Market Definition

The fluorescent pigment market encompasses the manufacturing, supply chain, and utilization of fluorescent pigments, which absorb light and re-emit it at a longer wavelength, producing vibrant and high-visibility colors. These pigments play a critical role across various industries, including paints & coatings, plastics, textiles, printing inks, cosmetics, and security applications.

Distinguished by their enhanced color intensity and UV-light responsiveness, fluorescent pigments offer superior visibility compared to conventional pigments. Key applications include safety signage, high-visibility apparel, advertising displays, and specialty products.

Fluorescent Pigment Market Overview

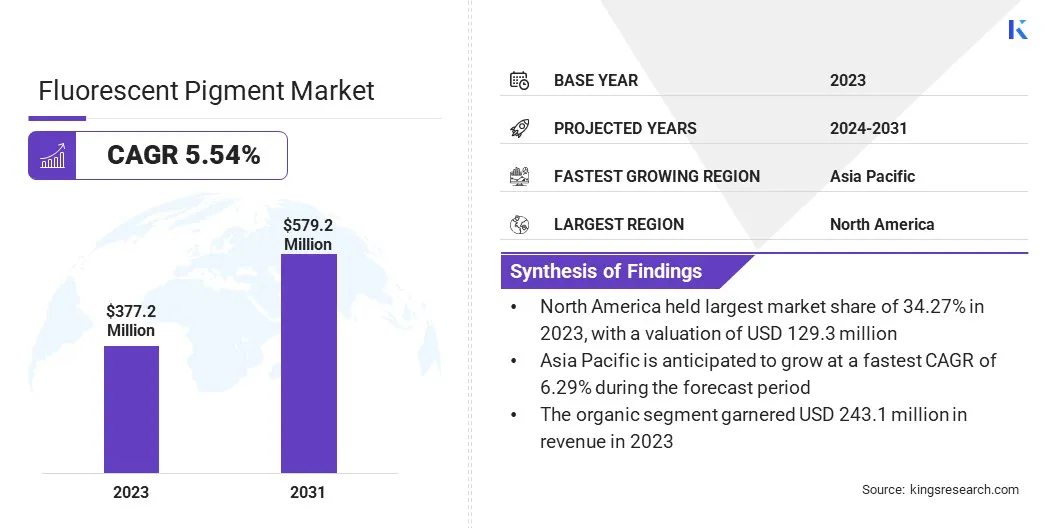

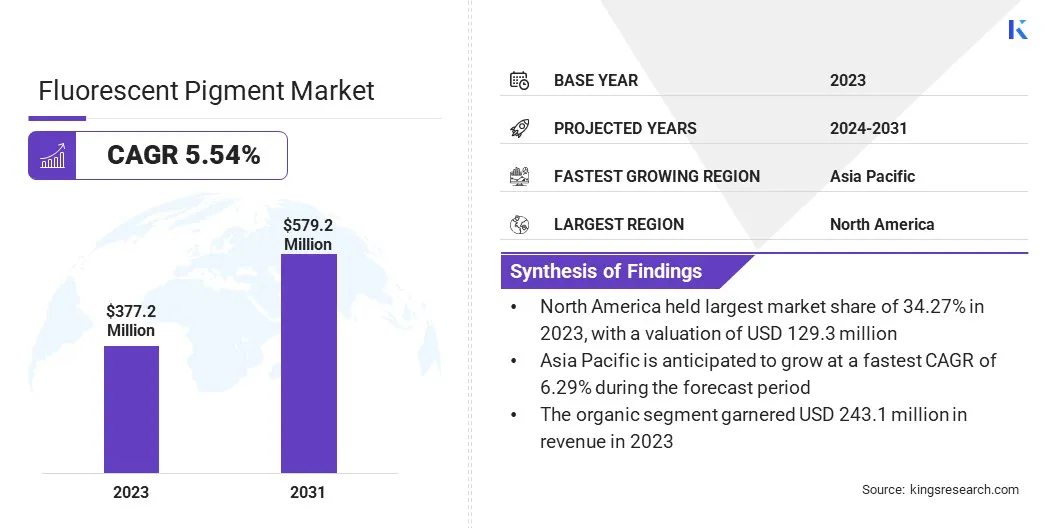

The global fluorescent pigment market size was valued at USD 377.2 million in 2023 and is projected to grow from USD 397.2 million in 2024 to USD 579.2 million by 2031, exhibiting a CAGR of 5.54% during the forecast period.

This market is registering significant growth, driven by the increasing demand for high-visibility materials across industries such as paints & coatings, textiles, plastics, printing inks, cosmetics, and security.

The rising adoption of fluorescent pigments in safety signage, high-visibility apparel, and branding materials is fueling the market. Technological advancements in printing and coating processes have enhanced the performance and application versatility of these pigments, further driving demand.

Major companies operating in the global fluorescent pigment industry are DayGlo Color Corp., RPM International Inc., Luminochem Kf, SINLOIHI CO .,LTD, Aron Universal Limited, Brilliant Group, Inc., WANLONG CHEMICAL CO., LTD, Vicome Corp., Nemoto &Co., Ltd., RC Tritec AG, Rado Colour Industries, Angstrom Technologies, Inc., PPG Industries, Inc., Glowinking Innovations Co.,Ltd., and VIBFAST PIGMENTS PVT. LTD.

Additionally, the growing use of fluorescent pigments in the fashion, cosmetics, and automotive industries for esthetic and functional purposes is contributing to the market growth. Expanding consumer preference for visually striking and UV-responsive materials, coupled with rising investments in innovative pigment formulations, is creating opportunities in the market.

Key Highlights

- The global fluorescent pigment market size was valued at USD 377.2 million in 2023.

- The market is projected to grow at a CAGR of 5.54% from 2024 to 2031.

- North America held a market share of 34.27% in 2023, with a valuation of USD 129.3 million.

- The organic segment garnered USD 243.1 million in revenue in 2023.

- The dayglow segment is expected to reach USD 256.8 million by 2031.

- The packaging segment is expected to reach USD 146.3 million by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.29% during the forecast period.

Market Driver

"Enhancing Road Safety and Growing Demand for Fluorescent Pigment in Packaging"

The fluorescent pigment market is registering substantial growth, primarily driven by the increasing demand for high-visibility & safety applications and the expanding adoption of these pigments in consumer goods and packaging.

Fluorescent pigments play a crucial role in enhancing visibility and safety, particularly in road infrastructure, traffic signs, and Personal Protective Equipment (PPE). Governments and regulatory bodies globally are implementing stringent road safety regulations and workplace hazard guidelines, which are fueling the need for high-visibility materials.

These pigments are widely used in construction sites, emergency signage, and industrial work wear to improve visibility in low-light or hazardous conditions, reducing accident risks.

Another key driver is the rising use of fluorescent pigments in consumer goods and packaging, as brands seek to create eye-catching and distinctive product designs. In the advertising and branding industry, fluorescent pigments are widely used in billboards, promotional materials, and product packaging to grab consumer attention under various lighting conditions.

The growing popularity of UV-reactive packaging, textiles, and cosmetics has further contributed to market growth, as companies leverage fluorescence to create visually appealing products that enhance consumer engagement.

- In March 2024, Brilliant Group introduced an advanced daylight fluorescent pigment technology, enhancing product applications with vibrant, high-visibility colors. These pigments, which emit up to four times more light than conventional pigments, are designed for safety gear, textiles, packaging, and coatings. The company focuses on improving durability, compatibility with various materials, and resistance to environmental factors, ensuring long-lasting fluorescence across industries.

Market Challenge

"Outdoor Durability Challenges"

Fluorescent pigments are highly valued for their vibrant and eye-catching colors; however, their performance in outdoor environments presents a significant challenge. When exposed to prolonged sunlight, these pigments undergo photo degradation, leading to fading and a reduction in brightness over time.

This is primarily attributed to the breakdown of the fluorescent molecules caused by UV radiation, oxygen exposure, and temperature fluctuations. In applications such as road markings, safety signage, and exterior coatings, where long-term visibility is crucial, this degradation can diminish both esthetic appeal and functional effectiveness.

Manufacturers are focusing on enhancing the UV stability and weather resistance of fluorescent pigments. Advanced encapsulation techniques, where pigments are coated with protective layers, help shield them from environmental damage and slow down photodegradation. Additionally, hybrid formulations combining fluorescent pigments with UV-resistant stabilizers and binders have been developed to improve longevity.

Market Trend

"Eco-friendly and Security Applications of Fluorescent Pigments"

The fluorescent pigment market is registering notable trends, driven by advancements in eco-friendly formulations and the growing demand for innovative applications in digital printing and coatings.

With increasing environmental awareness on hazardous chemicals, manufacturers are focusing on developing sustainable, non-toxic, and biodegradable fluorescent pigments. T

hese eco-friendly formulations cater to industries such as textiles, packaging, and cosmetics, where regulatory compliance and consumer preference for green products are shaping purchasing decisions. The shift toward water-based and solvent-free fluorescent pigments is also gaining momentum, reducing environmental impact while maintaining high color vibrancy and performance.

Another significant trend is the increasing demand for security and anti-counterfeiting solutions, which is driving the adoption of fluorescent pigments in specialized printing applications. Fluorescent pigments and dyes are widely used in security printing for banknotes, identity documents, tickets, and brand protection measures.

Advancements in inkjet printing technology have enabled the development of invisible UV-fluorescent inks, which enhance document security by allowing covert markings that become visible only under specific lighting conditions.

Counterfeiting threats are gradually increasing, thus, industries and governments are investing in high-performance fluorescent pigments to improve authentication measures and ensure the integrity of sensitive documents and branded products.

- In April 2024, Luminochem introduced its water-soluble, invisible fluorescent dyes for secure inkjet printing applications. These dyes are designed to enhance security document personalization by enabling invisible UV-fluorescent printing using standard drop-on-demand inkjet printers. The technology addresses the need for cost-effective, decentralized, and secure personalization of paper-based documents where laser engraving is not feasible.

Fluorescent pigment Market Report Snapshot

|

Segmentation

|

Details

|

|

By Form

|

Organic, Inorganic

|

|

By Type

|

Dayglow, Phosphorescent, Other Types

|

|

By End Use

|

Packaging, Automotive & Transportation, Building & Construction, Textiles, Personal Care & Cosmetics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Form (Organic, Inorganic): The organic segment earned USD 243.1 million in 2023, due to its superior brightness, environmental benefits, and increasing use in consumer goods.

- By Type (Dayglow, Phosphorescent, Other Types): The dayglow segment held 43.43% share of the market in 2023, due to its high visibility, widespread use in safety applications, and demand in advertising.

- By End Use (Packaging, Automotive & Transportation, Building & Construction, Textiles, Personal Care & Cosmetics, Others): The packaging segment is projected to reach USD 146.3 million by 2031, owing to the rising demand for eye-catching branding and enhanced product visibility.

Fluorescent pigment Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial fluorescent pigment market share of 34.27% in 2023 in the global market, with a valuation of USD 129.3 million. This expansion is fueled by the high demand for fluorescent pigments in packaging, automotive, textiles, and printing inks.

The region's dominance is attributed to advanced manufacturing capabilities, strong regulatory enforcement for safety and visibility, and a well-established industrial base. The automotive and construction industries have significantly contributed to market growth, with increasing adoption of high-visibility coatings and signage for traffic management and workplace safety.

Additionally, the cosmetics and fashion industries have fueled the demand for fluorescent pigments in premium beauty products and textiles, enhancing the region's market position.

Continuous research & development initiatives and collaboration between manufacturers and end-use industries further strengthen the region’s market position, ensuring sustained growth and innovation in fluorescent pigment applications.

- In February 2023, Brilliant Group and Terra Firma partnered to expand the sales and distribution of fluorescent and phosphorescent pigments across the U.S. This collaboration combines Brilliant Group’s advanced pigment technology with Terra Firma’s extensive sales and service network to enhance market support and meet growing demand in applications such as paints, coatings, inks, and plastics.

The market in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 6.29% over the forecast period. This growth is driven by rapid industrialization, expanding manufacturing sectors, and increasing consumer preference for vibrant and high-visibility products.

Countries such as China, India, and Japan are key contributors, with strong demand from the packaging, textiles, and automotive industries. The rise in construction activities, urbanization, and infrastructural development has led to higher adoption of fluorescent pigments in paints, coatings, and safety applications.

Additionally, the growing cosmetics and personal care industry boosted the demand for fluorescent pigments in beauty and skincare products. Increasing investments in innovative pigment technologies and the presence of cost-effective manufacturing facilities position Asia Pacific as a key driver of the global market.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates fluorescent pigments under the Toxic Substances Control Act (TSCA) to ensure that they meet safety and environmental standards. The Food and Drug Administration (FDA) oversees their use in food packaging, cosmetics, and medical applications, ensuring non-toxicity and compliance with consumer safety regulations.

- In Europe, the European Chemicals Agency (ECHA) regulates fluorescent pigments under the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) framework, ensuring that they do not contain hazardous substances.

- In China, the Ministry of Ecology and Environment (MEE) oversees the environmental impact of fluorescent pigments, ensuring compliance with national chemical safety standards.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) sets safety guidelines for fluorescent pigments in consumer products, including cosmetics and packaging materials. The Ministry of Economy, Trade and Industry (METI) regulates their production and industrial applications, ensuring adherence to chemical safety standards.

- In India, the Bureau of Indian Standards (BIS) establishes quality and safety guidelines for fluorescent pigments in paints, coatings, and consumer goods. The Central Pollution Control Board (CPCB) monitors their environmental impact, while the Food Safety and Standards Authority of India (FSSAI) regulate their use in food-contact materials to ensure consumer safety.

Competitive Landscape

The global fluorescent pigment market is characterized by ongoing technological advancements and increasing demand across multiple industries. Market players are focusing on innovation, product differentiation, and sustainability to strengthen their market presence.

The industry is registering a shift toward eco-friendly and high-performance pigments, driven by regulatory standards and rising consumer awareness. Additionally, the growing adoption of fluorescent pigments in digital printing, packaging, automotive coatings, and security applications is fueling competition among manufacturers.

Companies are investing in research and development, strategic partnerships, and product expansion to gain a competitive edge. Technological innovation plays a crucial role, with advancements in organic pigments, UV-responsive materials, and long-lasting phosphorescent formulations shaping the market.

Additionally, geographical expansion and supply chain optimization remain key strategies, with market players strengthening distribution networks and setting up production facilities in high-growth regions to enhance market reach and operational efficiency.

- In March 2025, LuminoKrom announced its partnership with CARF Ambiental, making them an authorized distributor for the development of LuminoKrom photoluminescent paint in Brazil. This collaboration marks a significant step in the international expansion of LuminoKrom phosphorescent road paint.

List of Key Companies in Fluorescent Pigment Market:

- DayGlo Color Corp.

- RPM International Inc.

- Luminochem Kf

- SINLOIHI CO .,LTD

- Aron Universal Limited

- Brilliant Group, Inc.

- WANLONG CHEMICAL CO., LTD

- Vicome Corp.

- Nemoto &Co., Ltd.

- RC Tritec AG

- Rado Colour Industries

- Angstrom Technologies, Inc.

- PPG Industries, Inc.

- Glowinking Innovations Co.,Ltd.

- VIBFAST PIGMENTS PVT. LTD.

Recent Developments (M&A/Partnerships/Agreements/ Product Launch)

- In October 2023, OliKrom announced its latest advancements in LuminoKrom glow-in-the-dark paint, an innovative solution for road safety and signage. The phosphorescent paint absorbs daylight and restores it at night, providing over 10 hours of visibility without artificial lighting.

- In September 2023, DIC Corporation announced that its near-infrared (NIR) fluorescent dye is used in BrightMarker, an invisible fluorescent tagging system developed by MIT researchers. The technology enhances motion tracking, virtual reality (VR), and object detection by embedding fluorescent tags into physical objects. The BrightMarker tags, created using DIC’s NIR fluorescent dye, remain invisible to the naked eye and can only be detected with an infrared camera, enabling secure data embedding without altering an object's appearance.