Market Definition

Finance cloud refers to internet-based platforms and services tailored to meet the unique needs of banks, insurers, investment firms, and other financial entities. These solutions enable secure management of data, operations, and customer interactions while eliminating reliance on extensive on-premise infrastructure.

The scope of the market includes applications in banking, insurance, wealth and asset management, customer analytics, risk assessment, and regulatory reporting across institutions of all sizes. Financial organizations use cloud platforms to enhance operational efficiency, support compliance, scale resources cost-effectively, and deliver real-time, personalized services to their customers.

Finance Cloud Market Overview

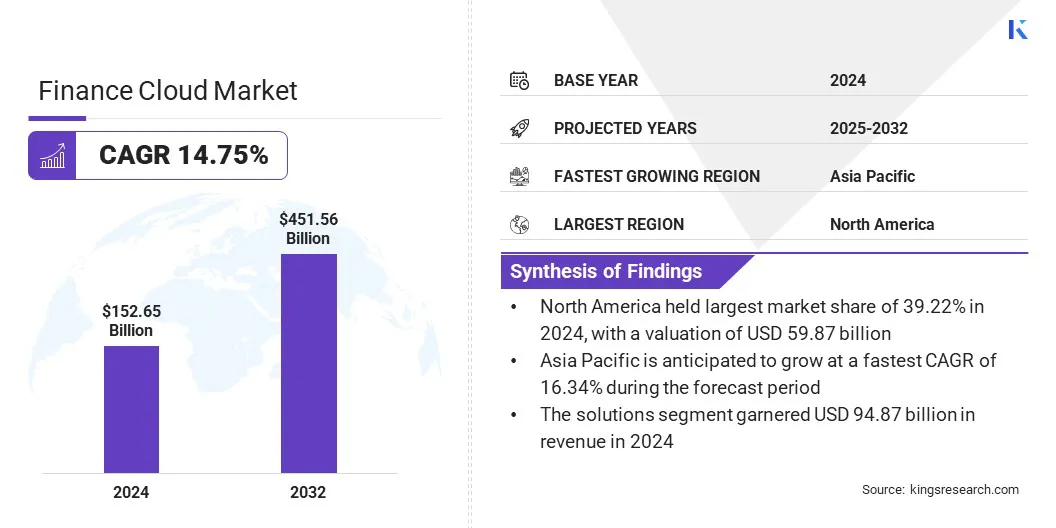

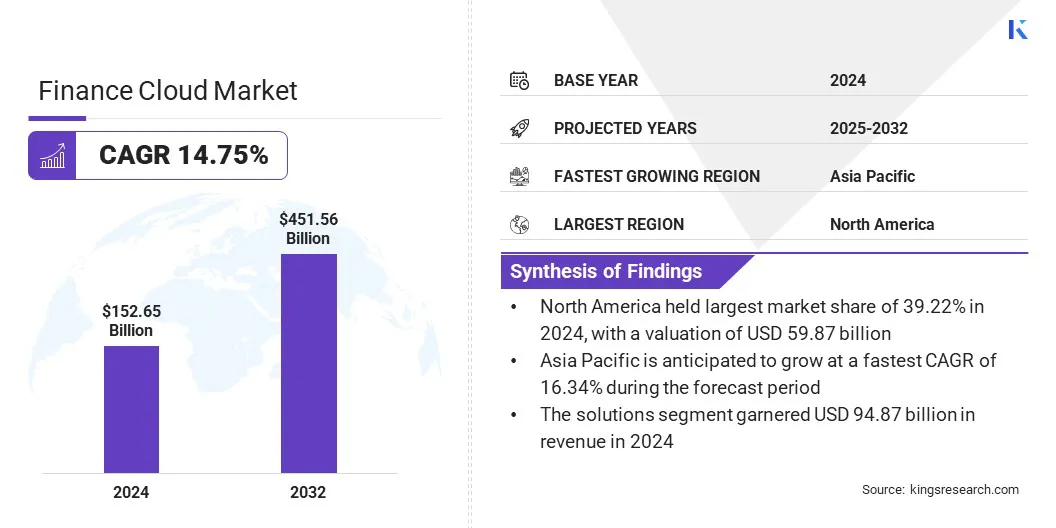

The global finance cloud market size was valued at USD 152.65 billion in 2024 and is projected to grow from USD 172.34 billion in 2025 to USD 451.56 billion by 2032, exhibiting a CAGR of 14.75% over the forecast period.

The growth of the market is driven by the expansion of digital banking and fintech, which require scalable, secure, and flexible platforms to manage increasing transaction volumes and customer demands. Adoption of hybrid and multi-cloud deployments is further supporting this growth by enabling financial institutions to efficiently maintain data security, regulatory compliance, and operational flexibility.

Key Highlights

- The finance cloud industry size was valued at USD 152.65 billion in 2024.

- The market is projected to grow at a CAGR of 14.75% from 2025 to 2032.

- North America held a market share of 39.22% in 2024, with a valuation of USD 59.87 billion.

- The solutions segment garnered USD 94.87 billion in revenue in 2024.

- The asset management segment is expected to reach USD 81.04 billion by 2032.

- The hybrid cloud segment secured the largest revenue share of 45.41% in 2024.

- The small & medium enterprises (SMEs) segment is poised for a robust CAGR of 16.18% through the forecast period.

- The banking and financial services segment is expected to secure the largest revenue share of 69.06% in 2032.

- Asia Pacific is anticipated to grow at a CAGR of 16.34% over the forecast period.

Major companies operating in the finance cloud market are Amazon Web Services, Microsoft, IBM, Salesforce, Oracle, Google, SAP SE, Hewlett Packard Enterprise Development LP, Tencent Cloud, Alibaba Cloud, Broadcom (Vmware), Cisco Systems, Inc., Huawei Technologies Co., Ltd., DXC Technology Company, and Sage Group plc.

Financial institutions are adopting cloud solutions to rapidly adjust infrastructure capacity in response to fluctuating transaction volumes. Cloud platforms are enabling banks and insurance companies to accelerate the rollout of innovative products and services without heavy upfront investments. The ability to scale resources efficiently is helping institutions manage peak demands during events such as regulatory changes or market volatility.

Real-time scalability is improving customer experience through faster processing and uninterrupted service delivery. The growing need for flexible and responsive IT systems is strengthening the adoption of finance cloud solutions across the financial services industry.

- In July 2025, NatWest entered into a five-year collaboration with Accenture and Amazon Web Services to modernize its customer data systems. The initiative consolidates data from 20 million customers onto a unified cloud platform. This transition aims to reduce fraud alert response times from days to hours and facilitate the rapid rollout of services like mortgage adjustments and new features.

Market Driver

Growth of Digital Banking and Fintech

Growth of digital banking and fintech ecosystems is driving the expansion of the finance cloud market. Increasing adoption of mobile banking and digital wallets is creating a strong requirement for secure and scalable cloud infrastructure. Fintech companies are relying on cloud platforms to deliver innovative payment solutions, lending services, and wealth management applications with greater speed and efficiency.

- A 2025 report by Infosys highlighted that 70% of banks are already hosting their core platforms, critical processes, and applications in the cloud, and a further 23% expect to do so in the next three years. The report also noted that 50% of banks are currently deploying cloud for non-core platforms, while 41% plan to migrate these systems soon. This indicates that, by 2028, more than 90% of banking platforms, both core and non-core, will be hosted in the cloud.

Cloud-based systems are enabling real-time transaction processing and seamless integration across multiple digital channels. The flexibility of cloud platforms is supporting collaboration between traditional banks and fintech companies to enhance customer offerings.

- In September 2025, Google signed a multi-year, multi-million-dollar partnership with Revolut to power its expanding global operations using Google Cloud’s secure and scalable infrastructure. The collaboration aims to enhance system reliability and performance as Revolut continues to onboard millions of users worldwide. It highlights how cloud platforms enable real-time processing, seamless digital services, and operational scalability across mobile banking and digital wallets.

Market Challenge

Data Privacy and Security Concerns

A key challenge impeding the finance cloud market is the heightened risk of data breaches and unauthorized access in cloud environments. Financial institutions manage highly sensitive customer information, making security lapses potentially damaging in terms of both reputation and compliance. Additionally, evolving regulations across jurisdictions are creating complexity in how financial data is stored, accessed, and shared.

To address this challenge, market players are strengthening encryption protocols, adopting zero-trust security frameworks, and ensuring compliance with global standards such as GDPR and CCPA. These measures are building greater confidence among financial institutions to migrate critical operations to cloud platforms.

- In June 2025, India’s Reserve Bank (RBI) issued a directive urging financial institutions to adopt a zero-trust cybersecurity framework, deploy AI-aware defence mechanisms, and implement risk-based supervision models. The guidance highlights the importance of robust cybersecurity measures to protect sensitive data and ensure compliance amid growing digital threats.

Market Trend

Adoption of Hybrid & Multi-Cloud Deployments

The finance cloud market is increasingly shaped by the adoption of hybrid and multi-cloud strategies. Financial institutions are deploying workloads across private and public clouds to achieve a balance between regulatory compliance, data security, and cost efficiency. This approach allows sensitive data to remain in controlled environments while enabling less critical processes to benefit from scalable public cloud infrastructure.

In 2024, Nutanix’s sixth annual Financial Services Enterprise Cloud Index report found that while hybrid multicloud deployment among financial services firms remained steady year-over-year, respondents anticipate a three-fold increase in adoption over the next three years, positioning hybrid multicloud as the future dominant IT model in the industry.

Multi-cloud adoption also reduces vendor dependency and enhances resilience by distributing operations across multiple platforms. This is supporting greater flexibility, risk management, and adaptability in financial services operations.

- In February 2025, Alinma Bank adopted IBM’s advanced hybrid cloud and AI technologies, such as IBM Cloud Pak for Integration, IBM API Connect, and Red Hat OpenShift on IBM Cloud to launch a centralized API platform supporting both private and public cloud environments. The platform provides a secure, scalable infrastructure that enables seamless integration of internal systems, including onboarding, pricing, and payments and delivers consistent, compliant access to fintech partners.

Finance Cloud Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Solutions, Services

|

|

By Application

|

Revenue Management, Wealth Management, Asset Management, Customer Relationship Management (CRM), Financial Forecasting, Others

|

|

By Deployment Model

|

Public Cloud, Private Cloud, Hybrid Cloud

|

|

By Organization Size

|

Large Enterprises, Small & Medium Enterprises (SMEs)

|

|

By End User

|

Banking and Financial Services, Insurance Companies

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Solutions and Services): The solutions segment earned USD 94.87 billion in 2024 due to its ability to provide comprehensive, scalable, and integrated platforms that streamline financial operations, enhance regulatory compliance, and support digital transformation initiatives across banking and financial institutions.

- By Application (Revenue Management, Wealth Management, Asset Management, Customer Relationship Management (CRM), Financial Forecasting, and Others): The revenue management segment held 20.50% of the market in 2024, due to financial institutions increasingly relying on cloud-based platforms to optimize billing, automate revenue recognition, and improve financial forecasting accuracy.

- By Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud): The hybrid cloud segment is projected to reach USD 219.63 billion by 2032, owing to the ability to provide financial institutions with the flexibility to manage sensitive data securely on private clouds while leveraging public clouds for scalable operations and cost efficiency.

- By Organization Size (Large Enterprises and Small & Medium Enterprises (SMEs)): The small & medium enterprises (SMEs) segment is poised for significant growth at a CAGR of 16.18% through the forecast period, attributed to their increasing adoption of scalable, cost-effective cloud solutions that enable rapid deployment, operational flexibility, and efficient management of financial processes without heavy IT infrastructure investment.

- By End User (Banking and Financial Services and Insurance Companies): The banking and financial services segment is expected to secure 69.06% of the market in 2032, due to its high demand for scalable, secure, and compliant cloud platforms to manage large transaction volumes, complex operations, and evolving digital services.

Finance Cloud Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America finance cloud market share stood at 39.22% in 2024, with a valuation of USD 59.87 billion. This dominance is due to the rising use of artificial intelligence and data analytics in financial decision-making.

Banks and investment firms are increasingly using predictive analytics, fraud detection, and automated advisory tools. Finance cloud solutions support large-scale data processing and integration of AI models. This capability enables better risk management and personalized financial services, which increases demand for cloud platforms.

Moreover, providers such as Microsoft, Amazon, IBM, and Oracle deliver specialized financial cloud solutions tailored to regional regulatory requirements and market needs. Their continuous investment in innovation and localized compliance tools strengthens trust among financial institutions. This regional focus accelerates the rollout of advanced cloud solutions across the finance sector, giving it a competitive edge over other markets.

The finance cloud industry in Asia Pacific is poised for a significant CAGR of 16.34% over the forecast period. Regional government initiatives promoting digital finance and cloud adoption are driving this growth in this region.

Authorities are rolling out national strategies to support digital banking and fintech innovation. Finance cloud systems provide the flexibility and compliance capabilities needed to align with these regulatory directions. This accelerates investment in cloud infrastructure across banks and financial service providers.

- In May 2025, India's Reserve Bank launched the Indian Financial Services (IFS) Cloud under its subsidiary IFTAS. This cloud platform is designed for RBI and financial institutions, delivering affordable and scalable data storage that ensures compliance with India’s data localization rules. It aims to enhance operational efficiency and technological access, particularly for smaller banks and Non-Banking Financial Companies (NBFCs).

Regulatory Frameworks

- In the U.S., financial institutions using cloud platforms must comply with the Federal Financial Institutions Examination Council (FFIEC) Cloud Computing Handbook and the Gramm-Leach-Bliley Act (GLBA). These frameworks require rigorous data protection, risk assessment, and secure management of customer information. Banks and non-banking financial companies must ensure cloud service providers meet federal security standards, maintain audit trails, and enable resilience against operational or cybersecurity risks.

- In the UK, financial institutions largely follow post-Brexit adaptations of the European Digital Operational Resilience Act (DORA) and European Banking Authority (EBA) guidelines. These regulations mandate operational resilience, incident reporting, and strict oversight of third-party cloud service providers. Firms must manage information and communications technology risks while ensuring compliance with cybersecurity standards and regulatory audits, enabling secure adoption of finance cloud solutions in the UK.

- China regulates finance cloud services through the Data Security Law (DSL) and Personal Information Protection Law (PIPL). These laws require strict control over personal and financial data, enforce localization within national borders, and restrict cross-border data transfers. Financial institutions using cloud platforms must comply with government-mandated security, storage, and processing rules, ensuring that sensitive customer and transaction data remain protected under Chinese law.

- In India, the Reserve Bank of India (RBI) regulates cloud adoption in the financial sector through its Indian Financial Services (IFS) Cloud initiative. Financial institutions must follow zero-trust cybersecurity frameworks and implement AI-aware defenses. RBI mandates risk-based supervision for cloud systems, particularly for non-banking financial companies. Data localization, secure cloud infrastructure, and continuous monitoring are essential to protect sensitive financial data while enabling cloud-based service expansion in India.

Competitive Landscape

Major players in the finance cloud industry are adopting strategies such as strategic partnerships, investments in research and development, and the integration of advanced technologies to remain competitive in the market. Companies are collaborating with regional and global firms to expand their service offerings and reach new customer segments.

They are also focusing on developing innovative cloud and artificial intelligence solutions to enhance operational efficiency and service quality. Continuous technological upgrades help firms handle increasing workloads and regulatory requirements. Investment in R&D enables the creation of customized solutions for specific industry needs.

- In September 2025, Tata Consultancy Services (TCS) signed a significant contract with Scandinavian insurer Tryg. Under this contract, TCS will deploy its AI and cloud solutions to manage Tryg’s end-to-end IT operations over seven years.

Key Companies in Finance Cloud Market:

- Amazon Web Services

- Microsoft

- IBM

- Salesforce

- Oracle

- Google

- SAP SE

- Hewlett Packard Enterprise Development LP

- Tencent Cloud

- Alibaba Cloud

- Broadcom (Vmware)

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- DXC Technology Company

- Sage Group plc

Recent Developments (Partnerships/Agreements)

- In September 2025, Microsoft entered into a significant agreement with Nebius, an Amsterdam-based AI infrastructure provider, valued at up to USD 19.4 billion. Under this deal, Nebius will supply GPU-based computing power from its new data center in Vineland, New Jersey, to support Microsoft's AI operations.

- In January 2025, Euroclear entered a seven-year strategic partnership with Microsoft to modernize its financial market infrastructure through the implementation of cloud computing, generative AI, and analytics tools. The collaboration aims to enhance Euroclear’s operational resilience, security, and client engagement by integrating Microsoft’s technology across its platform.

- In October 2024, Citi and Google Cloud announced a multi-year agreement to support Citi's digital strategy through cloud technology and artificial intelligence. This collaboration focuses on modernizing Citi's technology infrastructure and enhancing employee and client experiences on cloud-based applications. The partnership highlights the increasing importance of cloud adoption in the financial services sector to drive innovation and operational efficiency.

- In March 2024, Oracle announced the integration of generative AI features into its corporate software, enhancing its cloud-based solutions for finance, supply chain, and human resources. These features aim to aid tasks such as report generation, data summarization, and drafting job descriptions, thereby saving time for business users.

policy support