Floating Solar Panels Market Size

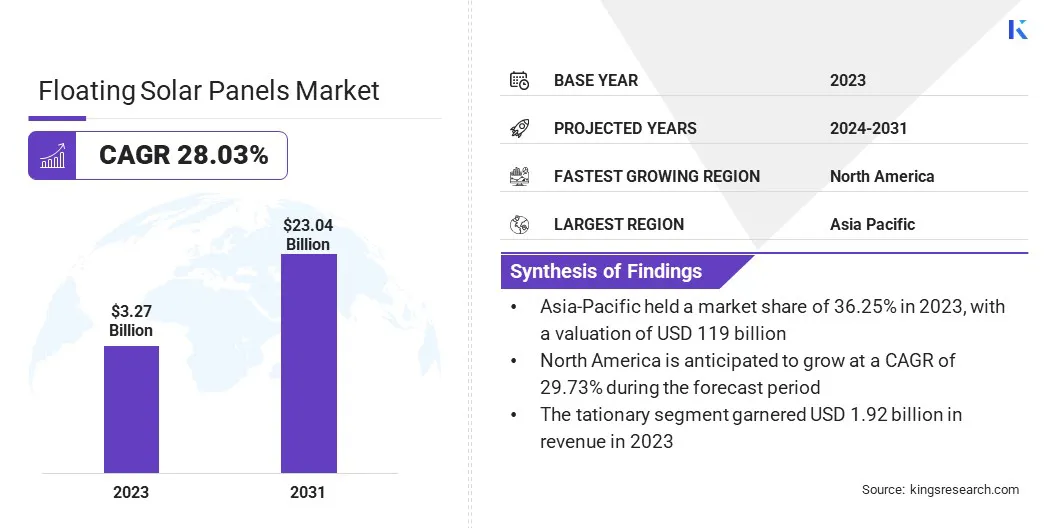

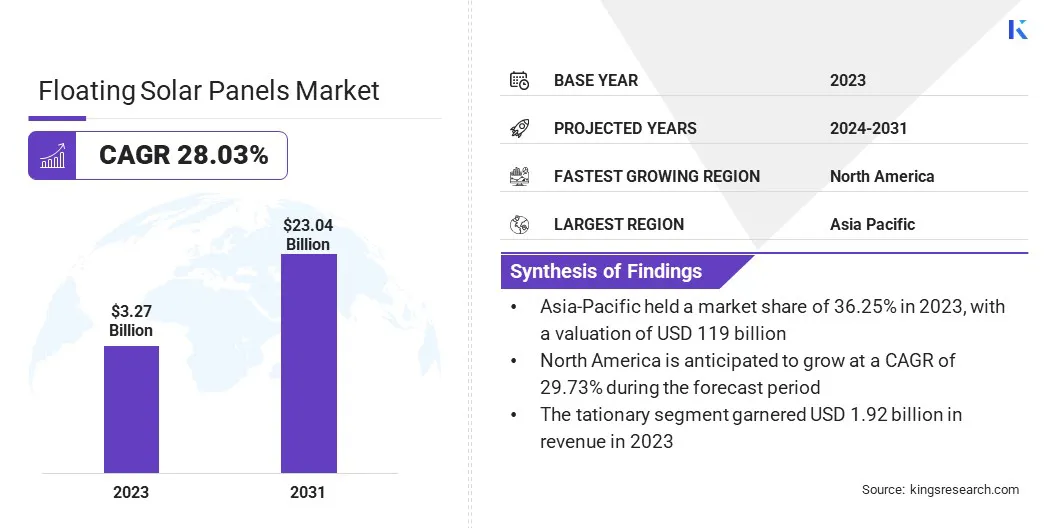

The global Floating Solar Panels Market size was valued at USD 3.27 billion in 2023 and is projected to grow from USD 4.09 billion in 2024 to USD 23.04 billion by 2031, exhibiting a CAGR of 28.03% during the forecast period. The expansion of the market is driven by the increasing demand for renewable energy, scarcity of land for traditional solar farms, technological advancements, and supportive government policies and incentives.

In the scope of work, the report includes products offered by companies such as Ciel & Terre, GCL System Integration, Hanwha Group., Talesun Solar Co., Ltd., Trina Solar ISBU, Wuxi Suntech Power Co., Ltd., Yingli Solar, JA SOLAR Technology Co. Ltd., KYOCERA Corporation, LONGi, and others.

The growth of the floating solar panels market is majorly fueled by the growing need for renewable energy sources to reduce carbon emissions. Additionally, the scarcity of land for traditional solar farms in densely populated areas makes floating solar an attractive alternative. Furthermore, the technology offers higher efficiency due to the cooling effect of water on panels.

Moreover, governments and environmental organizations are increasingly supporting renewable energy projects by offering incentives and subsidies. Additionally, advancements in technology have led to more durable and efficient floating solar systems, thereby boosting market growth.

- According to Invest India, as of May 2024, India's renewable energy sources, which include large hydropower, had a combined installed capacity of 193.57 GW. The installed capacity included 46.42 GW of wind power, 84.27 GW of solar power, 10.35 GW of biomass/co-generation, 5 GW of small hydro power, 0.59 GW of waste to energy, and 46.92 GW of large hydro. India has a set a target of achieving 500 GW of renewable energy capacity by 2030, along with specific goals for green hydrogen production and offshore wind energy development.

Asia-Pacific is leading the floating solar panels market due to widespread adoption, driven by countries such as China, Japan, and India. The market is characterized by collaborations among governments, private companies, and research institutions to develop innovative solutions. Major players are focusing on expanding their product portfolios and geographical presence. The market is expected to maintain its upward trajectory due to growing environmental concerns and the ongoing shift toward sustainable energy sources.

Floating solar panels, also known as floating photovoltaic (FPV) systems, are solar arrays that are designed to float on water bodies. These systems are anchored and secured to remain stable and can be deployed on various water surfaces, including lakes, reservoirs, and industrial ponds. The technology leverages the cooling effect of water, which enhances the efficiency of solar panels.

Unlike traditional ground-mounted solar farms, floating solar do not occupy valuable land resources, which makes them an attractive option for regions with limited land availability. The market encompasses a range of activities from design and manufacturing to installation and maintenance of floating solar systems.

Analyst’s Review

Manufacturers are innovating and expanding their product offerings in the floating solar panels market by investing heavily in research and development to create more efficient and durable products.

New products featuring advanced materials and integrated energy storage solutions are being introduced to the market, significantly enhancing both performance and reliability. Manufacturers are further focusing on strategic partnerships and collaborations to accelerate deployment.

- In February 2024, France-based start-up HelioRec established a partnership with EMP ROTOMOULAGE to produce floating solar systems in Bretagne. HelioRec developed a compact, transportable floating solar system with a machine learning feature to enhance efficiency. The system included a 'hydro-lock' feature for increased stability. In October 2023, HelioRec installed a 25 kW floating solar unit at the Port of Brest to demonstrate its latest technologies.

To capitalize on growth opportunities, companies should prioritize cost reduction strategies and explore emerging markets. Additionally, leveraging government incentives and investing in smart monitoring technologies are likely to play a crucial role in sustaining industry growth.

Floating Solar Panels Market Growth Factors

The increasing demand for renewable energy sources is a key factor boosting the growth of the floating solar panels market. Governments and corporations are prioritizing sustainable energy solutions to reduce carbon footprints and combat climate change. Floating solar panels are particularly appealing as they do not occupy valuable land resources and can be installed on existing water bodies, thereby maximizing space efficiency.

Additionally, the cooling effect provided by water bodies enhances the efficiency of solar panels, resulting in higher energy yields. This dual benefit of efficient land use and improved performance is propelling the adoption of floating solar technology, making it a significant contributor to the renewable energy landscape.

A prominent challenge hindering the adoption of solar panels is the high initial cost of installation. The expense of anchoring and mooring systems, along with specialized equipment, is often prohibitive. However, this challenge is being addressed through technological advancements and economies of scale. Manufacturers are focusing on developing more cost-effective materials and streamlining installation processes to enhance efficiency.

Additionally, government incentives and subsidies are mitigating the initial costs, thereby making the investment more attractive. Collaborative efforts between the public and private sectors are advancing innovation and reducing costs. By leveraging these strategies, the market is overcoming financial barriers and facilitating the broader adoption of floating solar technology.

Floating Solar Panels Market Trends

The integration of energy storage systems is a key trend in the market. Companies are increasingly combining floating solar installations with battery storage solutions to ensure a stable and reliable energy supply. This trend is garnering attention due to the need of addressing the intermittent nature of solar power.

By storing excess energy generated during periods of peak sunlight, these systems are able to provide electricity during cloudy conditions or at night. The integration of floating solar and energy storage enhances grid stability and reduces dependency on fossil fuels. This integrated approach is gaining traction and is expected to shape the landscape of the floating solar panels market.

Another prominent trend is the widespread adoption of advanced monitoring and maintenance technologies. Companies are implementing drones, sensors, and artificial intelligence (AI) to monitor the performance and health of floating solar installations. These technologies provide real-time data on panel efficiency, detect faults, and predict maintenance needs, thereby reducing downtime and operational costs.

The use of AI and machine learning algorithms is optimizing energy production and extending the lifespan of solar panels. This trend toward smart monitoring and predictive maintenance is enhancing the overall efficiency and reliability of floating solar systems, thereby making them a more appealing investment for stakeholders.

Segmentation Analysis

The global market is segmented based on type, capacity, and geography.

By Type

Based on type, the market is categorized into stationary and tracking. The stationary segment led the floating solar panels market in 2023, reaching a valuation of USD 1.92 billion. This expansion is attributed to its simplicity and lower installation costs. Stationary systems are easier to install and maintain compared to tracking systems, which require additional mechanisms to follow the sun's movement. This makes them an attractive option for several regions, especially those with limited budgets for renewable energy projects.

Additionally, stationary systems are known for their reliability and durability, which has contributed to their widespread adoption. The steady demand for cost-effective and dependable solar solutions is fueling the expansion of the stationary segment.

By Capacity

Based on capacity, the market is classified into Less than 100 MW, 100 MW - 1 GW, 2 GW - 100 GW, and Above 100 GW. The 2 GW - 100 GW segment is likely to witness significant growth at a staggering CAGR of 30.24% through the forecast period (2024-2031), mainly due to increasing investments in large-scale floating solar projects.

This capacity range offers a balance between manageable project size and substantial energy output, rendering it appealing to both public and private investors. Governments and utilities are focusing on large-scale deployments to meet ambitious renewable energy targets. The technological advancements and economies of scale are contributing to a reduction in the costs associated with higher capacity installations.

Floating Solar Panels Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

Asia-Pacific floating solar panels market share stood around 36.25% in 2023 in the global market, with a valuation of USD 1.19 billion. The widespread adoption of renewable energy technologies in countries such as China, Japan, and India is supporting regional market growth. These nations are investing heavily in floating solar projects to address land scarcity and meet their growing energy needs.

Favorable government policies and substantial funding are promoting the development of large-scale installations. Additionally, the presence of major manufacturers and ongoing technological advancements in the region are stimulating regional market growth.

North America is poised to experience substantial growth at a robust CAGR of 29.73% over the forecast period. This notable expansion is fostered by increasing environmental awareness and supportive regulatory frameworks. The US and Canada are focusing on expanding their renewable energy portfolios to reduce carbon emissions.

Government incentives and subsidies are making significant investments in floating solar more attractive. Additionally, technological advancements and innovations in floating solar systems are enhancing efficiency and reducing costs. The region's strong emphasis on sustainable energy solutions is boosting the adoption of floating solar panels.

Competitive Landscape

The floating solar panels market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Floating Solar Panels Market

- Ciel & Terre

- GCL System Integration

- Hanwha Group.

- Talesun Solar Co., Ltd.

- Trina Solar ISBU

- Wuxi Suntech Power Co., Ltd.

- Yingli Solar

- JA SOLAR Technology Co. Ltd.

- KYOCERA Corporation

- LONGi

Key Industry Developments

- April 2024 (Partnership): NHPC Limited partnered with Norwegian company Ocean Sun to advance sustainable energy in India. This collaboration focused on implementing Ocean Sun's innovative floating solar technology in the country. The technology involvs photovoltaic panels mounted on hydro-elastic membranes, which are strategically placed at suitable sites identified by NHPC. This effort aligns with NHPC's commitment to sustainable development and its goal of expanding its renewable energy portfolio.

- November 2023 (Launch): Abu Dhabi Future Energy Company PJSC – Masdar and Indonesia’s state-owned utility company, PLN, inaugurated the 145 MW (192 MWp) Cirata floating solar plant in Indonesia, the largest in Southeast Asia. The plant, opened by President Joko Widodo, is designed to power 50,000 homes and offset 214,000 tons of carbon dioxide emissions. Masdar and PLN NP have also outlined plans (Phase II) to develop an additional 500 MW capacity at Cirata.

The global floating solar panels market is segmented as:

By Type

By Capacity

- Less than 100 MW

- 100 MW - 1 GW

- 2 GW - 100 GW

- Above 100 GW

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America