Market Definition

The market encompasses the production, distribution, and utilization of ethanol as a renewable energy source for internal combustion engines.

Derived mainly from agricultural feedstocks such as corn, sugarcane, and other biomass, ethanol is primarily blended with gasoline to enhance fuel performance, reduce carbon emissions, and promote energy sustainability. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape influencing industry growth.

Fuel Ethanol Market Overview

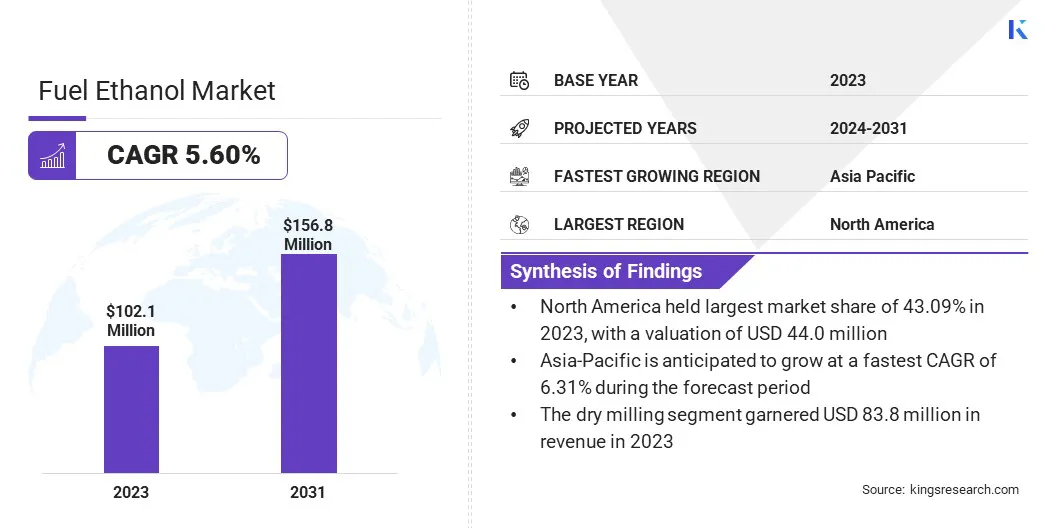

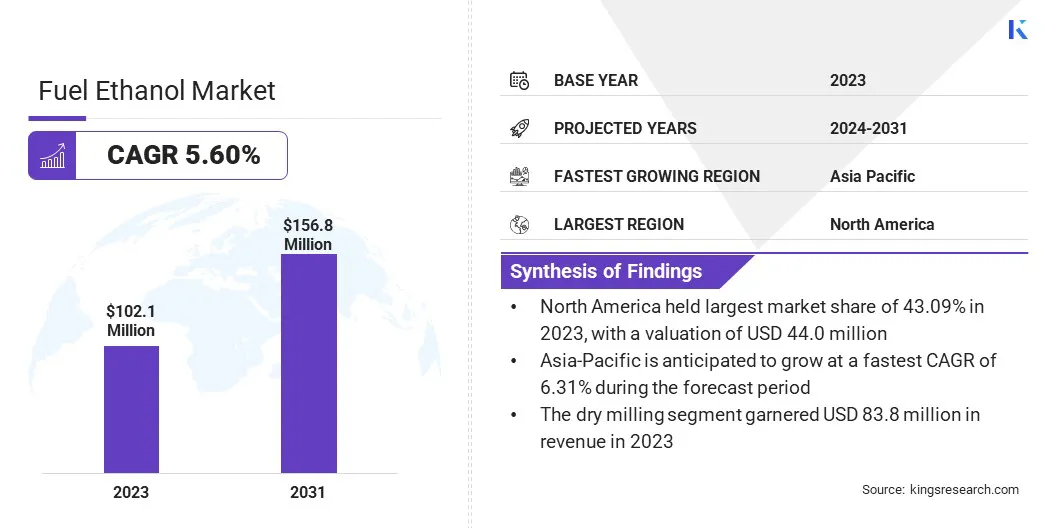

The global fuel ethanol market size was valued at USD 102.1 million in 2023 and is projected to grow from USD 107.1 million in 2024 to USD 156.8 million by 2031, exhibiting a CAGR of 5.60% during the forecast period.

This growth is largely attributed to supportive government policies promoting renewable energy, increasing environmental awareness, and the enforcement of stringent emissions regulations.

Major companies operating in the fuel ethanol industry are DuPont, Mitsubishi International Corporation, ADM, Absolute Energy, L.L.C., Cargill, Valero, Alto Ingredients, Inc., CropEnergies AG, The Andersons, Inc., BP p.l.c., FutureFuel Corporation, Shree Renuka Sugars Ltd., Balrampur Chini Mills Limited, Praj Industries, and Dwarikesh Sugar Industries Limited.

Furthermore, the rising demand for cleaner-burning fuels in the transportation sector, along with continuous advancements in biofuel production technologies, is expected to fuel market expansion. The global emphasis on energy diversification and sustainability, particularly in both developed and emerging economies, further contributes to this growth.

- In January 2024, the U.S. Department of Energy supported the launch of LanzaJet’s Freedom Pines Fuels facility in Georgia, marking the world’s first commercial plant to convert ethanol into sustainable aviation fuel (SAF) using alcohol-to-jet (ATJ) technology. The plant is set to produce 9 million gallons of SAF and 1 million gallons of renewable diesel annually, supporting national SAF production targets.

Key Highlights

- The fuel ethanol market size was valued at USD 102.1 million in 2023.

- The market is projected to grow at a CAGR of 5.60% from 2024 to 2031.

- North America held a market share of 43.09% in 2023, with a valuation of USD 44.0 million.

- The starch-based segment garnered USD 52.2 million in revenue in 2023.

- The E5 to E10 segment is expected to reach USD 66.2 million by 2031.

- The wet milling segment is anticipated to witness the fastest CAGR of 6.18% over the forecast period.

- The automotive segment garnered USD 77.7 million in revenue in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 6.31% through the projection period.

Market Driver

Rising Demand for Cleaner Transportation Fuels

Rising demand for cleaner transportation fuels is propelling the growth of the market. As the transportation sector is a major contributor to global greenhouse gas emissions, highlighting the need for low-emission fuel alternatives to address environmental concerns and meet climate goals.

Ethanol-blended fuels offer a practical and immediate solution, as they significantly reduce harmful tailpipe emissions without requiring major modifications to existing vehicle engines. Their compatibility and lower carbon footprint make them an attractive option for both consumers and policymakers.

As regulatory pressures intensify and public awareness of environmental sustainability grows, the adoption of ethanol as a cleaner transportation fuel continues to grow worldwide.

- In June 2023, Hindustan Petroleum Corporation Limited (HPCL) initiated a pilot study at its Green R&D Centre in Bengaluru, testing vehicles using E27 fuel and Ethanol Blended Diesel. This initiative contributes to India's target of achieving 20% ethanol blending by 2025. The study showed promising results, including lower emissions and potential CO₂ reductions, reinforcing the country’s dedication to sustainable biofuels and enhancing energy security.

Market Challenge

Infrastructure Limitations

The fuel ethanol market faces a significant challenge due to infrastructure limitations. The widespread use of ethanol-blended fuels relies on a dedicated supply chain, including storage, transportation, and dispensing systems specifically designed to handle ethanol’s chemical properties, which differ from conventional gasoline.

However, many regions, particularly in developing economies, lack the necessary infrastructure to support the efficient distribution and blending of ethanol at scale. This results in logistical bottlenecks, increased operational costs, and limited fuel availability at retail outlets.

Additionally, retrofitting existing petroleum infrastructure is often technically complex and cost-prohibitive, further restricting market expansion amid rising demand for renewable fuels.

This challenge can be addressed through public-private investment in fuel infrastructure, policy incentives for ethanol-compatible systems, and the integration of advanced logistics technologies to streamline supply chain operations.

Collaborative efforts between governments, energy companies, and technology providers can accelerate infrastructure development. Furthermore, regional pilot programs and phased implementation strategies can help build scalable, cost-effective ethanol distribution networks.

Market Trend

Advancements in Biofuel Technologies

Advancements in biofuel technologies are emerging as a key trend in the market, with innovations across biotechnology, engineering, and agricultural sciences enhancing ethanol production methods. This convergence is leading to more efficient processes, such as second- and third-generation biofuels, which utilize non-food feedstocks such as agricultural residues, algae, and waste materials.

These technologies increase ethanol yields and reduce the environmental impact associated with conventional biofuel production. By integrating expertise from various fields, researchers are creating more sustainable and cost-effective ethanol production methods that support the growth of the biofuel industry while minimizing resource use and greenhouse gas emissions, making ethanol a more viable and eco-friendly energy source for the future.

- In September 2024, LanzaTech signed a Master License Agreement with SEKISUI CHEMICAL to develop waste-to-ethanol plants in Japan. The collaboration aims to produce ethanol for sustainable aviation fuel (SAF) and other chemicals, aligning with Japan's efforts to reduce fossil fuel reliance and advance a circular carbon economy

Fuel Ethanol Market Report Snapshot

|

Segmentation

|

Details

|

|

By Feedstock Source

|

Sugar-based, Starch-based, Cellulose-based

|

|

By Fuel Blend

|

E5 to E10, E15 to E25, E85, Other Blends

|

|

By Production Process

|

Dry Milling, Wet Milling

|

|

By End-Use Industry

|

Automotive, Power Generation, Aviation, Other

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Feedstock Source (Sugar-based, Starch-based, and Cellulose-based): The starch-based segment earned USD 52.2 million in 2023 due to its widespread use of crops such as corn, which are cost-effective and readily available for ethanol production.

- By Fuel Blend (E5 to E10, E15 to E25, E85, and Other Blends): The E5 to E10 segment held a share of 42.09% in 2023, fueled by its widespread adoption in numerous regions as a standard blend for reducing emissions and improving fuel efficiency in internal combustion engines.

- By Production Process (Dry Milling and Wet Milling): The dry milling segment is projected to reach USD 127.5 million by 2031, propelled by its cost-effectiveness, efficiency in converting starch to ethanol, and its ability to produce valuable co-products such as distillers dried grains.

- By End-Use Industry (Automotive, Power Generation, Aviation, and Other): The aviation segment is anticipated to grow at a CAGR of 7.55% over the forecast period, bolstered by the increasing demand for sustainable aviation fuel (SAF) to reduce carbon emissions and the industry's shift toward greener, renewable energy sources.

Fuel Ethanol Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America fuel ethanol market share stood at around 43.09% in 2023, with a valuation of USD 44.0 million. This dominance is facilitated by its well-established agricultural base, strong governmental support for biofuels, and a large-scale infrastructure for ethanol production and distribution.

The United States, in particular, has made significant investments in ethanol production, benefiting from a combination of abundant feedstock, favorable policies such as the Renewable Fuel Standard, and technological advancements in biofuel production. Additionally, the strong demand for cleaner transportation fuels and the growth of the automotive sector have further contributed to this dominance.

- In September 2023, Lummus Technology launched its ethanol-based sustainable aviation fuel (SAF) process, combining advanced technologies to reduce costs and emissions. Its collaboration with Braskem to produce green ethylene supports the transition to a carbon-neutral aviation sector.

The Asia-Pacific fuel ethanol industry is estimated to grow at a CAGR of 6.31% over the forecast period. This rapid expansion is primarily fostered by increasing governmental support for renewable energy and growing concerns over environmental sustainability. The rising demand for cleaner-burning fuels, coupled with stricter emissions regulations in key countries, is further fueling this growth.

- In March 2024, India's Ministry of Petroleum & Natural Gas launched 'ETHANOL 100' at select outlets across five states. This initiative supports the goal of achieving 20% ethanol blending in petrol to 2025-26 from the earlier 2030 target. It aims to reduce fossil fuel dependence, conserve foreign exchange, and promote sustainable agriculture, contributing to cleaner transport and energy security.

Additionally, Asia-Pacific's efforts to reduce reliance on imported fossil fuels and strengthen energy security are fostering investments in biofuel production. Countries such as India, China, and Japan are expanding ethanol production and integrating it into their energy mix to meet domestic demand and global sustainability targets, thus accelerating regional market growth.

Regulatory Frameworks

- In the U.S., ethanol blends are regulated by the Environmental Protection Agency (EPA) under the Renewable Fuel Standard (RFS). The RFS sets mandatory renewable fuel volume requirements to reduce greenhouse gas emissions and promote the use of renewable fuels in the transportation sector.

- In India, ethanol is regulated under the National Policy on Biofuels – 2018, which promotes the sustainable production and use of biofuels to enhance energy security and reduce carbon emissions. The policy mandates a target of 20% ethanol blending in petrol by 2025 and promotes the use of diverse feedstocks for ethanol production.

- In Brazil, ethanol is regulated under the RenovaBio Program, which aims to reduce greenhouse gas emissions by expanding the use of biofuels, including ethanol. The program sets targets for the production, certification, and use of sustainable biofuels, promoting compliance with environmental standards to ensure sustainable biofuel practices in the transportation sector.

Competitive Landscape

Companies operating in the fuel ethanol market are actively investing in research and development to enhance production efficiency and explore new feedstocks, such as non-food-based biomass and waste materials, to align with sustainability goals. They are also focusing on developing advanced ethanol production technologies, such as cellulosic ethanol, to improve yield and reduce environmental impact.

Firms are enhancing their production capacities, ensuring compliance with stringent regulatory frameworks, and upgrading infrastructure to support the distribution of ethanol-blended fuels. Strategic collaborations, technological innovations, and the adoption of new production processes remain key strategies as companies aim to meet growing demand, reduce costs, and expand into emerging markets with sustainable fuel solutions.

- In July 2024, Airbus announced a strategic investment in LanzaJet to accelerate the development of the Alcohol-to-Jet (ATJ) process for Sustainable Aviation Fuel (SAF) production. This partnership aims to scale LanzaJet’s ethanol-based SAF technology, which reduces greenhouse gas emissions by over 70% compared to traditional fossil fuels. This collaboration aligns with Airbus’s goal to incorporating at least 30% SAF into its global fuel mix by 2030, advancing the aviation industry’s shift toward sustainability.

List of Key Companies in Fuel Ethanol Market:

- DuPont

- Mitsubishi International Corporation

- ADM

- Absolute Energy, L.L.C.

- Cargill

- Valero

- Alto Ingredients, Inc.

- CropEnergies AG

- The Andersons, Inc.

- BP p.l.c.

- FutureFuel Corporation

- Shree Renuka Sugars Ltd.

- Balrampur Chini Mills Limited

- Praj Industries

- Dwarikesh Sugar Industries Limited

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In February 2025, Greenfield Global, Alco Energy Canada, and Grain Farmers of Ontario launched the Farms and Fuels Alliance (FFA) to promote Canada's domestic ethanol industry. This coalition seeks to advocate for policy updates, create fair market opportunities, and support sustainable economic growth in rural communities.

- In February 2025, Taiyo Oil selected Honeywell’s Ethanol to Jet (ETJ) technology to produce sustainable aviation fuel (SAF) at its Okinawa facility, marking Honeywell’s first ETJ project in Asia-Pacific. The plant, expected to be operational by 2029, will produce 200 million liters of SAF annually and support Japan’s decarbonization goals.

- In September 2024, Gevo, Inc. acquired Red Trail Energy’s ethanol plant and carbon capture assets in North Dakota for USD 210 million. This acquisition strengthens Gevo’s sustainable aviation fuel (SAF) capabilities and is projected to generate an annual contribution of USD 30-60 million in adjusted EBITDA.

- In January 2024, Blue Biofuels, Inc. and Vertimass, LLC formed VertiBlue Fuels LLC to produce sustainable aviation fuel (SAF) and renewable LPG from ethanol using Vertimass' CADO technology. The Florida-based facility will initially produce 10 million gallons of SAF annually, with plans for expansion using sugarcane and cellulose-derived ethanol.