multiple classes of service, including economy, business, and first class, with differentiated service levels.

They typically operate from primary airports and maintain extensive route networks. There is a notable focus on providing a superior travel experience, with services such as lounges, frequent flyer programs, and seamless connectivity through code-sharing and alliances with other airlines.

Analyst’s Review

Full service carriers are increasingly intensifying their efforts to enhance both passenger experience and operational efficiency. Airlines are investing heavily in next-generation aircraft with advanced fuel efficiency to reduce operational costs and environmental impact. In-flight entertainment and connectivity are being significantly upgraded to meet passengers' growing expectations.

Additionally, the focus on sustainability is evident, with several carriers adopting sustainable aviation fuel and participating in carbon offset programs. To maintain a competitive advantage, airlines should continue to innovate service offerings and expand strategic alliances to improve route networks.

- In November 2023, United Airlines, Lufthansa Group, and Deutsche Bahn collaborated to offer integrated air and rail journeys between Germany and the U.S. This service enables passengers to book seamless travel with a single transaction that combined both air and rail fares into one unified ticket. This partnership expanded connectivity between 25 German cities, Switzerland, Basel, and United’s major hubs in the Americas.

Emphasizing digital transformation and personalized services is likely to play a crucial role. Maintaining a balance between cost management and customer satisfaction is key for sustained growth in this dynamic market.

Full Service Carrier Market Growth Factors

Rising disposable incomes and rapid economic growth are driving the growth of the market. More individuals are attaining higher income levels, resulting in an increased inclination to spend on travel and premium services. This trend is particularly evident in emerging markets such as Asia-Pacific and Latin America, where a growing middle-class population is fueling the demand for air travel.

Full service carriers are capitalizing on this trend by expanding their route networks and enhancing service offerings to attract these new travelers. Additionally, business travel is experiencing a resurgence, which is contributing to market growth. Companies are increasingly recognizing the importance of face-to-face meetings, thereby boosting the demand for full service carriers.

The full service carrier market is facing significant challenges due to fluctuating fuel prices, which are impacting both operational costs and profitability. To overcome this challenge, airlines are investing heavily in fuel-efficient aircraft, which help reduce fuel consumption and costs. Additionally, carriers are implementing hedging strategies to secure fuel prices and mitigate volatility.

Collaborating with fuel suppliers to obtain favorabe pricing and leveraging technological advancements in fuel management provides solutions. Furthermore, optimizing flight routes and improving operational efficiency help in managing fuel costs.

Full Service Carrier Market Trends

Sustainability is emerging as a major trend in the market. Airlines are increasingly prioritizing environmental responsibility by investing in sustainable aviation fuel (SAF), which reduces carbon emissions compared to traditional jet fuel. Furthermore, carriers are adopting more fuel-efficient aircraft and optimizing flight operations to minimize their environmental impact.

Efforts to reduce the use of single-use plastics and increase recycling practices onboard are being increasingly adopted as standard procedures. Additionally, airlines are engaging in carbon offset programs, allowing passengers to contribute to environmental projects. This focus on sustainability benefits the environment and appeals to environmentally conscious travelers, thus influencing their choice of airline.

Digital transformation is reshaping the landscape of the full service carrier market. Airlines are leveraging advanced technologies to enhance customer experience and operational efficiency. Artificial intelligence (AI) and machine learning are being used to personalize services, predict maintenance needs, and optimize pricing strategies. Self-service kiosks, mobile apps, and biometric boarding are enhancing the passenger experience by reducing wait times and improving convenience.

In-flight connectivity is becoming a standard expectation, with high-speed internet and entertainment options available on many flights. Additionally, data analytics is helping airlines understand customer preferences and behaviors, allowing for more targeted marketing and improved service delivery. This digital shift is driving significant changes in the industry.

Segmentation Analysis

The global market is segmented based on aircraft type, service type, and geography.

By Aircraft Type

Based on aircraft type, the market is categorized into fixed-wing aircraft and rotary-wing aircraft. The fixed-wing aircraft segment led the full service carrier market in 2023, reaching a valuation of USD 184.30 billion. This notable growth is fostered by its efficiency and versatility in covering long distances. These aircraft are highly favored due to their speed, range, and ability to operate in various weather conditions.

Airlines are investing heavily in fixed-wing aircraft due to their capacity to accommodate more passengers and cargo, which enhances the optimization of operational costs. The growth of the segment reflects the demand for reliable and efficient air travel solutions. Technological advancements in aerodynamics and fuel efficiency are further driving the adoption of fixed-wing aircraft, thereby enhancing their appeal for both domestic and international flights.

By Service Type

Based on service type, the full service carrier market is classified into in-flight entertainment, meals, beverages, and others. The in-flight entertainment segment is projected to witness significant growth at a CAGR of 4.89% through the forecast period (2024-2031), primarily due to increasing passenger demand for a more enjoyable and comfortable travel experience.

As airlines compete to enhance customer satisfaction, offering diverse entertainment options becomes crucial. Advanced technologies such as high-speed Wi-Fi, live TV, and interactive content are being integrated into aircraft systems. This trend is further fueled by passengers' demand to stay connected and entertained during flights. Airlines are recognizing that providing a superior in-flight entertainment experience can differentiate them in a competitive market, leading to increased passenger loyalty and revenue.

Full Service Carrier Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

North America full service carrier market share stood around 34.30% in 2023 in the global market, with a valuation of USD 92.80 billion. This dominance is reinforced by its advanced aviation infrastructure, high travel demand, and strong economic conditions. The region's extensive network of airports, coupled with significant investments in technology and services, enhances operational efficiency and passenger experience.

Major airlines headquartered in North America, such as American Airlines, Delta Air Lines, and United Airlines, contribute significantly to this dominance through extensive route networks and superior service offerings. Business travel and tourism in the United States and Canada are robust, generating consistent demand for full service carriers.

Asia-Pacific is poised to experience substantial growth at a CAGR of 5.66% through the projection period. This expansion is fostered by rapid economic development, a growing middle-class population, and increasing disposable incomes. Countries such as China, India, and Southeast Asian nations are witnessing a surge in both domestic and international travel.

Furthermore, the region's expanding aviation infrastructure, including new airports and improved facilities, supports this growth. Additionally, government initiatives to promote tourism and improve connectivity are playing a significant role. Airlines in Asia-Pacific are further investing in modern fleets and enhancing service quality to meet the rising expectations of passengers, thereby aiding regional market development.

Competitive Landscape

The full service carrier market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Full Service Carrier Market

- Delta Air Lines, Inc.

- Etihad Airways

- IAG International Airlines Group.

- Lufthansa Group

- Qatar Airways

- The Emirates Group

- Turkish Airlines

- United Airlines, Inc.

- JAPAN AIRLINES

- SINGAPORE AIRLINES GROUP

Key Industry Developments

- June 2024 (Expansion): Turkish Airlines expanded its US network with the launch of its 14th destination in Denver. The initial offering comprises 3 weekly flights, with plans to increase this frequency to 4 flights weekly starting in July 2024. This move aimed to bolster tourism and trade links, serving as a gateway between Turkey and the United States.

- October 2023 (Expansion): United Airlines expanded its fleet significantly by ordering 110 additional aircraft, including 50 Boeing 787-9s and 60 Airbus A321neos. The deliveries for these planes are scheduled from 2028 to 2030. This move aims to enhance operational flexibility and supports the company’s long-term fleet strategy.

The global full service carrier market is segmented as:

By Aircraft Type

- Fixed-Wing Aircraft

- Rotary-Wing Aircraft

By Service Type

- In-Flight Entertainment

- Meals

- Beverages

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America