Market Definition

The market involves the collection, processing, and repurposing of discarded electronic devices and components. This market encompasses a range of activities, including dismantling, material recovery, refurbishment, and safe disposal of obsolete or end-of-life electronics such as computers, mobile phones, televisions, and other consumer and industrial electronic equipment.

The report provides insights into the core drivers of market growth, supported by an in-depth evaluation of industry trends and regulatory frameworks.

Electronic Waste Recycling Market Overview

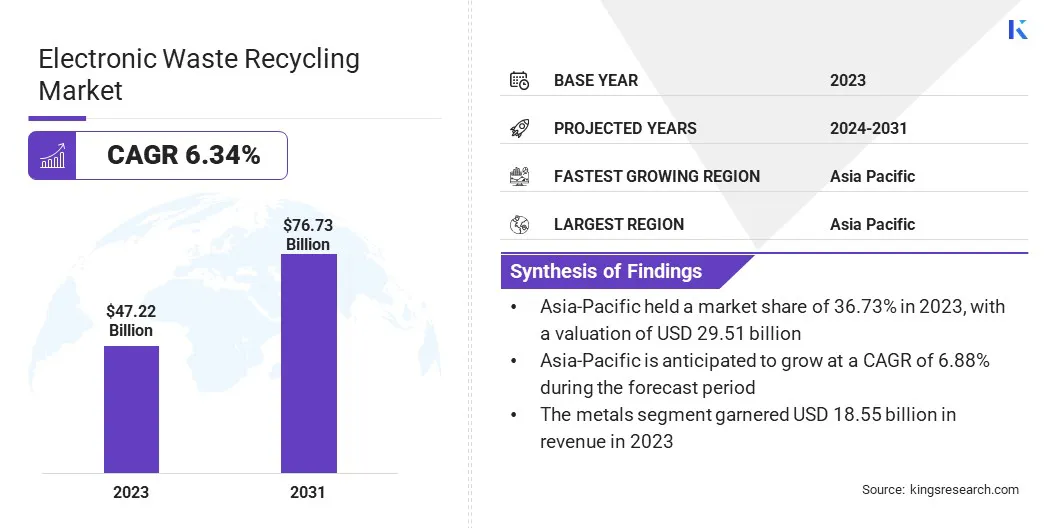

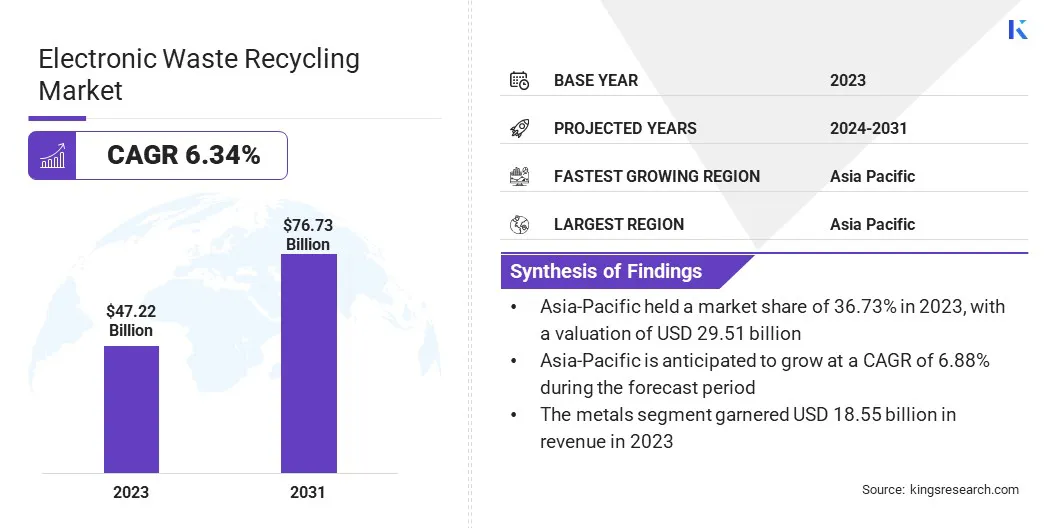

According to Kings Research, the global electronic waste recycling market size was valued at USD 47.22 billion in 2023 and is projected to grow from USD 49.90 billion in 2024 to USD 76.73 billion by 2031, exhibiting a CAGR of 6.34% during the forecast period.

This growth is attributed to the rising demand for efficient and sustainable waste management solutions across key end-use sectors such as consumer electronics, information technology, automotive, and industrial equipment. The rapid technological advancement and frequent product obsolescence have led to a surge in electronic waste generation, thereby creating significant opportunities for recycling service providers.

Key Market Highlights:

- The electronic waste recycling market size was valued at USD 47.22 billion in 2023.

- The market is projected to grow at a CAGR of 6.34% from 2024 to 2031.

- Asia-Pacific held a market share of 36.73% in 2023, with a valuation of USD 17.34 billion.

- The metals segment garnered USD 18.55 billion in revenue in 2023.

- The consumer electronics segment is expected to reach USD 28.71 billion by 2031.

- The market in North America is anticipated to grow at a CAGR of 6.32% during the forecast period.

Major companies operating in the electronic waste recycling industry are Attero, ERI, Recycling Villa, ENVIRO-HUB HOLDINGS LTD., Aurubis AG, Boliden Group, Umicore, Stena Metall AB, Kuusakoski, Deshwal Waste Management, Sims Lifecycle Services, Veolia Group, REMONDIS SE & Co. KG, COHEN, and Namo eWaste Management Ltd.

The increasing regulatory pressure to minimize landfill waste, combined with rising consumer awareness of environmental sustainability, has significantly accelerated market development.

Additionally, continuous advancements in recycling technologies and the growing demand for secondary raw materials such as precious metals and rare earth elements are further driving the market by enhancing the efficiency and profitability of electronic waste recovery processes.

- In February 2025, Panasonic Malaysia partnered with Electronic Recycling Through Heroes (ERTH) to launch an e-waste recycling campaign aimed at promoting responsible disposal of electronic waste. The initiative reflects Panasonic’s broader environmental commitment aligned with its Green Impact strategy.

Rising Electronic Waste Generation

The market is propelled by the rising generation of electronic waste across the globe. Device replacement cycles are becoming shorter with the increasing affordability and accessibility of consumer electronics such as smartphones, laptops, and home appliances, leading to a surge in discarded electronic products.

Rapid technological advancements and the trend of frequent upgrades have further intensified the volume of e-waste. This growing accumulation of obsolete devices is straining traditional waste management systems and highlighting the need for efficient, large-scale recycling infrastructure capable of handling complex electronic components.

The rising e-waste volume is compelling governments, industries, and consumers to adopt sustainable disposal practices, thereby accelerating the demand for advanced recycling solutions that recover valuable materials while minimizing environmental harm.

- The World Health Organization (WHO) released a fact sheet on electronic waste (e-waste), emphasizing its rapid growth as one of the fastest-growing global waste streams. In March 2024, the Global E-Waste Monitor revealed that the production of e-waste has been growing five times faster than documented recycling efforts. In 2022, 62 million tonnes of e-waste were generated, with only 22.3% properly recycled. This gap is expected to widen by 2030, with e-waste projected to reach 82 million tonnes.

Lack of Standardized Collection Systems

The lack of standardized collection systems poses a critical challenge to the growth and efficiency of the electronic waste recycling market, particularly in regions with underdeveloped waste management infrastructure. In many countries, the absence of coordinated and regulated e-waste collection frameworks leads to inconsistent recovery rates, with large volumes of discarded electronics ending up in landfills or being processed through informal channels.

These informal systems often lack environmental and safety standards, resulting in inefficient material recovery and increased ecological harm. Limited access to convenient drop-off points, insufficient public awareness, and the absence of incentives for consumers to return obsolete devices further hinder effective e-waste collection.

This fragmentation disrupts the supply chain for recycling operations, reduces the volume of high-quality input materials, and raises operational costs.

Governments and industry stakeholders are responding by implementing Extended Producer Responsibility (EPR) schemes and public-private partnerships to streamline collection efforts. Establishing accessible collection centers, promoting take-back programs, and launching awareness campaigns are also being prioritized to improve consumer participation.

Digital platforms for tracking and managing e-waste flows are increasingly being adopted to enhance traceability and coordination across the recycling ecosystem. These initiatives aim to create a more reliable and standardized collection infrastructure that supports long-term sustainability in the market.

- The Press Information Bureau (PIB) reported that e-waste recycling improved with the introduction of the E-Waste (Management) Rules, 2022. These rules, effective from April 1, 2023, enhance the EPR regime, ensuring formal recycling processes while curbing informal sector practices. The new regulations also promote a circular economy & ensure environmentally sound disposal methods, limiting the harmful practices of the informal sector, ultimately safeguarding both human health and the environment.

Technological Advancements in Recycling

Technological advancements are significantly transforming e-waste recycling by improving efficiency, material recovery, and environmental sustainability. Innovations in sorting and dismantling technologies, such as automated shredding and AI-powered sorting systems, are enhancing the accuracy of material separation, leading to higher recovery rates and reducing the reliance on manual labor.

The introduction of advanced chemical recovery techniques allows for the efficient extraction of precious metals and rare earth elements from e-waste with minimal environmental impact. Furthermore, improvements in battery recycling technology are enabling safer and more effective recovery of materials from lithium-ion and other types of batteries.

- In April 2025, Horizon Magazine, published by the European Commission, reported that EU-funded projects are leveraging AI-powered robots to tackle the growing electronic waste in Europe. These robots enhance the sorting and dismantling of e-waste, improving recovery rates and reducing exposure to hazardous materials. The initiative supports the EU's circular economy goals by making e-waste processing safer and more efficient.

Electronic Waste Recycling Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Metals, Plastics, Glass, Others (Printed Circuit Boards (PCBs) , ceramics)

|

|

By Source

|

Consumer Electronics, IT and Telecommunications, Household Appliances, Industrial Electronics

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Metals, Plastics, Glass, Others (Printed Circuit Boards (PCBs), ceramics)): The metals segment earned USD 18.55 billion in 2023, due to the high demand for precious and rare earth metals recovered from electronic waste.

- By Source (Consumer Electronics, IT and Telecommunications, Household Appliances, Industrial Electronics): The consumer electronics segment held 37.55% share of the market in 2023, due to the rapid turnover of devices like smartphones, laptops, and televisions, which contribute significantly to e-waste generation.

Electronic Waste Recycling Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 36.73% share of the electronic waste recycling market in 2023, with a valuation of USD 29.51 billion. This dominance is attributed to the region’s rapid urbanization, high consumption of electronic goods, and the strong presence of key electronics manufacturing countries such as China, India, and Japan.

Furthermore, increasing investments in e-waste recycling infrastructure, along with rising consumer awareness of environmental sustainability, continue to support market growth. Favorable government policies promoting e-waste collection and recycling, coupled with stringent environmental regulations, further strengthen Asia Pacific’s leadership in the market.

- In June 2024, Hindalco Industries Limited awarded Metso a major contract to supply technology and engineering services for India’s inaugural large-scale e-waste recycling plant. The facility will produce 50,000 tonnes of low-carbon copper annually. Metso’s delivery will include advanced equipment such as Kaldo and anode furnaces, along with comprehensive engineering support.

The electronic waste recycling industry in North America is poised for significant growth at a robust CAGR of 6.32% over the forecast period. This growth is attributed to the increasing need for efficient e-waste management and the rising demand for recycling solutions to recover valuable materials from discarded electronics.

The region's strong focus on sustainability and the implementation of stricter environmental regulations are driving the adoption of advanced recycling technologies. Moreover, the growing consumer preference for eco-friendly practices and the push for reduced landfill waste are contributing to the increased adoption of e-waste recycling services.

Ongoing investments in recycling infrastructure and the development of more effective recovery processes are further enhancing the efficiency and capacity of e-waste recycling operations in North America.

- In February 2023, Sojitz Corporation acquired a 34% stake in eCycle Solutions, Canada’s leading e-waste recycler, owned by JX Nippon Mining & Metals. The collaboration aims to expand eCycle’s operations, including IT Asset Disposition services, in response to rising e-waste volumes. Sojitz’s expertise in North American operations supports this strategic alliance, focusing on resource circulation, metal recycling, and a circular economy.

Regulatory Frameworks

- In the European Union (EU), the Directive 2012/19/EU on Waste Electrical and Electronic Equipment (WEEE) regulates the collection, recycling, and recovery of electronic waste. It enforces extended producer responsibility and sets mandatory targets to minimize environmental impact and promote resource efficiency.

- In the U.S., the Resource Conservation and Recovery Act (RCRA) regulates the management and disposal of hazardous waste. It ensures safe treatment, storage, and disposal practices, while allowing states to implement more specific e-waste recycling programs.

- In China, the Regulations for the Administration of the Recovery and Disposal of Waste Electrical and Electronic Products governs the collection, recycling, and environmentally sound disposal of electronic waste under an extended producer responsibility system.

- In India, the E-Waste (Management) Rules, 2022 enforce EPR, requiring producers to ensure proper collection and recycling of e-waste. The rules set targets, compliance requirements, and penalties to promote sustainable e-waste management.

- In Japan, the Home Appliance Recycling Law (HARL) mandates the recycling of major home appliances, requiring consumers to return them to retailers for recycling by manufacturers. The law aims to reduce waste and recover valuable materials.

Competitive Landscape

The electronic waste recycling market is characterized by a mix of established multinational corporations and emerging regional players, each striving to expand their operational footprint and enhance service offerings. Market leaders are actively pursuing strategic collaborations, acquisitions, and investments in advanced recycling technologies to gain a competitive edge.

Emphasis is being placed on the development of efficient sorting and recovery systems, particularly those capable of extracting high-value materials such as precious metals and rare earth elements.

In addition, several companies are aligning with EPR initiatives and building partnerships with OEMs to offer end-to-end recycling solutions. Innovation, compliance, and transparency remain key factors shaping the competitive dynamics of the market as environmental regulations become more stringent and consumer demand for sustainable practices grows.

- In February 2023, ITOCHU Corporation launched the E-waste Compensation Program in partnership with Closing the Loop, aiming to recycle one mobile device in Africa for every device sold in Japan. The initiative seeks to address global e-waste by improving recycling processes and ensuring safer disposal in Africa, while supporting fair wages for workers.

Key Companies in Electronic Waste Recycling Market:

- Attero

- ERI

- Recycling Villa.

- ENVIRO-HUB HOLDINGS LTD.

- Aurubis AG

- Boliden Group

- Umicore

- Stena Metall AB

- Kuusakoski

- Deshwal Waste Management

- Sims Lifecycle Services

- Veolia Group

- REMONDIS SE & Co. KG

- COHEN

- Namo eWaste Management Ltd.

Recent Developments (M&A/Partnerships/Agreements/Product Launches)

- In January 2025, MKS PAMP Group and Karo Sambhav announced a strategic partnership at the WEF 2025 Annual Meeting to enhance e-waste recycling and precious metal recovery in India. The collaboration aims to create sustainable solutions for e-waste management and promote resource recovery, contributing to India's circular economy and supporting sustainable development.

- In April 2025, Boliden, IVL Swedish Environmental Research Institute, and Ericsson announced their collaboration to enhance e-waste circularity in the telecom industry. The partnership aims to boost the recycling of valuable materials from electronic waste, specifically focusing on telecom equipment.

- In November 2024, Vodacom South Africa partnered with Circular Energy to reduce e-waste and promote a circular economy. The initiative supports responsible collection, recycling, and management of e-waste, including batteries and packaging, in line with South Africa’s (EPR) regulations.

- In June 2024, BASF Malaysia partnered with ERTH (to promote responsible electronic waste recycling. The initiative encourages the safe disposal of unwanted electronics through free home pickup services and aims to raise public awareness of environmental impacts related to e-waste.

- In September 2023, Ericsson and MTN Benin announced their successful collaboration to recycle 123 metric tons of e-waste in Benin. This initiative is part of Ericsson's commitment to sustainability and reducing environmental impacts in the telecommunications industry.