Market Definition

The market refers to the industry involved in the collection, processing, and recycling of used or discarded batteries. This market focuses on recycling valuable materials from batteries, such as lithium, cobalt, nickel, and lead in the production of new batteries or other products.

The report presents an overview of the primary growth drivers, supported by regional analysis and regulatory frameworks, which are expected to impact market development over the forecast period.

Battery Recycling Market Overview

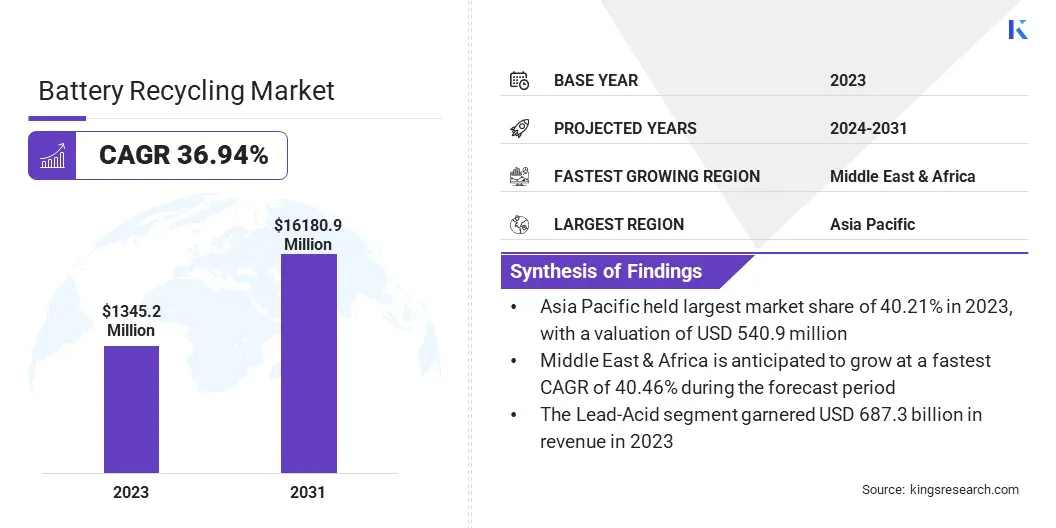

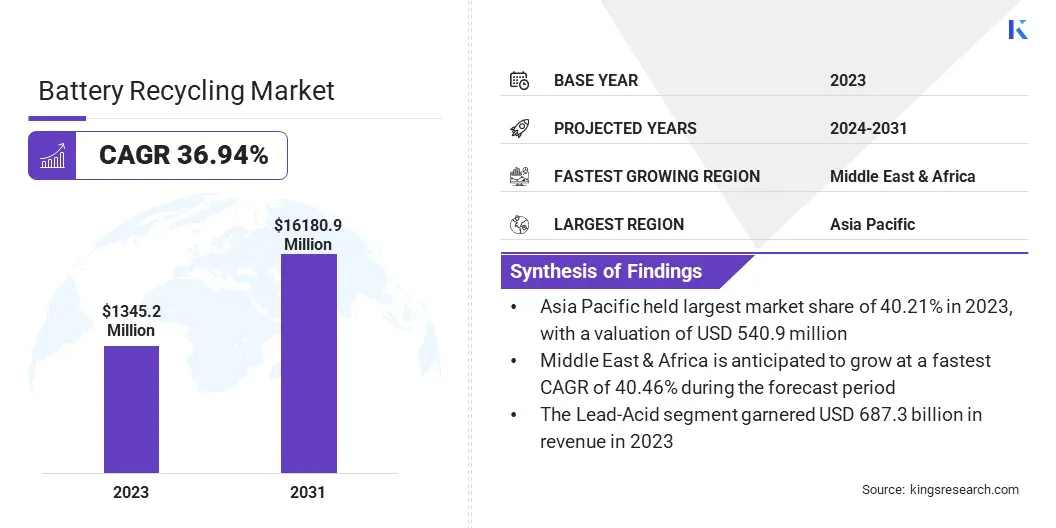

Global battery recycling market size was valued at USD 1,345.2 million in 2023, which is estimated to be valued at USD 1,791.8 million in 2024 and reach USD 16,180.9 million by 2031, growing at a CAGR of 36.94% from 2024 to 2031.

The growing awareness of the environmental risks posed by improper battery disposal is driving the demand for battery recycling. With the growing awareness of consumers, businesses are prioritizing sustainable practices, recognizing the importance of responsible battery recycling to protect the environment.

Major companies operating in the battery recycling industry are ACCUREC-Recycling GmbH, American Battery Technology Company, Aqua Metals, Inc., Contemporary Amperex Technology Co., Limited., Neometals Ltd, ECOBAT, Element Resources DE LLC, ENERSYS, EXIDE INDUSTRIES LIMITED, Fortum, GEM Co., Ltd., Glencore, Gopher Resource, Gravita India Limited, Li-Cycle Corp., and others.

Investment in recycling technologies is a key factor driving the market. Innovations in advanced recycling techniques, such as direct recycling, and automated sorting technologies, are enhancing recovery rates and improving cost-efficiency.

These advancements make the recycling process more sustainable and help address the growing demand for valuable materials like lithium, cobalt, and nickel. As technology continues to evolve, it is expected to significantly reduce operational costs, streamline recycling efforts, and increase the overall market potential.

- In April 2025, American Battery Technology Company (ABTC) announced that it had doubled its quarterly production at its lithium-ion battery recycling facility. This milestone is achieved through ABTC's proprietary recycling technologies.

Key Highlights

- The battery recycling industry size was recorded at USD 1,345.2 million in 2023.

- The market is projected to grow at a CAGR of 36.94% from 2024 to 2031.

- Asia Pacific held a market share of 40.21% in 2023, with a valuation of USD 540.9 million.

- The lead-acid segment garnered USD 687.3 million in revenue in 2023.

- The industrial segment is expected to reach USD 6,714.9 million by 2031.

- The hydrometallurgical segment held a market of 40.12% in 2023.

- The metallurgical industry is anticipated to grow at a CAGR of 37.23% during the forecast period.

- Europe is anticipated to grow at a CAGR of 37.23% during the forecast period.

Market Driver

"Sustainability Focus"

Environmental concerns are playing an increasingly pivotal role in driving the growth of the battery recycling market.In March 2024, UNITAR’s Global E-waste Monitor revealed that global e-waste generation is increasing by 2.6 million tonnes annually, projected to reach 82 million tonnes by 2030.

As improper battery disposal leads to soil and water contamination, and the release of harmful chemicals, the demand for sustainable recycling solutions is increasing.

Increased public awareness and stricter regulations are encouraging consumers, manufacturers, and governments to adopt responsible battery disposal practices. This shift is boosting the demand for recycling services globally to preserve natural resources and ensure a circular economy, in turn, driving market growth.

- In December 2024, LICO Materials inaugurated a zero-liquid-discharge battery recycling facility in Bengaluru, India. The company invested USD 28.99 million in a hydrometallurgy plant to support India's EV sector growth, addressing critical material supply challenges. The company plans to recycle 200,000 metric tonnes of batteries annually by 2027.

Market Challenge

"Insufficient Collection Infrastructure and Low Consumer Awareness"

A major challenge for the battery recycling market is the lack of convenient collection infrastructure and limited consumer awareness of drop-off locations. This hinders the efficient collection of used batteries and reduces recycling rates.

To address this, key players are expanding collection networks and partnering with retailers and municipalities. They are also launching awareness campaigns and creating digital tools to help consumers find drop-off points easily.

Market Trend

"Circular Economy"

The growing shift toward circular economy models is a key trend in the battery recycling market. Governments and companies are increasingly recognizing recycling as a primary element of sustainability, aiming to reduce waste, conserve resources, and minimize environmental impact.

By focusing on reusing materials in the production cycle, the circular economy promotes the recovery of valuable metals from used batteries, reducing the reliance on raw materials. This transition is driving innovations in recycling technologies, creating new business opportunities, and encouraging more sustainable practices in the industry.

- In February 2025, Li-Cycle Holdings Corp., a leading lithium-ion battery recycling company, partnered with major U.S. Battery Energy Storage System (BESS) companies to recycle critical battery materials. This collaboration aims to support the growing demand for energy storage and clean energy to reduce reliance on foreign mineral supplies and strengthen the circular economy.

Battery Recycling Market Report Snapshot

|

Segmentation

|

Details

|

|

By System

|

Lead-acid, Lithium-ion, Nickel-based, Others

|

|

By Source

|

Automotive, Industrial, Consumer Electronics

|

|

By Recycling Process

|

Hydrometallurgical, Pyrometallurgical, Mechanical

|

|

By End Use

|

Reused in Batteries, Metallurgical Industry, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By System (Lead-Acid, Lithium-ion, Nickel-based, Others): The lead-acid segment earned USD 687.3 million in 2023 due to its widespread use in automotive and backup power applications, driving demand for recycling.

- By Source (Automotive, Industrial, Consumer Electronics): The automotive segment held 45.09% of the market in 2023, driven by the increasing adoption of electric vehicles and the need for efficient battery recycling solutions.

- By Recycling Process (Hydrometallurgical, Pyrometallurgical, Mechanical): The hydrometallurgical segment is projected to reach USD 6,788.8 million by 2031, owing to its efficiency in recovering valuable metals like lithium, cobalt, and nickel from batteries.

- By End Use (Reused in Batteries, Metallurgical Industry, Others): The metallurgical industry segment is anticipated to have a CAGR of 37.23% during the forecast period, driven by increasing demand for recycled metals for manufacturing and construction purposes.

Battery Recycling Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific battery recycling market share stood around 40.21% in 2023 in the global market, with a valuation of USD 540.9 million. Asia-Pacific is a dominating region in the market due to rapid advancements in technology, increasing demand for electric vehicles (EVs), and stringent environmental regulations.

Governments in countries across the region are prioritizing sustainability initiatives and boosting collaborations to enhance recycling infrastructure. Additionally, the growing emphasis on a circular economy and the region’s role as a major manufacturing hub contribute to its leadership in battery recycling. These factors are driving the growth of the market in the Asia-Pacific.

- In November 2023, BASF and SK On entered into an agreement to explore collaboration opportunities in the global lithium-ion battery industry. This partnership focuses on cathode active materials (CAM) production, with future evaluations on battery recycling, aligning with their sustainability goals in North America and Asia-Pacific.

Europe battery recycling industry is poised for significant growth at a robust CAGR of 37.23% over the forecast period. The market in Europe is experiencing significant growth, driven by the rising adoption of electric vehicles (EVs) and the implementation of stringent environmental regulations.

The region is increasingly focused on improving resource efficiency and ensuring the recovery of critical materials essential for EV production. Additionally, the European Union's regulations and sustainability goals, such as the Circular Economy Action Plan, are pushing for enhanced recycling capabilities and reduced waste. These factors, along with investments in advanced recycling technologies, are propelling the market forward in this region.

Regulatory Frameworks

- In India, the Battery Waste Management Rules, 2022, promote a circular economy by mandating Extended Producer Responsibility (EPR) for battery collection, recycling, and refurbishment, encouraging new industries and reducing raw material dependency.

- In the US, the Environmental Protection Agency (EPA) plays a crucial role in promoting battery recycling and developing regulations to protect health and the environment while ensuring sustainable management of battery waste.

- In the EU, the new Battery Regulation (EU) 2023/1542, aims to enhance market functioning, promote a circular economy, and reduce environmental impacts across the battery lifecycle.

Competitive Landscape

In the battery recycling industry, companies are focusing on expanding their recycling capabilities, developing advanced technologies for more efficient processing, and enhancing sustainability efforts.

They are investing in facilities to handle large volumes of end-of-life batteries, recovering critical metals like lithium, cobalt, and nickel, while minimizing environmental impact. Partnerships with research institutions and governments are also being formed to drive innovation in recycling processes.

- In December 2024, American Battery Technology Company (ABTC) received a USD 144 million grant from the U.S. Department of Energy to construct its second lithium-ion battery recycling facility. The new plant will process 100,000 tonnes per year of battery materials, significantly expanding domestic recycling capacity and supporting the growing demand for critical battery materials.

List of Key Companies in Battery Recycling Market:

- ACCUREC-Recycling GmbH

- American Battery Technology Company

- Aqua Metals, Inc.

- Contemporary Amperex Technology Co., Limited.

- Neometals Ltd

- ECOBAT

- Element Resources DE LLC

- ENERSYS

- EXIDE INDUSTRIES LIMITED

- Fortum

- GEM Co., Ltd.

- Glencore

- Gopher Resource

- Gravita India Limited

- Li-Cycle Corp.

Recent Developments (Partnerships/Agreements)

- In February 2025, Blue Whale Materials (BWM) announced a strategic partnership with Call2Recycle to enhance lithium-ion battery recycling in North America. This collaboration will leverage Call2Recycle’s extensive collection network and BWM’s advanced recycling technologies to process spent batteries, providing essential feedstock to meet the growing demand for sustainable battery materials.

- In July 2023, Li-Cycle and EVE Energy signed a memorandum of understanding to collaborate on sustainable lithium-ion battery recycling solutions. The partnership aims to explore efficient recycling methods for battery materials in North America, supporting global electrification goals and advancing a circular economy.