Market Definition

Energy retrofit systems refer to solutions that upgrade existing buildings and infrastructures to improve energy efficiency, reduce operating costs, and support sustainability goals. They involve replacing and or improving components such as lighting, HVAC, insulation, windows, building controls, and integrating renewable energy technologies.

Energy Retrofit Systems Market Overview

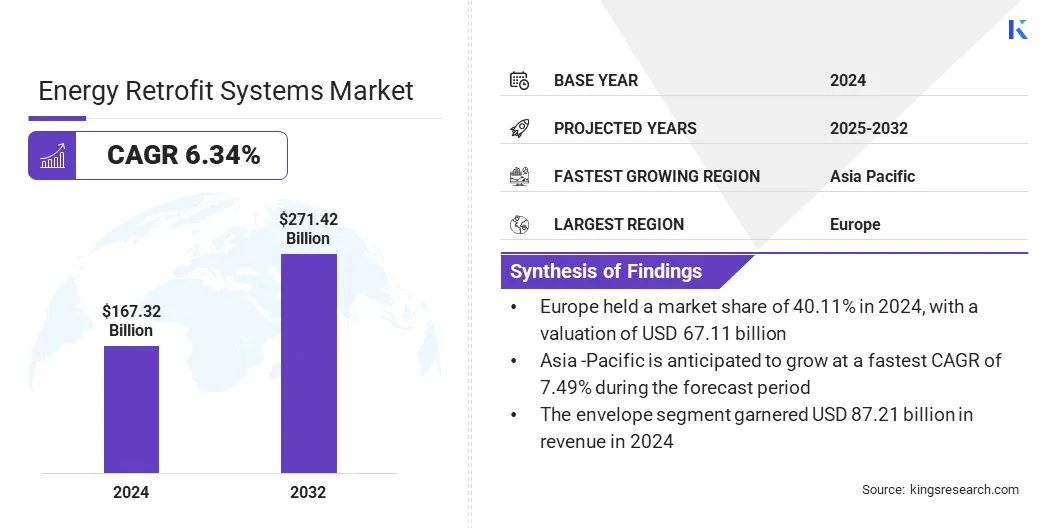

The global energy retrofit systems market size was valued at USD 167.32 billion in 2024 and is projected to grow from USD 176.52 billion in 2025 to USD 271.42 billion by 2032, exhibiting a CAGR of 6.34% during the forecast period.

This growth is driven by rising global power demand, prompting the adoption of energy-efficient retrofit solutions to optimize electricity use, reduce costs, and support sustainable infrastructure. Increasing awareness of carbon reduction allows businesses and public sector entities to implement energy retrofit solutions that lower greenhouse gas emissions, improve environmental performance, and contribute to global sustainability targets.

Key Highlights:

- The energy retrofit systems industry size was recorded at USD 167.32 billion in 2024.

- The market is projected to grow at a CAGR of 6.34% from 2025 to 2032.

- Europe held a share of 40.11% in 2024, valued at USD 67.11 billion.

- The envelope segment garnered USD 87.21 billion in revenue in 2024.

- The commercial segment is expected to reach USD 134.67 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 7.49% over the forecast period.

Major companies operating in the energy retrofit systems market are Schneider Electric, Johnson Controls International plc, Siemens, Honeywell International Inc, Ameresco, DAIKIN INDUSTRIES, Ltd, Ballard Power Systems, ITM Power plc, Intelligent Energy Limited, PowerCell Sweden AB, Cummins Inc, AVL, Engie SA, ABB Ltd, and Orion Energy Systems, Inc.

Increasing collaboration between government bodies and international organizations is fueling market expansion by fostering large-scale implementation of efficiency projects. This initiative creates demand for modern retrofit solutions across public infrastructure and industrial sectors.

- In June 2025, MAHAPREIT, a subsidiary of the Government of Maharashtra, signed an MoU with Sustainable Energy for All (SEforALL) to enhance energy efficiency across the state, creating significant opportunities in municipal infrastructure, industrial operations, and MSMEs.

Market Driver

Rising Global Power Demand

The growth of the energy retrofit systems market is propelled by the rising global power demand for reliable and efficient energy use across residential, commercial, and industrial sectors.

Increasing consumption creates the need for retrofit solutions that optimize efficiency, reduce energy waste, and manage operational costs more effectively. This rising demand for efficiency upgrades prompts manufacturers to develop advanced technologies, expand service offerings, and deliver integrated solutions for diverse applications across residential, commercial, and industrial sectors.

- In July 2025, the International Energy Agency’s Electricity Mid-Year Update projected global electricity demand to grow by 3.3% in 2025 and 3.7% in 2026, more than double the rate of total energy demand.

Market Challenge

High Upfront Investment

A key challenge hindering the expansion of the energy retrofit systems market is the high upfront investment required for implementing advanced technologies and replacing outdated infrastructure. The significant capital needed for equipment, installation, and integration often places a financial burden on organizations, particularly small and medium enterprises. This cost barrier delays decision-making and limits large-scale adoption of retrofit projects.

To address this challenge, market players are introducing innovative financing models such as performance-based contracting and leasing options to reduce upfront capital requirements. They are also collaborating with financial institutions to provide accessible credit lines and low-interest loans for retrofit projects. Manufacturers are offering energy savings guarantees and ROI-focused solutions to promote investment in energy retrofit projects.

Market Trend

Integration of Advanced HVAC Technologies

A key trend influencing the energy retrofit systems market is the increasing integration of advanced HVAC technologies in commercial and industrial buildings to enhance energy efficiency and operational performance.

Market players are offering solutions that integrate smart controls, IoT sensors, and modular components to optimize heating, cooling, and ventilation. This facilitates the retrofitting of existing infrastructure with high-performance HVAC systems, reducing energy consumption, lowering operational costs, and supporting sustainability goals.

- In February 2025, Grundfos launched MIXIT, a next-generation HVAC solution, at ACREX India 2025. The technology enhances energy efficiency, reduces environmental impact, and addresses the growing cooling demand in commercial and industrial buildings. It also supports sustainable infrastructure and promotes smarter energy management through advanced retrofit solutions.

Energy Retrofit Systems Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Envelope, LED Retrofit, HVAC Retrofit, Appliances

|

|

By Application

|

Residential, Commercial, Institutional

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Envelope, LED Retrofit, HVAC Retrofit, and Appliances): The envelope segment earned USD 87.21 billion in 2024, mainly due to increasing adoption of energy-efficient building materials and insulation solutions across commercial and residential properties.

- By Application (Residential, Commercial, and Institutional): The commercial segment held a share of 45.32% in 2024, fueled by rising energy costs, stringent efficiency regulations, and extensive retrofitting of office and industrial buildings.

Energy Retrofit Systems Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

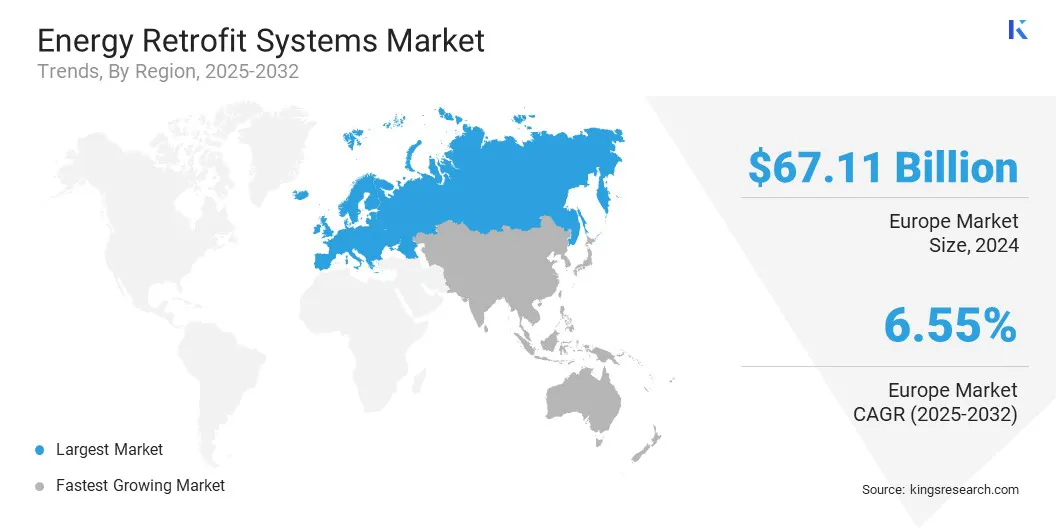

Europe energy retrofit systems market share stood at 40.11% in 2024, valued at USD 67.11 billion. This dominance is reinforced by rising energy costs that are prompting businesses and households to implement retrofit solutions to improve efficiency and lower expenses.

Government incentives, such as tax credits, rebates, and grants, along with regulations such as energy efficiency standards, are supporting large-scale adoption of efficiency upgrades, including advanced insulation and smart energy management systems. These measures are also prompting households to invest in modern technologies that lower energy consumption and enhance long-term sustainability.

Corporate commitments to sustainability and net-zero targets are prompting organizations to modernize their existing infrastructure through advanced retrofitting. Moreover, strategic acquisitions by key players in the energy sector are accelerating the development of advanced retrofit solutions by integrating AI-driven optimization, data analytics, and forecasting tools, creating sustained demand for innovative retrofit systems across the region.

- In January 2024, Danfoss acquired ENFOR’s district energy software business to strengthen its Leanheat suite of sustainable heating and cooling solutions. The acquisition integrates advanced AI-driven optimization, data analytics, and forecasting tools to improve efficiency in district energy systems and buildings.

The Asia-Pacific retrofit systems market is set to grow at a robust CAGR of 7.49% over the forecast period. This growth is propelled by rising electricity demand driven by industrialization and urbanization in countries such as China and India.

The increasing adoption of smart building technologies, including IoT sensors, automated HVAC controls, and connected lighting systems, along with AI-driven energy management solutions, is enhancing efficiency and accelerating retrofit implementation across commercial, industrial, and municipal infrastructure.

Additionally, increasing awareness of environmental sustainability and carbon reduction targets is prompting companies and municipalities to modernize infrastructure, thereby fueling regional market growth.

- In July 2025, Actis acquired Barghest Building Performance (bbp), a Energy-Savings-as-a-Service provider for HVAC systems in Asia. The acquisition leverages AI-driven optimization, machine learning, and proprietary software to enhance energy efficiency in cooling systems across commercial, industrial, and district applications.

Regulatory Frameworks

- In the U.S., the Department of Energy (DOE) regulates energy efficiency standards, building codes, and retrofit programs across residential, commercial, and industrial sectors. Through initiatives such as the Building Technologies Office and ENERGY STAR, it ensures compliance, promotes sustainable energy use, and provides research, funding, and guidance for the implementation of advanced heating, cooling, and insulation technologies.

- In the UK, the Department for Energy Security and Net Zero (DESNZ) regulates energy efficiency policies, building codes, and retrofit programs. It oversees compliance with energy performance standards, supports funding schemes for commercial and residential retrofits, promotes low-carbon technologies, and monitors energy-saving initiatives, including smart systems, district heating, and AI-driven efficiency solutions.

- In China, the National Energy Administration (NEA) regulates energy efficiency and conservation measures for buildings and industrial facilities. It sets mandatory standards, monitors retrofit programs, approves incentive schemes, and enforces compliance with national energy-saving targets. The NEA also oversees smart grid integration, district energy systems, and deployment of advanced technologies to optimize energy consumption and reduce emissions.

- In India, the Bureau of Energy Efficiency (BEE) regulates energy efficiency standards, building codes, and labeling programs for appliances and infrastructure. It oversees retrofit initiatives, monitors compliance with energy-saving targets, provides technical support and incentives for industrial and commercial upgrades, and promotes sustainable practices, including renewable integration and intelligent energy management systems.

Competitive Landscape

Major players operating in the energy retrofit systems industry are implementing upgrades to HVAC, lighting, and control systems across commercial, industrial, and institutional facilities.

They are integrating building management systems and occupancy sensors to optimize energy use and enhance operational efficiency. Additionally, they are focusing on modular and scalable solutions to accommodate different facility types and sizes for effective retrofit deployment.

- In November 2024, Tarshid initiated an energy efficiency retrofit at Imam Abdulrahman Al Faisal Hospital in Riyadh. It includes upgrading HVAC, lighting, and control systems, implementing a building management system and occupancy sensors, achieving a 30% reduction in energy consumption, and supporting Saudi Arabia’s sustainability goals.

Key Companies in Energy Retrofit Systems Market:

- Schneider Electric

- Johnson Controls International plc

- Siemens

- Honeywell International Inc

- Ameresco

- DAIKIN INDUSTRIES, Ltd

- Ballard Power Systems

- ITM Power plc

- Intelligent Energy Limited

- PowerCell Sweden AB

- Cummins Inc

- AVL

- Engie SA

- ABB Ltd

- Orion Energy Systems, Inc.

Recent Developments (Product Launch)

- In June 2025, Hitachi Energy launched the Compact Line Voltage Regulator (C-LVR), enabling efficient voltage control and optimization of existing distribution grids. The solution enhances energy efficiency, supports grid modernization, and allows utilities and industries to upgrade infrastructure with minimal space and capital requirements.

- In May 2025, Schneider Electric launched the “Energy Efficiency Audits” program to help businesses enhance efficiency and reduce energy consumption. The initiative provides strategic audits and recommendations to support sustainable and net-zero operations.

- In September 2024, Cummins India Limited launched the Retrofit Aftertreatment System (RAS), a clean air solution for CPCBII and CPCBI gensets. The system reduces particulate matter, carbon monoxide, and hydrocarbon emissions by up to 90%, helping businesses comply with stringent emission regulations.