Market Definition

Flow cytometry is a laboratory technique used to analyze the physical and chemical characteristics of cells or particles in a fluid stream using laser technology. It enables rapid multipara metric analysis of thousands of cells per second with high precision.

The technique is widely applied in clinical diagnostics, biomedical research, and pharmaceutical development, supporting areas such as disease diagnosis, immune profiling, drug discovery, and quality control in bioprocessing.

Flow Cytometry Market Overview

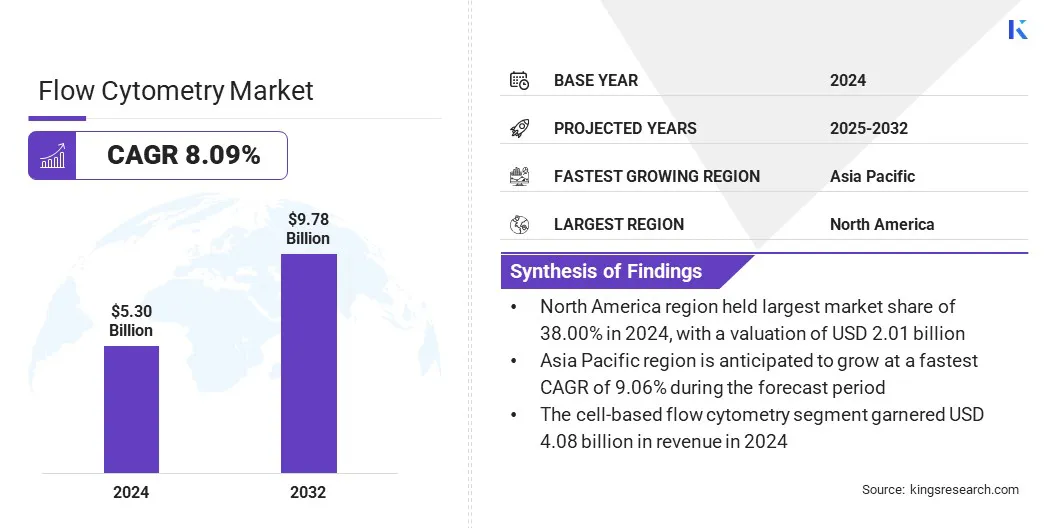

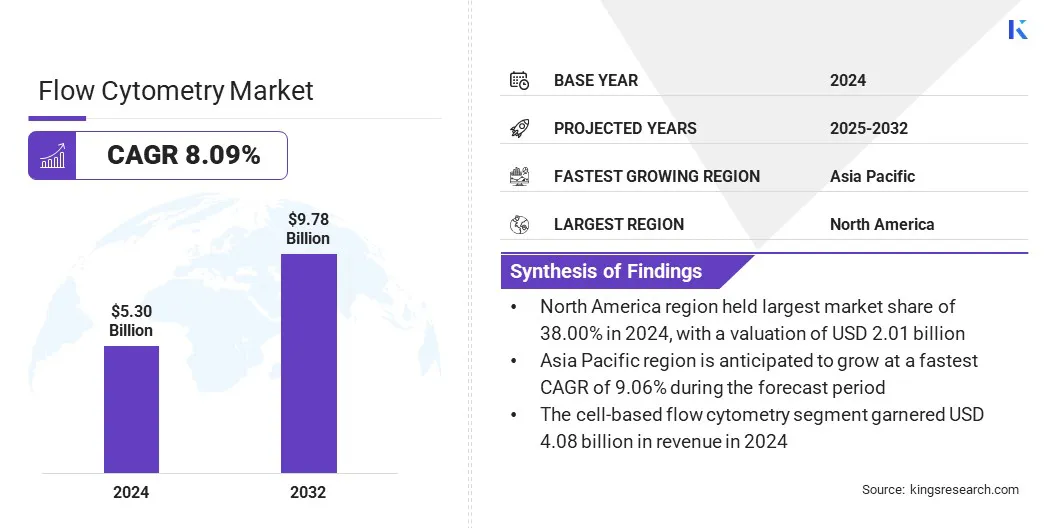

The global flow cytometry market size was valued at USD 5.30 billion in 2024 and is projected to grow from USD 5.67 billion in 2025 to USD 9.78 billion by 2032, exhibiting a CAGR of 8.09% during the forecast period.

This growth is fueled by the growing demand for speed, versatility, and reliability in laboratory testing, leading to the widespread adoption of advanced flow cytometry systems. The use of nanoscale flow cytometers enables high-precision analysis of nanoparticles, including extracellular vesicles and viruses, thereby expanding applications in oncology, immunology, and virology.

Key Highlights:

- The flow cytometry industry size was recorded at USD 5.30 billion in 2024.

- The market is projected to grow at a CAGR of 8.09% from 2025 to 2032.

- North America held a share of 38.00% in 2024, valued at USD 2.01 billion.

- The reagents & consumables segment garnered USD 2.38 billion in revenue in 2024.

- The cell-based flow cytometry segment is expected to reach USD 7.60 billion by 2032.

- The clinical & diagnostic segment is projected to generate a valuation of USD 4.41 billion by 2032.

- The hospitals & clinical laboratories segment is estimated to register a revenue of USD 3.40 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 9.06% over the forecast period.

Major companies operating in the flow cytometry market are BD, Danaher Corporation, Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Miltenyi Biotec, Diasorin S.p.A., Sysmex Corporation, Sartorius AG, Curiox Biosystems, SPT Labtech Ltd, Stratedigm, Inc, United BioChannels, BioLegend, Inc., and RayBiotech, Inc.

Market growth is propelled by improved sample throughput and advanced automation capabilities in modern flow cytometry systems. High-throughput instruments enable the rapid analysis of large sample volumes, which increases efficiency in both clinical diagnostics and research workflows.

Automation features, including automated sample loading, data acquisition, and analysis, reduce manual intervention and minimize the risk of errors. These advancements allow laboratories to handle higher workloads with greater accuracy and consistency, supporting wider adoption across the healthcare, pharmaceutical, and academic sectors.

- In May 2025, Cytek Biosciences, Inc. launched the Cytek Aurora Evo full spectrum flow cytometer, featuring improved sample throughput, automation capabilities, and an updated hardware design. Building on the established Cytek Aurora platform, the system integrates Full Spectrum Profiling (FSP) technology to support large multicolor experiments with high reliability and flexibility.

Market Driver

Growing Demand for Speed, Versatility, & Reliability in Laboratory Testing

The expansion of the flow cytometry market is fueled by the increasing demand for speed, versatility, and reliability in laboratory testing. Modern flow cytometry systems provide high-throughput capabilities, processing thousands of cells per second while maintaining precision and accuracy.

Their capacity to analyze multiple parameters concurrently enables a wide range of assays within a single workflow, enhancing operational efficiency. These advantages position flow cytometry as a critical technology in clinical diagnostics, biomedical research, and industrial applications.

- In May 2025, Thermo Fisher Scientific Inc. launched the spectral-enabled Invitrogen Attune Xenith Flow Cytometer, designed to provide increased speed, versatility, and reliability for laboratories . The system combines spectral unmixing and conventional flow cytometry capabilities, enhancing application flexibility and sensitivity.

Market Challenge

High Operational and Maintenance Costs of Flow Cytometry Systems

High operational and maintenance costs present a significant challenge to the expansion of the flow cytometry market. Advanced instruments require regular servicing, calibration, and consumable replacement, creating financial pressure for smaller laboratories and research facilities. These expenses limit adoption in regions with budget constraints and slow the growth of advanced diagnostic capabilities.

Manufacturers are addressing this by developing cost-efficient models, introducing flexible financing plans, and offering service agreements that reduce upfront investment. They are also focusing on improving system durability and minimizing consumable usage to lower long-term operational expenses.

Market Trend

Adoption of Nanoscale Flow Cytometers

The flow cytometry market is experiencing a notable shift toward the rising adoption of nanoscale flow cytometers. These systems allow precise detection and characterization of particles at the nanometer scale, including extracellular vesicles, exosomes, and specific viruses.

This advancement is broadening applications in oncology, immunology, and virology. The capability to analyze nanoscale particles with exceptional sensitivity and resolution, while enhancing biomarker research and supporting the development of targeted therapies.

- In March 2024, Beckman Coulter Life Sciences launched the CytoFLEX nano Flow Cytometer, designed for research applications with detection capability down to 40 nm. The system delivers 30–50% more data generation compared to existing solutions, with enhanced sensitivity and simultaneous multiparameter detection through six fluorescent and five side scatter channels.

Flow Cytometry Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Reagents & Consumables, Instruments (Cell Analyzers, Cell Sorters, Imaging Flow Cytometers, Next-Generation Flow Cytometers), Accessories, Software, Services

|

|

By Technology

|

Cell-Based Flow Cytometry, Bead-Based Flow Cytometry

|

|

By Application

|

Clinical & Diagnostic (Cancer Diagnostics, Organ Transplantation, Immunodeficiency, Hematology, Autoimmune Disorders), Research (Immunophenotyping, Cell Sorting, Cell Cycle Analysis, Stem Cell Analysis, In Vitro Toxicity, Cell Viability, Others), Pharmaceutical & Industrial (Drug Discovery & Development, Bioprocess Monitoring)

|

|

By End User

|

Hospitals & Clinical Laboratories, Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs), Diagnostic Testing Labs, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Reagents & Consumables, Instruments, Accessories, Software, and Services): The reagents & consumables segment earned USD 2.38 billion in 2024, mainly due to consistent demand for assay kits, dyes, and antibodies in routine testing and research workflows.

- By Technology (Cell-Based Flow Cytometry and Bead-Based Flow Cytometry): The cell-based flow cytometry segment held a share of 77.00% in 2024, mainly fueled by its widespread use in immunophenotyping, cancer diagnostics, and stem cell analysis.

- By Application (Clinical & Diagnostic, Research, and Pharmaceutical & Industrial): The clinical & diagnostic segment is projected to reach USD 4.41 billion by 2032, owing to increasing adoption in oncology, hematology, and infectious disease testing.

- By End User (Hospitals & Clinical Laboratories, Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Contract Research Organizations (CROs), Diagnostic Testing Labs, and Others): The hospitals & clinical laboratories segment is projected to reach USD 3.40 billion by 2032, propelled by the growing need for high-throughput diagnostic capabilities and advanced patient monitoring.

Flow Cytometry Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America flow cytometry market share stood at 38.00% in 2024, with a valuation of USD 2.01 billion. This dominance is reinforced by a well-established healthcare infrastructure and strong regulatory support that promote the use of advanced diagnostic and research technologies.

Robust reimbursement frameworks, high research funding, and the presence of major biotechnology and pharmaceutical companies have further strengthened adoption across clinical, academic, and industrial settings. This supportive environment has allowed for the rapid integration of next-generation flow cytometry systems into routine diagnostics and research applications.

- In March 2024, Beckman Coulter Life Sciences received FDA 510(k) clearance for its DxFLEX Clinical Flow Cytometer, allowing U.S. distribution. The benchtop IVD system offers up to 13-color capability with additional detectors that can be activated without new hardware purchases. Utilizing avalanche photodiode detector technology, the system simplifies compensation procedures, enhances sensitivity, and streamlines workflows, providing laboratories with greater testing flexibility and efficiency.

The Asia-Pacific flow cytometry industry is poised to grow at a CAGR of 9.06% over the forecast period. This growth is bolstered by rising healthcare investments, expanding research capabilities, and improved access to advanced diagnostic solutions.

Government initiatives to promote biomedical research, expanding clinical trial activities, and the growing prevalence of chronic and infectious diseases are further accelerating adoption. Additionally, cost-competitive manufacturing and the rapid expansion of the life sciences sector contribute to regional market progress.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates flow cytometry instruments and associated diagnostic reagents to ensure safety, effectiveness, and quality before they enter the market.

- In Europe, the European Medicines Agency (EMA) and national competent authorities oversee compliance under the In Vitro Diagnostic Regulation, which governs manufacturing, performance, and post-market surveillance.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA), in collaboration with the Ministry of Health, Labour and Welfare, handles product review, approval, and quality management compliance.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates licensing and market authorization for flow cytometry instruments while enforcing adherence to applicable quality standards.

Competitive Landscape

Key players in the flow cytometry industry are prioritizing technological advancements and new product launches to enhance their market position. Organizations are introducing next-generation instruments with higher sensitivity, faster throughput, and advanced multiparametric analysis capabilities. Companies are incorporating sophisticated software platforms with improved data analytics, automation, and interoperability to optimize laboratory workflows.

Manufacturers are introducing compact and user-oriented systems to increase accessibility in smaller laboratories and decentralized testing environments. Furthermore, the development of specialized reagents and consumables further broadens the application scope and customization for end users.

- In May 2024, Agilent Technologies Inc. expanded its NovoCyte portfolio with the launch of the NovoCyte Opteon Spectral Flow Cytometer. The system features three to five laser configurations and supports up to 73 detectors, enabling simultaneous analysis of over 40 markers for advanced flow cytometry assays.

Key Companies in Flow Cytometry Market:

- BD

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Miltenyi Biotec

- Diasorin S.p.A.

- Sysmex Corporation

- Sartorius AG

- Curiox Biosystems

- SPT Labtech Ltd

- Stratedigm, Inc

- United BioChannels

- BioLegend, Inc.

- RayBiotech, Inc.

Recent Developments (Product Launches)

- In May 2025, BD (Becton, Dickinson and Company) launched the BD FACSDiscover A8 Cell Analyzer, the first system to feature both spectral and real-time cell imaging technologies. Equipped with BD SpectralFX Technology and BD CellView Image Technology, it enables analysis of 50 or more cellular characteristics with high resolution and sensitivity, while providing high-speed fluorescent and label-free imaging for real-time spatial and morphological insights.

- In March 2025, Beckman Coulter Life Sciences introduced the CytoFLEX mosaic Spectral Detection Module, the industry’s first modular spectral flow cytometry solution. The system, compatible with the CytoFLEX LX and S Flow Cytometers, offers up to 88 detection channels, two unmixing algorithms, and up to 10 autofluorescence channels.